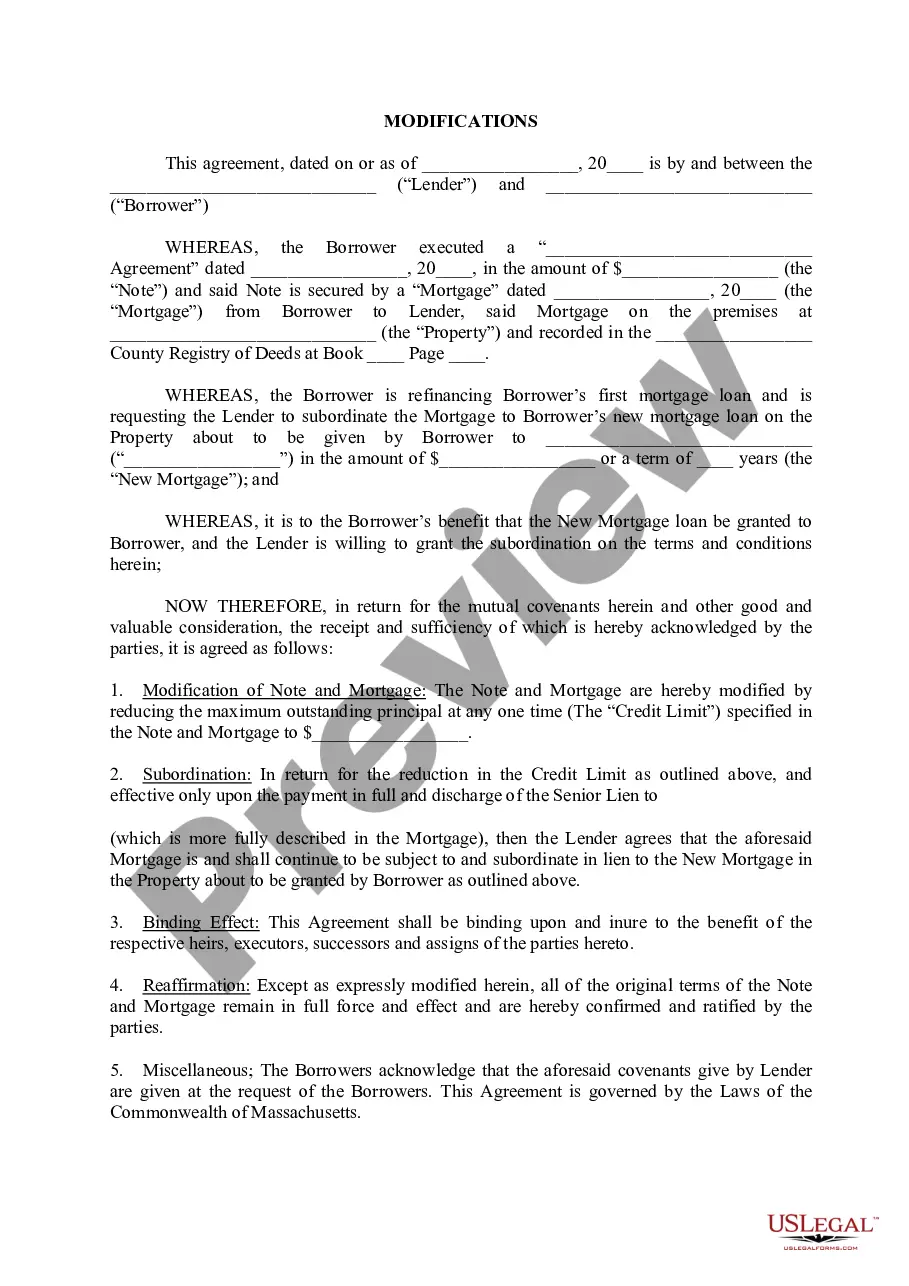

Boston Massachusetts Loan Modifications refer to the process of altering the terms and conditions of an existing mortgage loan in order to make it more manageable for borrowers facing financial difficulties. These modifications can help homeowners who are struggling to make their mortgage payments and are at risk of foreclosure. There are various types of loan modifications available in Boston, Massachusetts, based on the specific needs and circumstances of the borrowers. Some of them include: 1. Interest Rate Reduction: This type of loan modification involves lowering the interest rate charged on the mortgage loan. By reducing the interest rate, borrowers can potentially lower their monthly payments, making them more affordable and manageable. 2. Loan Term Extension: This modification option extends the duration of the loan term, allowing borrowers to spread their payments over a longer period of time. This results in lower monthly payments, providing relief to homeowners with financial constraints. 3. Principal Balance Reduction: In certain cases, lenders may agree to reduce the outstanding principal balance of the loan. This type of modification aims to decrease the total amount owed, reducing the overall financial burden on the borrower and potentially lowering monthly payments. 4. Forbearance Agreement: A forbearance agreement is a temporary modification that allows borrowers to suspend or reduce their mortgage payments for a specific period of time. This option is often suitable for individuals facing short-term financial difficulties, such as job loss or medical emergencies. 5. Loan Refinancing: Although not technically a loan modification, refinancing is an option available to homeowners in Boston, Massachusetts. It involves replacing the existing mortgage loan with a new one, usually at more favorable terms. Refinancing can help borrowers lower their interest rates, monthly payments, or change the type of loan they have. In Boston, Massachusetts, loan modifications are typically facilitated by professional mortgage loan modification consultants or through direct negotiations with the lender. It is important for homeowners to consult a qualified professional, such as a housing counselor or attorney, to understand the specific eligibility criteria, requirements, and implications of each loan modification option available.

Boston Massachusetts Loan Modifications

Description

How to fill out Boston Massachusetts Loan Modifications?

If you are searching for a relevant form template, it’s extremely hard to choose a more convenient service than the US Legal Forms site – probably the most extensive online libraries. With this library, you can get thousands of document samples for organization and personal purposes by types and regions, or keywords. With our high-quality search function, finding the newest Boston Massachusetts Loan Modifications is as elementary as 1-2-3. Furthermore, the relevance of every record is confirmed by a group of skilled lawyers that regularly review the templates on our website and revise them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to get the Boston Massachusetts Loan Modifications is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you require. Look at its explanation and use the Preview function to check its content. If it doesn’t suit your needs, use the Search field at the top of the screen to discover the proper document.

- Affirm your choice. Choose the Buy now button. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Boston Massachusetts Loan Modifications.

Each and every template you save in your user profile does not have an expiry date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an extra version for modifying or printing, you can come back and download it again at any moment.

Make use of the US Legal Forms extensive catalogue to get access to the Boston Massachusetts Loan Modifications you were seeking and thousands of other professional and state-specific samples on a single website!