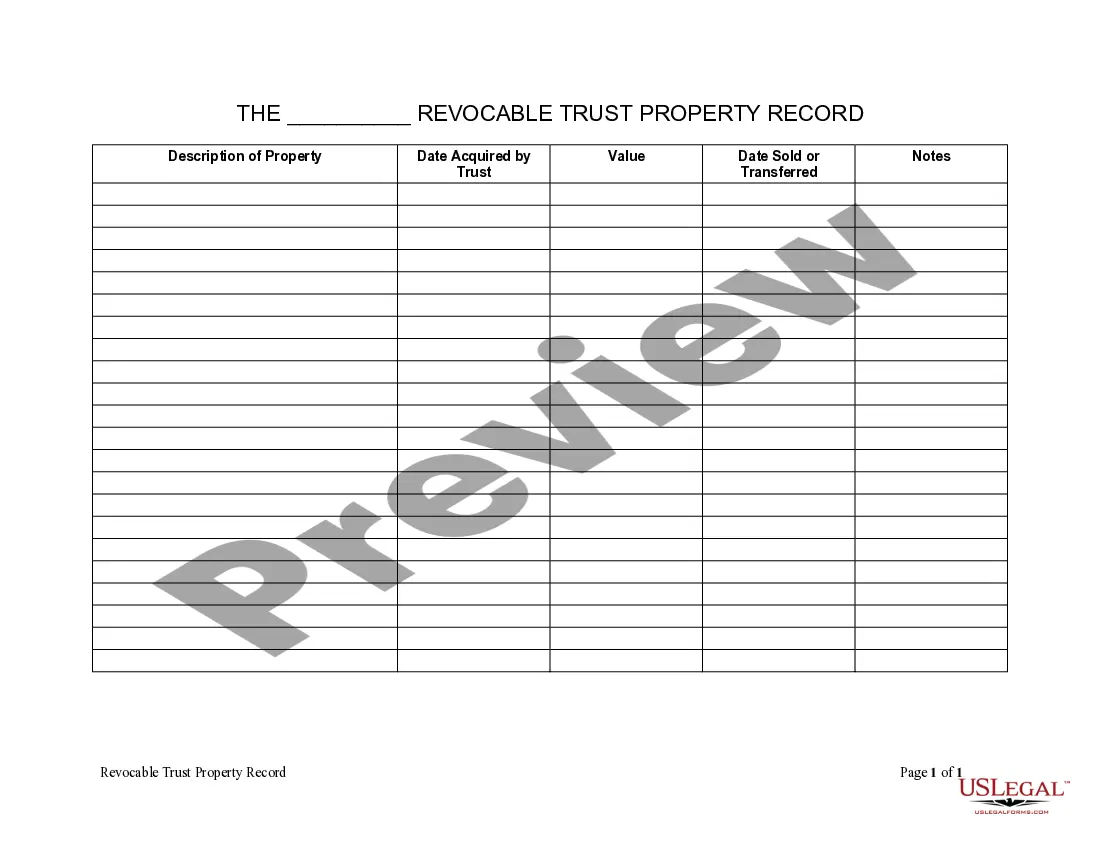

New Orleans Louisiana Living Trust Property Record: A Comprehensive Overview A living trust property record refers to a vital document that records the property details held within a living trust in New Orleans, Louisiana. It serves as an organized and comprehensive record of the assets, properties, and any related information encompassed by the trust. This record plays a crucial role in managing and distributing assets in accordance with the terms and conditions specified in the living trust. Keywords: New Orleans Louisiana, living trust, property record, assets, properties, record-keeping, trust management, asset distribution. Types of New Orleans Louisiana Living Trust Property Records: 1. Real Estate Property Record: This type of living trust property record pertains specifically to real estate properties held within the trust. It includes information such as property addresses, legal descriptions, title documents, purchase and sale agreements, mortgages, liens, and any other relevant property-related details. 2. Financial Asset Record: Financial assets held within the living trust are recorded in this type of property record. It encompasses bank accounts, investment portfolios, stocks, bonds, certificates of deposit, retirement accounts, and similar financial instruments. Detailed information such as account names, numbers, institutions, current values, and ownership percentages are essential aspects of this record. 3. Personal Property Record: Personal property, including valuable possessions like jewelry, artwork, antiques, vehicles, and other tangible assets, finds mention in this type of living trust property record. It ensures proper documentation of these items, providing details such as descriptions, appraisals, purchase receipts, photographs, and any relevant supporting documents. 4. Business Asset Record: In cases where the living trust holds business-related assets, this specialized record becomes necessary. It includes documentation of business interests, partnership agreements, business property, intellectual property rights, commercial real estate assets, and other valuable business assets. This record's accuracy is crucial for the seamless management and transfer of business assets within the trust. 5. Debts and Liabilities Record: While not an asset, this type of living trust property record documents any debts or liabilities associated with the trust. It includes mortgages, loans, credit card debts, outstanding bills, and any other financial obligations connected to the trust. This record ensures proper administration of debts during the trust's lifespan and helps settle them during distribution. Maintaining an up-to-date New Orleans Louisiana Living Trust Property Record is of utmost importance for trustees, beneficiaries, and legal representatives. It ensures a clear and efficient understanding of the trust's assets and liabilities, streamlining the management, distribution, and settlement processes. Furthermore, regularly reviewing and updating this record guarantees that it reflects any modifications or changes in the trust's property portfolio, providing an accurate snapshot of its current status.

New Orleans Louisiana Living Trust Property Record

Description

How to fill out Louisiana Living Trust Property Record?

If you are looking for an appropriate form, it’s hard to discover a better site than the US Legal Forms platform – one of the most comprehensive collections on the internet.

With this collection, you can obtain thousands of templates for organizational and personal uses by categories and areas, or keywords.

With the excellent search feature, obtaining the latest New Orleans Louisiana Living Trust Property Record is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Choose the file format and save it on your device. Edit. Fill out, review, print, and sign the obtained New Orleans Louisiana Living Trust Property Record.

- Moreover, the applicability of each document is ensured by a group of experienced lawyers who consistently evaluate the templates on our site and refresh them in line with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to acquire the New Orleans Louisiana Living Trust Property Record is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have selected the form you desire. Review its description and use the Preview feature (if accessible) to examine its contents. If it doesn’t meet your requirements, utilize the Search box at the top of the screen to locate the desired file.

- Verify your choice. Select the Buy now button. Afterward, pick your favorite pricing option and provide details to create an account.

Form popularity

FAQ

Finding out who owns a living trust can be challenging, as trust ownership details are often private. However, in New Orleans Louisiana Living Trust Property Record, you may be able to access information through public records if the trust has been probated. If you seek clarity, consider reaching out to the trustee or utilizing resources from U.S. Legal Forms, which can offer guidance on navigating trust documentation.

Yes, a trust can own property in Louisiana. In fact, New Orleans Louisiana Living Trust Property Record specifically allows trusts to hold real estate and other types of assets. This feature provides flexibility in estate planning, allowing grantors to manage their property more efficiently. Utilizing a trust for property ownership can help streamline the transfer of assets to beneficiaries.

No, a living trust is not completely anonymous as the trust documents often become part of public records after the grantor’s death. Specifically for New Orleans Louisiana Living Trust Property Record, certain details may be disclosed to the public, revealing information about the trust and its assets. Privacy can be a concern, but carefully drafted trust provisions can help maintain some confidentiality. Consulting with a legal expert can clarify these aspects.

The grantor, or creator, of the trust is typically viewed as the owner. In the context of New Orleans Louisiana Living Trust Property Record, the grantor retains control over the assets within the trust during their lifetime. After their passing, ownership may shift to the beneficiaries as outlined in the trust documents. It’s essential to understand the roles of both the grantor and the beneficiaries.

Yes, beneficiaries have the right to request access to the trust documents. In the context of New Orleans Louisiana Living Trust Property Record, transparency is crucial for beneficiaries to understand their rights and interests. Trusts usually outline the specific terms and conditions regarding access to their documents. Therefore, it is important to communicate openly and ensure beneficiaries are informed.

Filling out a certification of trust form involves providing essential details about the trust, including the name of the trust, the trustee's name, and the date of establishment. Ensure that you include information about the powers of the trustee and any relevant provisions that impact the New Orleans Louisiana Living Trust Property Record. If you need assistance, platforms like US Legal Forms offer templates and guidance to simplify the process.

While a trust offers many benefits, there are some disadvantages to consider. Creating a trust may involve upfront costs and fees for legal assistance, which can be a barrier for some. Additionally, transferring property into the trust can complicate the New Orleans Louisiana Living Trust Property Record, making future transactions slightly more challenging.

To put your house in a trust in Louisiana, you need to create a living trust document that outlines the terms of the trust. Once you have the document, transfer the title of your property to the trust by filing a new deed with the local recorder's office. This process ensures your New Orleans Louisiana Living Trust Property Record accurately reflects your intent to manage your property through the trust.

Generally, you do not need to file your living trust with a court, but you must keep it updated and comply with the necessary documentation for any assets it holds. However, if your trust generates income or holds property, you may have additional tax filings to consider. Staying informed about your responsibilities regarding your New Orleans Louisiana Living Trust Property Record ensures your estate plan remains effective and legally sound.

One significant mistake parents make when setting up a trust fund is failing to fund the trust properly. This oversight can lead to complications when heirs try to access the assets you intended to protect. To avoid this pitfall, ensure you transfer assets into your trust, especially regarding your New Orleans Louisiana Living Trust Property Record, so that your wishes are honored seamlessly.