Boston Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Massachusetts Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

If you are looking for an authentic form template, it’s hard to find a superior location than the US Legal Forms site – likely the largest online collections.

With this collection, you can discover thousands of templates for corporate and personal needs categorized by types and areas, or keywords.

Utilizing our enhanced search functionality, locating the most current Boston Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is as simple as 1-2-3.

Obtain the document. Choose the file format and download it to your device.

Make changes. Fill out, edit, print, and sign the obtained Boston Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

- If you are already familiar with our platform and possess a registered account, all you need to do to acquire the Boston Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is to Log In to your user account and click the Download button.

- If this is your first time using US Legal Forms, just adhere to the instructions outlined below.

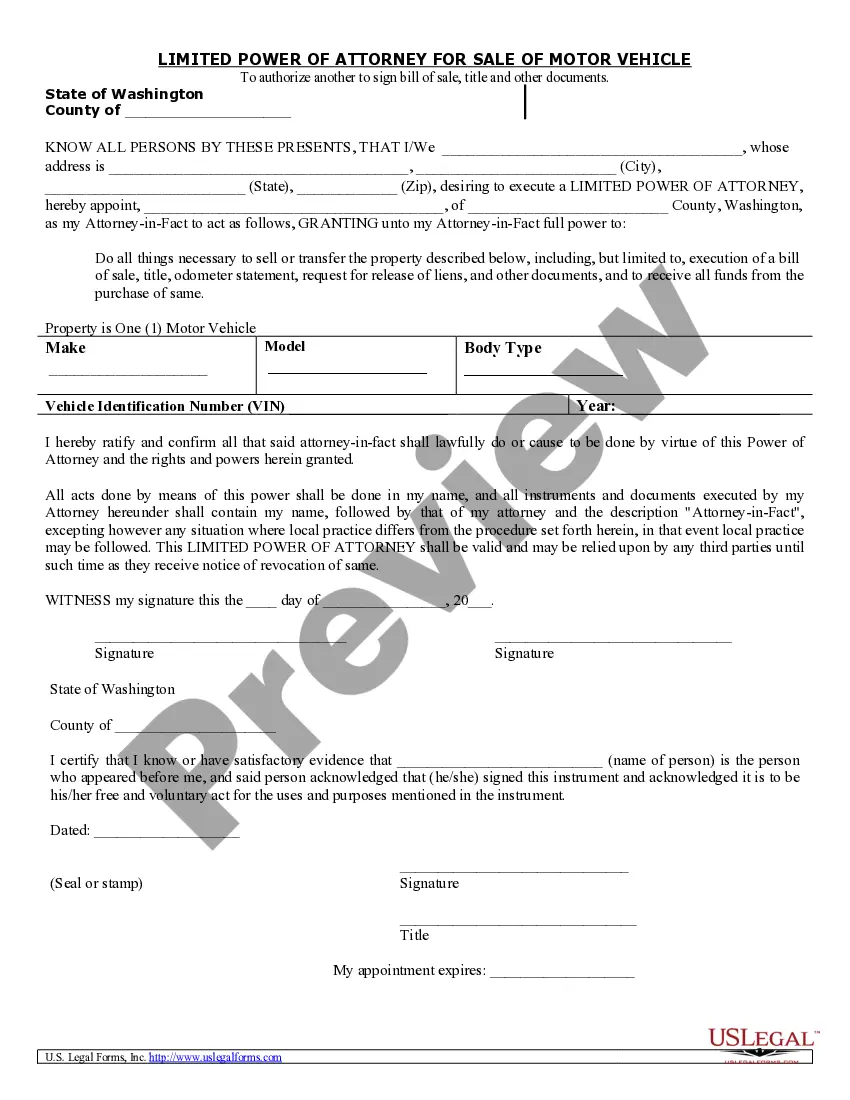

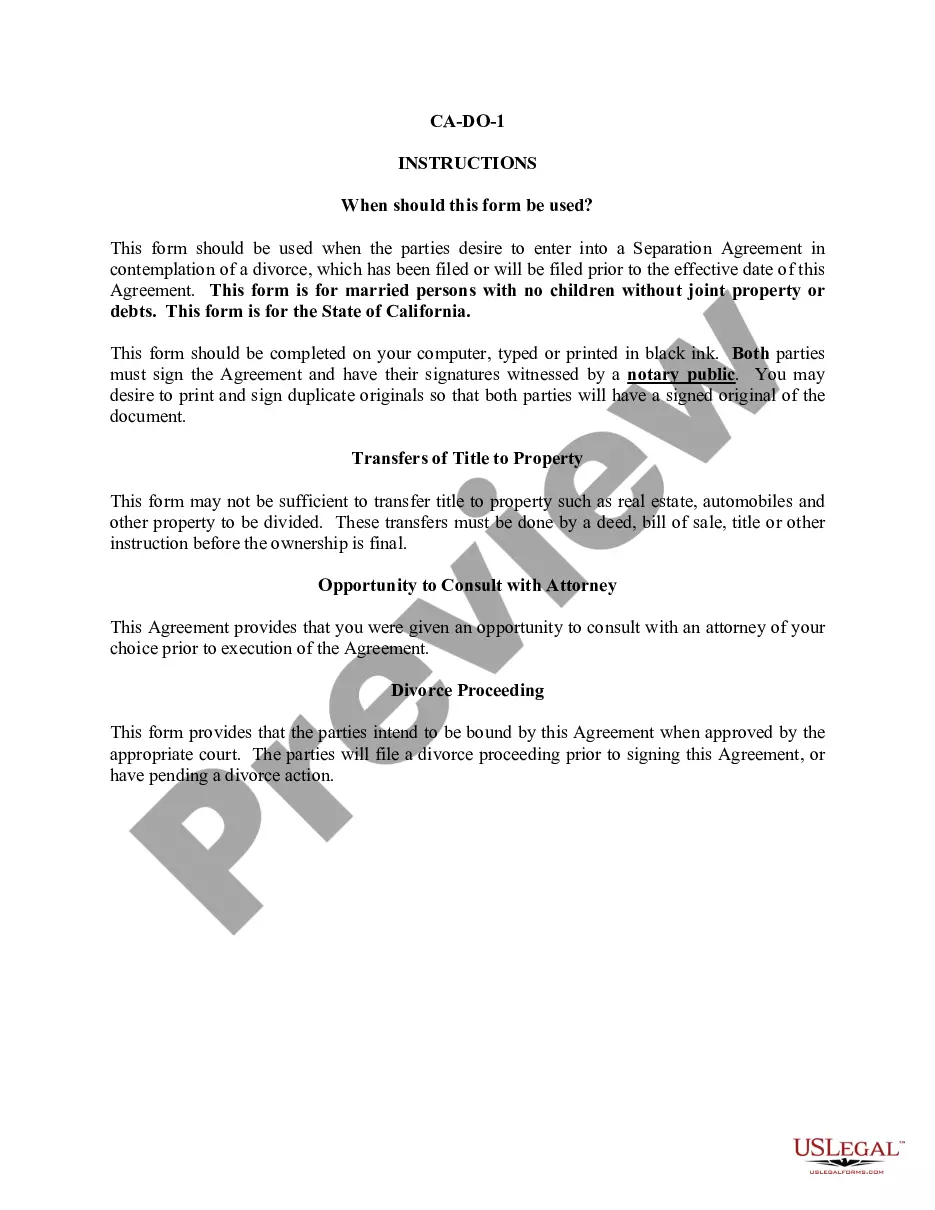

- Ensure you have located the form you desire. Review its description and utilize the Preview feature (if available) to examine its content. If it doesn’t satisfy your needs, utilize the Search box at the top of the screen to find the suitable document.

- Confirm your choice. Click the Buy now button. Next, select the desired pricing option and enter your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

While Massachusetts does provide a form, you can also hand-draft your own, or use a custom vehicle bill of sale template. All bills of sale, however, should contain the following criteria: The names, contact information, and signatures of the buyer and seller. The sales price.

What paperwork do I need to privately sell a car in Massachusetts? A Bill of Sale (although not legally required) The vehicle's original or replacement certificate of title. Current maintenance and vehicle records. A Registration and Title Application (filled out by the buyer)

If you decide to write your own bill of sale, make sure to include the following information: Date of sale. Cost of vehicle purchase. Your full name and address. Buyer's full name and address. Vehicle's year, make, model, identification number and mileage. Acknowledgement of any liens held on the vehicle.

To register and title a vehicle purchased from an individual (non-dealer), you will need the following: A completed Registration and Title Application. The previous owner's certificate of title or the previous owner's registration and bill of sale for vehicles that are exempt because of its age. Applicable fee.

The best way is to properly fill out the ?Assignment of Title,? which is found on the back of the vehicle's ?Certificate of Title.? This must include: The date of sale. Purchase price. Buyer's name, address, and signature.

It is important to make sure all the requirements for the respected state law are included in the bill of sale. As, with any legal written document a bill of sale can be handwritten.

What's The Purpose of the Vehicle Bill of Sale in Massachusetts? The primary purpose of a bill of sale is to confirm the terms and provide evidence of the transaction between the seller and buyer. The bill of sale will verify ownership of the car and the transaction amount (so the RMV knows how much tax to assess).

To register and title a vehicle purchased from an individual (non-dealer), you will need the following: A completed Registration and Title Application. The previous owner's certificate of title or the previous owner's registration and bill of sale for vehicles that are exempt because of its age. Applicable fee.