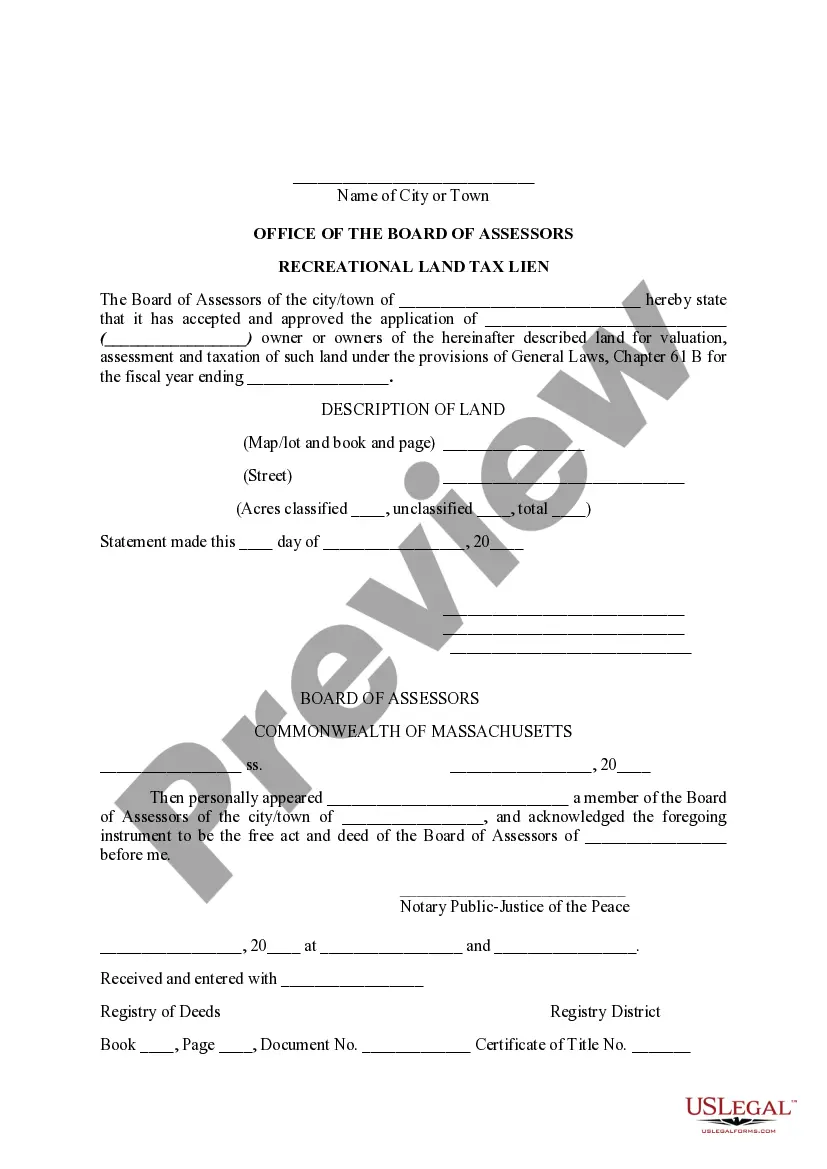

Boston Massachusetts Recreational Land Tax Lien refers to a legal claim placed on recreational land in the city of Boston, Massachusetts due to unpaid property taxes. It is a mechanism employed by the local tax authorities to recover delinquent tax payments. A tax lien is created when a property owner fails to pay their property taxes within the specified time frame. In Boston, this lien can be imposed on recreational land, which includes properties such as parks, sports facilities, golf courses, and other public or privately-owned spaces used for recreational purposes. The tax lien grants the municipality the right to collect the unpaid taxes by selling the property through a public auction. This auction allows potential buyers to bid on the tax lien, with the highest bidder being awarded the lien. The buyer, known as the lien holder, then has the right to collect the unpaid tax amount from the property owner. There are different types of Boston Massachusetts Recreational Land Tax Liens based on the specific purpose of the recreational land. Some common types include park tax liens, sports facility tax liens, and golf course tax liens. Each type of tax lien is associated with a distinct recreational land category. It is important for property owners to promptly pay their property taxes to avoid the imposition of a tax lien. Failure to do so can result in the sale of their recreational land through a tax lien auction. Potential buyers, on the other hand, can participate in these auctions as a means to acquire recreational land at potentially lower prices, while also helping the municipality recover its owed taxes.

Boston Massachusetts Recreational Land Tax Lien

Description

How to fill out Boston Massachusetts Recreational Land Tax Lien?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal services that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Boston Massachusetts Recreational Land Tax Lien or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Boston Massachusetts Recreational Land Tax Lien complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Boston Massachusetts Recreational Land Tax Lien is suitable for you, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!