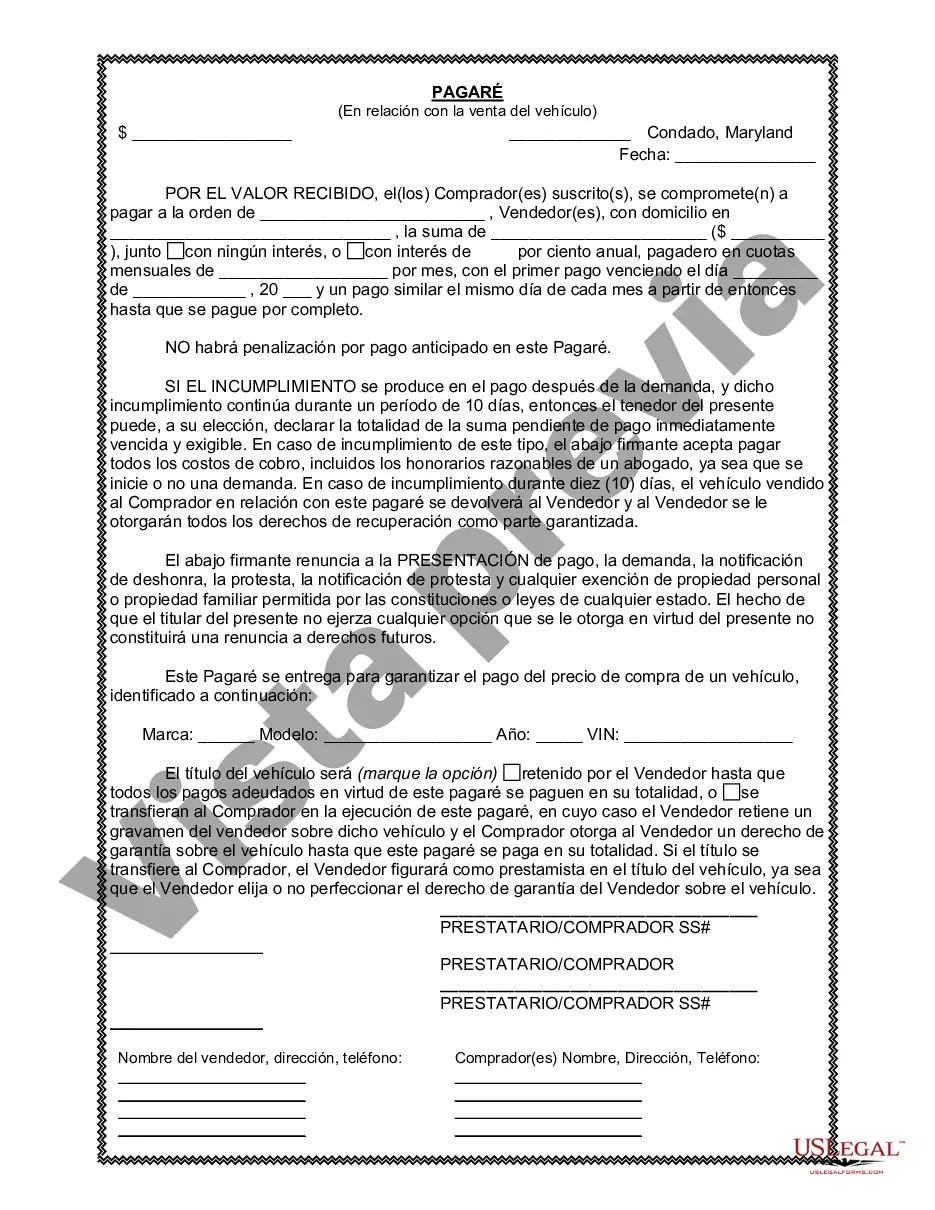

A Montgomery Maryland Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan or financing agreement between the buyer and the seller. It serves as proof of the loan's existence, specifying the amount borrowed, interest rate, repayment schedule, and any other relevant details. The purpose of a Montgomery Maryland Promissory Note is to ensure that both parties are clear on their obligations and to protect both the buyer and seller's rights in the transaction. This document helps establish a formal agreement, enhances transparency, and provides legal recourse in case of disputes. Different types of Montgomery Maryland Promissory Notes in connection with the sale of a vehicle or automobile may include: 1. Installment Promissory Note: This type of promissory note establishes a repayment plan where the borrower agrees to make regular monthly payments over a set period until the loan is fully repaid. The exact terms, including the interest rate, duration, and payment schedule, are specified in the note. 2. Balloon Promissory Note: A balloon promissory note involves making smaller monthly payments with a large final payment, called the "balloon payment," due at the end of the specified term. This type of note can be beneficial for borrowers who anticipate having the means to make a substantial payment towards the end of the loan. 3. Secured Promissory Note: A secured promissory note involves the borrower providing collateral, such as the vehicle being sold, as security for the loan. If the borrower defaults on the loan, the lender has the right to seize and sell the collateral to recover the outstanding balance. 4. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral. This type of note relies solely on the borrower's creditworthiness and the trust between the parties. In the case of default, legal action can be taken against the borrower, but the lender does not have a specific asset to seize. When creating a Montgomery Maryland Promissory Note in connection with the sale of a vehicle or automobile, it is recommended to consult with a legal professional to ensure compliance with state laws and to address any additional clauses that may be required. Both parties should read and understand the terms thoroughly before signing the promissory note, as it becomes a binding contract once executed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Pagaré en relación con la venta de vehículos o automóviles - Maryland Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Montgomery Maryland Pagaré En Relación Con La Venta De Vehículos O Automóviles?

If you are looking for a valid form template, it’s impossible to choose a better platform than the US Legal Forms site – one of the most extensive libraries on the internet. With this library, you can find a huge number of templates for organization and personal purposes by categories and regions, or key phrases. With our high-quality search function, discovering the newest Montgomery Maryland Promissory Note in Connection with Sale of Vehicle or Automobile is as elementary as 1-2-3. Additionally, the relevance of each file is confirmed by a team of professional attorneys that regularly check the templates on our platform and revise them in accordance with the latest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Montgomery Maryland Promissory Note in Connection with Sale of Vehicle or Automobile is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the form you need. Read its description and utilize the Preview option to see its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the proper record.

- Affirm your selection. Choose the Buy now button. After that, pick the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the form. Choose the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the received Montgomery Maryland Promissory Note in Connection with Sale of Vehicle or Automobile.

Every form you add to your user profile has no expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you need to have an extra version for editing or printing, you can return and export it again at any moment.

Make use of the US Legal Forms professional library to get access to the Montgomery Maryland Promissory Note in Connection with Sale of Vehicle or Automobile you were seeking and a huge number of other professional and state-specific templates on one platform!