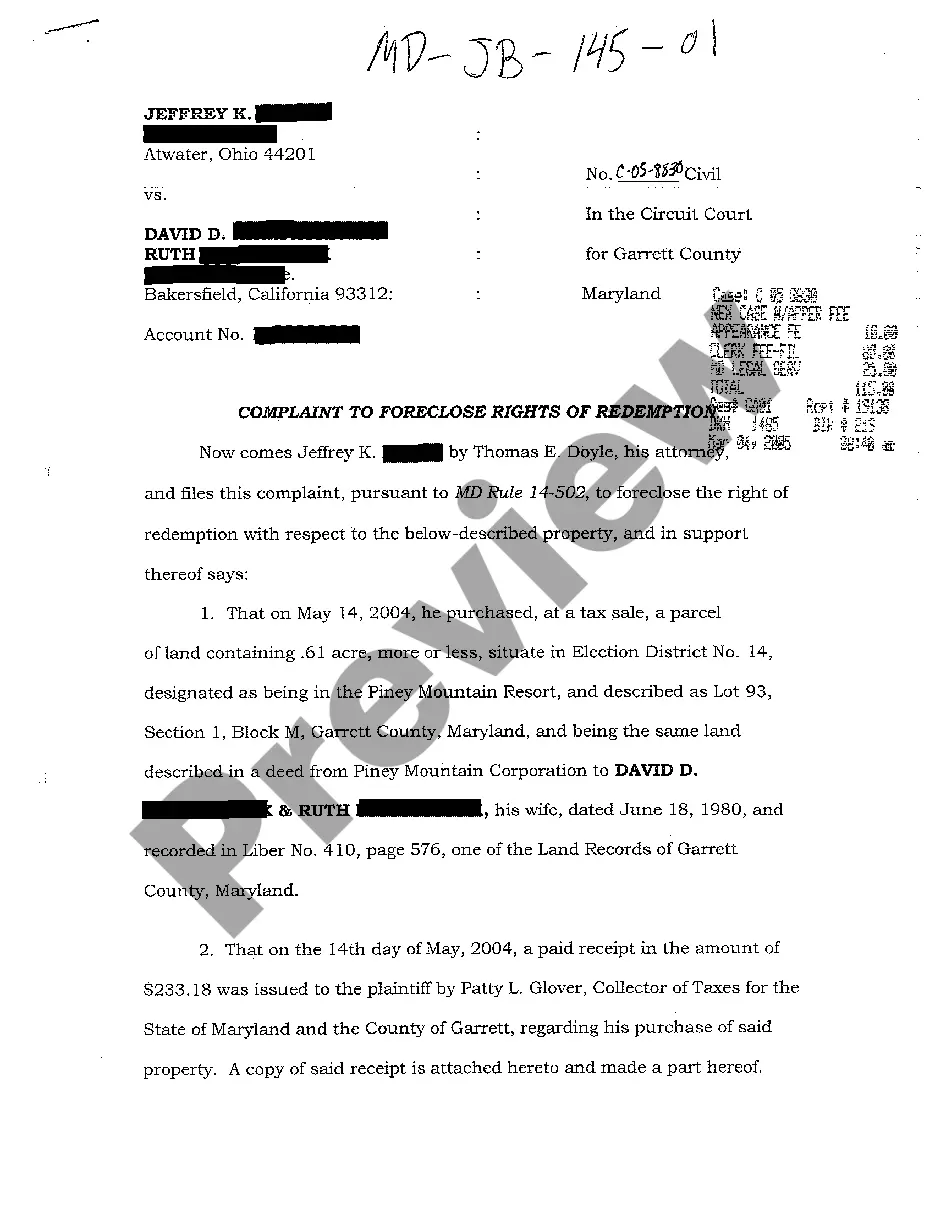

Montgomery Maryland Complaint to Foreclose Rights of Redemption

Description

How to fill out Maryland Complaint To Foreclose Rights Of Redemption?

Are you seeking a reliable and affordable legal forms provider to purchase the Montgomery Maryland Complaint to Foreclose Rights of Redemption? US Legal Forms is your primary choice.

Whether you need a straightforward agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce through the court, we have you covered. Our website features over 85,000 current legal document templates for personal and business use. All templates we offer are not generic and tailored according to the needs of specific states and counties.

To download the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased form templates at any time from the My documents tab.

Is this your first visit to our platform? No problem. You can set up an account with ease, but before that, make sure to do the following.

Now you can establish your account. Then choose the subscription plan and proceed to payment. Once the payment is finalized, download the Montgomery Maryland Complaint to Foreclose Rights of Redemption in any available format. You can return to the website anytime and redownload the document without incurring additional charges.

Acquiring current legal documents has never been simpler. Try US Legal Forms now, and stop wasting hours searching for legal papers online.

- Ensure that the Montgomery Maryland Complaint to Foreclose Rights of Redemption aligns with the regulations of your state and locality.

- Review the details of the form (if available) to understand who and what the document is suitable for.

- Restart your search if the template isn’t appropriate for your legal circumstances.

Form popularity

FAQ

Rule 2 501 in Maryland outlines the requirements for initiating civil actions, including foreclosure cases. This rule is vital for understanding how to properly file a Montgomery Maryland Complaint to Foreclose Rights of Redemption. By adhering to this rule, both plaintiffs and defendants can ensure that their legal processes proceed smoothly and justly within the Maryland court system.

The 502 tax return in Maryland is a form used by residents to report their individual income taxes. It allows taxpayers to claim deductions, credits, and any amounts due. For individuals dealing with a Montgomery Maryland Complaint to Foreclose Rights of Redemption, staying updated on filing their 502 tax return is crucial to avoid additional financial penalties that could complicate their situation.

The new tax law for retirees in Maryland includes significant changes that can benefit seniors in financial planning. These changes may impact how retirees manage their income and assets, particularly in relation to property taxes. For those facing a Montgomery Maryland Complaint to Foreclose Rights of Redemption, understanding these tax benefits can provide insights into how to protect their property rights effectively.

Rule 14 205 in Maryland governs the procedures associated with a Montgomery Maryland Complaint to Foreclose Rights of Redemption. This rule empowers mortgage lenders to initiate foreclosure proceedings against properties where the owner has defaulted on their mortgage payments. Understanding this rule is essential for property owners, as it outlines their rights and responsibilities throughout the foreclosure process.

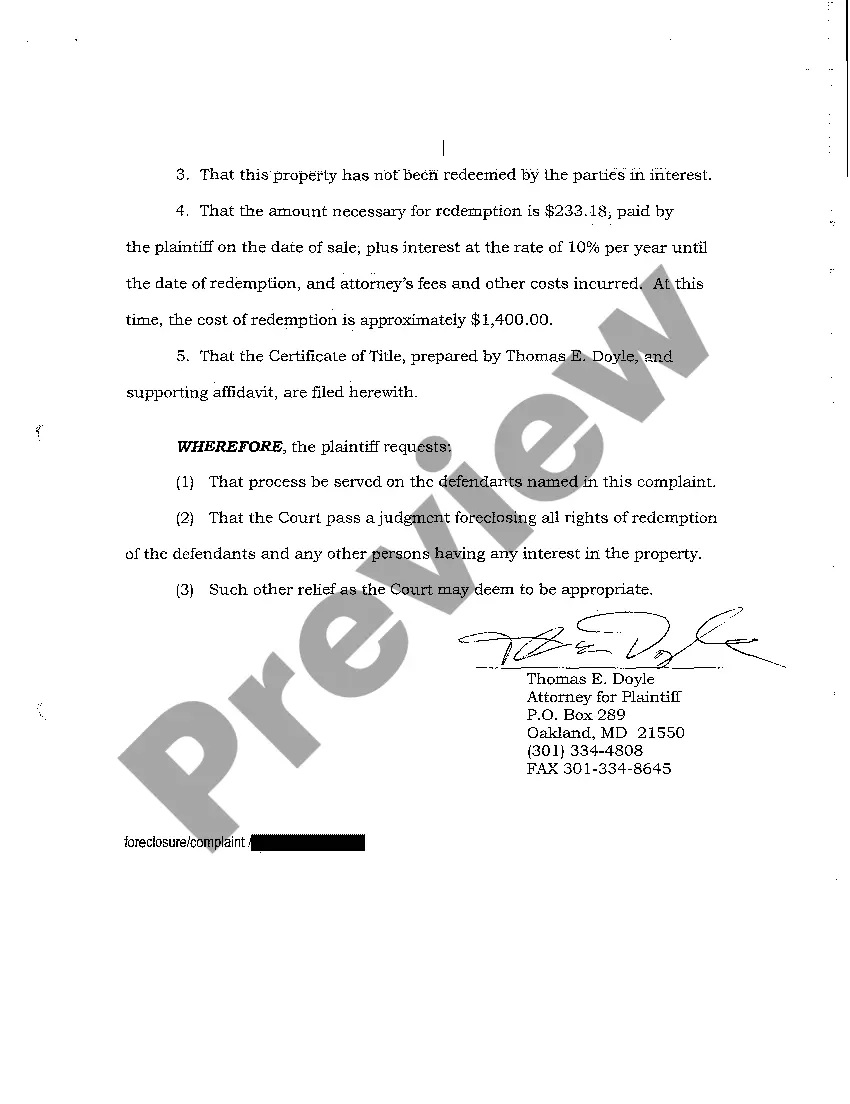

In Maryland, the redemption period for tax liens typically lasts for six months after the tax sale. During this time, property owners can redeem their property by paying the owed taxes, interest, and fees associated with the sale. If a Montgomery Maryland Complaint to Foreclose Rights of Redemption is filed, the property owner may lose their chance to reclaim their property. It's crucial to understand your rights and options, and using platforms like US Legal Forms can provide the necessary legal documents to navigate this process effectively.

Yes, a foreclosure can be reversed in Maryland under certain circumstances, particularly through the exercise of the right of redemption. Homeowners can reclaim their property by paying the owed balance before the redemption period expires. To effectively navigate this process after receiving a Montgomery Maryland Complaint to Foreclose Rights of Redemption, consulting legal resources is advisable.

The right of redemption in Maryland allows homeowners to reclaim their property from foreclosure by paying the past due amounts within a certain period. This right serves as a safety net, providing homeowners a chance to maintain ownership despite financial difficulties. If you're facing a Montgomery Maryland Complaint to Foreclose Rights of Redemption, leveraging this right can be key in securing your property.

Rule 14 502 in Maryland pertains to the procedures involved in a foreclosure case, specifically outlining how redemption can be handled. It emphasizes the importance of providing clear notices and timelines for all parties involved in the foreclosure process. Understanding this rule is essential if you are navigating a Montgomery Maryland Complaint to Foreclose Rights of Redemption.

Fighting property tax foreclosure requires understanding local laws and taking action quickly. You can contest the tax amount or the validity of the tax itself, often leveraging legal aid or resources. Tools like USLegalForms can provide valuable documents and guidance when responding to a Montgomery Maryland Complaint to Foreclose Rights of Redemption, helping you establish a solid defense.

The right of redemption foreclosure in Maryland allows property owners to reclaim their property after a foreclosure. This process ensures that homeowners have a chance to regain ownership even after the sale, safeguarding their rights. If you are facing a Montgomery Maryland Complaint to Foreclose Rights of Redemption, it's crucial to understand this right to take appropriate action.