This note may be used in connection with a purchase of a motor vehicle in Massachusetts and reserves a vendor's lien in favor of the Seller.

A Lowell Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller. Keywords: Lowell Massachusetts Promissory Note, Promissory Note, Loan, Sale of motor vehicle, Car, Auto. This note serves as a written agreement that details the loan amount, interest rate, repayment schedule, and any other specific terms or conditions agreed upon by both parties. It ensures that both the buyer and seller are protected and have a clear understanding of their financial responsibilities. There are different types of Lowell Massachusetts Promissory Note — Loan in connection with the sale of motor vehicle, car, or auto, such as: 1. Secured Promissory Note: In this type of loan agreement, the motor vehicle, car, or auto serves as collateral to secure the loan. If the buyer fails to make timely payments, the seller has the right to repossess the vehicle, ensuring the protection of the seller's investment. 2. Unsecured Promissory Note: This type of loan agreement does not require any collateral. It is based solely on the buyer's creditworthiness and trustworthiness, making it a riskier option for the seller. In case of default, the seller may have difficulty recovering their funds. 3. Installment Promissory Note: This type of Promissory Note involves the repayment of the loan in fixed monthly installments over a specific period. Each installment includes both principal and interest, allowing the buyer to budget their payments accordingly. 4. Balloon Promissory Note: A Balloon Promissory Note involves smaller monthly payments throughout the loan term and a substantial final payment, known as a balloon payment, at the end of the term. This type of note is suitable for buyers who expect to have a lump sum of money available at the end of the loan term. 5. Simple Interest Promissory Note: This type of loan agreement calculates interest based solely on the outstanding principal balance of the loan. It does not compound on previous interest payments, making it a transparent and straightforward method of interest calculation. When using any Lowell Massachusetts Promissory Note — Loan in connection with the sale of motor vehicle, car, or auto, it is crucial to ensure that the document complies with the state's laws and regulations governing loan agreements.A Lowell Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller. Keywords: Lowell Massachusetts Promissory Note, Promissory Note, Loan, Sale of motor vehicle, Car, Auto. This note serves as a written agreement that details the loan amount, interest rate, repayment schedule, and any other specific terms or conditions agreed upon by both parties. It ensures that both the buyer and seller are protected and have a clear understanding of their financial responsibilities. There are different types of Lowell Massachusetts Promissory Note — Loan in connection with the sale of motor vehicle, car, or auto, such as: 1. Secured Promissory Note: In this type of loan agreement, the motor vehicle, car, or auto serves as collateral to secure the loan. If the buyer fails to make timely payments, the seller has the right to repossess the vehicle, ensuring the protection of the seller's investment. 2. Unsecured Promissory Note: This type of loan agreement does not require any collateral. It is based solely on the buyer's creditworthiness and trustworthiness, making it a riskier option for the seller. In case of default, the seller may have difficulty recovering their funds. 3. Installment Promissory Note: This type of Promissory Note involves the repayment of the loan in fixed monthly installments over a specific period. Each installment includes both principal and interest, allowing the buyer to budget their payments accordingly. 4. Balloon Promissory Note: A Balloon Promissory Note involves smaller monthly payments throughout the loan term and a substantial final payment, known as a balloon payment, at the end of the term. This type of note is suitable for buyers who expect to have a lump sum of money available at the end of the loan term. 5. Simple Interest Promissory Note: This type of loan agreement calculates interest based solely on the outstanding principal balance of the loan. It does not compound on previous interest payments, making it a transparent and straightforward method of interest calculation. When using any Lowell Massachusetts Promissory Note — Loan in connection with the sale of motor vehicle, car, or auto, it is crucial to ensure that the document complies with the state's laws and regulations governing loan agreements.

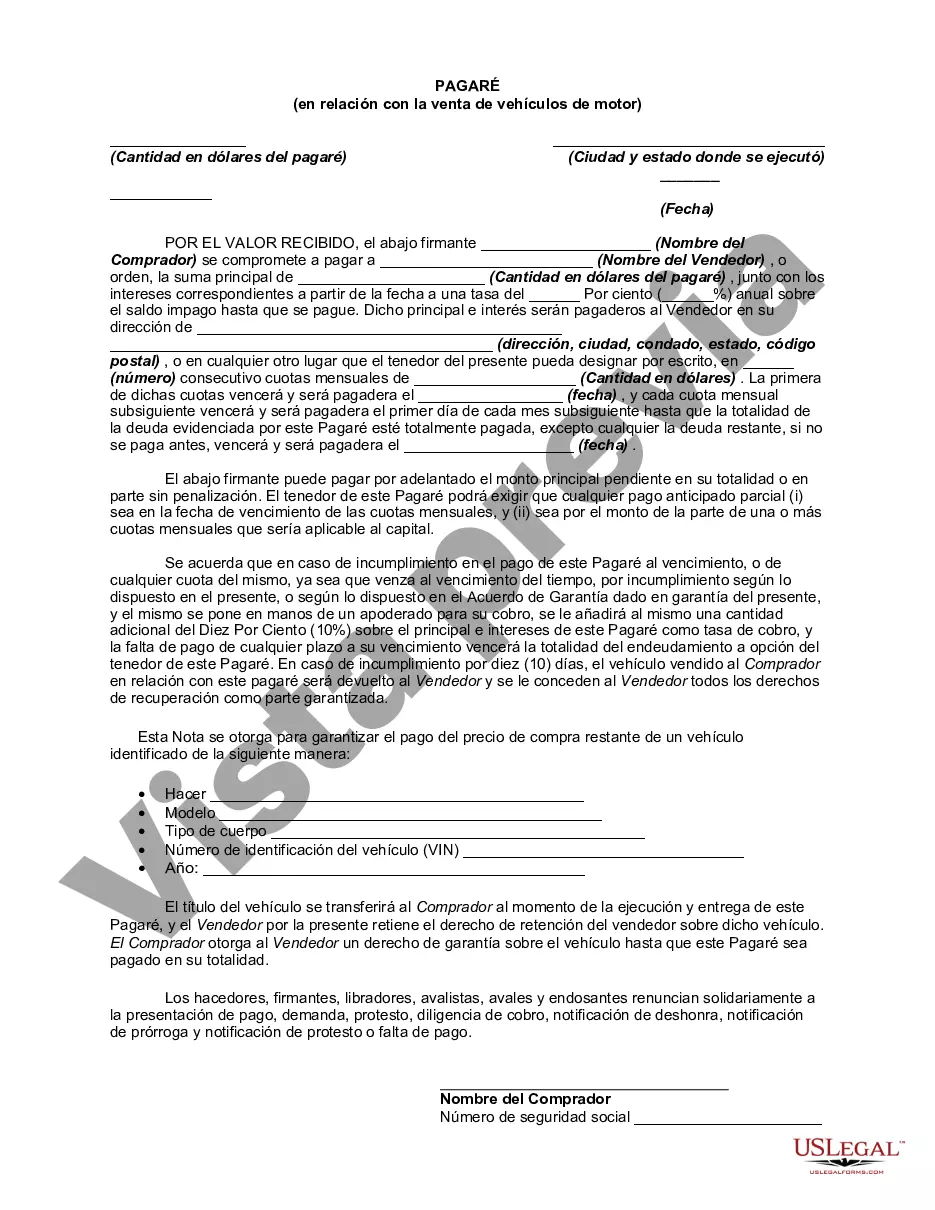

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.