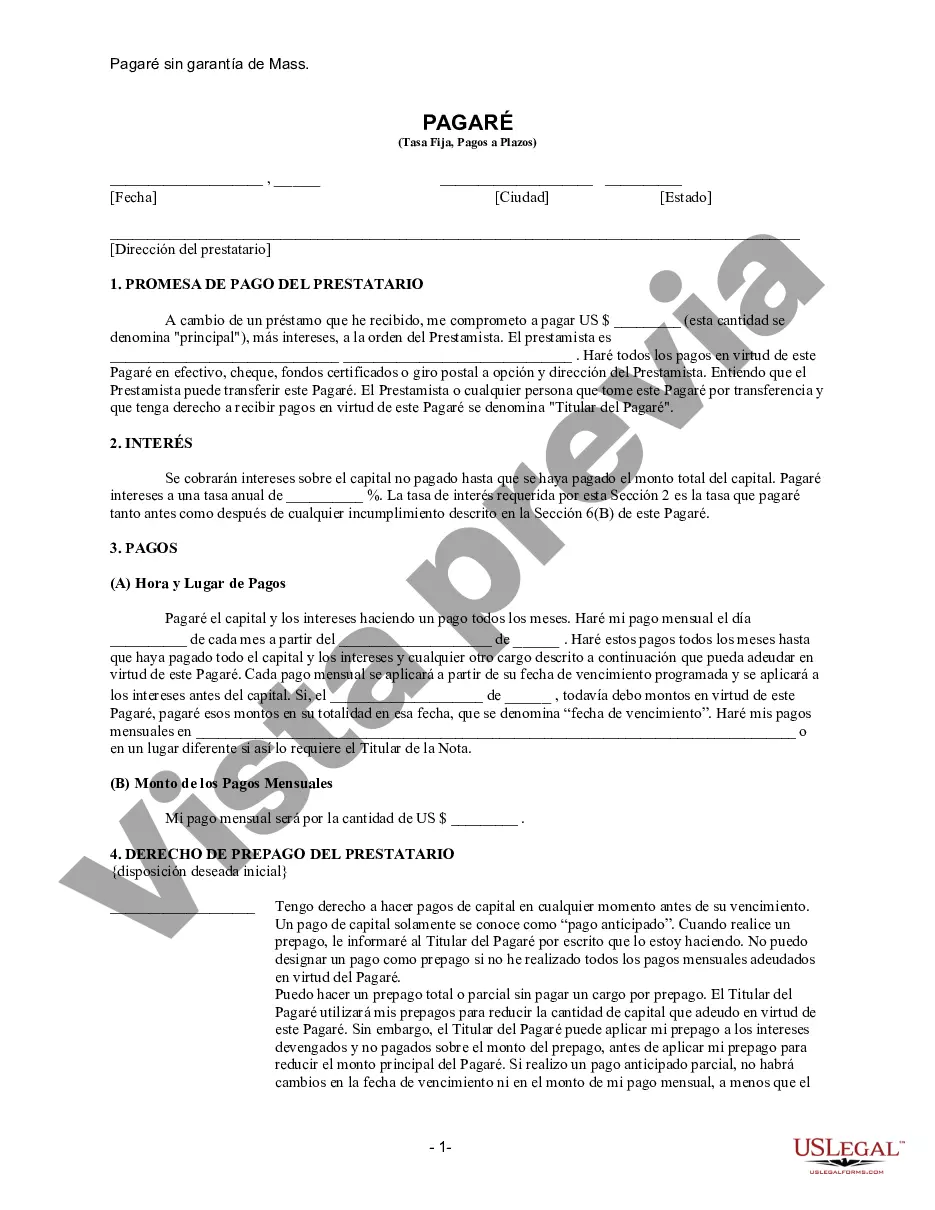

Cambridge Pagaré de pago a plazos no garantizado de Massachusetts para tasa fija - Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Pagaré De Pago A Plazos No Garantizado De Massachusetts Para Tasa Fija?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our advantageous platform with a vast array of templates simplifies the process of locating and obtaining nearly any document sample you desire.

You can save, complete, and authenticate the Cambridge Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate in just a few minutes rather than searching the internet for hours in search of a suitable template.

Employing our collection is an excellent way to enhance the security of your form submissions. Our skilled attorneys routinely evaluate all documents to guarantee that the templates are applicable for a specific state and comply with recent laws and regulations.

If you haven’t created an account yet, follow the steps outlined below.

Locate the document you need. Ensure that it is the document you intended to find: verify its title and description, and utilize the Preview option if available. If not, use the Search box to locate the correct one.

- How can you acquire the Cambridge Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate? If you possess an account, simply Log In.

- The Download feature will be activated for all the documents you review.

- Additionally, you can retrieve all previously saved files from the My documents section.