Baton Rouge Louisiana Financial Account Transfer to Living Trust

Description

How to fill out Louisiana Financial Account Transfer To Living Trust?

If you have utilized our service previously, Log In to your account and download the Baton Rouge Louisiana Financial Account Transfer to Living Trust onto your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Take advantage of the US Legal Forms service to effortlessly find and store any template for your personal or professional requirements!

- Confirm you have found the correct document. Review the description and use the Preview option, if accessible, to verify if it satisfies your needs. If it doesn’t match your requirements, use the Search tab above to find the suitable one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and finalize the payment. Utilize your credit card information or the PayPal option to complete the transaction.

- Obtain your Baton Rouge Louisiana Financial Account Transfer to Living Trust. Choose the file format for your document and save it on your device.

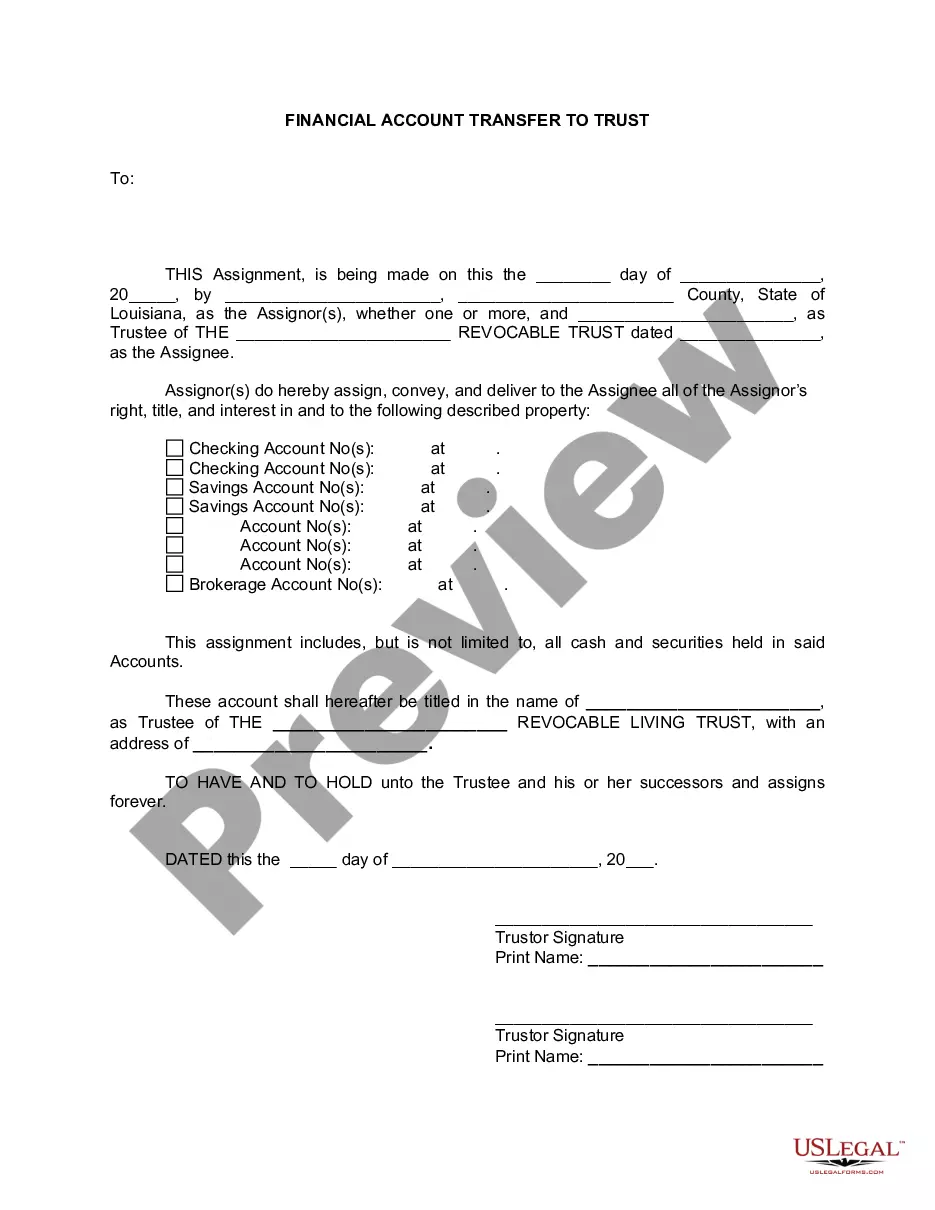

- Complete your template. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To transfer a checking account into your living trust, visit your bank with a copy of your trust document. Inform the bank representative of your intention to transfer the account to the trust. They will guide you through the necessary forms to designate the trust as the account owner. By effectively executing a Baton Rouge Louisiana Financial Account Transfer to Living Trust, you can ensure your finances are managed according to your wishes.

In Louisiana, a trust does not need to be recorded to be valid, but it is beneficial to document its existence. While the trust itself remains private, property transferred into the trust must be recorded, especially if it involves real estate. This step solidifies the trust's claim over the assets. For a seamless Baton Rouge Louisiana Financial Account Transfer to Living Trust, consider using uslegalforms to find helpful templates.

A trust often provides more benefits than a will in Louisiana, primarily in avoiding probate. While a will requires court validation, a trust transfers assets directly to beneficiaries without court involvement. This efficiency ensures privacy and quicker distribution of your estate. Ultimately, a Baton Rouge Louisiana Financial Account Transfer to Living Trust can offer you peace of mind as well.

To avoid probate in Louisiana, consider establishing a living trust. A living trust allows your assets to bypass the probate process upon your death. Additionally, naming beneficiaries on your accounts and designating transfer-on-death for property can help. Utilizing uslegalforms can guide you efficiently in ensuring your Baton Rouge Louisiana Financial Account Transfer to Living Trust securely avoids probate.

Transferring property into a living trust in Louisiana begins with creating the trust document. Once established, you will need to draft a deed transferring the property into the trust's name. This deed should then be filed with the local parish's clerk of court. By utilizing uslegalforms, you can find the necessary templates to simplify the Baton Rouge Louisiana Financial Account Transfer to Living Trust process.

Choosing between a will and a trust depends on your specific needs and goals. A trust can provide privacy, avoid probate, and allow for smoother management of assets, while a will is often less complex and easier to create. For a comprehensive approach, many individuals consider a Baton Rouge Louisiana Financial Account Transfer to Living Trust to supplement their wills.

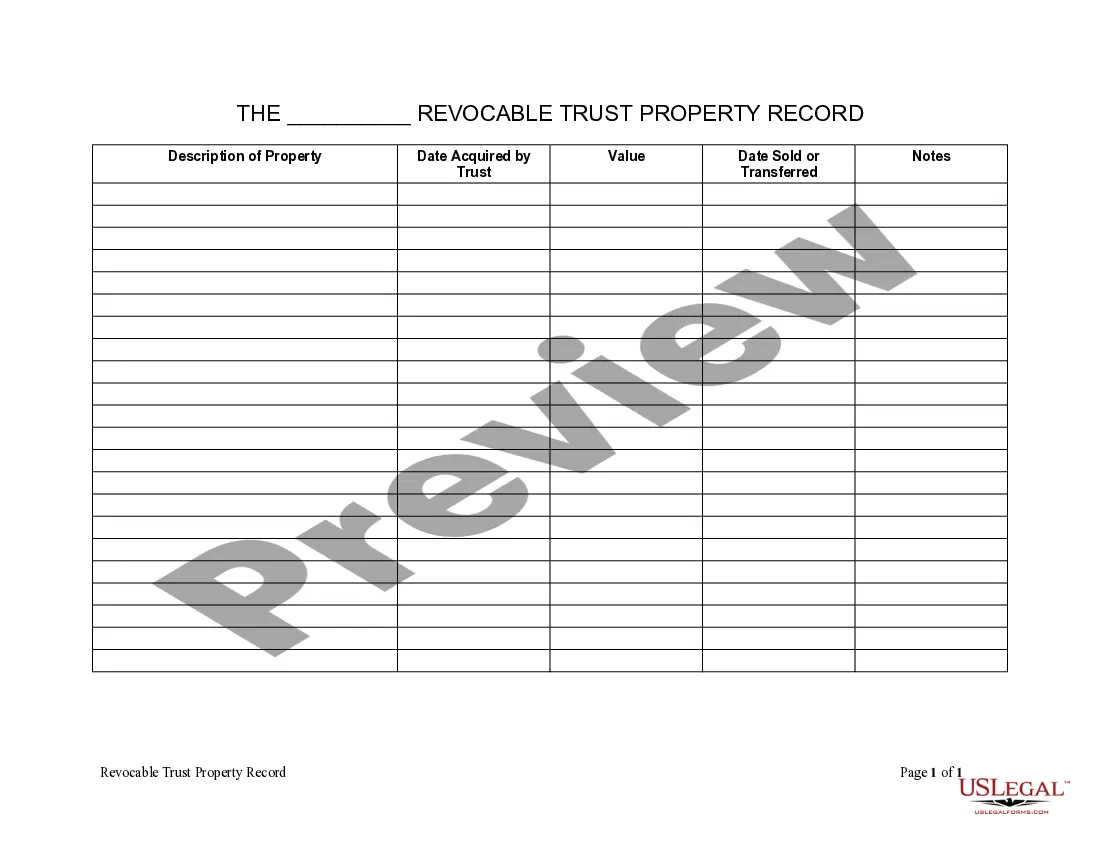

A living trust in Louisiana allows you to retain control of your assets during your lifetime while ensuring they pass to beneficiaries smoothly after your death. You can modify or revoke the trust at any time, making it a flexible estate planning option. Establishing a Baton Rouge Louisiana Financial Account Transfer to Living Trust simplifies asset distribution and potentially avoids probate.

Transferring accounts into a trust involves changing the ownership of your financial accounts to the trust's name. You typically need to complete specific forms provided by your financial institution. When you execute a Baton Rouge Louisiana Financial Account Transfer to Living Trust, it's crucial to follow your institution's procedures to ensure a seamless transfer.

In Louisiana, while it is not mandatory for a trust document to be notarized, having it notarized can add an extra layer of security. Notarization can help in affirming the legitimacy of the trust in legal and financial settings. Ensuring proper documentation is essential for a successful Baton Rouge Louisiana Financial Account Transfer to Living Trust.

Yes, Louisiana generally taxes income generated by trusts. Beneficiaries may be responsible for reporting and paying taxes on trust income, depending on distributions received. Therefore, understanding the tax implications is vital when considering a Baton Rouge Louisiana Financial Account Transfer to Living Trust.