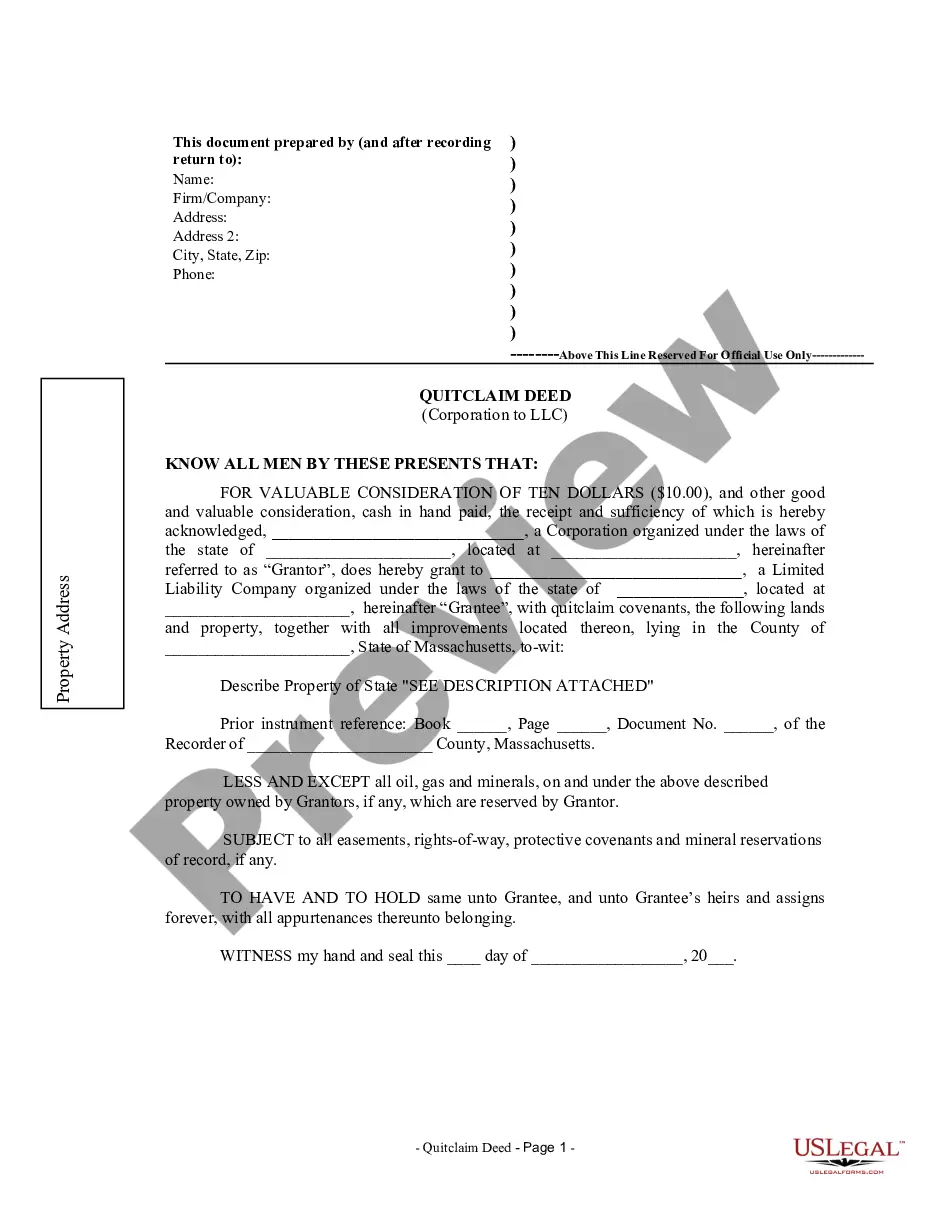

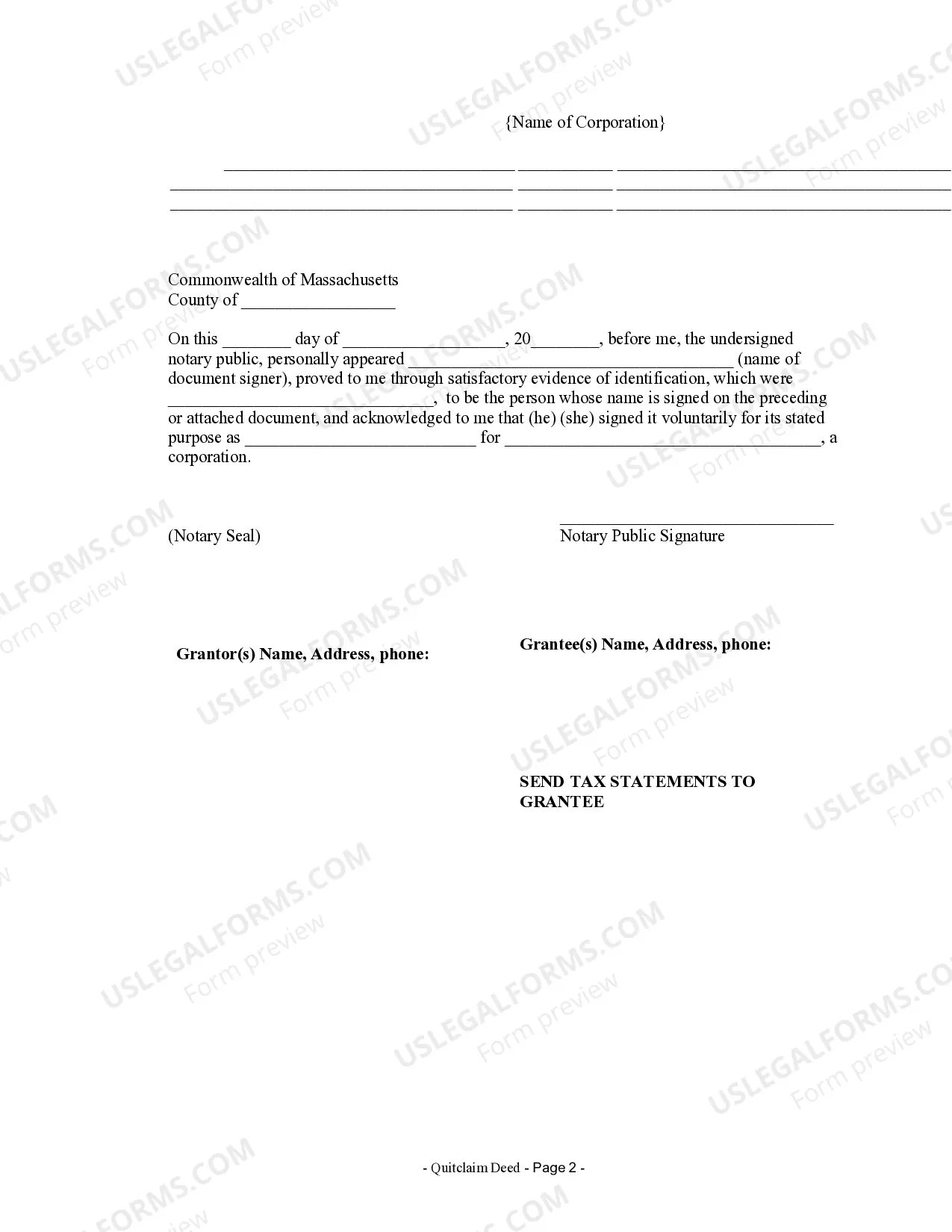

A Middlesex Massachusetts Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of real estate from a corporation to a limited liability company (LLC) in Middlesex County, Massachusetts. This type of transaction typically occurs when a corporation wishes to transfer the ownership of a property it owns into a newly formed LLC entity. It is essential to understand the intricacies of this process before proceeding. There are various types of Middlesex Massachusetts Quitclaim Deeds from Corporation to LLC, including: 1. Standard Middlesex Massachusetts Quitclaim Deed from Corporation to LLC: This is the most common type of deed used in the transfer of property ownership from a corporation to an LLC. It involves the corporation officially releasing all of its interest and rights to the property and conveying it to the LLC. 2. Middlesex Massachusetts Special Warranty Quitclaim Deed from Corporation to LLC: This type of quitclaim deed provides limited warranty protection to the LLC. The corporation guarantees that it has not done anything to encumber the property during its ownership but doesn't provide broad protection against potential defects or encumbrances that may have existed before its ownership. 3. Middlesex Massachusetts Bargain and Sale Quitclaim Deed from Corporation to LLC: This type of deed is often used when the corporation is transferring the property without guaranteeing the absence of defects or encumbrances. It signifies that the corporation is transferring the property "as is" to the LLC with no warranties. The Middlesex Massachusetts Quitclaim Deed from Corporation to LLC typically includes the following key elements: 1. Names and addresses of the parties involved: The deed identifies the corporation, the LLC, as well as any individuals representing each entity, providing their names and addresses. 2. Description of the property: The deed provides a detailed and accurate legal description of the property being transferred, including its boundaries, lot numbers, and any associated legal references. 3. Consideration: This section explains the value or compensation exchanged between the corporation and the LLC as part of the transfer. 4. Signatures: The deed requires the authorized signatures of both the corporation and the LLC, usually by their respective officers or board members. These signatures validate the agreement and make it legally binding. 5. Legal language and acknowledgments: The deed includes standard legal language and certifications, affirming that the individuals signing the document are acting willingly and with full authority. Executing a Middlesex Massachusetts Quitclaim Deed from Corporation to LLC requires proper legal guidance to ensure compliance with state and local regulations. It is advised to consult with a qualified attorney or real estate professional well-versed in Massachusetts property laws to ensure a smooth and accurate transfer of ownership.

Middlesex Massachusetts Quitclaim Deed from Corporation to LLC

Description

How to fill out Middlesex Massachusetts Quitclaim Deed From Corporation To LLC?

Make use of the US Legal Forms and have immediate access to any form template you require. Our helpful platform with thousands of templates makes it easy to find and get almost any document sample you need. You are able to save, fill, and sign the Middlesex Massachusetts Quitclaim Deed from Corporation to LLC in just a couple of minutes instead of browsing the web for hours trying to find a proper template.

Using our library is an excellent strategy to increase the safety of your form filing. Our experienced attorneys on a regular basis check all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Middlesex Massachusetts Quitclaim Deed from Corporation to LLC? If you already have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Open the page with the template you require. Make sure that it is the form you were looking for: verify its name and description, and utilize the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Download the document. Pick the format to obtain the Middlesex Massachusetts Quitclaim Deed from Corporation to LLC and revise and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable template libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Middlesex Massachusetts Quitclaim Deed from Corporation to LLC.

Feel free to take advantage of our service and make your document experience as straightforward as possible!