Baton Rouge Louisiana Assignment to Living Trust

Description

How to fill out Louisiana Assignment To Living Trust?

If you’ve previously utilized our service, Log In to your account and download the Baton Rouge Louisiana Assignment to Living Trust to your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment schedule.

If this is your initial interaction with our service, follow these easy steps to acquire your file.

You have continuous access to every document you've purchased: you can find it in your profile under the My documents section whenever you need to use it again. Leverage the US Legal Forms service to effortlessly find and save any template for your personal or professional use!

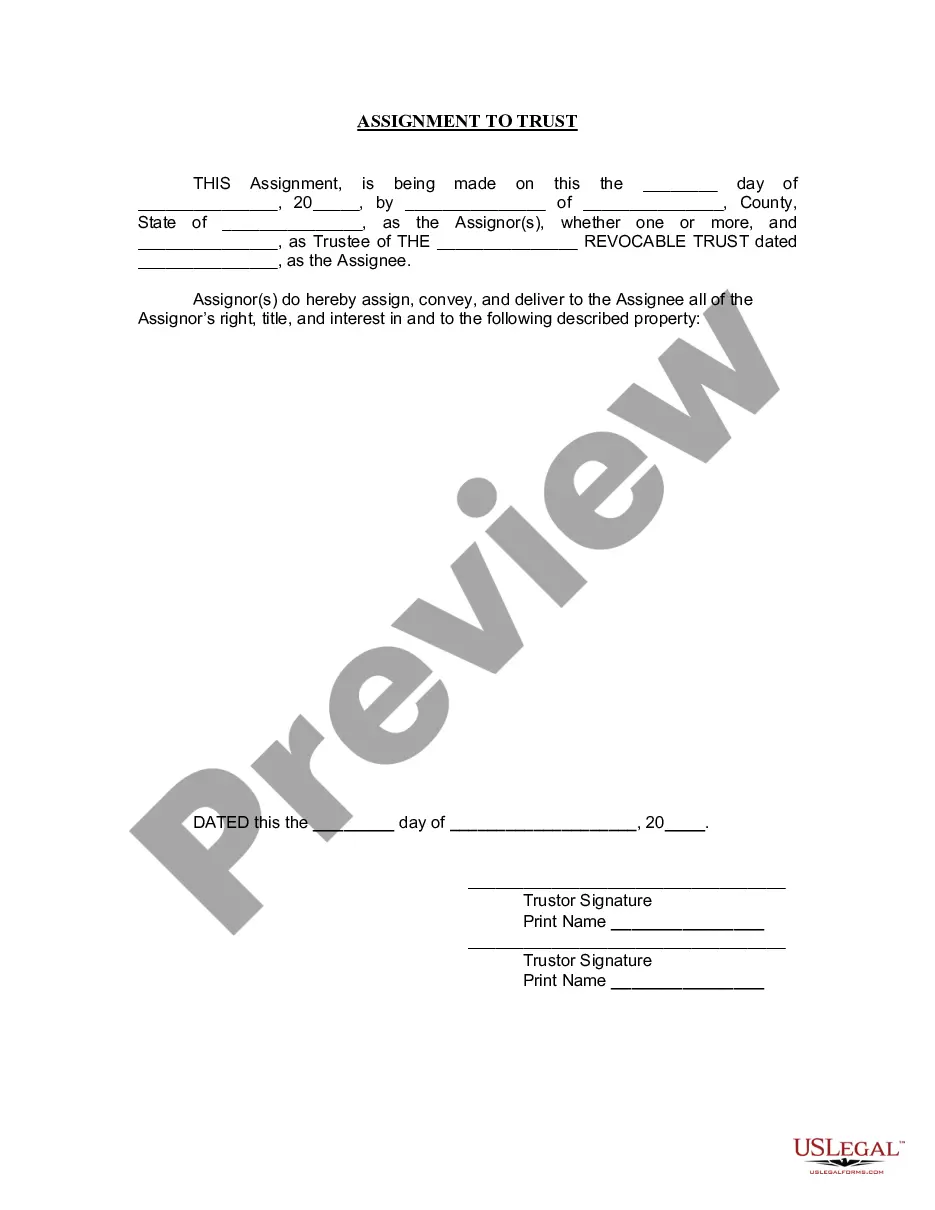

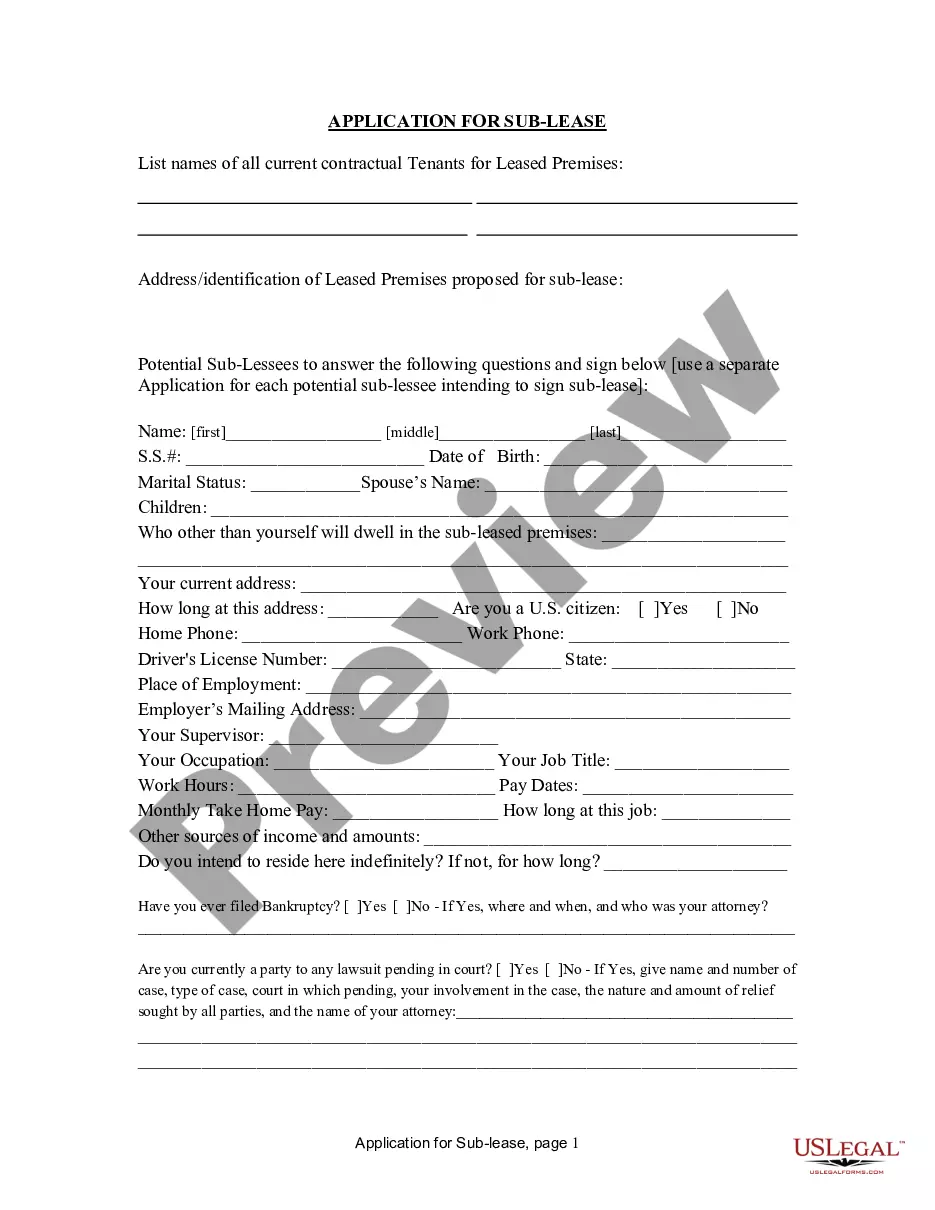

- Ensure you’ve located an appropriate document. Review the description and use the Preview feature, if accessible, to see if it fulfills your needs. If it doesn’t meet your criteria, use the Search option above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Baton Rouge Louisiana Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

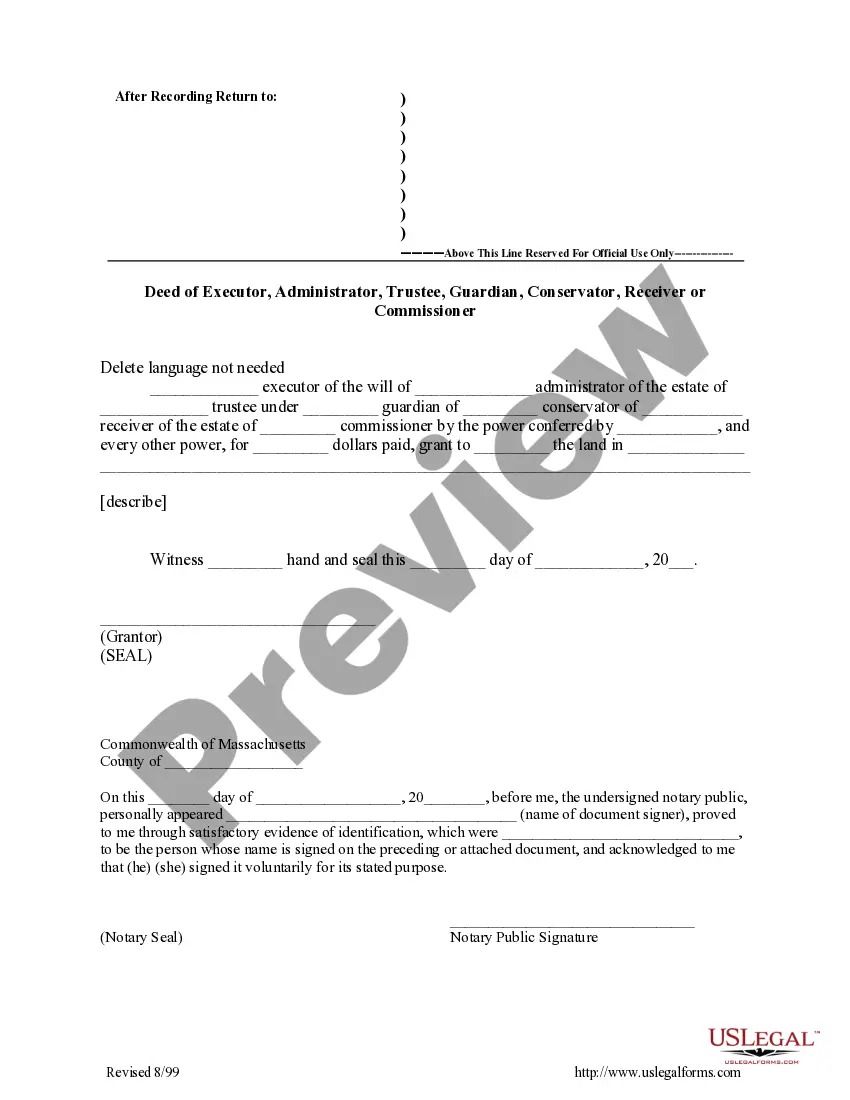

Yes, a trust can own property in Louisiana, including real estate. This feature allows for various benefits such as probate avoidance and easy transfer of assets to beneficiaries. By utilizing a Baton Rouge Louisiana Assignment to Living Trust, you can maintain control over your property while ensuring it is managed according to your wishes.

Certain assets, such as retirement accounts and some life insurance policies, are typically not placed directly in a trust due to tax considerations. Additionally, personal property or items that are not easily transferable may pose challenges. In your Baton Rouge Louisiana Assignment to Living Trust, it’s wise to consult a legal expert who can guide you on how to manage these assets effectively.

To transfer items into a trust, you need to execute a process called retitling. This process involves changing the ownership of the assets to the name of the trust. For a smooth Baton Rouge Louisiana Assignment to Living Trust, you may want to use professional services to ensure everything is done correctly. Proper documentation is essential to avoid any future complications.

A Baton Rouge Louisiana Assignment to Living Trust offers several advantages over a traditional will. Unlike a will, a trust allows your assets to pass directly to your beneficiaries without going through probate, ensuring a quicker distribution. Furthermore, a trust can provide ongoing management for your assets if you become incapacitated, which a will cannot do. For tailored solutions, consider uslegalforms to assist you in setting up a trust that meets your needs.

The primary difference between a will and a trust in Baton Rouge Louisiana lies in their operation after death. A will outlines how your assets should be distributed, but it goes through probate, making the process public. In contrast, a trust takes effect immediately and allows for a more private transfer of assets without probate. This distinction can significantly affect how your estate is managed and distributed.

While trusts have many advantages, there are some disadvantages to consider in Baton Rouge Louisiana. Setting up a trust typically requires more time and legal expertise compared to creating a will, which may increase initial costs. Additionally, you must actively manage the trust, which can be time-consuming. Lastly, certain types of trusts may not offer complete protection against creditors.

Creating a trust in Baton Rouge Louisiana can offer you several key benefits. A trust allows for the management of your assets during your lifetime and after your passing, ensuring your wishes are honored. It can help avoid the lengthy and costly probate process, providing a smoother transition for your beneficiaries. Additionally, trusts offer privacy since they do not become public records like wills do.

In many cases, a trust can be more beneficial than a will in Louisiana. While a will typically requires probate, a Baton Rouge Louisiana Assignment to Living Trust can help manage your assets during your lifetime and distribute them outside of probate upon your death. This can save time and costs for your heirs, providing a more efficient transition of your estate. It's essential to consider your specific situation and goals to determine the best option for you.

Avoiding probate in Louisiana can be accomplished by establishing a living trust or designating beneficiaries on financial accounts. Property placed within a Baton Rouge Louisiana Assignment to Living Trust does not go through probate, allowing for a smoother distribution. Additionally, using named beneficiaries for life insurance and retirement accounts can also bypass the probate process. These strategies ensure your assets go directly to your loved ones without costly delays.

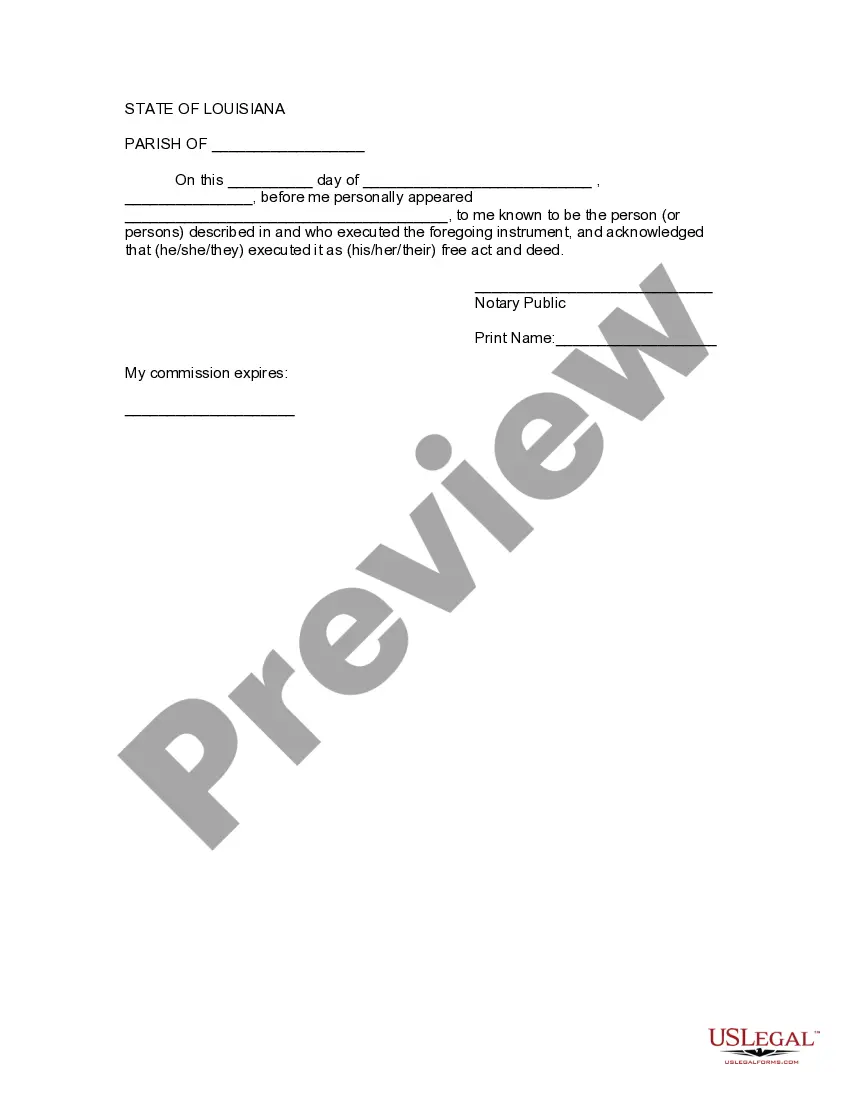

To transfer property into a living trust in Louisiana, you must first create the trust document and name the trust as the new owner of the property. This often involves drafting and signing a deed that outlines this transfer, which should comply with state laws. Utilizing a Baton Rouge Louisiana Assignment to Living Trust can simplify this process, as it helps clarify the ownership and can prevent future legal challenges over the property. Professional assistance, such as from USLegalForms, can ensure proper execution.