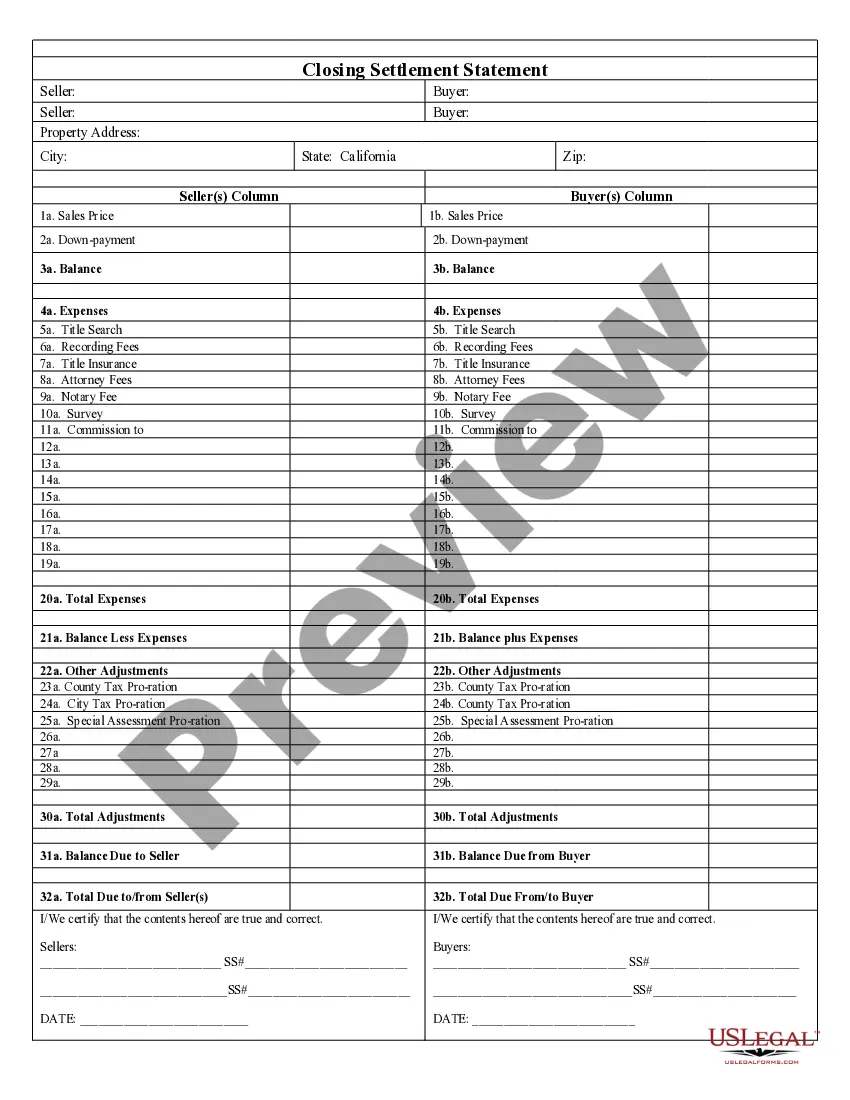

Boston Massachusetts Average Weekly Wage Computation Schedule for Workers' Compensation

Description

How to fill out Massachusetts Average Weekly Wage Computation Schedule For Workers' Compensation?

If you have previously utilized our service, Log In to your account and retrieve the Boston Massachusetts Average Weekly Wage Computation Schedule for Workers' Compensation onto your device by clicking the Download button. Verify that your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have perpetual access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to promptly find and secure any template for your personal or professional purposes!

- Ensure you’ve found an appropriate document. Review the description and use the Preview option, if available, to determine if it satisfies your requirements. If it doesn’t suit you, use the Search tab above to locate the correct one.

- Buy the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Set up an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Boston Massachusetts Average Weekly Wage Computation Schedule for Workers' Compensation. Select the file format for your document and download it to your device.

- Complete your document. Print it or employ professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To determine an hourly worker's average weekly wage, take the past 13 weeks and add up the earnings and then divide that number by 13.

To calculate your regular weekly wage, you divide your annual salary by 52. If someone makes $52,000 a year, this would amount to $1,000 weekly. The maximum benefit would be $666.66 in this case as state law stipulates the maximum benefit is 2/3 of your pretax gross wage.

For 2022, the new state average weekly wage is $1,694.24 and the new maximum weekly benefit rate is $1,084.31.

C. 152, Workers' Compensation Act. This regulation is referred to as the ?fee schedule? and contains 12 separate sections that list rates used to pay for health care services delivered by ambulatory provider types, such as physicians and physical therapists.

Average annual wages are calculated by dividing total wages paid by the employer to employees during a taxable year (box 5 of W-2 wages) by the number of FTEs for the year.

Minimum and maximum compensation rates Date Of ChangeMaximum RateMinimum Rate10/1/21$ 1,694.24$ 338.8510/1/20$ 1,487.78$ 297.5610/1/19$ 1,431.66$ 286.3310/1/18$ 1,383.41$ 276.6827 more rows

To calculate your regular weekly wage, you divide your annual salary by 52. If someone makes $52,000 a year, this would amount to $1,000 weekly. The maximum benefit would be $666.66 in this case as state law stipulates the maximum benefit is 2/3 of your pretax gross wage.

The average weekly wages is the amount a worker earns in a year divided by the number of weeks in a year.

Your Total Disability Benefit rate is sixty (60%) of your average weekly wage. So, once you have determined your average weekly wage, you would multiply it by 60%. For Example: If a worker had an average weekly wage of $750.00, their Temporary Total Disability Benefits would be $450.00 per week ($750 X 60%).