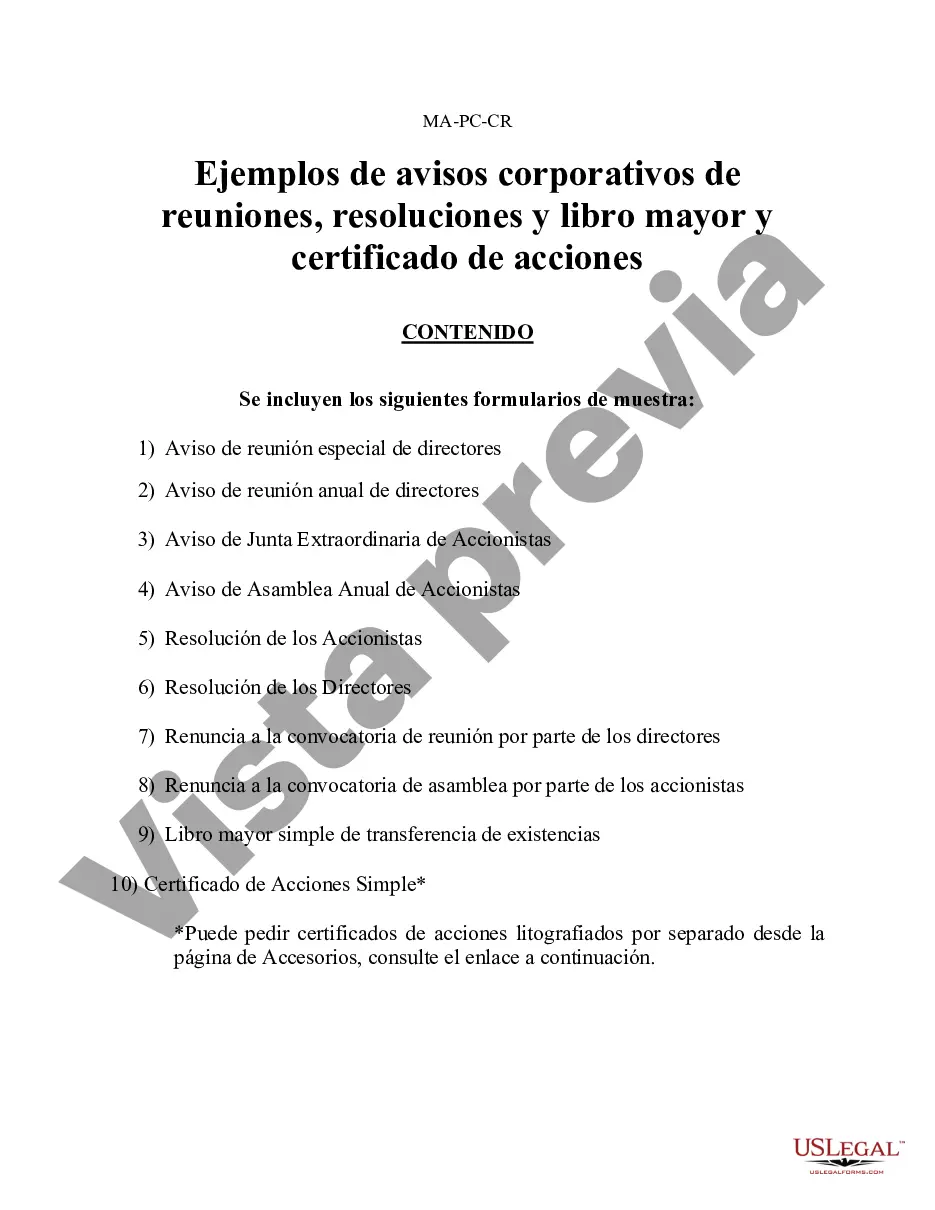

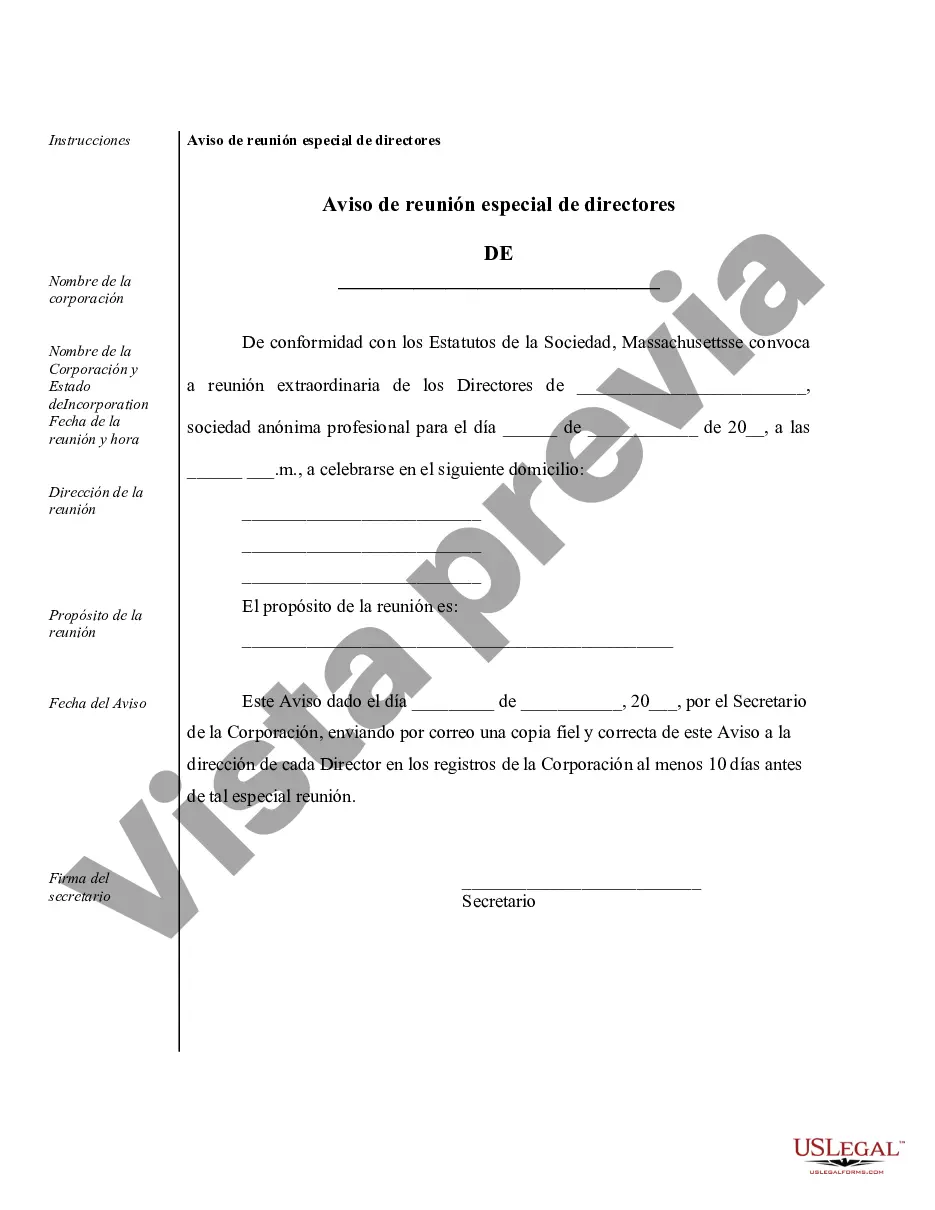

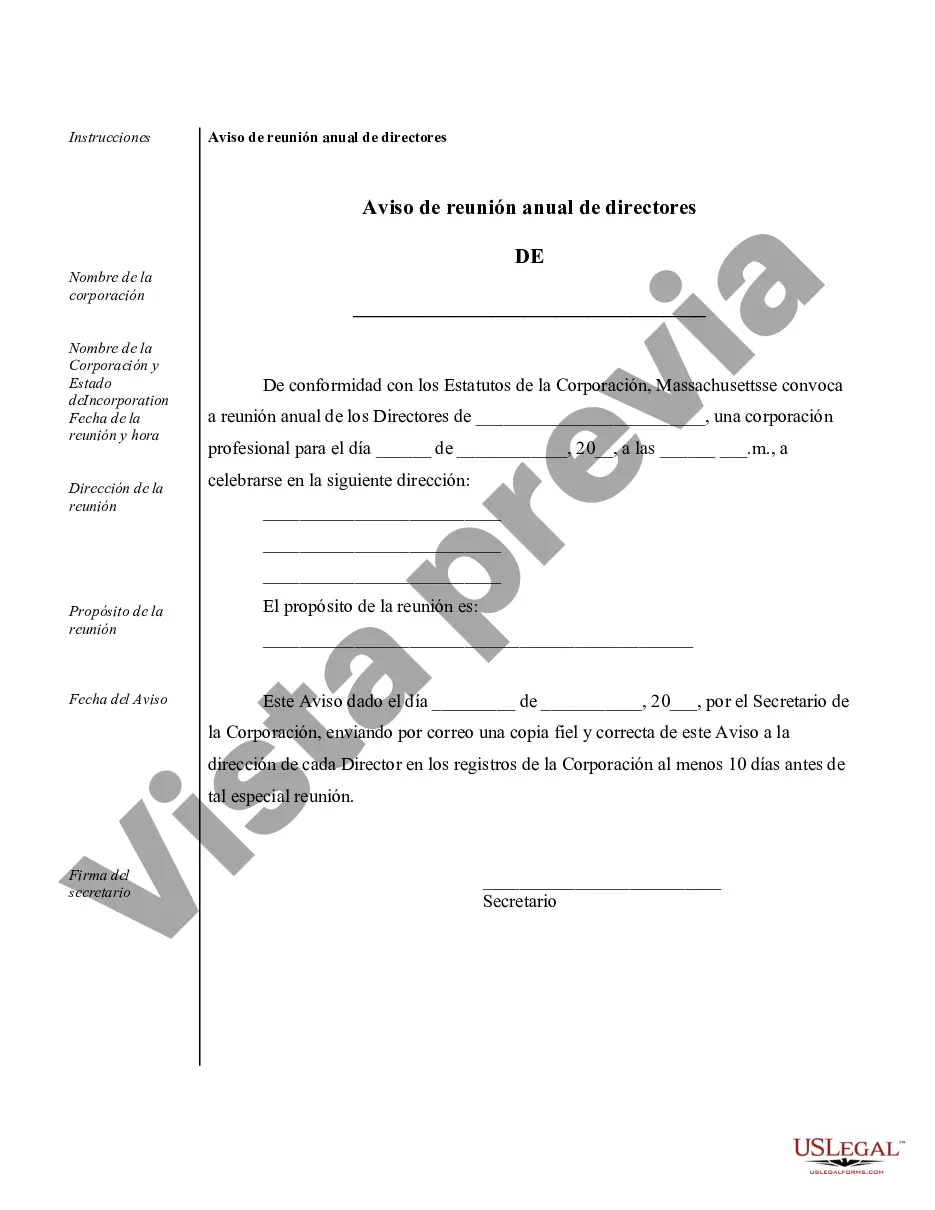

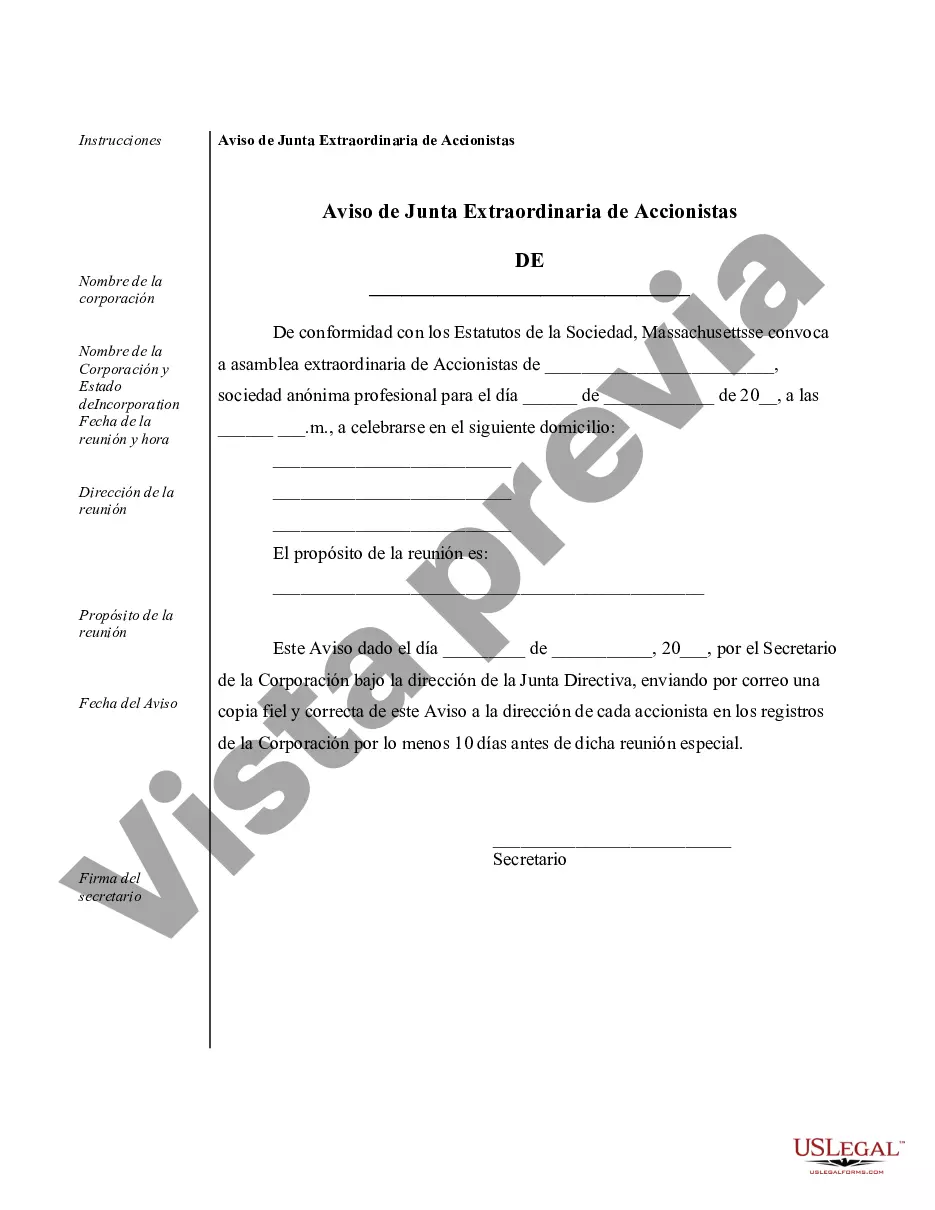

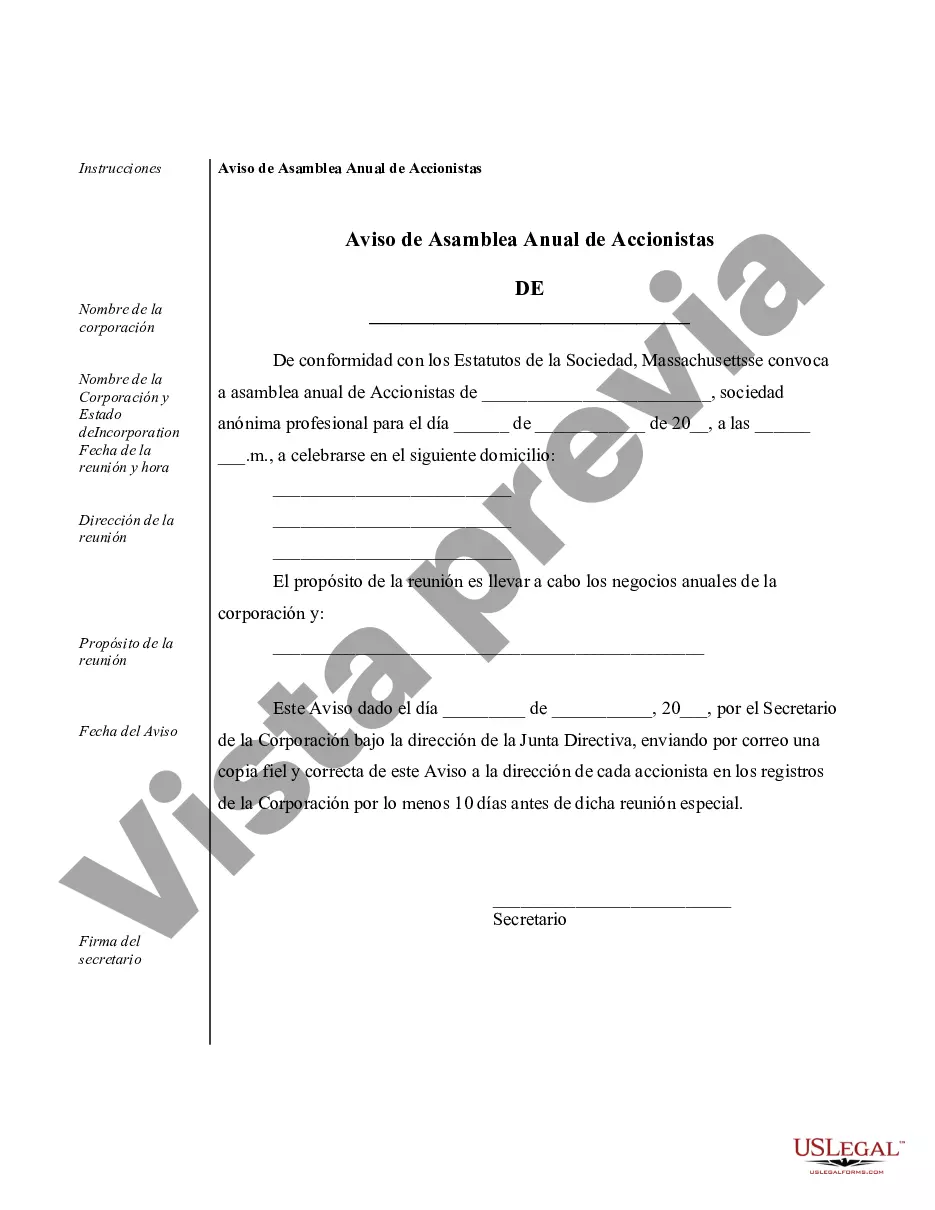

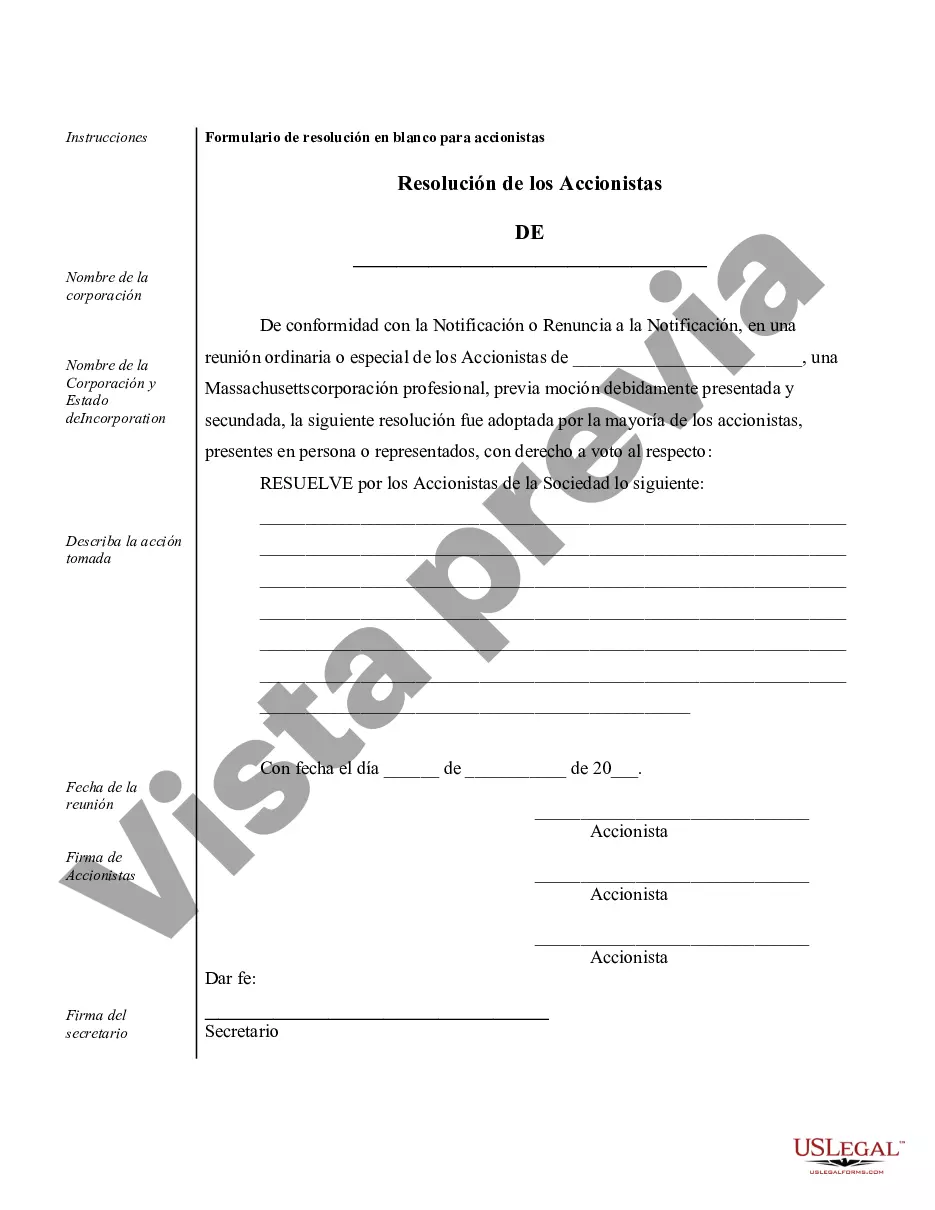

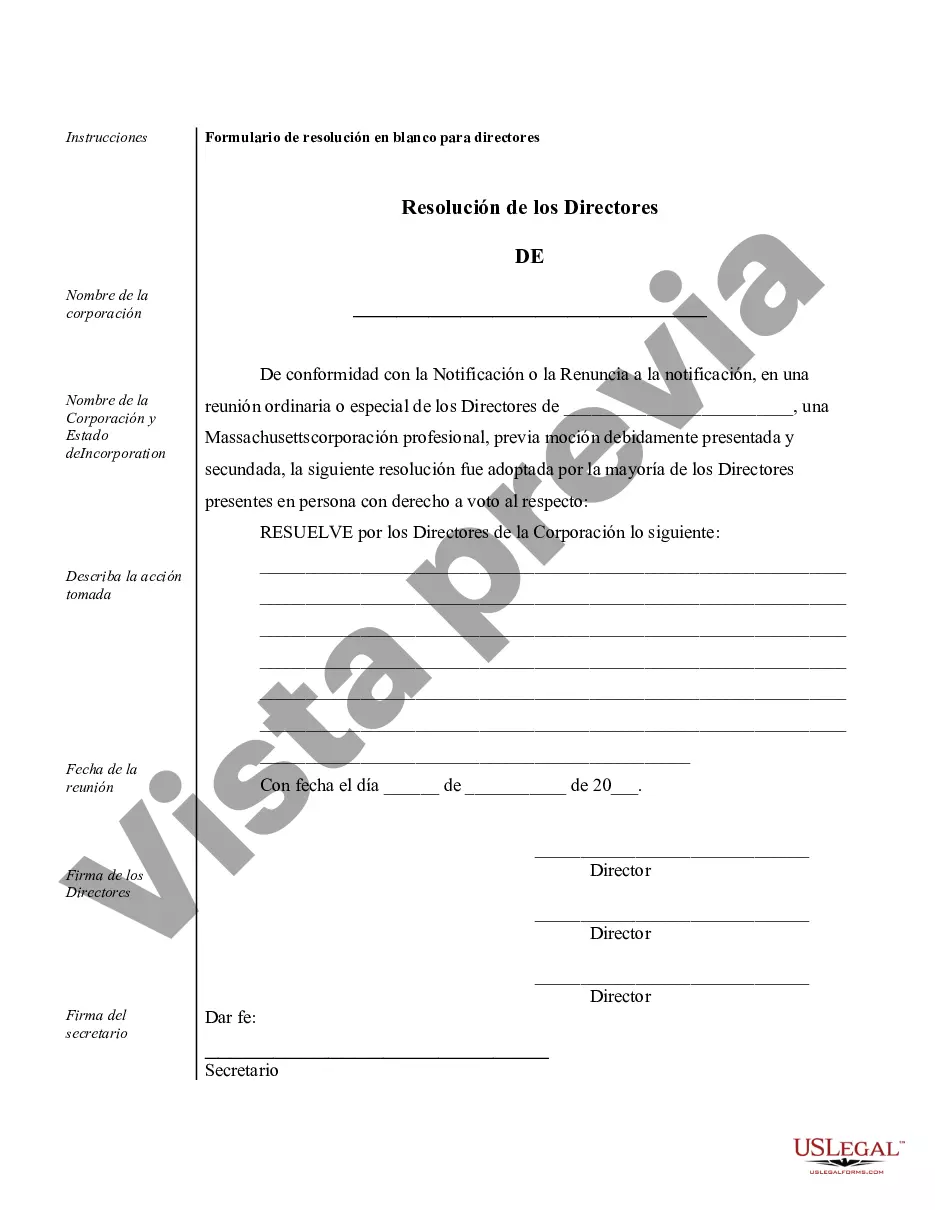

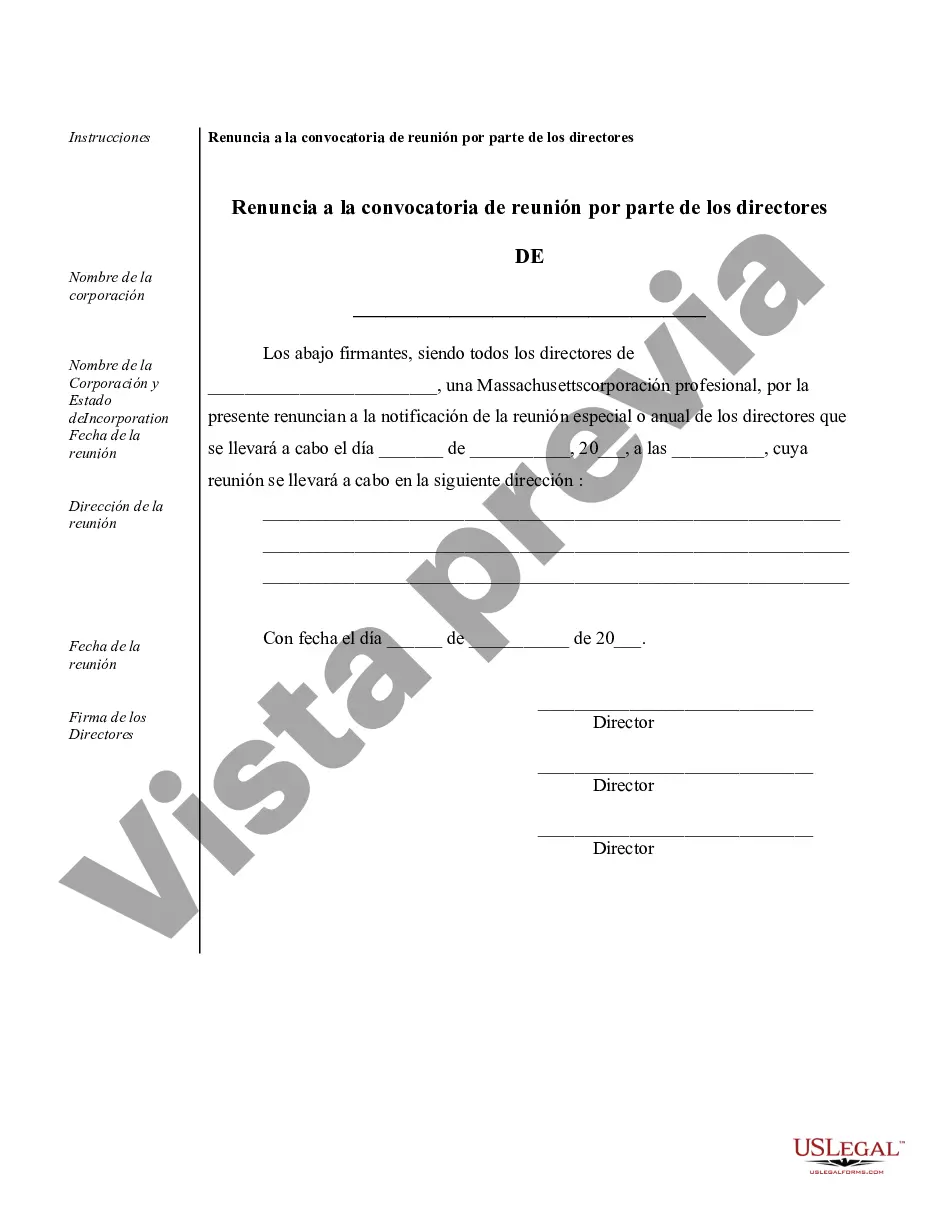

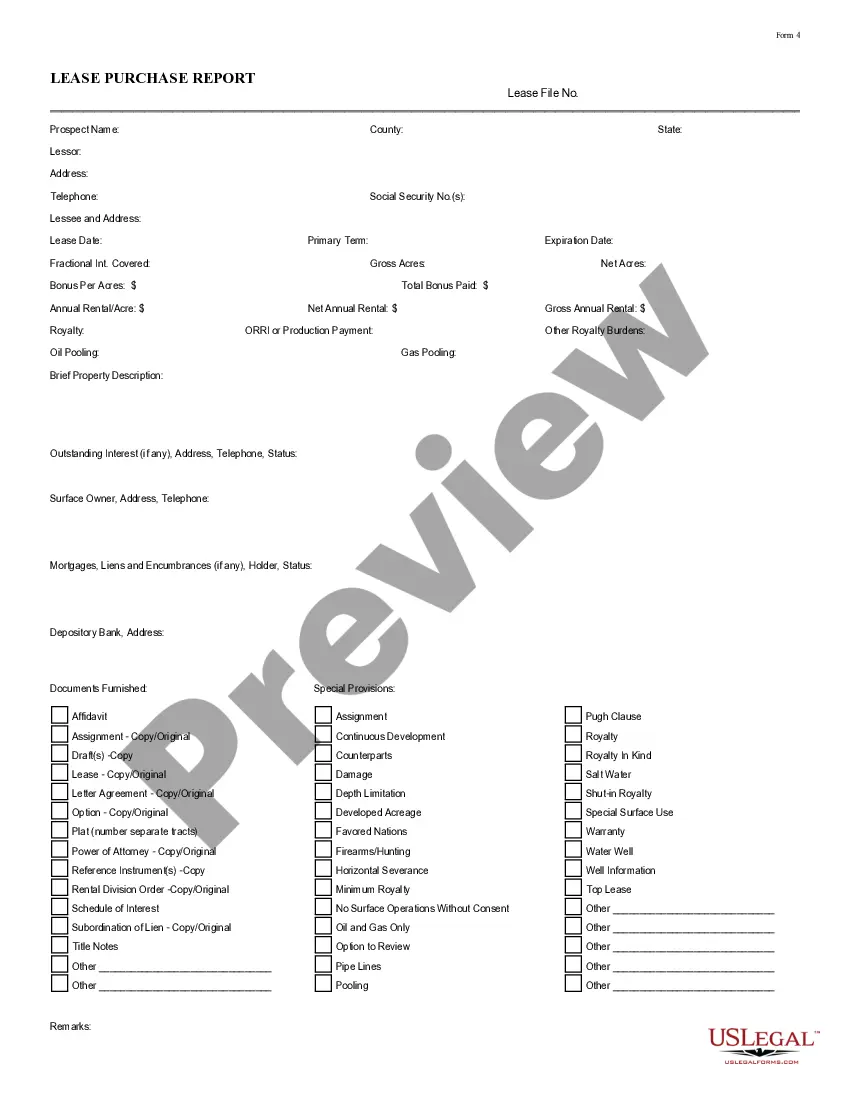

Cambridge Sample Corporate Records for a Massachusetts Professional Corporation Cambridge Sample Corporate Records provide a comprehensive and detailed documentation of the activities and operations of Massachusetts Professional Corporations. These records serve as vital tools for maintaining and organizing corporate information while ensuring compliance with the state's legal requirements. 1. Articles of Incorporation: This document outlines the formation of a Massachusetts Professional Corporation, including the company's name, principal place of business, purpose, stock information, and governing structure. It establishes the legal existence of the corporation. 2. Bylaws: The bylaws serve as the internal rule book for the corporation, outlining the rights, responsibilities, and powers of shareholders, directors, and officers. It includes provisions on how meetings are conducted, voting procedures, and the appointment and removal of directors/officers. 3. Shareholder Agreements: This agreement outlines the respective rights and obligations of the company's shareholders, covering matters such as stock ownership, dividend distribution, stock transfer restrictions, and shareholder voting rights. It helps ensure a clear understanding among shareholders and aids in dispute resolution. 4. Meeting Minutes: These records document the proceedings of meetings held by directors, shareholders, and committees. Minutes include key discussions, decisions made, resolutions passed, and voting outcomes. They serve as an accurate record of the company's decision-making processes. 5. Stock Certificates: These documents act as evidence of ownership for company shares held by shareholders. Stock certificates typically include the shareholder's name, number of shares owned, and the certificate's unique identification number. 6. Financial Statements: Massachusetts Professional Corporations are required to maintain accurate financial records, including balance sheets, income statements, and cash flow statements. These records provide insights into the company's financial performance, position, and cash flows. 7. Annual Reports: Massachusetts requires corporations to file annual reports with the Secretary of the Commonwealth. These reports update the state on the corporation's current status, including general business activities, registered agent information, and changes in directors or officers. 8. Tax Filings: Massachusetts Professional Corporations must comply with state tax regulations. The collection and maintenance of tax-related records are necessary for reporting and filing state and federal taxes accurately. 9. Contracts and Agreements: Any contracts or agreements entered into by the corporation, such as leases, employment agreements, client contracts, or vendor agreements, should be kept as records to ensure compliance and documentation of obligations. 10. Licenses and Permits: Massachusetts Professional Corporations may have various licenses or permits specific to their industry. These records prove compliance with relevant regulations and may be necessary for business operations and legal requirements. Maintaining up-to-date and accurate Cambridge Sample Corporate Records is crucial for Massachusetts Professional Corporations. These records facilitate transparency, ensure legal compliance, and aid in making informed business decisions. It is recommended to consult with legal professionals or corporate governance experts for guidance on how to maintain and organize these records effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cambridge Ejemplos de registros corporativos para una corporación profesional de Massachusetts - Sample Corporate Records for a Massachusetts Professional Corporation

Description

How to fill out Cambridge Ejemplos De Registros Corporativos Para Una Corporación Profesional De Massachusetts?

Are you in need of a reliable and economical provider of legal forms to acquire the Cambridge Sample Corporate Records for a Massachusetts Professional Corporation? US Legal Forms is your ideal choice.

Whether you require a straightforward arrangement to establish rules for living with your partner or a set of documents to proceed with your divorce through the judicial system, we have you covered. Our platform provides over 85,000 current legal document templates for personal and business purposes. All templates that we offer access to are not generic and are tailored according to the specifications of particular states and counties.

To obtain the document, you must Log In to your account, find the desired template, and click the Download button beside it. Please keep in mind that you can re-download your previously purchased form templates anytime from the My documents section.

Is this your first time visiting our website? No problem. You can create an account within minutes, but first, ensure you do the following.

Now, you can set up your account. Then choose the subscription plan and proceed to payment. Once the payment is finalized, you can download the Cambridge Sample Corporate Records for a Massachusetts Professional Corporation in any of the provided file formats. You may revisit the website whenever needed and re-download the document at no cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting your precious time searching for legal paperwork online.

- Verify that the Cambridge Sample Corporate Records for a Massachusetts Professional Corporation meets the regulations of your state and locality.

- Examine the details of the form (if available) to understand for whom and what the document is meant.

- Reinitiate the search if the template does not suit your particular needs.