This note may be used in connection with a purchase of a motor vehicle in Massachusetts and reserves a vendor's lien in favor of the Seller.

A Cambridge Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. This promissory note serves as evidence of the loan and specifies the obligations, responsibilities, and repayment terms of both parties involved in the transaction. Keywords: Cambridge Massachusetts, Promissory Note, loan, sale, motor vehicle, car, auto Types of Cambridge Massachusetts Promissory Note — Loan in connection with sale of motor vehicle, car, or auto: 1. Traditional Promissory Note: This type of promissory note is the most common and straightforward option. It includes the basic terms of the loan, such as the loan amount, interest rate, repayment period, and consequences of default. 2. Secured Promissory Note: If the buyer is unable to meet the requirements for a traditional promissory note, a secured promissory note may be considered. In this case, the buyer offers collateral, such as the motor vehicle itself, as security for the loan. If the buyer defaults, the seller has the right to seize the vehicle. 3. Installment Promissory Note: This type of promissory note breaks down repayments into smaller, more manageable amounts. Both parties agree on a fixed payment schedule, typically monthly, until the loan is fully repaid. The installment promissory note includes details about the repayment amounts, due dates, and any interest or fees involved. 4. Balloon Promissory Note: In certain cases, the buyer and seller may agree to a large final payment, known as a balloon payment, due at the end of the loan term. This type of promissory note allows for lower monthly payments during the loan period, but the buyer is responsible for the larger lump sum at the end. The document outlines the repayment plan, including the balloon payment amount and due date. 5. Simple Interest Promissory Note: For loans with an interest rate based on the outstanding balance, a simple interest promissory note is used. This type of promissory note specifies the principal amount, fixed interest rate, and how interest is calculated. It also includes information about late payment penalties, loan duration, and conditions for prepayment. 6. Default Promissory Note: If the buyer has a history of financial instability or poses a higher risk, a default promissory note might be employed. This type of promissory note typically includes stricter terms, higher interest rates, and stricter consequences for nonpayment or default. No matter the type, a Cambridge Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto should always be carefully reviewed and understood by both parties before signing. It is advisable to consult a legal professional to ensure the document is well-drafted and complies with local regulations.A Cambridge Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto is a legal document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. This promissory note serves as evidence of the loan and specifies the obligations, responsibilities, and repayment terms of both parties involved in the transaction. Keywords: Cambridge Massachusetts, Promissory Note, loan, sale, motor vehicle, car, auto Types of Cambridge Massachusetts Promissory Note — Loan in connection with sale of motor vehicle, car, or auto: 1. Traditional Promissory Note: This type of promissory note is the most common and straightforward option. It includes the basic terms of the loan, such as the loan amount, interest rate, repayment period, and consequences of default. 2. Secured Promissory Note: If the buyer is unable to meet the requirements for a traditional promissory note, a secured promissory note may be considered. In this case, the buyer offers collateral, such as the motor vehicle itself, as security for the loan. If the buyer defaults, the seller has the right to seize the vehicle. 3. Installment Promissory Note: This type of promissory note breaks down repayments into smaller, more manageable amounts. Both parties agree on a fixed payment schedule, typically monthly, until the loan is fully repaid. The installment promissory note includes details about the repayment amounts, due dates, and any interest or fees involved. 4. Balloon Promissory Note: In certain cases, the buyer and seller may agree to a large final payment, known as a balloon payment, due at the end of the loan term. This type of promissory note allows for lower monthly payments during the loan period, but the buyer is responsible for the larger lump sum at the end. The document outlines the repayment plan, including the balloon payment amount and due date. 5. Simple Interest Promissory Note: For loans with an interest rate based on the outstanding balance, a simple interest promissory note is used. This type of promissory note specifies the principal amount, fixed interest rate, and how interest is calculated. It also includes information about late payment penalties, loan duration, and conditions for prepayment. 6. Default Promissory Note: If the buyer has a history of financial instability or poses a higher risk, a default promissory note might be employed. This type of promissory note typically includes stricter terms, higher interest rates, and stricter consequences for nonpayment or default. No matter the type, a Cambridge Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto should always be carefully reviewed and understood by both parties before signing. It is advisable to consult a legal professional to ensure the document is well-drafted and complies with local regulations.

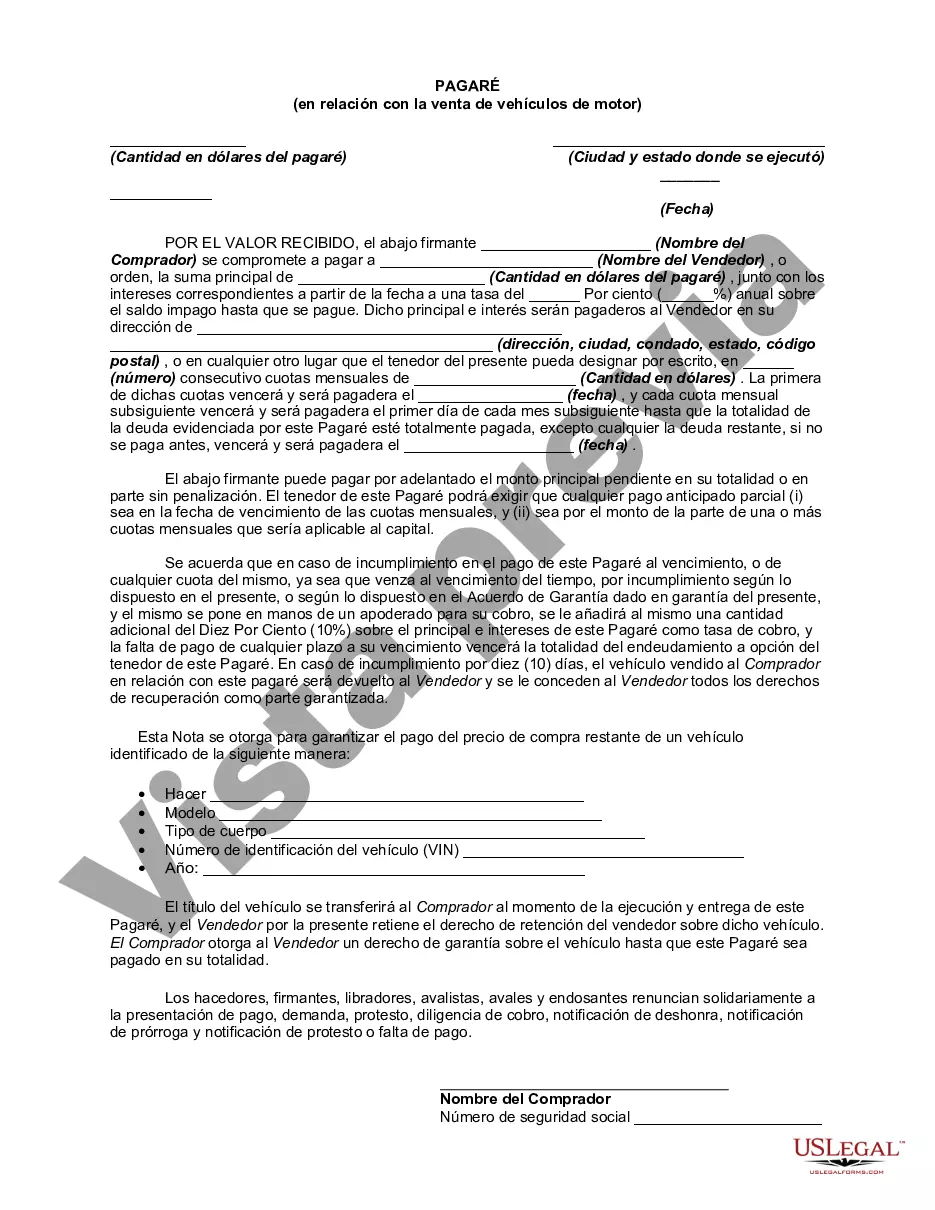

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.