The Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children is a legally binding document that enables individuals in a civil union partnership to outline their final wishes and distribution of assets upon their passing. This comprehensive document ensures that your estate is distributed according to your specific instructions, offering peace of mind and security. The Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children serves as a vital tool for individuals in civil unions without children to communicate their preferences regarding the division of their assets, debts, and properties. By utilizing this legal form, you can make important decisions such as appointing an executor, designating beneficiaries for your assets, and even specifying funeral arrangements. This specific Middlesex Massachusetts legal document recognizes the unique nature of civil unions and caters to the needs of partners without children. While there may not be different variations of this specific form considering the absence of children, it is essential to customize it according to your individual circumstances and wishes. Adding specific details about your assets, financial accounts, real estate, and sentimental possessions will help ensure that your intentions are accurately reflected in the document. Some relevant keywords associated with the Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children include: 1. Civil union: Signifies a legally recognized partnership between two individuals. 2. Legal form: A document that conforms to the legal requirements for creating a valid will and testament. 3. Last will and testament: A legal document that states an individual's final wishes and instructions for asset distribution after their passing. 4. Estate planning: The process of organizing and planning for the distribution of assets and properties after an individual's death. 5. Distribution of assets: Ensuring that an individual's possessions, financial accounts, and real estate are allocated to the intended beneficiaries. 6. Executor: The person designated to carry out the instructions outlined in the will, including the distribution of assets and fulfilling any other wishes. 7. Beneficiaries: Individuals or groups who are designated to receive assets, properties, or investments outlined in the will. 8. Funeral arrangements: Instructions regarding the desired arrangements for the funeral or memorial service, including burial, cremation, or specific wishes. 9. Debts and liabilities: Addressing any outstanding debts or liabilities and specifying how they should be settled from the estate. 10. Personalization: The importance of customizing the form to reflect individual circumstances, assets, and specific wishes. While there may not be variations of this form specifically for different types of civil unions or individuals without children, it is always recommended consulting with a legal professional or attorney experienced in estate planning to ensure that the document accurately captures your preferences and benefits from the protection that a legally sound will and testament offers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Formulario de última voluntad y testamento legal para una pareja de unión civil sin hijos - Massachusetts Last Will and Testament for a Civil Union Partner with No Children

Description

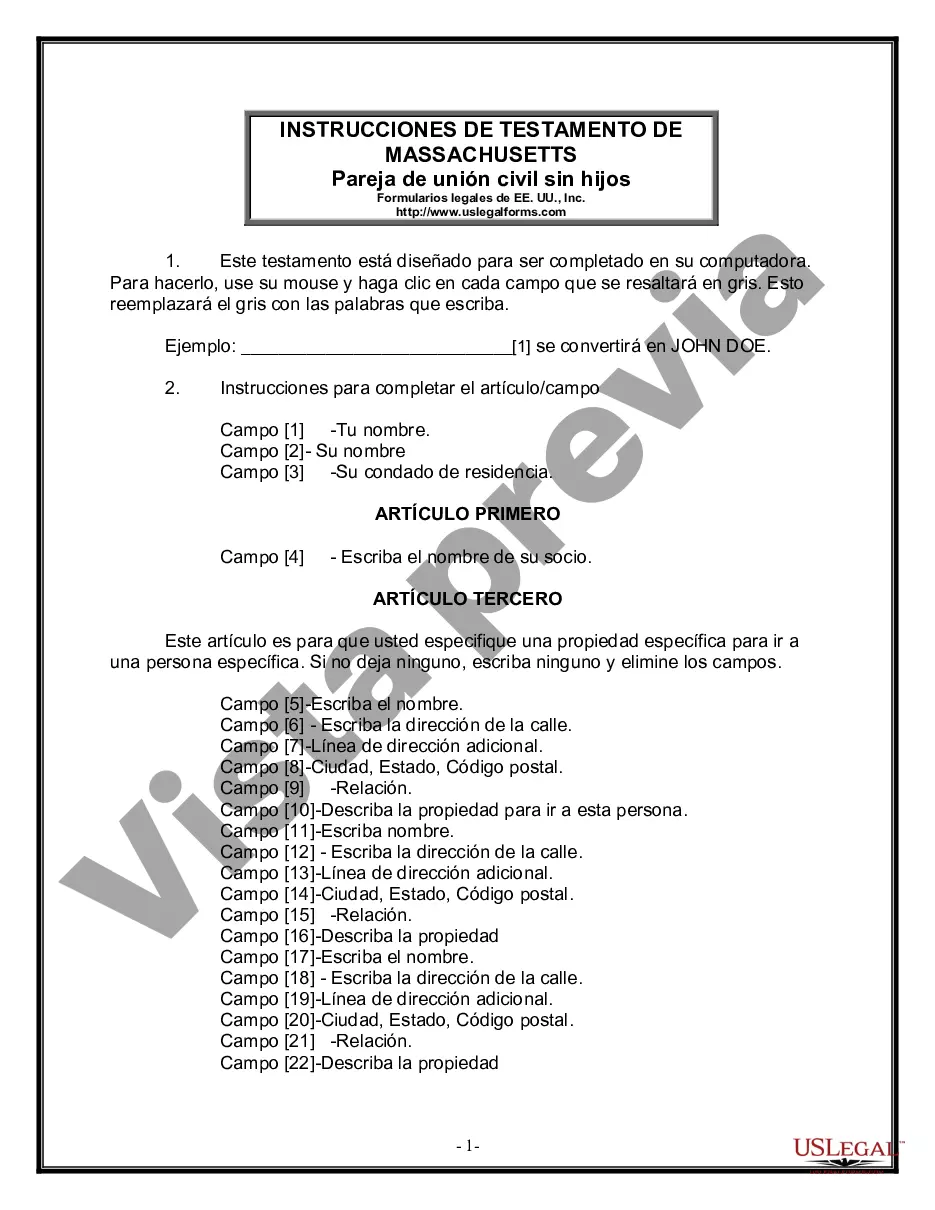

How to fill out Middlesex Massachusetts Formulario De última Voluntad Y Testamento Legal Para Una Pareja De Unión Civil Sin Hijos?

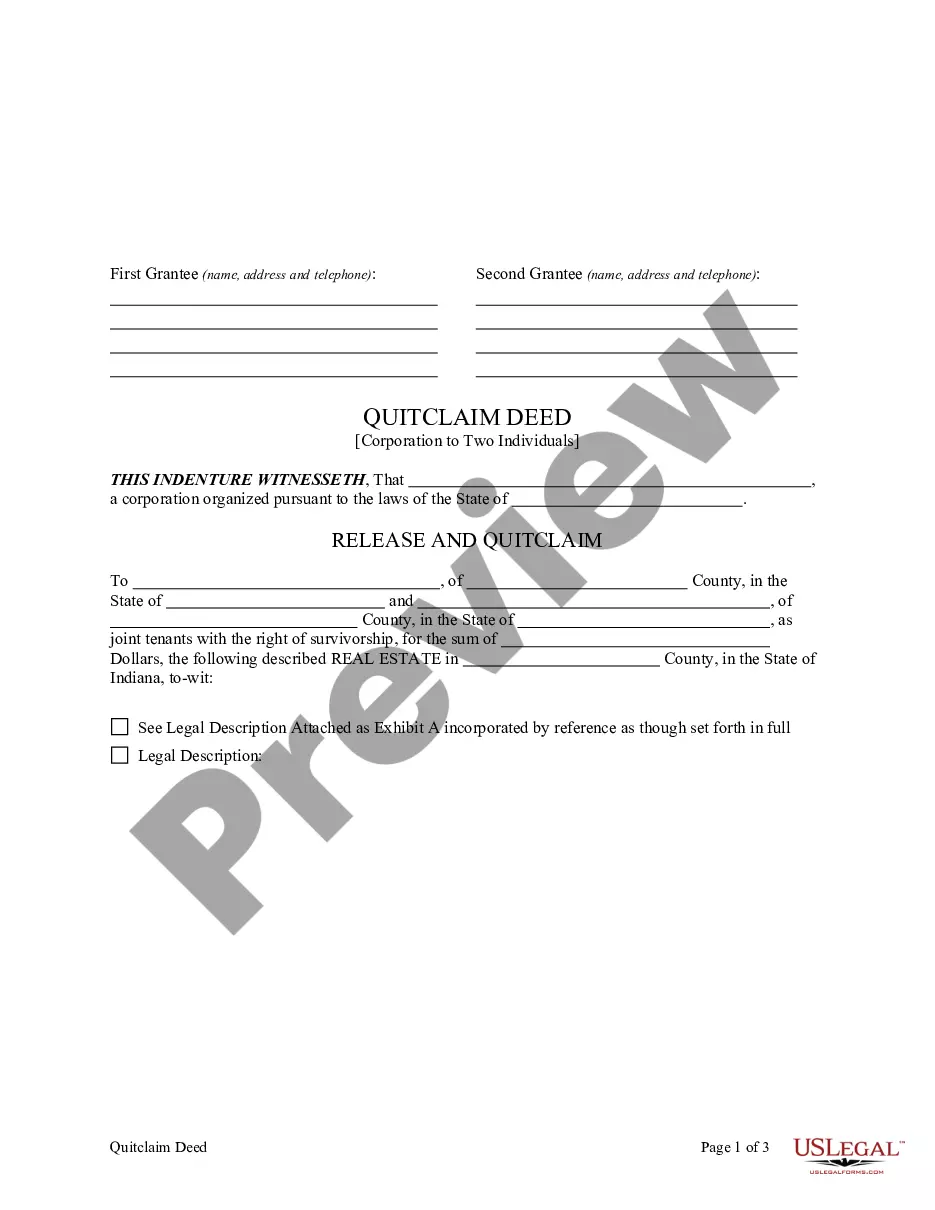

If you are looking for a valid form template, it’s difficult to find a more convenient platform than the US Legal Forms website – probably the most comprehensive online libraries. With this library, you can find thousands of document samples for business and individual purposes by types and regions, or keywords. Using our advanced search option, discovering the latest Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children is as elementary as 1-2-3. Moreover, the relevance of each and every record is verified by a team of professional attorneys that regularly review the templates on our platform and revise them in accordance with the newest state and county regulations.

If you already know about our system and have an account, all you need to get the Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the form you need. Read its explanation and make use of the Preview option to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the proper file.

- Affirm your selection. Click the Buy now option. After that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the format and download it to your system.

- Make changes. Fill out, modify, print, and sign the acquired Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children.

Every form you add to your account does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you need to have an additional version for enhancing or creating a hard copy, you may return and save it once again whenever you want.

Take advantage of the US Legal Forms extensive collection to gain access to the Middlesex Massachusetts Legal Last Will and Testament Form for a Civil Union Partner with No Children you were seeking and thousands of other professional and state-specific samples in one place!

Form popularity

FAQ

CUMPLA LAS SIGUIENTES REGLAS: Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

¿COMO HACER SU PROPIO TESTAMENTO? Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

Bajo el Codigo Testamentario de Texas, para que un testamento escrito a mano sea valido debe ser totalmente escrito a mano por el testador y firmado por el o ella. No tiene que ser atestiguado y puede ser escrito en cualquier tipo de papel. Palabras escritas en maquina no pueden ser incorporadas al testa- mento.

COMO REDACTAR UN TESTAMENTO Decide lo que deberia incluir tu testamento. Haz una lista de tus bienes. Decide quien debe recibir cada cosa. Divide tu patrimonio restante. Contrata un abogado. Usa un servicio de escritura de testamentos online. Escribe el testamento tu mismo. Finaliza tu testamento.

¿COMO HACER SU PROPIO TESTAMENTO? Escriba cada palabra de su testamento con su puno y letra.Cancele cualquier testamento que haya escrito anteriormente.Haga un documento completo.Firme su nombre al pie de cada pagina.No necesita testigos que firmen su testamento holografo.

Para un testamento generico, que se realiza sobre todos los bienes y se instituye a una persona como heredera, el costo minimo es de $28.000 y maximo de $100.000. Es importante registrarlo ya que al momento de una sucesion, el juez buscara saber si la persona fallecida indico que hacer con sus bienes despues de muerto.

Para que un testamento de la Florida sea valido, debe haber testigos del mismo. Bajo la ley de la Florida, debe haber dos testigos. Estos testigos deben firmar el testamento en presencia del otro, asi como en presencia del testador.

El precio por hacer un testamento en linea esta entre $60 y $120.

¿ Que requisitos debe cumplir? El testador debe tener como minimo 18 anos de edad. El testador debe tener buena salud mental. Al redactarlo, debe escribir su nombre y apellidos como aparecen en su acta de nacimiento. El testamento debe precisar quien sera el albacea.

Los pasos a seguir para hacer un testamento casero que sea valido son los siguientes: Redactarse en presencia de testigos.El testamento no puede estar escrito a mano.El testamento debe empezar identificando al testador.Nombrar detalladamente a los herederos.Quienes no pueden elaborar un testamento casero.

Interesting Questions

More info

Fornication means two or more adults in a sexual relationship that are married to someone other than each other, but it is not limited to homosexual and heterosexual relationships. Sex. There is some debate in the literature whether the word refers primarily to the act of sexual intercourse or whether it refers primarily to vaginal intercourse. Although it is clear from the language of the Virginia code that oral sex and penis-in-vagina intercourse are covered if done between people married to each other, the question of which words and which terms are meant to describe these sexual practices remains unsettled. The use of the terms oral and vaginal is not new in Virginia; when the Virginia Code was written, oral intercourse was still regarded as a marital act. In light of the fact that oral intercourse is covered under marriage in the Virginia Code, this Court has a responsibility to determine whether and how it is covered when the code is written today.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.