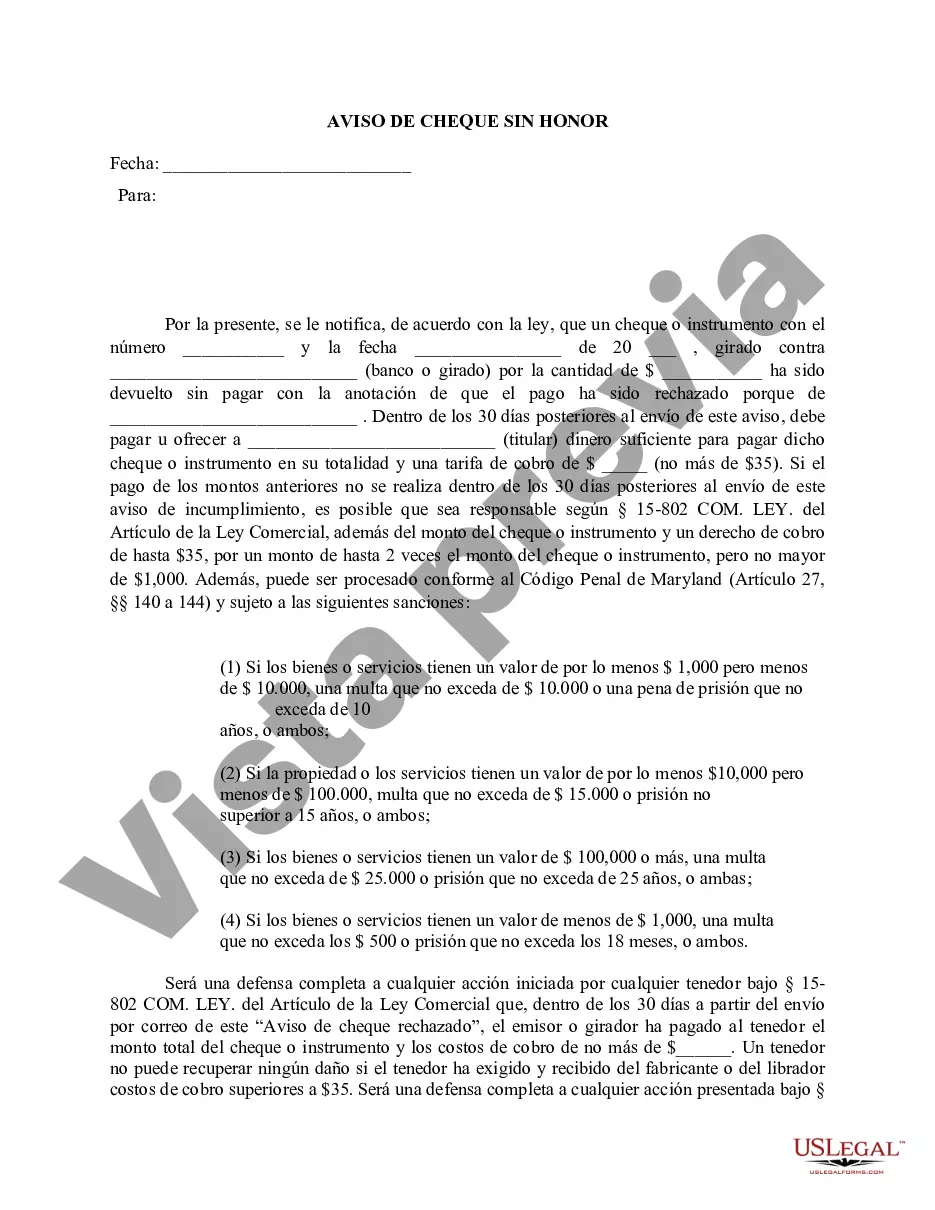

The Montgomery Maryland Notice of Dishonored Check — Civil, commonly known as a "bad check" or "bounced check" notice, is a legal document informing individuals or businesses that a check they presented for payment has been returned unpaid by the bank. This notice is crucial for both the party issuing the check and the recipient, as it serves to protect their rights and initiate necessary actions to resolve the matter. Keywords: bad check, bounced check In Montgomery County, Maryland, different types of Montgomery Maryland Notice of Dishonored Check — Civil can be issued based on specific circumstances: 1. Personal Bad Check: This type of notice is issued when an individual writes a check from their personal account, but the payment gets declined due to insufficient funds or account closure. It highlights the importance of resolving the issue promptly to avoid further consequences. Keywords: personal account, insufficient funds, account closure 2. Business Bad Check: This notice is issued when a business issues a check which bounces. It may be due to various reasons such as insufficient funds, a closed account, or an inaccurate or fraudulent check. It emphasizes the importance of maintaining accurate financial records and monitoring account balances to prevent such situations. Keywords: business account, insufficient funds, closed account, inaccurate check, fraudulent check 3. Fraudulent Check: If a check that is dishonored is deemed to be deliberately fraudulent, a specialized Montgomery Maryland Notice of Dishonored Check — Civil can be issued. This type of notice is relevant when there is evidence of intentional deception, counterfeit checks, or identity theft involved, making it crucial to take appropriate legal actions against the responsible party. Keywords: deliberate fraud, counterfeit check, identity theft When receiving a Montgomery Maryland Notice of Dishonored Check — Civil, the recipient or "payee" of the check is advised to take the following steps: 1. Contact the Issuer: The payee should first contact the issuer of the check to discuss the matter and seek clarification. There may be a genuine reason for the dishonor, such as a temporary cash flow issue, which can be resolved through communication. Keywords: payee, issuer, communication, clarification, dishonor 2. Communicate in Writing: If the issuer fails to respond or rectify the situation, the payee should send a written response, acknowledging the notice and demanding immediate payment. Maintaining a written record of communication is vital for further legal actions, if necessary. Keywords: written response, acknowledgment, demand payment, legal actions 3. Legal Actions: If all attempts to resolve the issue amicably fail, the payee may need to pursue legal actions to recover the amount owed. This could involve filing a lawsuit, engaging a collections' agency, or seeking assistance from small claims court, depending on the amount and local laws. Keywords: legal actions, lawsuit, collections agency, small claims court In conclusion, the Montgomery Maryland Notice of Dishonored Check — Civil, often referred to as a bad check or bounced check notice, serves to inform individuals and businesses about the dishonor of a check they presented for payment. Depending on the circumstances, such as personal or business checks, insufficient funds, closed accounts, or deliberate fraud, different types of notices can be issued. It is essential for both the issuer and the recipient of the check to communicate, resolve the issue promptly, and take appropriate legal actions, if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Montgomery Maryland Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Are you looking for a reliable and affordable legal forms provider to buy the Montgomery Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Montgomery Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the document is good for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Montgomery Maryland Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any available format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time researching legal papers online once and for all.