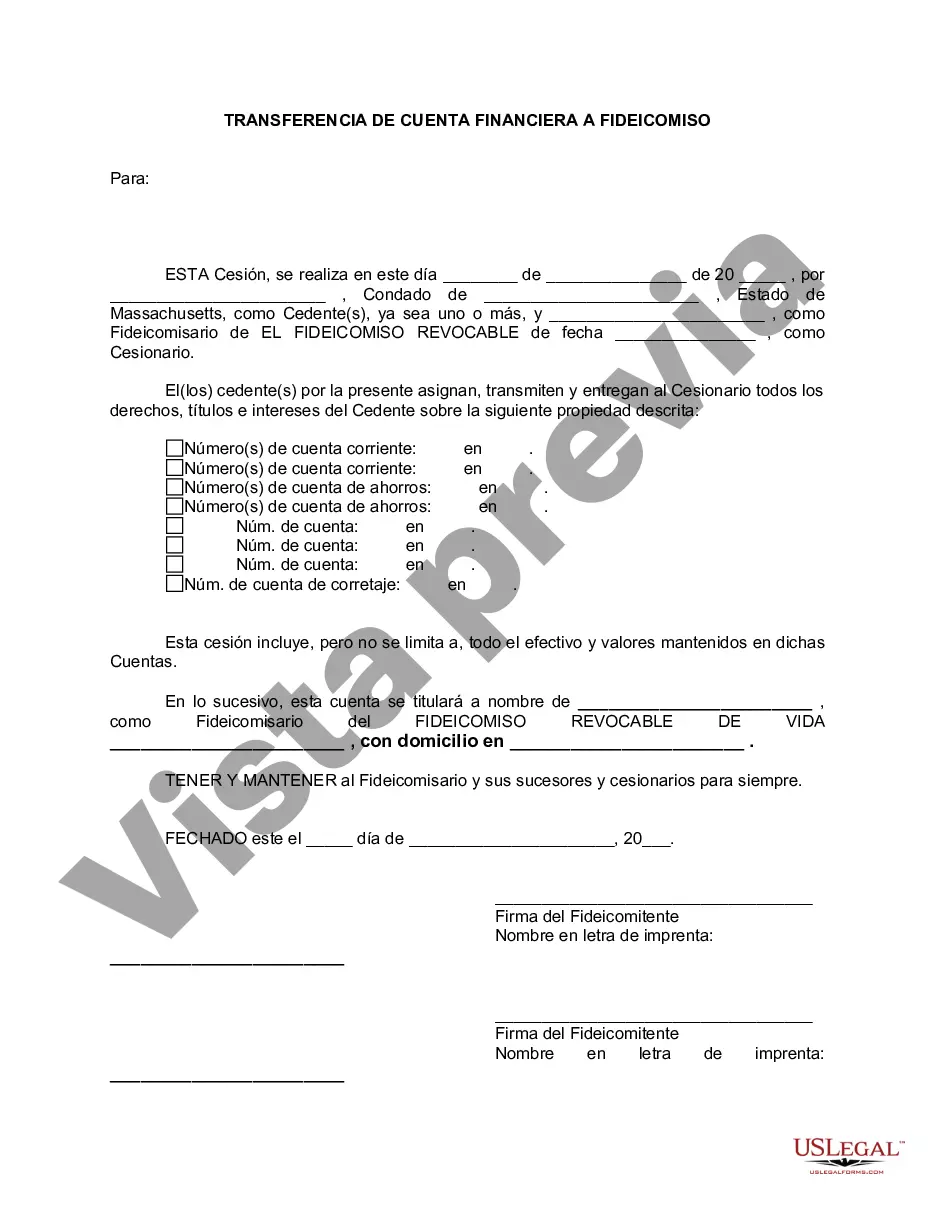

A Boston Massachusetts Financial Account Transfer to Living Trust refers to the process of transferring ownership and control of one's financial accounts to a living trust in the state of Massachusetts, specifically in the city of Boston. This legal arrangement allows individuals to protect their assets, manage their financial affairs, and ensure a smooth transition of these accounts to their beneficiaries after their death. Living trusts are commonly used estate planning tools that enable individuals to retain control over their assets while they are alive and designate how these assets will be managed and distributed after their passing. By placing financial accounts, such as bank accounts, brokerage accounts, and investment portfolios, into a living trust, individuals can avoid the probate process, which can be time-consuming, costly, and subject to public records. There are different types of Boston Massachusetts Financial Account Transfer to Living Trust options, including revocable living trusts and irrevocable living trusts. 1. Revocable living trusts: This type of trust allows individuals to maintain control over their financial accounts during their lifetime. They have the flexibility to amend or revoke the trust's terms as needed. In Boston, individuals who opt for a revocable living trust will execute a legal document known as a trust agreement, which outlines the terms and conditions of the trust, including the transfer of financial accounts. 2. Irrevocable living trusts: In contrast to revocable living trusts, irrevocable living trusts cannot be altered or revoked once established. By placing financial accounts into an irrevocable living trust, individuals relinquish their control over these assets but gain certain tax advantages and asset protection benefits. This type of trust may be suitable for those with substantial assets and specific estate planning goals. To initiate a financial account transfer to a living trust in Boston, the individual must first establish the trust by creating a comprehensive trust agreement, often with the assistance of an attorney specializing in estate planning. The trust agreement will specify the intended beneficiaries and trustees, outline the powers and responsibilities of the trustees, and designate how the financial accounts are to be managed and distributed. Once the trust is established, the individual must contact the financial institution where the accounts are held, such as banks or investment firms, to inform them of the transfer. The financial institution may require specific documentation, such as a certified copy of the trust agreement, a death certificate in the case of the transfer due to death of the original account holder, and any other relevant paperwork. It is advisable to work closely with the financial institution and seek professional advice during this process to ensure a smooth and accurate transfer of the accounts to the living trust. By executing a Boston Massachusetts Financial Account Transfer to Living Trust, individuals can have peace of mind knowing that their financial affairs will be efficiently managed during their lifetime and seamlessly transferred to their beneficiaries upon their passing, all while avoiding the probate process and potentially reducing estate taxes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Boston Massachusetts Transferencia de cuenta financiera a fideicomiso en vida - Massachusetts Financial Account Transfer to Living Trust

State:

Massachusetts

City:

Boston

Control #:

MA-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

A Boston Massachusetts Financial Account Transfer to Living Trust refers to the process of transferring ownership and control of one's financial accounts to a living trust in the state of Massachusetts, specifically in the city of Boston. This legal arrangement allows individuals to protect their assets, manage their financial affairs, and ensure a smooth transition of these accounts to their beneficiaries after their death. Living trusts are commonly used estate planning tools that enable individuals to retain control over their assets while they are alive and designate how these assets will be managed and distributed after their passing. By placing financial accounts, such as bank accounts, brokerage accounts, and investment portfolios, into a living trust, individuals can avoid the probate process, which can be time-consuming, costly, and subject to public records. There are different types of Boston Massachusetts Financial Account Transfer to Living Trust options, including revocable living trusts and irrevocable living trusts. 1. Revocable living trusts: This type of trust allows individuals to maintain control over their financial accounts during their lifetime. They have the flexibility to amend or revoke the trust's terms as needed. In Boston, individuals who opt for a revocable living trust will execute a legal document known as a trust agreement, which outlines the terms and conditions of the trust, including the transfer of financial accounts. 2. Irrevocable living trusts: In contrast to revocable living trusts, irrevocable living trusts cannot be altered or revoked once established. By placing financial accounts into an irrevocable living trust, individuals relinquish their control over these assets but gain certain tax advantages and asset protection benefits. This type of trust may be suitable for those with substantial assets and specific estate planning goals. To initiate a financial account transfer to a living trust in Boston, the individual must first establish the trust by creating a comprehensive trust agreement, often with the assistance of an attorney specializing in estate planning. The trust agreement will specify the intended beneficiaries and trustees, outline the powers and responsibilities of the trustees, and designate how the financial accounts are to be managed and distributed. Once the trust is established, the individual must contact the financial institution where the accounts are held, such as banks or investment firms, to inform them of the transfer. The financial institution may require specific documentation, such as a certified copy of the trust agreement, a death certificate in the case of the transfer due to death of the original account holder, and any other relevant paperwork. It is advisable to work closely with the financial institution and seek professional advice during this process to ensure a smooth and accurate transfer of the accounts to the living trust. By executing a Boston Massachusetts Financial Account Transfer to Living Trust, individuals can have peace of mind knowing that their financial affairs will be efficiently managed during their lifetime and seamlessly transferred to their beneficiaries upon their passing, all while avoiding the probate process and potentially reducing estate taxes.

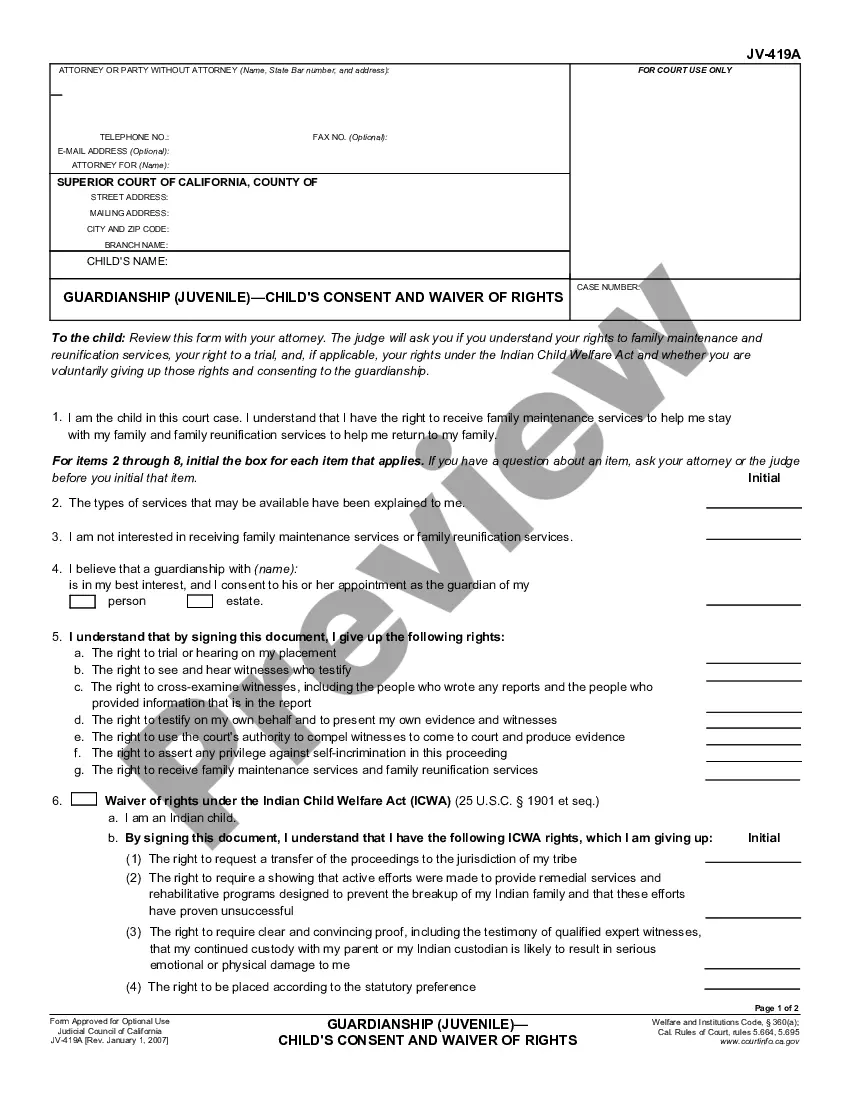

Free preview

How to fill out Boston Massachusetts Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you are seeking a pertinent form template, it’s exceptionally difficult to locate a more user-friendly service than the US Legal Forms website – likely the most extensive repositories on the web.

Here you can discover thousands of document samples for business and personal needs categorized by type and region, or by keywords.

Utilizing our high-quality search feature, locating the most recent Boston Massachusetts Financial Account Transfer to Living Trust is as simple as 1-2-3.

Execute the payment procedure. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the format and store it on your device.

- Moreover, the applicability of each document is verified by a team of professional attorneys who consistently review the templates on our site and update them according to the most recent state and county laws.

- If you are already familiar with our platform and possess a registered account, all you have to do to obtain the Boston Massachusetts Financial Account Transfer to Living Trust is to Log In/">Log In to your user profile and click the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions listed below.

- Ensure you have located the template you need. Review its description and utilize the Preview feature (if available) to assess its contents. If it doesn’t satisfy your needs, use the Search option at the top of the page to find the suitable file.

- Verify your choice. Select the Buy now option. Following that, choose your preferred pricing plan and enter details to create an account.