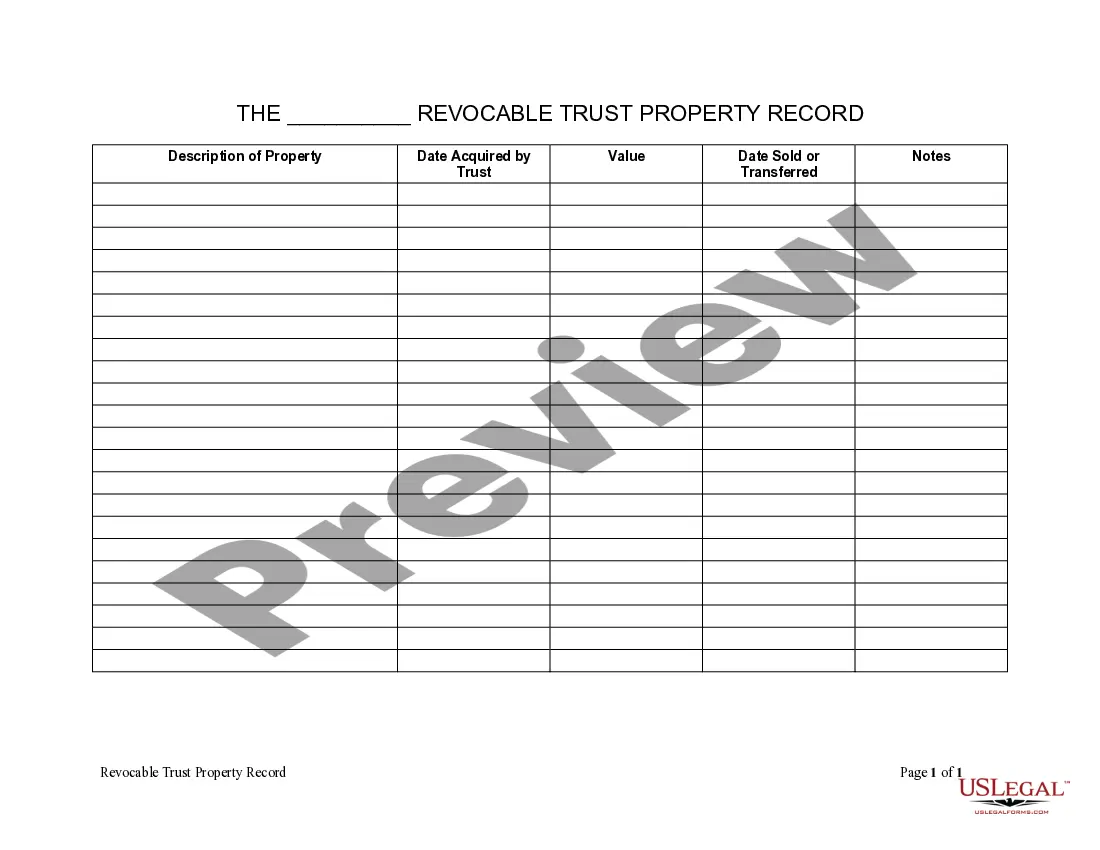

Boston Massachusetts Living Trust Property Record

Description

How to fill out Massachusetts Living Trust Property Record?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our user-friendly platform with thousands of documents simplifies the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and endorse the Boston Massachusetts Living Trust Property Record in just a few minutes rather than spending countless hours online searching for the correct template.

Using our catalog is an excellent method to enhance the security of your record submissions.

If you have not yet created an account, please follow the instructions below.

Access the page with the template you need. Ensure it is the template you are seeking: confirm its title and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to find the required one.

- Our skilled legal experts routinely verify all documents to ensure that the templates are suitable for a specific state and adhere to the latest laws and regulations.

- How can you obtain the Boston Massachusetts Living Trust Property Record.

- If you already have an account, simply Log In to your profile.

- The Download button will be visible on every document you view.

- Additionally, you can access all previously saved records under the My documents section.

Form popularity

FAQ

Phone Main number Call Supreme Judicial Court, Main number at (617) 557-1000. Clerks' Offices Emergency Number Call Supreme Judicial Court, Clerks' Offices Emergency Number at (857) 275-8036. Clerk's Office for the Commonwealth Call Supreme Judicial Court, Clerk's Office for the Commonwealth at (617) 557-1020.

The main benefit of putting your home into a trust is the ability to avoid probate. Additionally, putting your home in a trust keeps some of the details of your estate private. The probate process is a matter of public record, while the passing of a trust from a grantor to a beneficiary is not.

A trustee is required to send a copy of the Trust and its amendments, if there are any amendments, to the beneficiaries of the Trust and heirs of the settlor (i.e., the person who created the Trust), within 60 days of a written request.

A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

What are the Disadvantages of a Trust? Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate.Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust.No Protection from Creditors.

As legal owner of the real estate, the nominee trust instrument or a certificate that sets forth information about the trust must be recorded with the registry of deeds.

A Trust Provides More Privacy Than a Will or Intestacy A trust in Massachusetts is a private document that handles your estate without court intervention.

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.