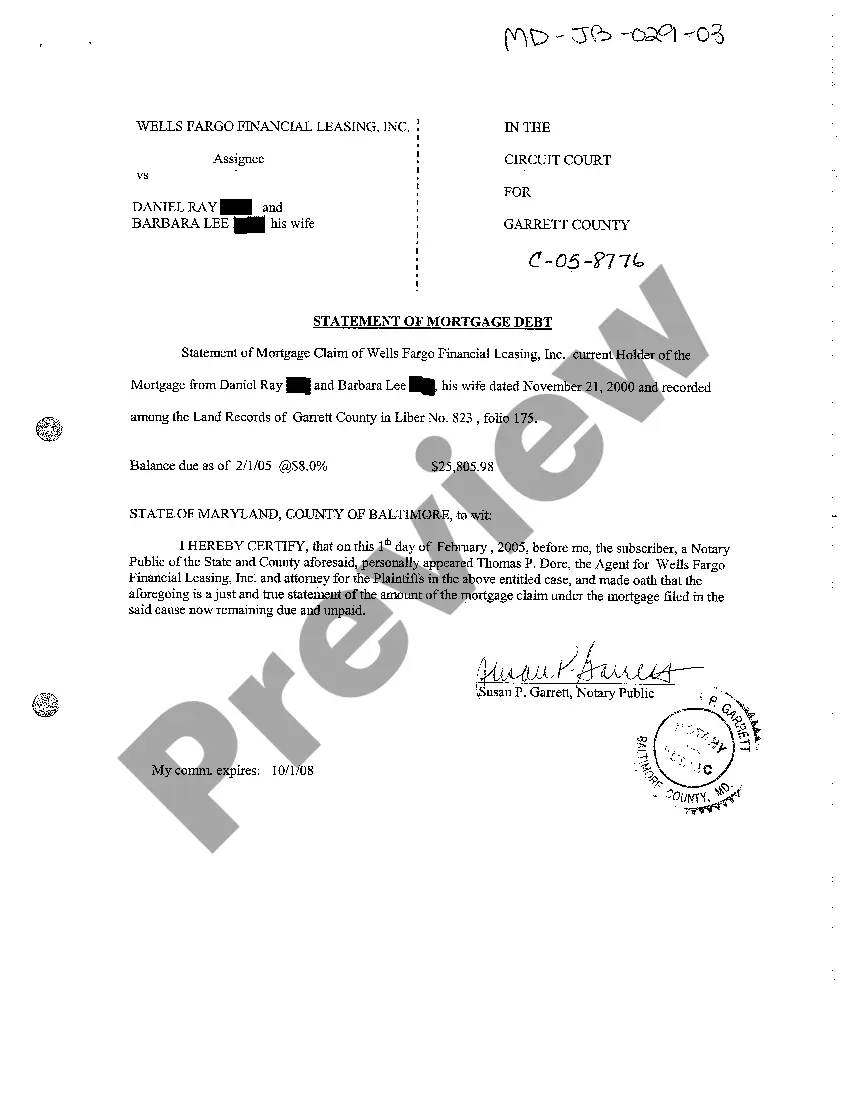

The Montgomery Maryland Statement of Mortgage Debt is an official document that outlines the financial obligations of an individual or entity related to their mortgage. It serves as a legal record of the amount owed, the terms of repayment, and other crucial details regarding the mortgage agreement. This statement is typically issued by the mortgage lender or service and acts as a comprehensive summary of the debt associated with the property located in Montgomery County, Maryland. Keywords: Montgomery Maryland, Statement of Mortgage Debt, mortgage, financial obligations, legal record, amount owed, terms, repayment, mortgage agreement, lender, service, property, Montgomery County. There are several types of Montgomery Maryland Statements of Mortgage Debt that could be referred to: 1. Initial Statement of Mortgage Debt: This document is generated at the beginning of a mortgage agreement, providing the initial details of the loan amount, interest rate, payment schedule, and any additional terms. 2. Monthly/Periodic Statement of Mortgage Debt: This type of statement is issued on a regular basis, typically monthly, and includes information such as the outstanding principal balance, accrued interest, escrow account balance (if applicable), and a breakdown of the payment made towards principal, interest, and escrow. 3. Delinquency Statement of Mortgage Debt: In case of missed or late payments, a delinquency statement is issued by the lender or service. It highlights the outstanding amount, late fees, penalties, and any other charges associated with the overdue payments. 4. Payoff Statement of Mortgage Debt: This statement is requested by borrowers who intend to pay off their mortgage in full before the scheduled term. It provides a detailed breakdown of the outstanding balance, including any prepayment penalties, and specifies the final amount required to satisfy the debt. 5. Modification/Forbearance Agreement Statement of Mortgage Debt: When a mortgage has undergone modification or forbearance due to financial hardship, a statement reflecting the revised terms, adjusted payment amounts, and any temporary suspension of debt obligations is issued. These various types of Montgomery Maryland Statements of Mortgage Debt serve to document and communicate the financial details and obligations related to the mortgage, ensuring transparency and accountability for both the borrower and lender.

Montgomery Maryland Statement of Mortgage Debt

Description

How to fill out Montgomery Maryland Statement Of Mortgage Debt?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any legal background to draft this sort of paperwork from scratch, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you want the Montgomery Maryland Statement of Mortgage Debt or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Montgomery Maryland Statement of Mortgage Debt in minutes using our reliable platform. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

However, in case you are a novice to our library, ensure that you follow these steps prior to obtaining the Montgomery Maryland Statement of Mortgage Debt:

- Ensure the form you have chosen is suitable for your location since the regulations of one state or area do not work for another state or area.

- Review the form and go through a short outline (if provided) of scenarios the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your credentials or create one from scratch.

- Pick the payment method and proceed to download the Montgomery Maryland Statement of Mortgage Debt as soon as the payment is through.

You’re good to go! Now you can go on and print out the form or fill it out online. If you have any issues getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.