Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Massachusetts Dissolution Package To Dissolve Limited Liability Company LLC?

Regardless of social or occupational rank, completing legal paperwork is an unfortunate requirement in today’s business landscape.

Frequently, it’s nearly impossible for someone lacking any legal experience to create this kind of documentation from scratch, primarily because of the intricate language and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Confirm that the template you’ve found is appropriate for your region, considering the regulations of one state or county may not apply to another.

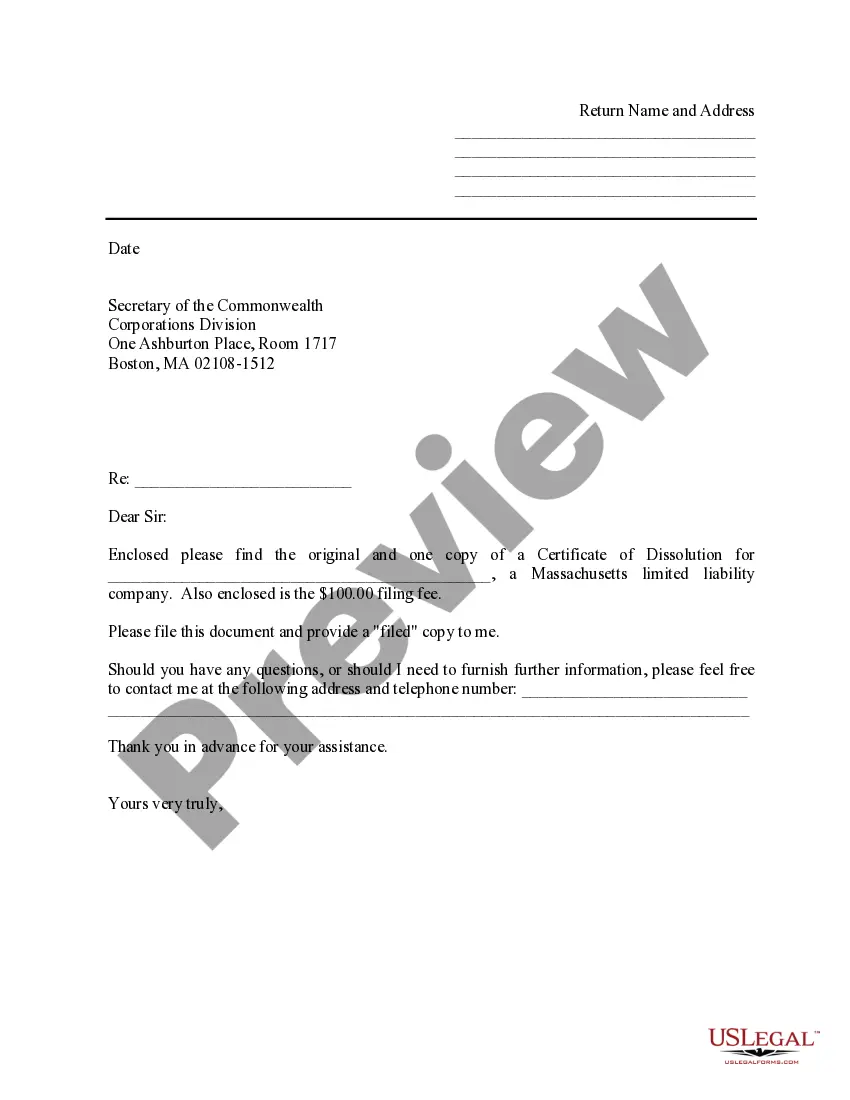

Review the document and read through a brief description (if available) of the situations the form can be utilized for. Should the form you selected not satisfy your needs, you can restart and search for the correct document. Click Buy now and select the subscription plan that best fits you, using your existing Log In details or creating a new account from scratch. Choose the payment method and proceed to download the Cambridge Massachusetts Dissolution Package to dissolve a Limited Liability Company (LLC) once payment is confirmed. You’re all set! You can print the form or fill it out online. Should you encounter any issues with acquiring your purchased documents, you can easily locate them in the My documents tab. Whatever situation you’re aiming to resolve, US Legal Forms has you covered. Try it today and witness the benefits for yourself.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific forms that are applicable for nearly any legal circumstance.

- US Legal Forms serves as a superb tool for associates or legal advisors looking to save time by using our DIY forms.

- Regardless of whether you need the Cambridge Massachusetts Dissolution Package to dissolve a Limited Liability Company (LLC) or any other document valid in your locality, with US Legal Forms, everything is easily accessible.

- Here’s how you can quickly obtain the Cambridge Massachusetts Dissolution Package to dissolve a Limited Liability Company (LLC) using our reliable platform.

- If you are already a customer, feel free to Log In to your account to retrieve the required form.

- However, if you are not acquainted with our library, ensure to follow these steps before downloading the Cambridge Massachusetts Dissolution Package to dissolve a Limited Liability Company (LLC).

Form popularity

FAQ

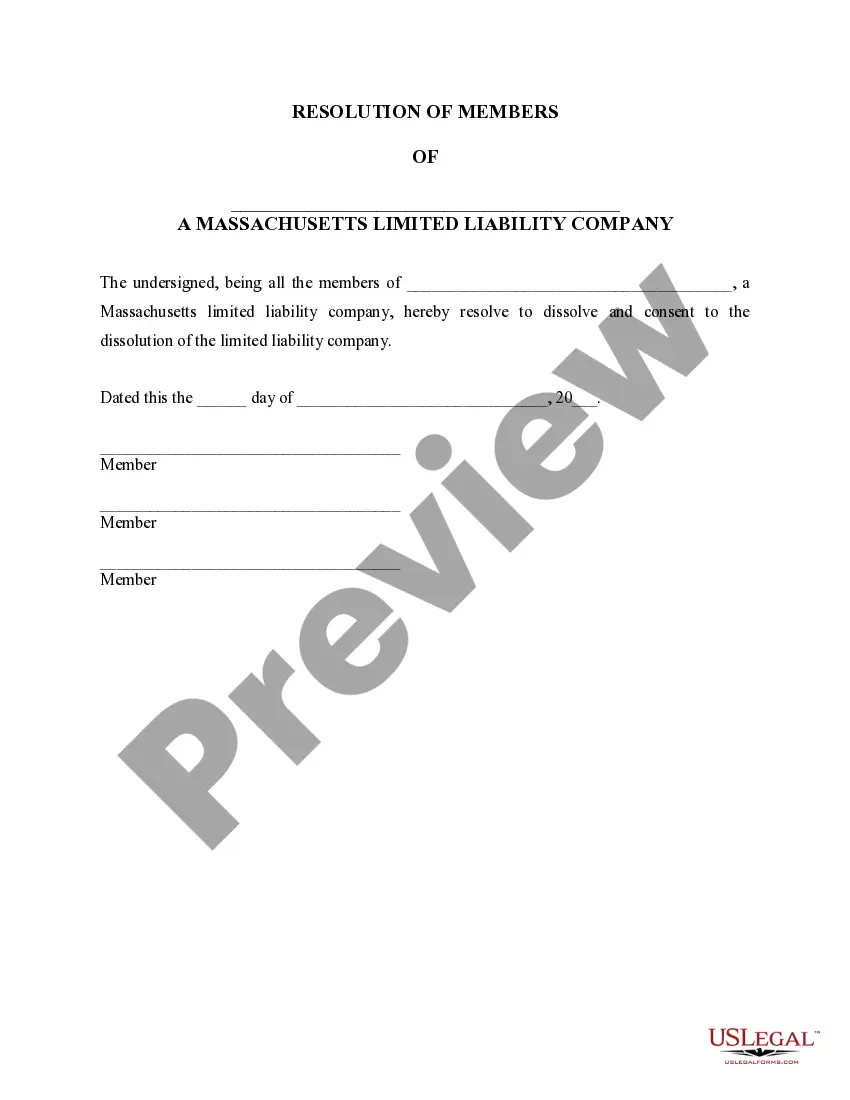

Dissolving your LLC in Massachusetts involves submitting the required documents to the Secretary of the Commonwealth. This includes filing the Certificate of Cancellation after addressing any outstanding financial matters. The Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC, available through uslegalforms, can simplify this process, ensuring all steps are correctly followed. You will benefit from professional support, making your LLC dissolution smoother.

To shut down an LLC in Massachusetts, start by filing the Certificate of Cancellation with the Secretary of the Commonwealth. Before doing this, ensure all debts and obligations are settled. Utilize the Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC from uslegalforms to streamline the process. This package provides the necessary forms and guidance, making your dissolution experience more manageable.

To undissolve your LLC, you will need to contact your state's Secretary of State office to find out their specific requirements. Generally, this involves submitting a reinstatement application along with any outstanding fees and filing the appropriate forms. While the process can be complex, utilizing resources like the Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC can guide you through the necessary steps effectively.

Before dissolving your LLC, review your operating agreement to understand the required steps for dissolution. It's also crucial to settle any debts, distribute assets among members, and notify creditors of your decision. Using the Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC can assist you in fulfilling all legal requirements, ensuring a smoother transition.

Yes, it is essential to notify the IRS when you close your LLC. You need to file the final tax return for your LLC and check the box indicating that it is your final return. By completing the required steps, including using the Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC, you can avoid potential tax issues and liabilities down the road.

When your LLC is dissolved, the first step is to inform the members and creditors about the dissolution. Next, settle all outstanding debts and obligations. Finally, file the necessary documents with the state to officially confirm the dissolution, utilizing a Cambridge Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC. This package helps streamline the process and ensures compliance with state regulations.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

There is a $100 filing fee to dissolve your Massachusetts Limited Liability Company. If you file by fax, you will have to pay an additional $9 fee for expedited processing.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.