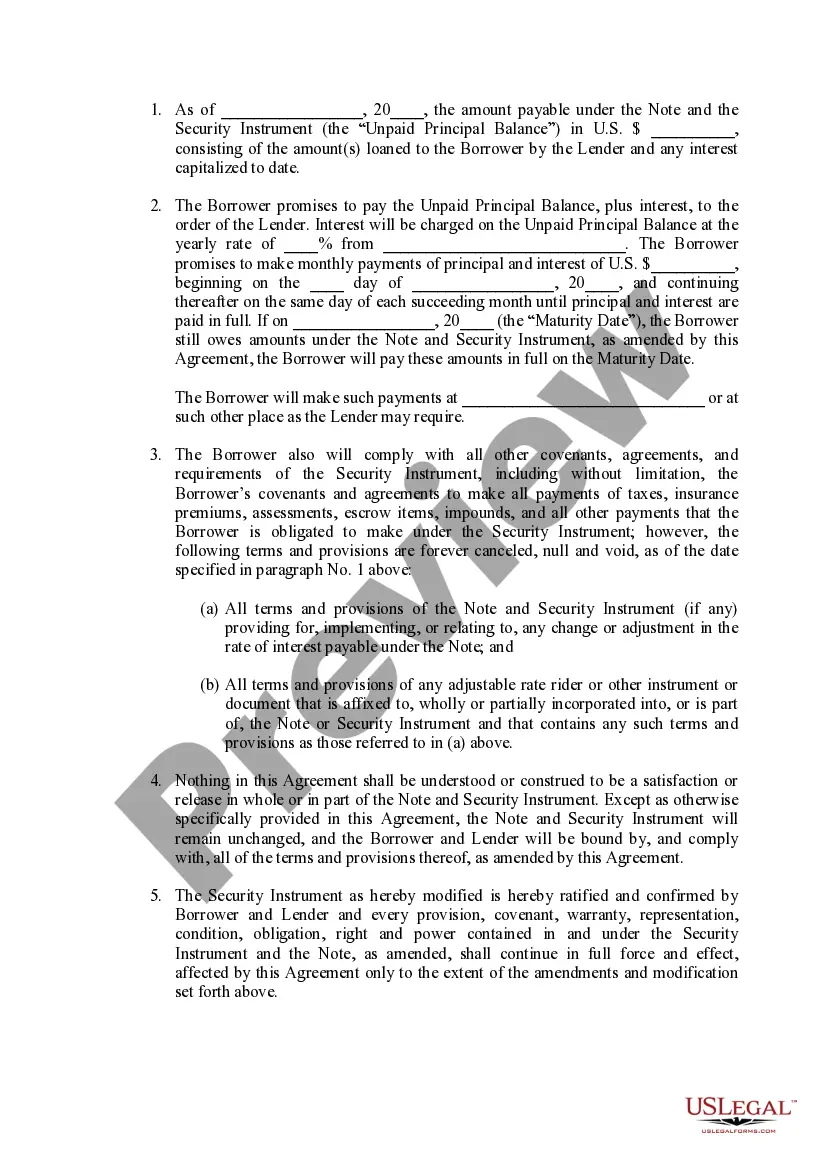

A Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate) refers to a legal contract that allows borrowers in Cambridge, Massachusetts, to negotiate changes to the terms of their existing loan, specifically targeting the interest rate component. The purpose of this agreement is to help borrowers struggling with mortgage payments to avoid foreclosure by making their monthly installments more affordable. With a fixed interest rate modification, the borrower and lender agree to alter the initial terms of the loan, establishing a new fixed interest rate that remains unchanged for the remaining loan term. This modification helps stabilize monthly payments and provides borrowers with a predictable repayment schedule. Keywords: Cambridge Massachusetts, Loan Modification Agreement, Fixed Interest Rate, borrowers, mortgage payments, foreclosure, new fixed interest rate, monthly installments, loan term, stabilize, predictable repayment schedule. Different types of Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate) include: 1. Rate Reduction Modification: In this type of modification, the borrower negotiates with the lender to decrease the existing interest rate. This reduction aims to provide immediate financial relief and make the mortgage payments more manageable. 2. Interest Freeze Modification: With an interest freeze modification, the lender agrees to temporarily pause or freeze the accrual of interest on the existing loan. This helps borrowers who are experiencing short-term financial hardship to get back on their feet without accumulating additional interest charges. 3. Extended Loan Term Modification: In certain cases, borrowers may request an extension of the loan term, which allows for lower monthly payments due to the increased repayment period. With a fixed interest rate, this modification ensures that the interest rate remains steady throughout the extended tenure. 4. Principal Forbearance Modification: This modification involves the temporary reduction or suspension of a portion of the loan principal owed by the borrower. This reduction helps borrowers meet their financial obligations by reducing the overall loan balance, thereby decreasing the interest charged and monthly payments. 5. Combination Modification: Lenders may offer a combination of different loan modification types to borrowers depending on their specific financial circumstances. For instance, a fixed interest rate modification may be paired with a principal forbearance or interest freeze to provide comprehensive relief. It is important to note that the specific terms and conditions of Cambridge Massachusetts Loan Modification Agreements (Fixed Interest Rate) may vary between lenders and borrowers. The agreement should be carefully reviewed, and professional advice sought to fully understand its implications before entering into any loan modification.

Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate)

Description

How to fill out Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney services that, as a rule, are very costly. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate) or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate) complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Cambridge Massachusetts Loan Modification Agreement (Fixed Interest Rate) is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!