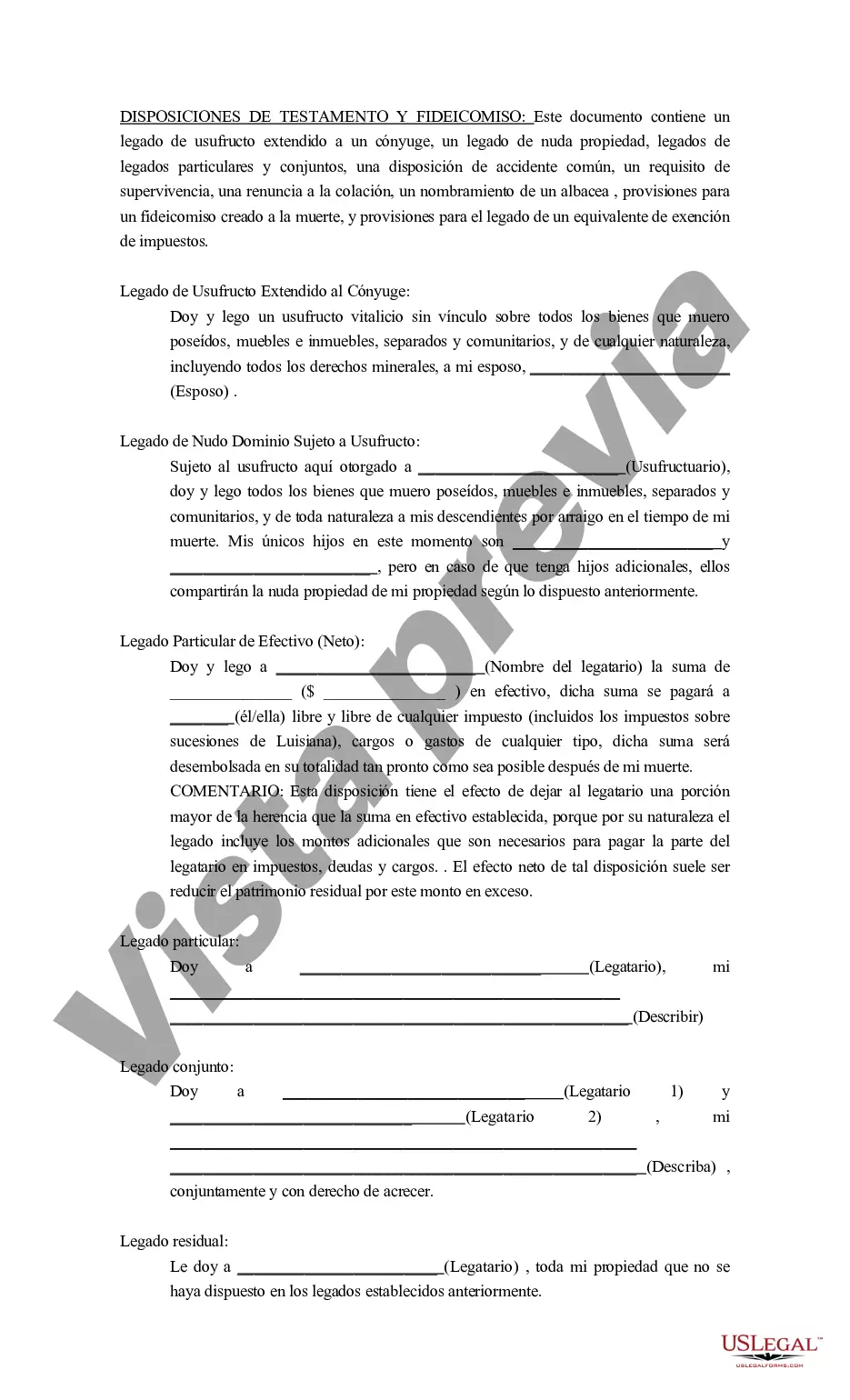

New Orleans Louisiana Will and Trust Provisions refer to the legal provisions set forth in wills and trust documents in the state of Louisiana, specifically in the city of New Orleans. These provisions dictate how the assets and properties of an individual will be distributed upon their death, ensuring that their wishes are honored and their loved ones are taken care of. The New Orleans Louisiana Will and Trust Provisions are designed to comply with the specific laws and regulations of the state. There are several types of New Orleans Louisiana Will and Trust Provisions that individuals can include in their estate planning. These provisions aim to address various aspects of asset distribution, beneficiary designations, guardianship, and more: 1. Testamentary Trust Provisions: These provisions establish a trust within a will, ensuring that assets are managed and distributed according to the designated terms upon the individual's death. 2. Living Trust Provisions: Living trusts or revocable trusts enable individuals to transfer assets to a trust during their lifetime, outlining how the assets should be managed and distributed during their lifetime and after their death. 3. Charitable Trust Provisions: These provisions allow individuals to designate certain assets or a portion of their estate to be donated to charitable organizations or causes of their choice, promoting philanthropy and leaving a lasting impact. 4. Minor Children Trust Provisions: These provisions establish trusts for minor children, ensuring that their financial needs, education, and overall well-being are taken care of in the event of the parents' death or incapacity. 5. Spendthrift Trust Provisions: A spendthrift trust restricts the beneficiary's access to the trust funds and is designed to protect the beneficiary from poor financial management or possible creditors. 6. Special Needs Trust Provisions: These provisions create trusts for individuals with special needs, ensuring that they continue to receive funds for their care and support while still being eligible for government assistance programs. 7. Family Trust Provisions: Family trusts are created to hold and distribute family assets, providing ongoing financial support and security to family members, often spanning multiple generations. It is vital for individuals in New Orleans, Louisiana, to work with experienced estate planning attorneys who can guide them through the complexities of these various provisions. An attorney can help individuals assess their unique circumstances, goals, and wishes, and create wills and trusts that comply with the New Orleans Louisiana Will and Trust Provisions while maximizing the benefits for their beneficiaries and minimizing tax implications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Orleans Louisiana Disposiciones de testamento y fideicomiso - Louisiana Will and Trust Provisions

Description

How to fill out New Orleans Louisiana Disposiciones De Testamento Y Fideicomiso?

Benefit from the US Legal Forms and obtain immediate access to any form you need. Our beneficial website with thousands of documents allows you to find and obtain almost any document sample you need. You can save, fill, and sign the New Orleans Louisiana Will and Trust Provisions in a few minutes instead of browsing the web for hours attempting to find the right template.

Utilizing our catalog is a great way to raise the safety of your record filing. Our experienced lawyers regularly review all the documents to make certain that the forms are relevant for a particular state and compliant with new acts and regulations.

How do you obtain the New Orleans Louisiana Will and Trust Provisions? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions below:

- Find the template you need. Make sure that it is the template you were looking for: examine its headline and description, and take take advantage of the Preview function when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Select the format to obtain the New Orleans Louisiana Will and Trust Provisions and edit and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy template libraries on the internet. We are always happy to help you in virtually any legal process, even if it is just downloading the New Orleans Louisiana Will and Trust Provisions.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!