Montgomery Maryland Articles of Incorporation for Tax-Exempt Nonstick Corporation are legal documents that establish the formation and purpose of a nonstick corporation in Montgomery County, Maryland, seeking tax-exempt status. These articles are specifically tailored for organizations that are not seeking to distribute profits or dividends to its members or shareholders. The Montgomery Maryland Articles of Incorporation for Tax-Exempt Nonstick Corporation include crucial information such as the corporation's name, the purpose for which it is being established, the registered agent's contact details, the initial board of directors, and the duration of the corporation's existence. Some key keywords that are relevant to these articles include: 1. Tax-exempt: This refers to the status the corporation is seeking, which means that it will be exempt from federal and state income taxes. 2. Nonstick corporation: This term specifies that the corporation does not issue shares of stock or distribute profits to its members but operates for educational, charitable, scientific, religious, or other nonprofit purposes. 3. Montgomery County: This refers to the specific county in Maryland where the corporation will be incorporated and operate from. Different types of Montgomery Maryland Articles of Incorporation for Tax-Exempt Nonstick Corporation may vary based on the specific purpose and activities of the organization. For example, articles of incorporation for a charitable organization would include additional provisions related to fundraising, grant distribution, and community outreach, while articles for an educational nonprofit might focus on curriculum development, accreditation, and scholarships. It is important to consult legal or tax professionals to ensure adherence to Montgomery County's specific requirements for tax-exempt nonstick corporations. These professionals can help draft articles of incorporation that accurately represent the organization's objectives and comply with legal regulations, ultimately increasing the likelihood of obtaining tax-exempt status.

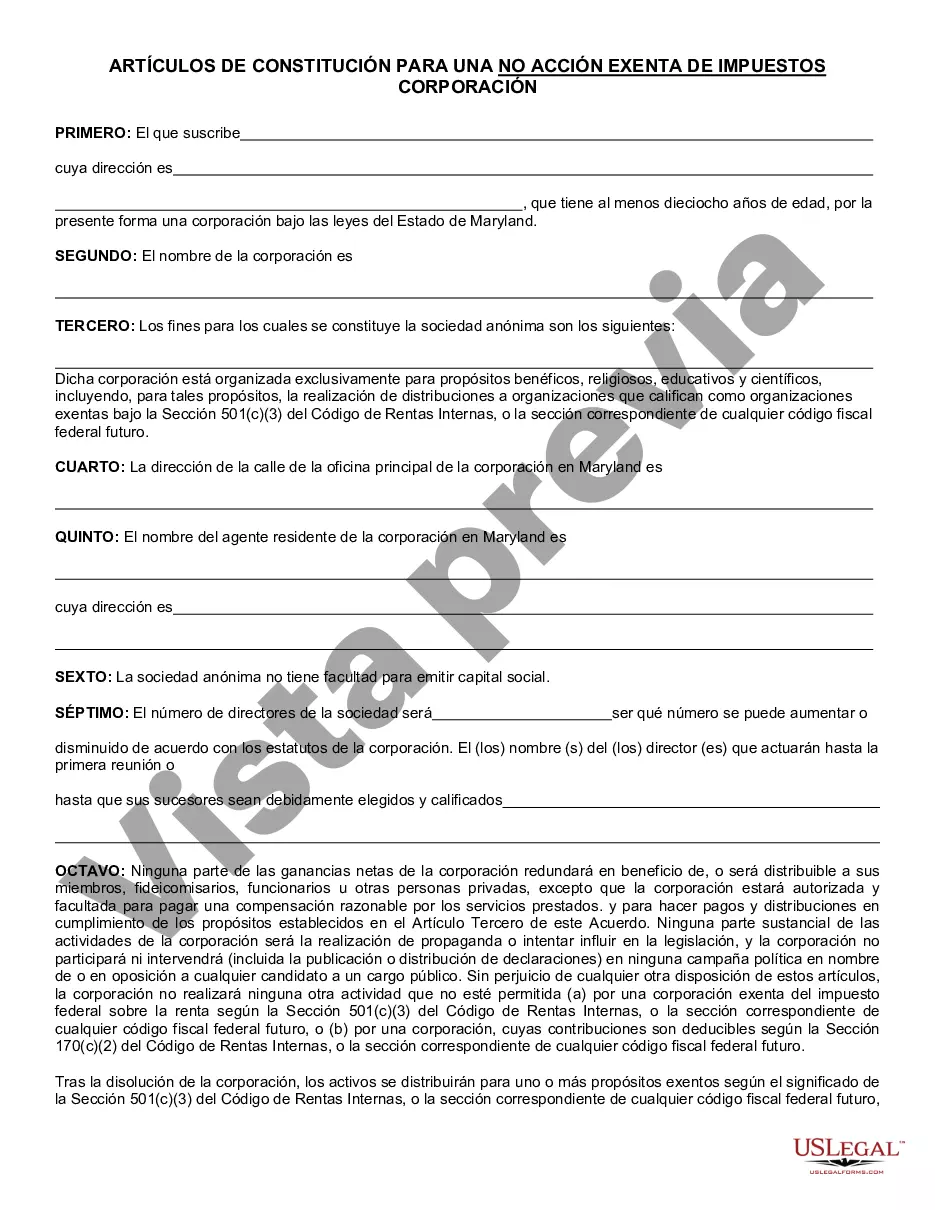

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Artículos de incorporación de Maryland para sociedades sin acciones exentas de impuestos - Maryland Articles of Incorporation for Tax-Exempt Nonstock Corporation

Description

How to fill out Montgomery Artículos De Incorporación De Maryland Para Sociedades Sin Acciones Exentas De Impuestos?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Montgomery Maryland Articles of Incorporation for Tax-Exempt Nonstock Corporation or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Montgomery Maryland Articles of Incorporation for Tax-Exempt Nonstock Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Montgomery Maryland Articles of Incorporation for Tax-Exempt Nonstock Corporation would work for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!