Montgomery Maryland Statutory Personal Financial Power of Attorney (POA) is a legal document that grants authority to an appointed individual, known as an agent or attorney-in-fact, to manage and make decisions regarding the financial matters of another person, referred to as the principal. This document complies with the specific laws and regulations governing power of attorney in Montgomery County, Maryland. The Montgomery Maryland Statutory Personal Financial Power of Attorney allows the appointed agent to act on behalf of the principal in various financial matters, including but not limited to banking, investment transactions, real estate transactions, tax matters, retirement plans, insurance policies, and more. The appointed agent holds the responsibility to act in the best interest of the principal, managing their finances diligently and ethically. It is important to note that there may indeed be different types of Montgomery Maryland Statutory Personal Financial Power of Attorney, which are tailored to meet specific requirements or situations. These variations may include: 1. Limited Power of Attorney: This type of POA grants the agent authority over specific financial matters or a designated period. It restricts the agent's powers and is commonly used when the principal is temporarily unable to manage their own financial affairs. 2. Durable Power of Attorney: This POA remains in effect even if the principal becomes mentally incapacitated or unable to make decisions for themselves. The agent continues to manage the principal's financial affairs as long as the principal is alive. 3. Springing Power of Attorney: A springing POA only becomes effective when specific conditions specified by the principal are met. For instance, it may require a doctor's certification declaring the principal's incapacity before the agent can exercise their powers. 4. General Power of Attorney: This type of POA grants broad authority to the agent, allowing them to handle a wide range of financial matters on behalf of the principal. The agent may have the power to buy/sell property, access bank accounts, manage investments, and more. When creating a Montgomery Maryland Statutory Personal Financial Power of Attorney, it is important to consult with an attorney or utilize a reliable legal service to ensure the document complies with all necessary legal requirements. The POA should clearly state the agent's powers, responsibilities, and the circumstances under which the POA comes into effect. Regular reviews and updates are also recommended reflecting any changes in the principal's financial situation or preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Poder legal para asuntos financieros personales de Maryland - Maryland Statutory Personal Financial Power of Attorney

State:

Maryland

County:

Montgomery

Control #:

MD-P003C

Format:

Word

Instant download

Description

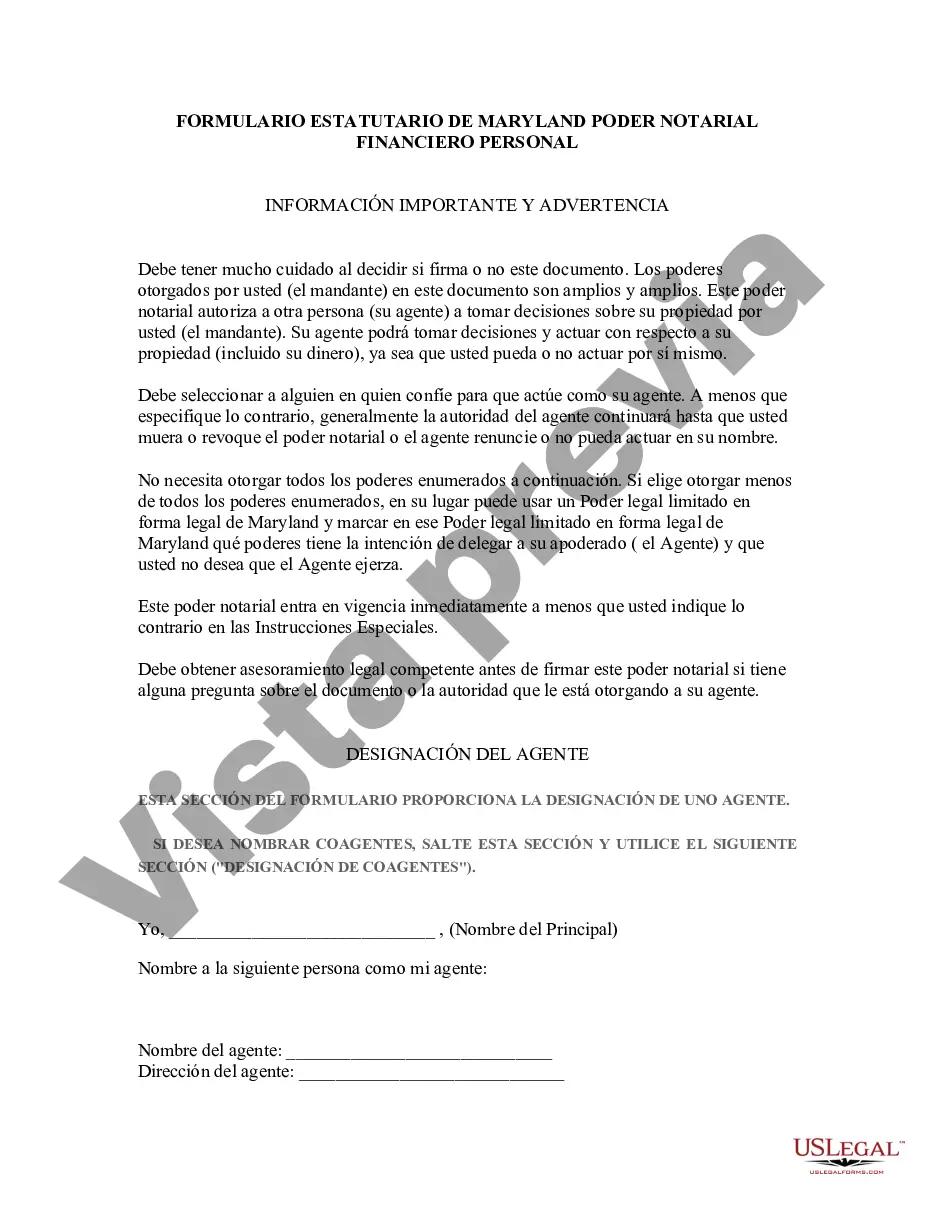

This is a statutory form as provided for in Maryland state statutes. This form allows you to appoint an agent to manage your property when you are unable to do so yourself. You need not give to your agent all of the authorities listed and may give the agent only those limited powers that you specifically indicate. This form gives your agent the right to make limited decisions for you. It may be used to take effect immediately or to begin or end when you specify. The form is presumed to be a durable power of attorney, so that it remains effect despite your incapacity, unless you state otherwise.

Montgomery Maryland Statutory Personal Financial Power of Attorney (POA) is a legal document that grants authority to an appointed individual, known as an agent or attorney-in-fact, to manage and make decisions regarding the financial matters of another person, referred to as the principal. This document complies with the specific laws and regulations governing power of attorney in Montgomery County, Maryland. The Montgomery Maryland Statutory Personal Financial Power of Attorney allows the appointed agent to act on behalf of the principal in various financial matters, including but not limited to banking, investment transactions, real estate transactions, tax matters, retirement plans, insurance policies, and more. The appointed agent holds the responsibility to act in the best interest of the principal, managing their finances diligently and ethically. It is important to note that there may indeed be different types of Montgomery Maryland Statutory Personal Financial Power of Attorney, which are tailored to meet specific requirements or situations. These variations may include: 1. Limited Power of Attorney: This type of POA grants the agent authority over specific financial matters or a designated period. It restricts the agent's powers and is commonly used when the principal is temporarily unable to manage their own financial affairs. 2. Durable Power of Attorney: This POA remains in effect even if the principal becomes mentally incapacitated or unable to make decisions for themselves. The agent continues to manage the principal's financial affairs as long as the principal is alive. 3. Springing Power of Attorney: A springing POA only becomes effective when specific conditions specified by the principal are met. For instance, it may require a doctor's certification declaring the principal's incapacity before the agent can exercise their powers. 4. General Power of Attorney: This type of POA grants broad authority to the agent, allowing them to handle a wide range of financial matters on behalf of the principal. The agent may have the power to buy/sell property, access bank accounts, manage investments, and more. When creating a Montgomery Maryland Statutory Personal Financial Power of Attorney, it is important to consult with an attorney or utilize a reliable legal service to ensure the document complies with all necessary legal requirements. The POA should clearly state the agent's powers, responsibilities, and the circumstances under which the POA comes into effect. Regular reviews and updates are also recommended reflecting any changes in the principal's financial situation or preferences.

Free preview

How to fill out Montgomery Poder Legal Para Asuntos Financieros Personales De Maryland?

If you’ve already utilized our service before, log in to your account and save the Montgomery Maryland Statutory Personal Financial Power of Attorney on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Montgomery Maryland Statutory Personal Financial Power of Attorney. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!