Title: Understanding Montgomery Maryland Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Montgomery Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed is an official communication typically issued by a lender or contract holder to notify the borrower about their failure to make timely payments under a Contract for Deed agreement. This legal document serves as a final warning, indicating the imminent consequences that the borrower may face if they don't rectify their overdue payments promptly. In Montgomery County, Maryland, there may be variations of this notice depending on the specific circumstances. Let's explore the details and implications associated with this notice. 1. Key elements of a Montgomery Maryland Final Notice of Default: — Identification: The notice will usually include the full legal names and contact information of both the borrower and the lender/contract holder. — Contract details: The notice will outline the pertinent information of the Contract for Deed, such as the agreement's commencement date, terms, and conditions. — Delinquency details: The notice will clearly state the amount and nature of overdue payments, including principal, interest, penalties, or any additional charges incurred. — Deadline for payment: The notice specifies a deadline by which the borrower must settle the arrears to avoid further action. — Default consequences: The notice outlines the potential consequences of continued non-payment, such as foreclosure, repossession, or legal action, as permitted by Maryland state laws. 2. Variations of Montgomery Maryland Final Notice of Default: — Standard Final Notice: This notice is issued when a borrower fails to make the required periodic payments within the stipulated due dates as per the Contract for Deed terms. — Cure Period Extension Notice: In certain cases, lenders may offer borrowers an extended period to rectify their delinquency by issuing this notice. However, it requires the borrower to meet specific conditions for availing the extension. — Acceleration Notice: Typically issued when repeated default occurs, this notice demands immediate payment of the entire remaining balance under the Contract for Deed, accelerating the loan's repayment schedule. — Notice of Intent to Foreclose: If the borrower fails to resolve their overdue payments within the specified deadline, the lender may issue this notice, informing them about the initiation of foreclosure proceedings. Conclusion: Receiving a Montgomery Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed can be a daunting experience for borrowers. It is crucial for recipients to address the overdue payments promptly to avoid severe consequences such as foreclosure or legal action. If you receive such a notice, seeking professional advice from a real estate attorney or engaging in productive communication with the lender or contract holder is strongly recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed

State:

Maryland

County:

Montgomery

Control #:

MD-00470-9

Format:

Word

Instant download

Description

Aviso final de mora en los pagos vencidos bajo contrato de escrituración.

Title: Understanding Montgomery Maryland Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: A Montgomery Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed is an official communication typically issued by a lender or contract holder to notify the borrower about their failure to make timely payments under a Contract for Deed agreement. This legal document serves as a final warning, indicating the imminent consequences that the borrower may face if they don't rectify their overdue payments promptly. In Montgomery County, Maryland, there may be variations of this notice depending on the specific circumstances. Let's explore the details and implications associated with this notice. 1. Key elements of a Montgomery Maryland Final Notice of Default: — Identification: The notice will usually include the full legal names and contact information of both the borrower and the lender/contract holder. — Contract details: The notice will outline the pertinent information of the Contract for Deed, such as the agreement's commencement date, terms, and conditions. — Delinquency details: The notice will clearly state the amount and nature of overdue payments, including principal, interest, penalties, or any additional charges incurred. — Deadline for payment: The notice specifies a deadline by which the borrower must settle the arrears to avoid further action. — Default consequences: The notice outlines the potential consequences of continued non-payment, such as foreclosure, repossession, or legal action, as permitted by Maryland state laws. 2. Variations of Montgomery Maryland Final Notice of Default: — Standard Final Notice: This notice is issued when a borrower fails to make the required periodic payments within the stipulated due dates as per the Contract for Deed terms. — Cure Period Extension Notice: In certain cases, lenders may offer borrowers an extended period to rectify their delinquency by issuing this notice. However, it requires the borrower to meet specific conditions for availing the extension. — Acceleration Notice: Typically issued when repeated default occurs, this notice demands immediate payment of the entire remaining balance under the Contract for Deed, accelerating the loan's repayment schedule. — Notice of Intent to Foreclose: If the borrower fails to resolve their overdue payments within the specified deadline, the lender may issue this notice, informing them about the initiation of foreclosure proceedings. Conclusion: Receiving a Montgomery Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed can be a daunting experience for borrowers. It is crucial for recipients to address the overdue payments promptly to avoid severe consequences such as foreclosure or legal action. If you receive such a notice, seeking professional advice from a real estate attorney or engaging in productive communication with the lender or contract holder is strongly recommended.

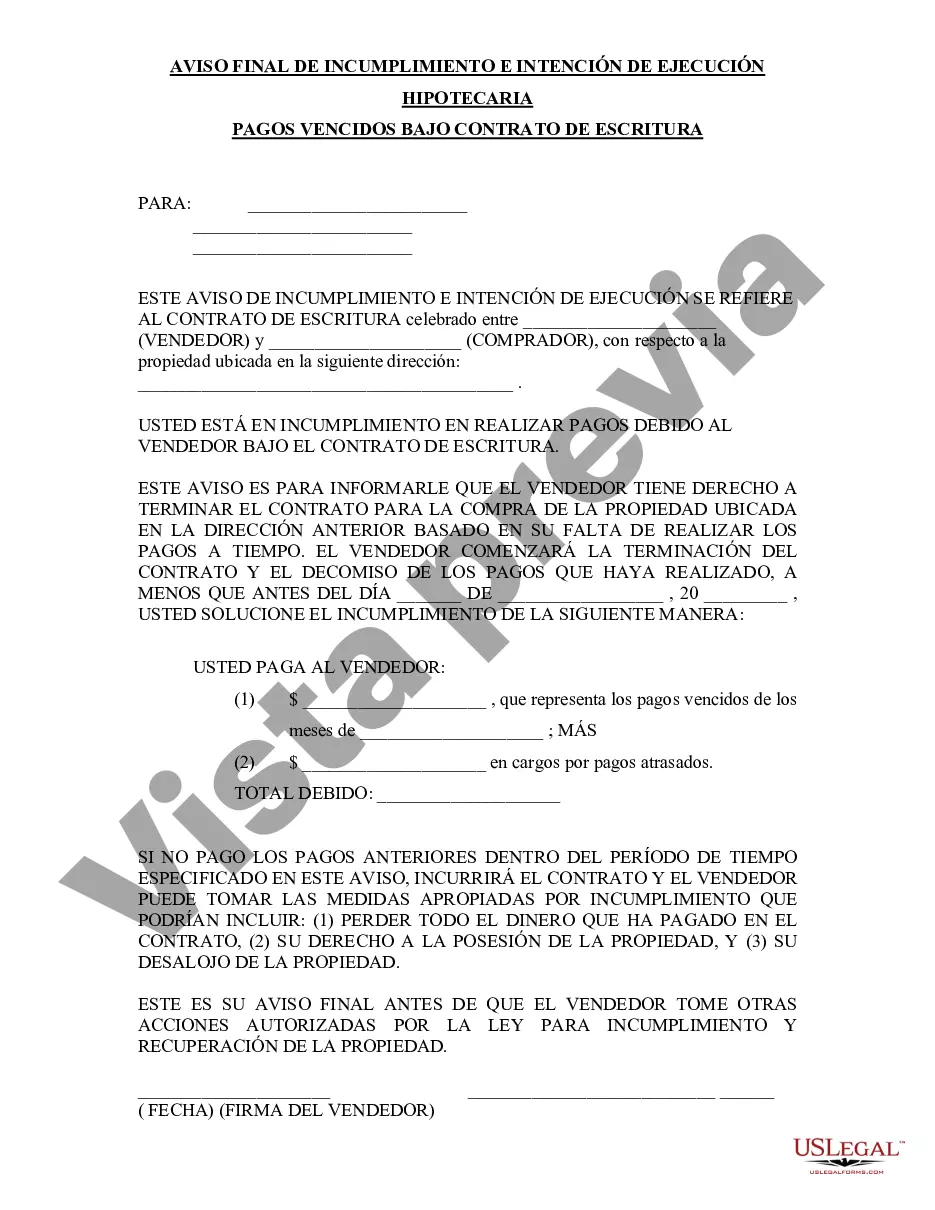

Free preview

How to fill out Montgomery Maryland Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

If you’ve already used our service before, log in to your account and download the Montgomery Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Montgomery Maryland Final Notice of Default for Past Due Payments in connection with Contract for Deed. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!