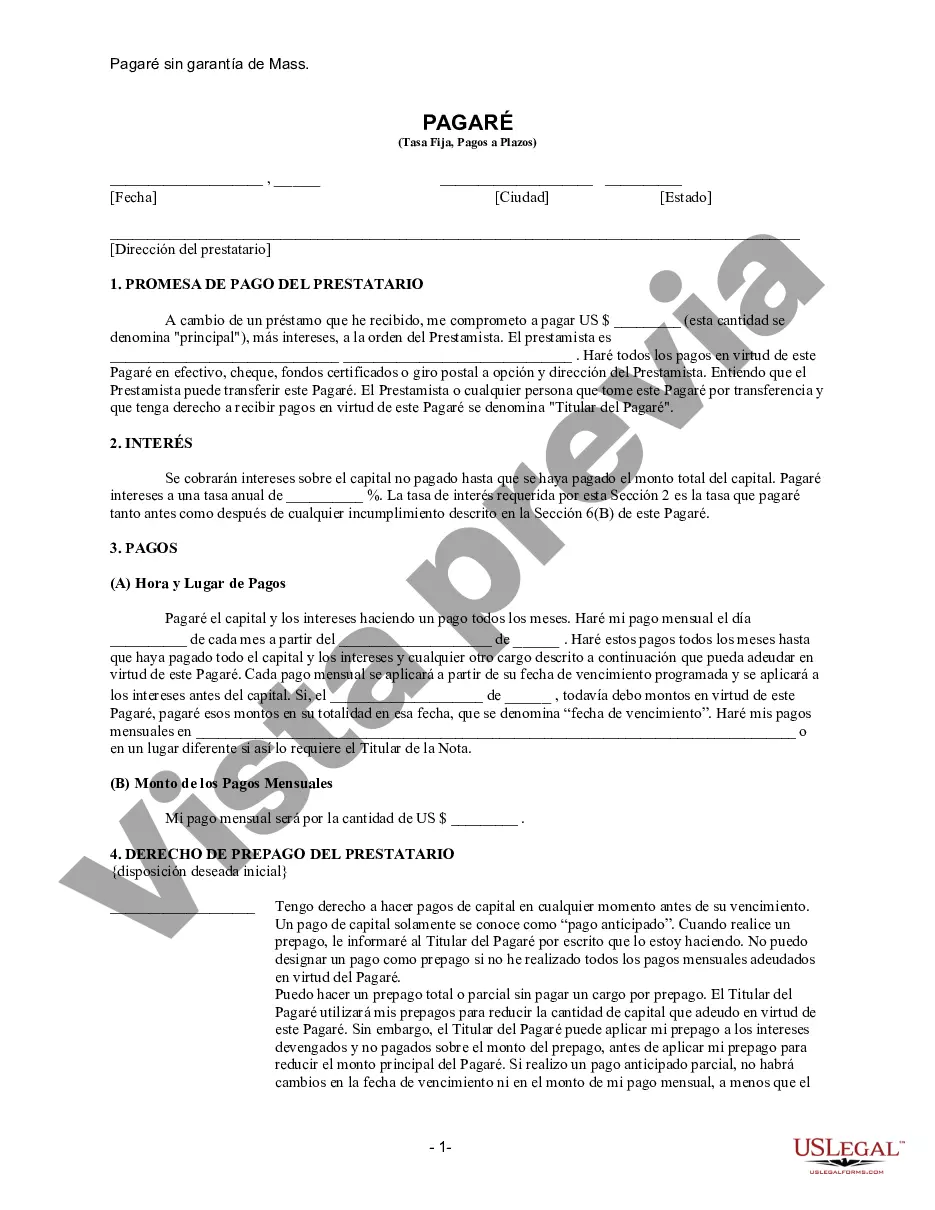

The Boston Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions for borrowing money in Boston, Massachusetts. This promissory note is used when someone lends money to another person or entity and wishes to establish a fixed rate of interest for the loan. It is an agreement between the lender and the borrower that specifies the repayment schedule, interest rate, and other important details of the loan. The note states that the borrower promises to repay the lender a specified amount of money within a defined period of time, usually through a series of installment payments. The payment schedule can be structured monthly, quarterly, or annually, depending on the agreement reached between the lender and the borrower. The fixed rate of interest remains constant throughout the repayment period, ensuring predictable monthly payments for the borrower. The note includes the principal amount, which refers to the total loan amount borrowed, and the interest rate, which determines the additional cost of borrowing. The interest rate is expressed as an annual percentage rate (APR), and it is crucial for the borrower to clearly understand the cost of paying back the loan. The promissory note may also outline any additional fees or charges related to the loan, such as late payment fees or prepayment penalties. In terms of security, the Boston Massachusetts Unsecured Installment Payment Promissory Note does not require collateral from the borrower. This means that if the borrower defaults on the loan, the lender does not have any specific property or assets to claim in order to recover the outstanding debt. It is important for both parties to carefully consider the risks associated with unsecured borrowing and ensure that the borrower's creditworthiness and ability to repay the loan are thoroughly assessed. Different types of Boston Massachusetts Unsecured Installment Payment Promissory Notes for Fixed Rate may exist based on variations in specific terms or provisions. Some common variations may include: 1. Short-term promissory notes: These notes have a relatively short repayment period, usually ranging from a few months to a year. The principal amounts and interest rates may be lower compared to long-term notes. 2. Long-term promissory notes: These notes have a longer repayment period, often spanning several years. The principal amounts and interest rates may be higher compared to short-term notes, reflecting the extended duration of the loan. 3. Balloon payment promissory notes: These notes involve regular installment payments over the loan term, but with a final "balloon" payment that is significantly larger than the preceding installments. This payment structure may allow for smaller monthly payments but requires a larger sum to be paid at the end of the loan term. Overall, the Boston Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate provides a legally binding agreement that protects both the lender and borrower by clearly outlining the terms and conditions of the loan. It ensures transparency, predictability, and a fair lending environment for financial transactions in Boston, Massachusetts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Boston Pagaré de pago a plazos no garantizado de Massachusetts para tasa fija - Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate

State:

Massachusetts

City:

Boston

Control #:

MA-NOTE-2

Format:

Word

Instant download

Description

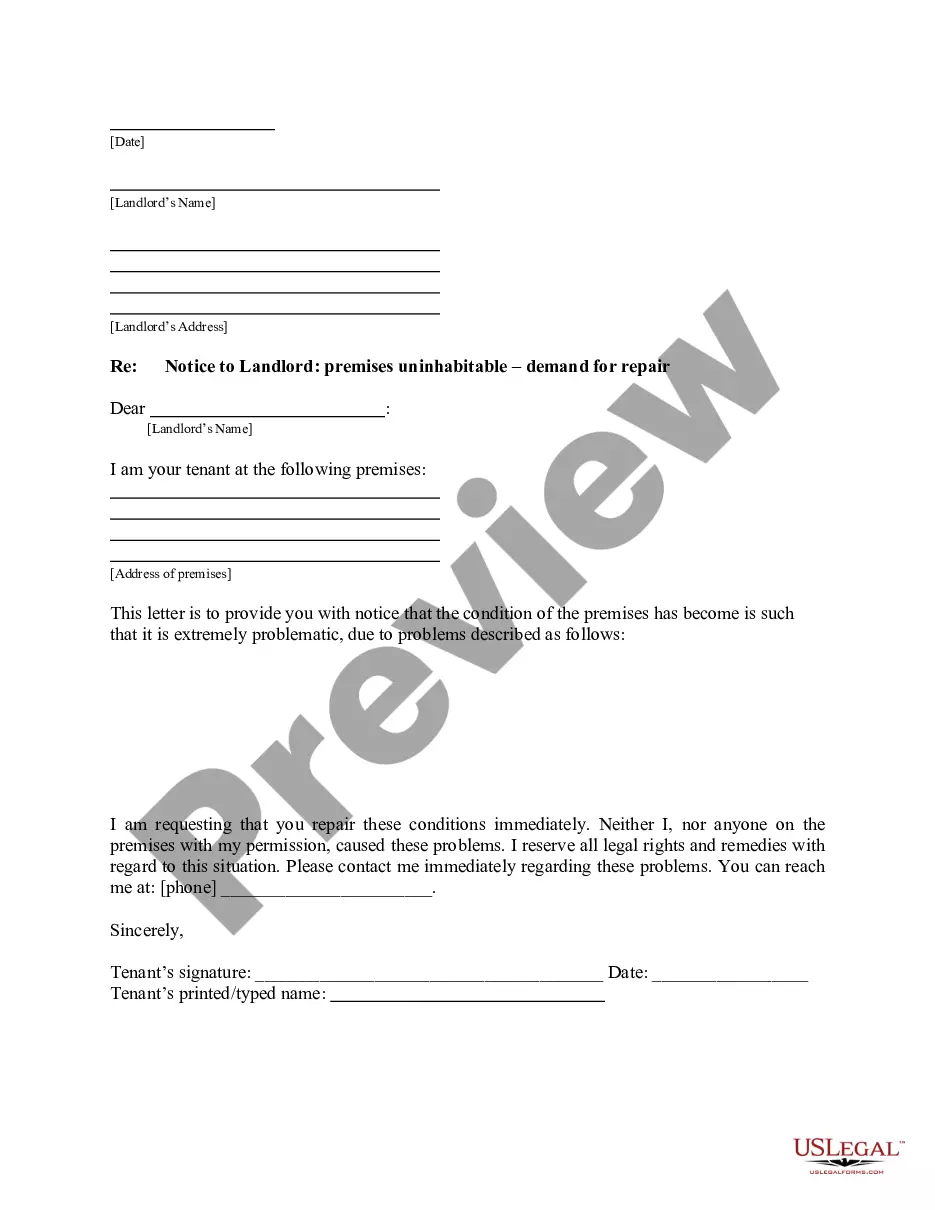

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

The Boston Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions for borrowing money in Boston, Massachusetts. This promissory note is used when someone lends money to another person or entity and wishes to establish a fixed rate of interest for the loan. It is an agreement between the lender and the borrower that specifies the repayment schedule, interest rate, and other important details of the loan. The note states that the borrower promises to repay the lender a specified amount of money within a defined period of time, usually through a series of installment payments. The payment schedule can be structured monthly, quarterly, or annually, depending on the agreement reached between the lender and the borrower. The fixed rate of interest remains constant throughout the repayment period, ensuring predictable monthly payments for the borrower. The note includes the principal amount, which refers to the total loan amount borrowed, and the interest rate, which determines the additional cost of borrowing. The interest rate is expressed as an annual percentage rate (APR), and it is crucial for the borrower to clearly understand the cost of paying back the loan. The promissory note may also outline any additional fees or charges related to the loan, such as late payment fees or prepayment penalties. In terms of security, the Boston Massachusetts Unsecured Installment Payment Promissory Note does not require collateral from the borrower. This means that if the borrower defaults on the loan, the lender does not have any specific property or assets to claim in order to recover the outstanding debt. It is important for both parties to carefully consider the risks associated with unsecured borrowing and ensure that the borrower's creditworthiness and ability to repay the loan are thoroughly assessed. Different types of Boston Massachusetts Unsecured Installment Payment Promissory Notes for Fixed Rate may exist based on variations in specific terms or provisions. Some common variations may include: 1. Short-term promissory notes: These notes have a relatively short repayment period, usually ranging from a few months to a year. The principal amounts and interest rates may be lower compared to long-term notes. 2. Long-term promissory notes: These notes have a longer repayment period, often spanning several years. The principal amounts and interest rates may be higher compared to short-term notes, reflecting the extended duration of the loan. 3. Balloon payment promissory notes: These notes involve regular installment payments over the loan term, but with a final "balloon" payment that is significantly larger than the preceding installments. This payment structure may allow for smaller monthly payments but requires a larger sum to be paid at the end of the loan term. Overall, the Boston Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate provides a legally binding agreement that protects both the lender and borrower by clearly outlining the terms and conditions of the loan. It ensures transparency, predictability, and a fair lending environment for financial transactions in Boston, Massachusetts.

Free preview

How to fill out Boston Pagaré De Pago A Plazos No Garantizado De Massachusetts Para Tasa Fija?

If you’ve already used our service before, log in to your account and save the Boston Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Boston Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!