The New Orleans Louisiana Office Lease Agreement is a legally binding contract between a landlord and a tenant for renting office space in the city of New Orleans, Louisiana. This agreement outlines the terms and conditions that both parties must adhere to throughout the lease period. This lease agreement includes various important clauses that define the responsibilities and rights of both the landlord and tenant. It typically covers details such as the duration of the lease, the rental amount and payment schedule, security deposit requirements, maintenance responsibilities, utilities, and any restrictions or rules that the tenant must follow. There are different types of New Orleans Louisiana Office Lease Agreements that cater to various specific needs and circumstances. Some common types include: 1. Gross Lease Agreement: This type of lease agreement typically includes a fixed rental amount where the landlord assumes responsibility for all or most of the property expenses, including property taxes, insurance, common area maintenance, and utilities. 2. Net Lease Agreement: In this type of lease agreement, the tenant is responsible for paying a base rental amount along with additional costs such as property taxes, insurance, and maintenance expenses. There are three subtypes of net leases: a. Single Net Lease: Tenant pays rent and a portion of property taxes. b. Double Net Lease: Tenant pays rent, a portion of property taxes, and building insurance. c. Triple Net Lease: Tenant pays rent, property taxes, building insurance, and maintenance expenses. 3. Modified Gross Lease Agreement: This lease agreement combines elements of both the gross and net lease types. It outlines the specific expenses that the tenant and landlord are responsible for, such as utilities or maintenance costs, while the other expenses are divided based on negotiation. 4. Full-Service Lease Agreement: Commonly used in office buildings, this type of lease agreement includes all costs within the monthly rent, such as utilities, maintenance, janitorial services, and property taxes. It is essential for both landlords and tenants to carefully review and understand the terms mentioned in a New Orleans Louisiana Office Lease Agreement before signing. Seeking legal advice is recommended to ensure compliance with local laws and protect the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Orleans Louisiana Contrato de arrendamiento de oficina - Louisiana Office Lease Agreement

State:

Louisiana

City:

New Orleans

Control #:

LA-802LT

Format:

Word

Instant download

Description

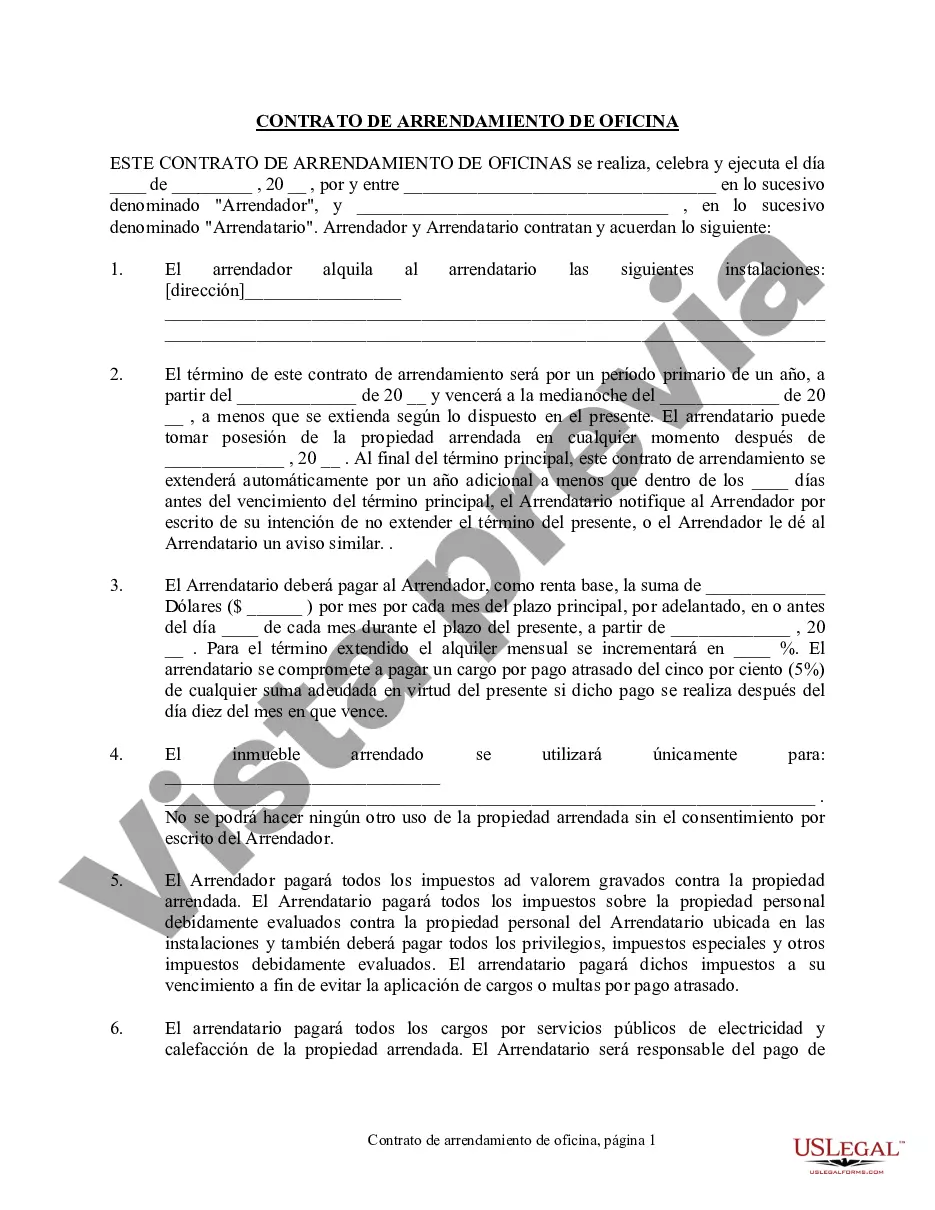

This form is a contract to Lease office space from property owner to tenant. This contract will include lease terms that are compliant with state statutory law. Tenant must abide by terms of the lease and its conditions as agreed.

The New Orleans Louisiana Office Lease Agreement is a legally binding contract between a landlord and a tenant for renting office space in the city of New Orleans, Louisiana. This agreement outlines the terms and conditions that both parties must adhere to throughout the lease period. This lease agreement includes various important clauses that define the responsibilities and rights of both the landlord and tenant. It typically covers details such as the duration of the lease, the rental amount and payment schedule, security deposit requirements, maintenance responsibilities, utilities, and any restrictions or rules that the tenant must follow. There are different types of New Orleans Louisiana Office Lease Agreements that cater to various specific needs and circumstances. Some common types include: 1. Gross Lease Agreement: This type of lease agreement typically includes a fixed rental amount where the landlord assumes responsibility for all or most of the property expenses, including property taxes, insurance, common area maintenance, and utilities. 2. Net Lease Agreement: In this type of lease agreement, the tenant is responsible for paying a base rental amount along with additional costs such as property taxes, insurance, and maintenance expenses. There are three subtypes of net leases: a. Single Net Lease: Tenant pays rent and a portion of property taxes. b. Double Net Lease: Tenant pays rent, a portion of property taxes, and building insurance. c. Triple Net Lease: Tenant pays rent, property taxes, building insurance, and maintenance expenses. 3. Modified Gross Lease Agreement: This lease agreement combines elements of both the gross and net lease types. It outlines the specific expenses that the tenant and landlord are responsible for, such as utilities or maintenance costs, while the other expenses are divided based on negotiation. 4. Full-Service Lease Agreement: Commonly used in office buildings, this type of lease agreement includes all costs within the monthly rent, such as utilities, maintenance, janitorial services, and property taxes. It is essential for both landlords and tenants to carefully review and understand the terms mentioned in a New Orleans Louisiana Office Lease Agreement before signing. Seeking legal advice is recommended to ensure compliance with local laws and protect the rights and interests of both parties involved.

Free preview

How to fill out New Orleans Louisiana Contrato De Arrendamiento De Oficina?

If you’ve already utilized our service before, log in to your account and save the New Orleans Louisiana Office Lease Agreement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your New Orleans Louisiana Office Lease Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!