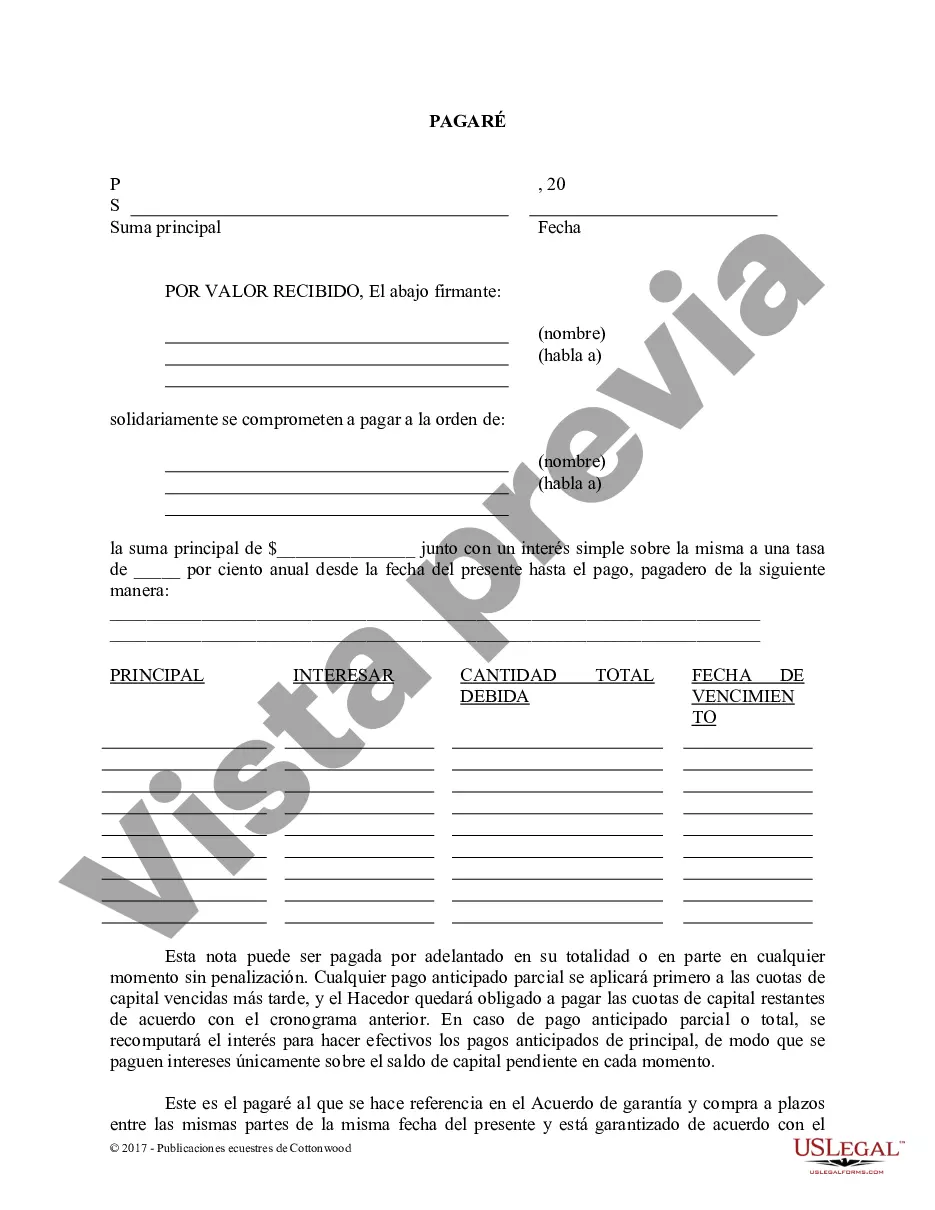

A Middlesex Massachusetts Promissory Note — Horse Equine Form is a legally binding document that outlines the terms and conditions of a loan agreement made between two parties in Middlesex County, Massachusetts, specifically in relation to horse or equine related transactions. This note serves as evidence of the loan and provides protection to both the borrower and the lender. The Middlesex Massachusetts Promissory Note — Horse Equine Form contains various essential sections that must be filled out accurately by both parties involved. These sections typically include: 1. Parties: This section requires the full legal names and contact information of the borrower (also known as the promise) and the lender (also known as the promise). It is crucial to include accurate details to avoid any confusion or disputes in the future. 2. Loan Terms: This part of the promissory note outlines the specific terms of the loan, including the principal amount, interest rate (if applicable), repayment schedule, and any late payment penalties or fees. The interest rate can be fixed or variable, depending on the agreement between both parties. 3. Collateral: In some cases, the lender may require collateral to secure the loan. This section defines the collateral provided by the borrower, which could include horses, equine equipment, or any other valuable assets related to the equine industry. The collateral serves as a guarantee for the lender in case of default. 4. Default and Remedies: This section specifies the actions that will be taken in the event of default by the borrower. It covers details such as the grace period for missed payments, the lender's right to demand immediate repayment, and any legal remedies available to the lender. 5. Governing Law: The Middlesex Massachusetts Promissory Note — Horse Equine Form is subject to the laws and regulations of the state of Massachusetts. This section clarifies the jurisdiction and venue for any potential legal proceedings related to the note. Different types of Middlesex Massachusetts Promissory Note — Horse Equine Forms may vary based on individual circumstances and preferences. Some examples include: 1. Secured Promissory Note: This type of promissory note includes collateral to secure the loan, which provides an added layer of protection for the lender. The specific collateral, such as horses or equine equipment, will be described in detail. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not require collateral. The borrower's promise to repay the loan is the sole guarantee for the lender, making it relatively riskier for the lender. 3. Installment Promissory Note: This form allows the borrower to repay the loan amount in installments, typically including principal and interest, over a specified period of time. The repayment schedule is provided within the note. It is crucial to consult with a legal professional or an attorney specializing in equine law when drafting or signing a Middlesex Massachusetts Promissory Note — Horse Equine Form to ensure that all legal requirements are met and both parties are protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Pagaré - Caballo Equino Formas - Massachusetts Promissory Note - Horse Equine Forms

Description

How to fill out Middlesex Massachusetts Pagaré - Caballo Equino Formas?

Do you need a reliable and inexpensive legal forms supplier to get the Middlesex Massachusetts Promissory Note - Horse Equine Forms? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Middlesex Massachusetts Promissory Note - Horse Equine Forms conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Middlesex Massachusetts Promissory Note - Horse Equine Forms in any available file format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal papers online once and for all.

Form popularity

FAQ

La rinoneumonitis equina es una enfermedad virica contagiosa producida por los herpesvirus equino (EHV) que causan enfermedad respiratoria, abortos y alteraciones nerviosas.

La rabdomiolisis es una enfermedad metabolica equina que aparece poco despues de una fuerte sobrecarga y afecta a la musculatura. Esta enfermedad recibe muchos nombres, como azoturia, mioglobinuria paralitica, miositis posesfuerzo y hemoglobinuria paralitica. Esta patologia puede ser genetica.

El medicamento para la eutanasia que usan la mayoria de los veterinarios es pentobarbital. Este barbiturico (similar al utilizado para las anestesias) se emplea por lo general para tratar las convulsiones, pero en grandes dosis lograra que el peludo amigo pierda la consciencia.

Los caballos pueden ser eutanizados con arma de fuego o pistola de perno cautivo penetrante. Como se describio previamente, el uso de la pistola de perno cautivo penetrante requiere de una buena sujecion de manera que se pueda colocar en contacto directo con el craneo cuando sea disparada.

El disparo es comunmente el unico metodo practico de eutanasia cuando la asistencia veterinaria no esta disponible. Ya sea una pistola o un rifle seran adecuados para sacrificar a tu caballo por medio de un disparo.

La rotura de una pierna es una lesion importante, pero no supone un peligro de muerte (salvo complicaciones) en los humanos, ni en la mayoria de los animales. Entonces, ¿por que es mortal para los caballos? Durante siglos, cuando un caballo se rompia la pata, era sacrificado al instante.

Existe un sencillo truco que funciona la gran mayoria de las veces: silbe. Cuando pare al caballo un momento, pruebe a silbar con fuerza. El silbido captara su atencion y esto provocara la liberacion de la retencion de la vejiga, permitiendole asi orinar.

La orina normal del caballo contiene una elevada concentracion de materia organica y sales inorganicas, especialmente carbonato calcico y la retencion de la orina en la vejiga facilita la formacion de grandes cantidades de sedimento.

Salud Animal. Los caballos sanos comen con gusto cuando se les acerca alimento y generalmente toman agua despues de comer. Defecan heces consistentes varias veces al dia y orinan cada 2 a 4 horas.

El disparo es comunmente el unico metodo practico de eutanasia cuando la asistencia veterinaria no esta disponible. Ya sea una pistola o un rifle seran adecuados para sacrificar a tu caballo por medio de un disparo.

Interesting Questions

More info

This information may be made available to research teams as research and public records. The Town of Cambridge (and other departments) may request copies of these documents in hard copy, on microfilm, or in digital format to facilitate access as research and public records. Public Records. In 1791, the town of Newton, Massachusetts, established a system of “Public Records” that was used to record records that were not kept in town. Town Clerk James Gage and Clerk of the Court William Paine are in the process of collating them. The “Public Records” are available for public inspection at the Cambridge Public Library.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.