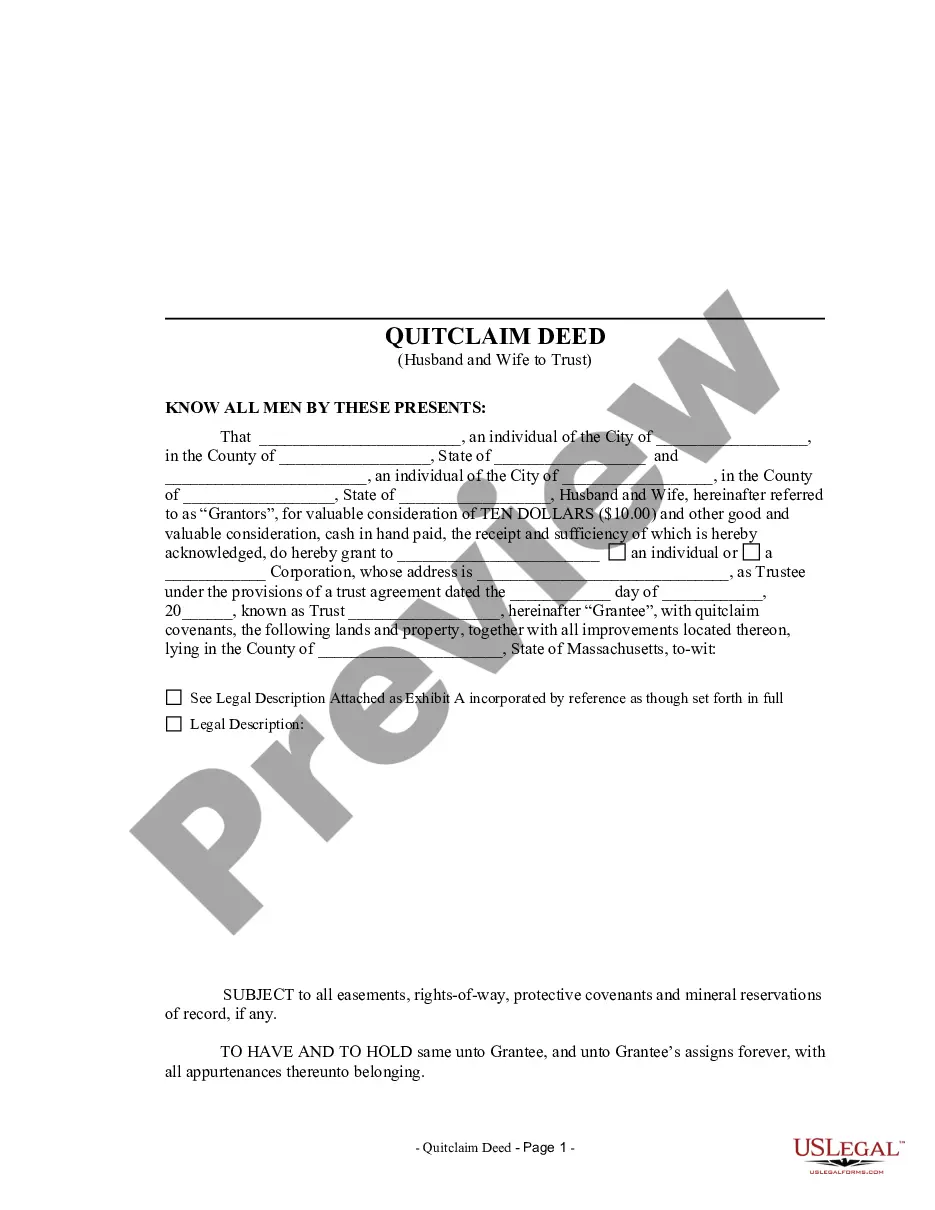

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantee is a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Cambridge Massachusetts Quitclaim Deed — Husband and Wife to Trust is a legal document that allows married individuals in the state of Massachusetts to transfer their property ownership rights to a trust. This type of deed is commonly used when a couple wants to place their property into a trust for various reasons, such as asset protection, estate planning, or avoiding probate. By utilizing a Quitclaim Deed, the married couple is essentially conveying their interests, both present and future, in the property to the trust. This transfer ensures that the property is no longer individually owned, but rather owned by the trust as a separate legal entity. The trust can then hold, manage, and distribute the property assets as outlined by the couple's predetermined terms and instructions. Specifically, the "Husband and Wife to Trust" aspect of the Quitclaim Deed signifies that both spouses collectively transfer their interests in the property to the trust. This means that both parties are participating in the transfer and agreeing to relinquish their individual ownership rights in favor of the trust. There may be different variations or subtypes of Cambridge Massachusetts Quitclaim Deed — Husband and Wife to Trust, such as: 1. Irrevocable Trust Quitclaim Deed: This type of deed transfers the property ownership to an irrevocable trust, which means that the terms of the trust are unchangeable without the consent of all involved parties. It offers enhanced asset protection and has specific tax implications. 2. Revocable Trust Quitclaim Deed: Unlike an irrevocable trust, a revocable trust allows for modifications and amendments during the lifetime of the granters (the couple transferring the property). It offers flexibility in managing the property and the ability to revoke or dissolve the trust if desired. 3. Testamentary Trust Quitclaim Deed: This type of deed is utilized to transfer ownership of the property to a trust that will only take effect upon the death of the granters. It allows for the smooth transition of assets to the trust beneficiaries, bypassing probate court proceedings. Overall, a Cambridge Massachusetts Quitclaim Deed — Husband and Wife to Trust serves as an important legal instrument for married couples seeking to transfer their property into a trust arrangement. This transfer ensures that the property is managed and distributed according to their specific wishes, offering potential benefits in terms of estate planning, asset protection, and avoiding probate.