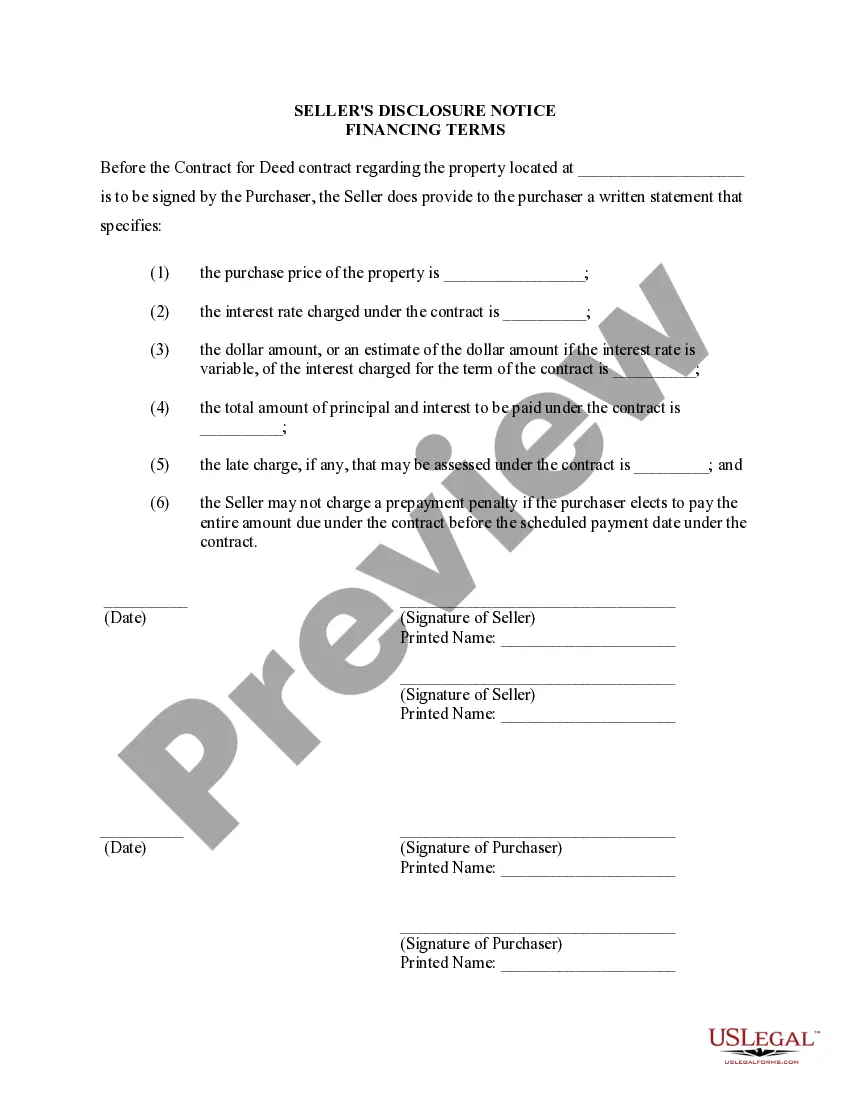

The Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legal document that provides detailed information about the financing terms pertaining to the sale of a residential property in Boston, Massachusetts. This disclosure is typically prepared by the seller and is required by law to be provided to the buyer before entering into a contract or agreement for deed. The purpose of this disclosure is to ensure that the buyer is fully informed about the financial aspects of the transaction, enabling them to make an informed decision about proceeding with the purchase. It aims to prevent any misunderstandings or disputes arising due to the lack of knowledge regarding the financing terms. The Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property can include various types, depending on the specific conditions agreed upon by the parties involved in the contract or agreement for deed. Some common types of disclosures that may be named are: 1. Interest Rate: The disclosure would clearly stipulate the interest rate agreed upon by the seller and the buyer for the financing of the property. This is a crucial aspect of the financing terms, as it directly affects the cost of the property over time. 2. Payment Schedule: This type of disclosure outlines the payment schedule that the buyer would be required to adhere to. It may specify the frequency of payments (e.g., monthly, quarterly) and the due dates for each installment. 3. Balloon Payment: In some cases, the financing terms may include a balloon payment, which is a larger lump sum payment due at the end of the term. The disclosure would provide details about the amount and due date of the balloon payment. 4. Prepayment Penalties: The disclosure may indicate whether there are any penalties for prepaying the loan before the agreed-upon term. These penalties are usually imposed to compensate the seller for potential financial losses due to early repayment of the loan. 5. Default and Foreclosure Process: It is essential for the buyer to understand the consequences of defaulting on the payment obligations outlined in the financing terms. The disclosure may outline the process for default and foreclosure, including any grace periods or remedies available to the buyer. 6. Other Conditions: The disclosure may also include additional information or conditions specific to the financing terms, such as any required insurance coverage, maintenance responsibilities, or obligations related to property taxes. It is crucial for both the buyer and the seller to carefully review and understand the Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property before signing a contract or agreement for deed. If either party has any concerns or questions regarding the disclosed financing terms, it is recommended to seek legal advice or consult a real estate professional for clarification.

Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Boston Massachusetts Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you are looking for a relevant form template, it’s difficult to choose a more convenient service than the US Legal Forms site – probably the most considerable libraries on the web. With this library, you can find a huge number of templates for company and individual purposes by categories and states, or key phrases. Using our advanced search option, finding the most recent Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is as easy as 1-2-3. Moreover, the relevance of each and every record is confirmed by a team of expert lawyers that regularly check the templates on our website and revise them according to the newest state and county requirements.

If you already know about our platform and have an account, all you should do to receive the Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have discovered the form you need. Check its explanation and use the Preview option to see its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the needed file.

- Affirm your selection. Select the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the form. Indicate the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Every form you add to your profile has no expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you need to have an additional version for editing or creating a hard copy, you may come back and download it once more anytime.

Make use of the US Legal Forms extensive library to get access to the Boston Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract you were looking for and a huge number of other professional and state-specific templates on one platform!