Shreveport Louisiana Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Shreveport, Louisiana, residents have the opportunity to protect and manage their assets through a financial account transfer to a living trust. A living trust is a legal document that allows individuals to transfer ownership of their financial accounts and assets to a separate entity for the purpose of effective estate planning. This detailed description will explore the process and types of financial account transfers to living trusts available in Shreveport. 1. Understanding Living Trusts: A living trust, also known as a revocable trust, is a tool that enables individuals to maintain control over their assets while planning for the future. By transferring financial accounts to a living trust, individuals can ensure the seamless management of their assets during their lifetime and even after their passing. It offers benefits such as avoiding probate, maintaining privacy, and providing flexibility. 2. Types of Shreveport Louisiana Financial Account Transfers to Living Trust: a) Bank Accounts: Residents of Shreveport can transfer various types of bank accounts to a living trust, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By doing so, owners can designate a trustee to manage these accounts in accordance with their wishes. b) Investment Accounts: Individuals can transfer investment accounts, such as brokerage accounts, stocks, bonds, mutual funds, and exchange-traded funds (ETFs), to a living trust. This ensures continuity in managing investment portfolios and facilitates a seamless transition of ownership or control to beneficiaries. c) Retirement Accounts: While it's generally not advisable to transfer retirement accounts (e.g., IRAs, 401(k)s) directly into a living trust, it is possible to name the trust as a beneficiary. By doing so, individuals can integrate their retirement accounts into the overall estate plan, providing enhanced control and distribution options. d) Real Estate: Homeowners in Shreveport can opt to transfer their real estate properties, including primary residences, vacation homes, rental properties, and undeveloped land, into a living trust. This allows for effective management and potential tax benefits while preserving the property's value for designated beneficiaries. e) Business Interests: Individuals who own businesses or shares in companies can also transfer their ownership interests to a living trust. This ensures continuity in business operations, facilitates succession planning, and avoids potential disputes or complications regarding the transfer of ownership. 3. Process of Financial Account Transfer to Living Trust: a) Consultation: Seek guidance from an experienced estate planning attorney familiar with Shreveport's laws and regulations. Discuss your unique circumstances, goals, and desires for the financial account transfer. b) Trust Creation: Your attorney will create a living trust document tailored to your needs. This document will outline the terms, beneficiaries, and management instructions for your financial accounts. c) Account Review: Work with your attorney to identify your financial accounts and understand their eligibility for transfer to the living trust. Gather necessary documentation for smooth transfer, including account statements, deeds, and business ownership certificates. d) Legal Documentation: Prepare the required legal documentation, including assignment forms, beneficiary designations, and trust ownership changes, to effectuate the transfer of your financial accounts to the living trust. e) Communication with Financial Institutions: Coordinate with your financial institutions to ensure a seamless transfer process. They may require specific forms or additional documentation, which your attorney can guide you through. f) Ongoing Management: Once the financial account transfer is complete, the designated trustee assumes control and management responsibilities. Regular reviews and updates may be required to reflect changes in your financial situation or personal circumstances. In summary, a Shreveport Louisiana Financial Account Transfer to Living Trust empowers individuals to protect their financial accounts and assets while ensuring efficient estate planning. By availing themselves of various types of transfers, individuals can achieve their goals of asset management, smooth transition to beneficiaries, and the preservation of their hard-earned wealth. To embark on this journey, it is prudent to consult a knowledgeable estate planning attorney who can guide and support you throughout the process.

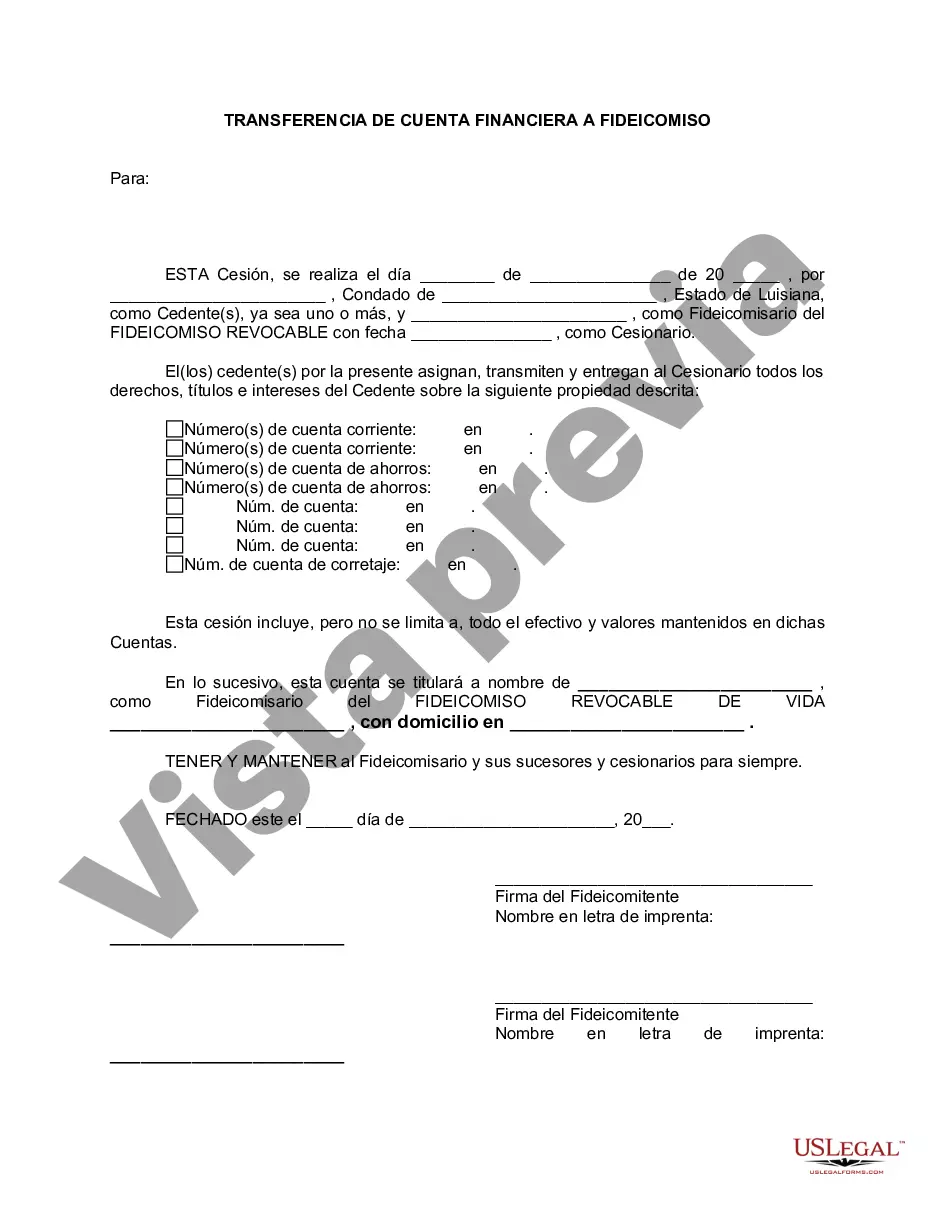

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Shreveport Louisiana Transferencia de cuenta financiera a fideicomiso en vida - Louisiana Financial Account Transfer to Living Trust

State:

Louisiana

City:

Shreveport

Control #:

LA-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Shreveport Louisiana Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Shreveport, Louisiana, residents have the opportunity to protect and manage their assets through a financial account transfer to a living trust. A living trust is a legal document that allows individuals to transfer ownership of their financial accounts and assets to a separate entity for the purpose of effective estate planning. This detailed description will explore the process and types of financial account transfers to living trusts available in Shreveport. 1. Understanding Living Trusts: A living trust, also known as a revocable trust, is a tool that enables individuals to maintain control over their assets while planning for the future. By transferring financial accounts to a living trust, individuals can ensure the seamless management of their assets during their lifetime and even after their passing. It offers benefits such as avoiding probate, maintaining privacy, and providing flexibility. 2. Types of Shreveport Louisiana Financial Account Transfers to Living Trust: a) Bank Accounts: Residents of Shreveport can transfer various types of bank accounts to a living trust, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). By doing so, owners can designate a trustee to manage these accounts in accordance with their wishes. b) Investment Accounts: Individuals can transfer investment accounts, such as brokerage accounts, stocks, bonds, mutual funds, and exchange-traded funds (ETFs), to a living trust. This ensures continuity in managing investment portfolios and facilitates a seamless transition of ownership or control to beneficiaries. c) Retirement Accounts: While it's generally not advisable to transfer retirement accounts (e.g., IRAs, 401(k)s) directly into a living trust, it is possible to name the trust as a beneficiary. By doing so, individuals can integrate their retirement accounts into the overall estate plan, providing enhanced control and distribution options. d) Real Estate: Homeowners in Shreveport can opt to transfer their real estate properties, including primary residences, vacation homes, rental properties, and undeveloped land, into a living trust. This allows for effective management and potential tax benefits while preserving the property's value for designated beneficiaries. e) Business Interests: Individuals who own businesses or shares in companies can also transfer their ownership interests to a living trust. This ensures continuity in business operations, facilitates succession planning, and avoids potential disputes or complications regarding the transfer of ownership. 3. Process of Financial Account Transfer to Living Trust: a) Consultation: Seek guidance from an experienced estate planning attorney familiar with Shreveport's laws and regulations. Discuss your unique circumstances, goals, and desires for the financial account transfer. b) Trust Creation: Your attorney will create a living trust document tailored to your needs. This document will outline the terms, beneficiaries, and management instructions for your financial accounts. c) Account Review: Work with your attorney to identify your financial accounts and understand their eligibility for transfer to the living trust. Gather necessary documentation for smooth transfer, including account statements, deeds, and business ownership certificates. d) Legal Documentation: Prepare the required legal documentation, including assignment forms, beneficiary designations, and trust ownership changes, to effectuate the transfer of your financial accounts to the living trust. e) Communication with Financial Institutions: Coordinate with your financial institutions to ensure a seamless transfer process. They may require specific forms or additional documentation, which your attorney can guide you through. f) Ongoing Management: Once the financial account transfer is complete, the designated trustee assumes control and management responsibilities. Regular reviews and updates may be required to reflect changes in your financial situation or personal circumstances. In summary, a Shreveport Louisiana Financial Account Transfer to Living Trust empowers individuals to protect their financial accounts and assets while ensuring efficient estate planning. By availing themselves of various types of transfers, individuals can achieve their goals of asset management, smooth transition to beneficiaries, and the preservation of their hard-earned wealth. To embark on this journey, it is prudent to consult a knowledgeable estate planning attorney who can guide and support you throughout the process.

Free preview

How to fill out Shreveport Louisiana Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and download the Shreveport Louisiana Financial Account Transfer to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Shreveport Louisiana Financial Account Transfer to Living Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!