A Boston Massachusetts Office Lease Agreement is a legally binding contract between a landlord and a tenant for the rental of office space in Boston, Massachusetts. It outlines the terms and conditions under which the commercial property will be leased, including the rights and obligations of both parties. The agreement typically includes important details such as the duration of the lease, the rental payments and frequency, the security deposit required, the permitted uses of the office space, and any restrictions or limitations on alterations to the property. It also covers maintenance responsibilities, insurance requirements, and potential penalties or consequences for violations of the lease agreement. There may be different types of Boston Massachusetts Office Lease Agreements available, depending on the specific needs and preferences of the landlord and tenant. Some common types include: 1. Gross Lease: In this type of lease, the tenant pays a fixed rent amount that includes both the base rent and other costs such as property taxes, insurance, and maintenance expenses. The landlord is responsible for paying these additional costs. 2. Net Lease: In a net lease, the tenant is responsible for paying a base rent amount, as well as additional costs such as property taxes, insurance, and maintenance expenses. These expenses are usually calculated based on the tenant's proportionate share of the overall property. 3. Modified Gross Lease: This type of lease combines elements of both the gross and net leases. The tenant and landlord negotiate which expenses will be included in the base rent and which will be paid separately. 4. Full-Service Lease: Also known as a triple net lease, this lease requires the tenant to pay for all operating expenses, including property taxes, insurance, maintenance, utilities, and common area maintenance charges. It is important for both parties to thoroughly review and understand the terms and conditions outlined in the Boston Massachusetts Office Lease Agreement before signing it. It is advisable to seek legal advice or consult with a real estate professional to ensure that all necessary provisions are included and to clarify any questions or concerns.

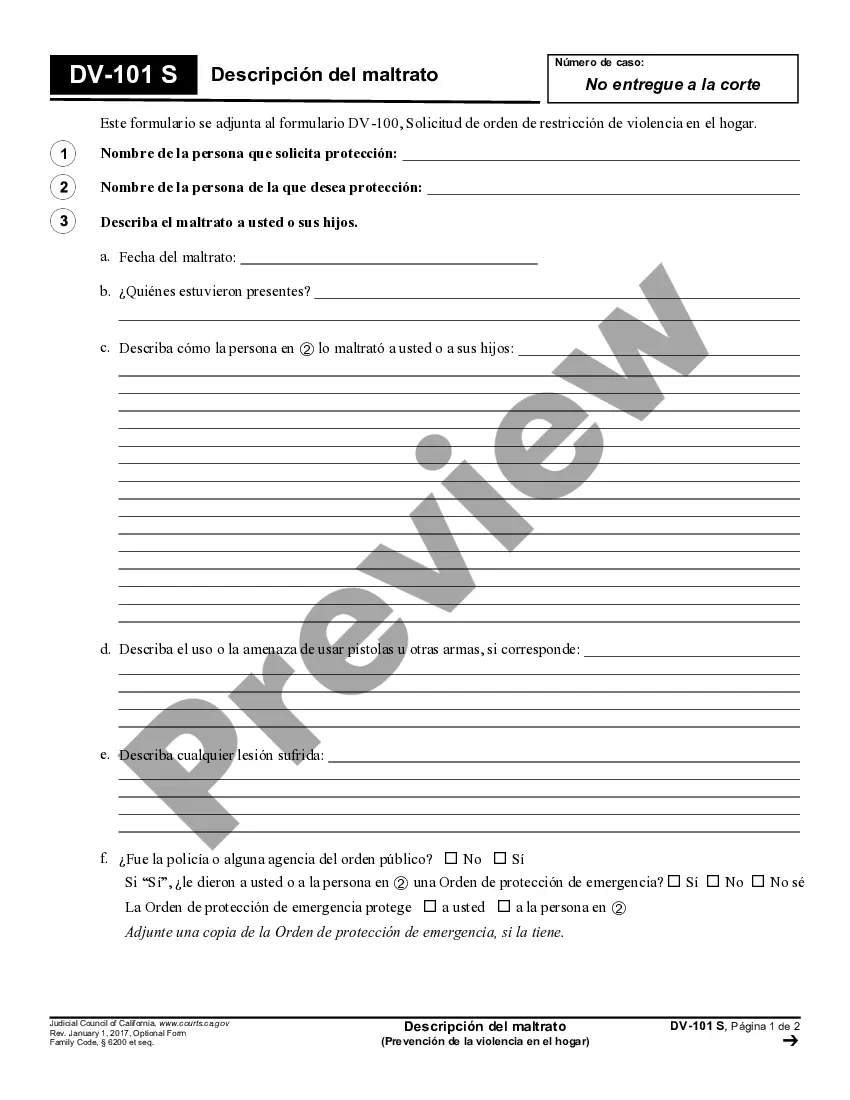

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Boston Massachusetts Contrato de arrendamiento de oficina - Massachusetts Office Lease Agreement

Description

How to fill out Boston Massachusetts Contrato De Arrendamiento De Oficina?

Do you need a trustworthy and inexpensive legal forms provider to buy the Boston Massachusetts Office Lease Agreement? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of particular state and area.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Boston Massachusetts Office Lease Agreement conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is intended for.

- Start the search over in case the form isn’t good for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Boston Massachusetts Office Lease Agreement in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online for good.