This note may be used in connection with a purchase of a motor vehicle in Massachusetts and reserves a vendor's lien in favor of the Seller.

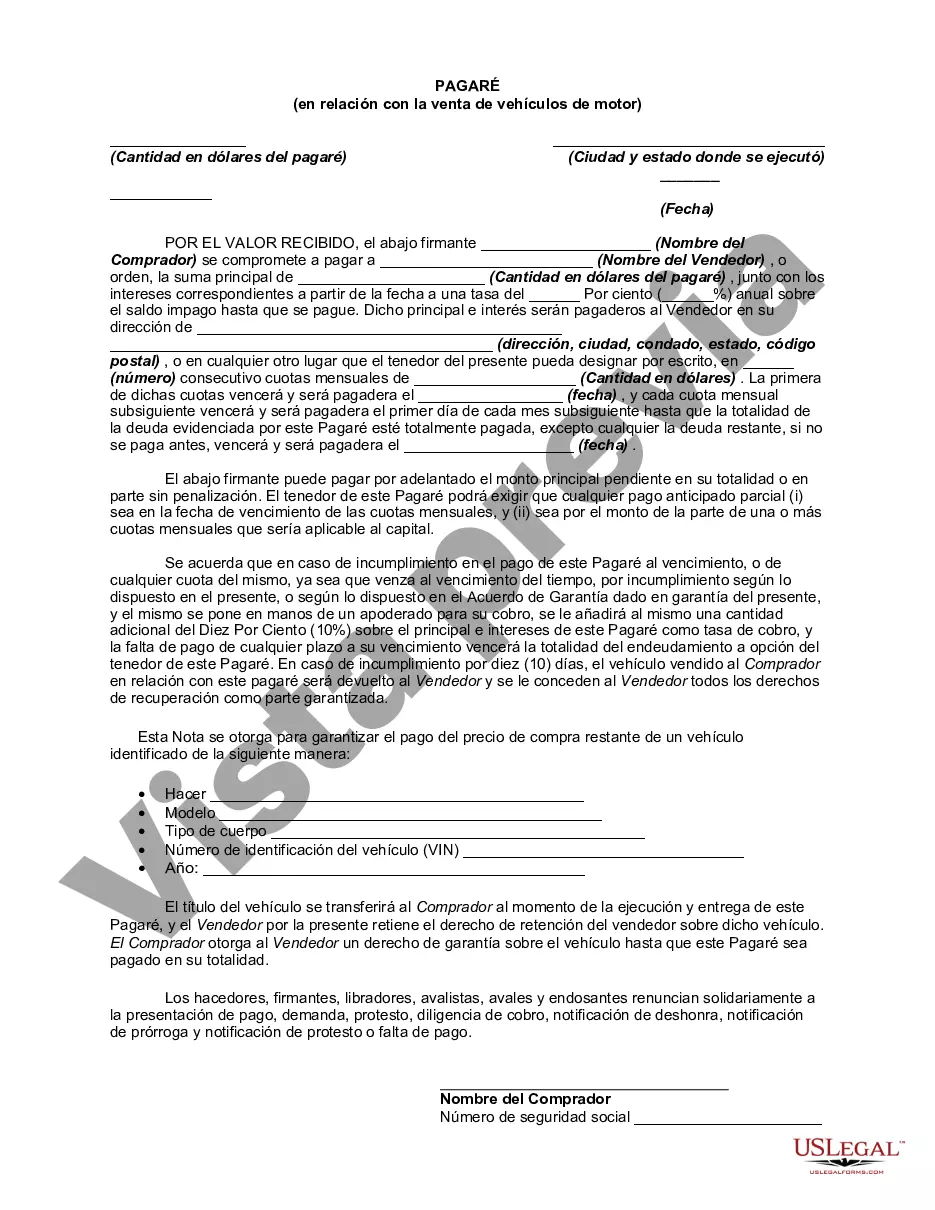

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Pagaré - Préstamo en relación con la venta de un vehículo motorizado, automóvil o automóvil - Massachusetts Promissory Note - Loan in connection with sale of motor vehicle, car, or auto

Description

How to fill out Massachusetts Pagaré - Préstamo En Relación Con La Venta De Un Vehículo Motorizado, Automóvil O Automóvil?

If you’ve previously utilized our service, Log In to your account and retrieve the Middlesex Massachusetts Promissory Note - Loan related to the sale of a motor vehicle, car, or auto onto your device by selecting the Download button. Verify that your subscription is active. If not, renew it according to your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to obtain your document.

You have uninterrupted access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to access them again. Utilize the US Legal Forms service to swiftly locate and download any template for your personal or business requirements!

- Confirm you've located an appropriate document. Browse the description and utilize the Preview feature, if available, to verify if it fulfills your needs. If it’s not a match, use the Search tab above to discover the correct one.

- Purchase the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process the payment. Employ your credit card information or the PayPal option to finalize the purchase.

- Obtain your Middlesex Massachusetts Promissory Note - Loan related to the sale of a motor vehicle, car, or auto. Select the file format for your document and store it on your device.

- Fill out your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Para saber cuanto estaras pagando de intereses, lo que tienes que hacer es multiplicar el monto inicial por la tasa de interes en porcentaje por los plazos de pago. Para saber el monto total que pagaras, unicamente tienes que sumar la cantidad que te de, del total de intereses, mas el monto inicial.

El que usted pueda pagar por adelantado y por completo su prestamo vehicular sin que lo penalicen depende de su contrato y de la ley en su estado. Si el prestamista quiere cobrarle una multa o cargo por adelantar el pago completo de su prestamo, el contrato debe contener una clausula de penalizacion por prepago.

7 Formas de pagar el prestamo de su automovil mas rapido 1 - Redondea tus pagos.2 - Paga dos veces al mes.3 - Refinanciar su prestamo original.4 - Utilice sabiamente las ganancias inesperadas.5 - Encuentra ingresos adicionales.6 - Piense en bolas de nieve y avalanchas.7 - Realizar pagos adicionales contra el capital.

Refinanciar un prestamo de auto implica tomar un nuevo prestamo para pagar el saldo de su prestamo de auto existente. La mayoria de estos prestamos estan garantizados por un carro y se saldan en pagos mensuales fijos durante un periodo de tiempo predeterminado (generalmente unos pocos anos).

Lo primero que debes saber es que los creditos automotrices estan disenados para que puedas adquirir cualquier tipo de automoviles, nuevo o seminuevo, a traves del prestamo de una cantidad de dinero que te entregan las instituciones financieras.

El precio de los autos sube 5% pero el financiamiento se vuelve mas competitivo. Con tasas de interes preferenciales y plazos largos, los fabricantes buscan mantener sus ventas en medio de la crisis economica derivada de la pandemia del coronavirus.

7 maneras de pagar su prestamo de auto mas rapido Averigue si hay una penalizacion por pago anticipado.Realice dos pagos al mes.Realice pagos mas grandes.Refinancie para obtener un tipo de interes mas bajo.Aplique las devoluciones de impuestos y las bonificaciones.Realice un pago inicial mayor.

No hay un tiempo requerido para refinanciar su auto. Si su prestamo es nuevo y tiene un interes alto, ahorrara mas dinero al refinanciar.

El refinanciamiento del prestamo de tu auto te permite pagarle a tu prestamista y comprometerte con un nuevo prestamo pero con una tasa de interes anual mas favorable. Eso quiere decir que, en general, no debes considerar el refinanciamiento a menos que puedas obtener una tasa de interes mas baja.

Es la renovacion de un credito. El banco o institucion financiera te otorga uno nuevo para cancelar el primero o bien, ampliar la linea de credito. Al final, tendras mas dinero disponible con las mismas condiciones, o a veces hasta mejores.