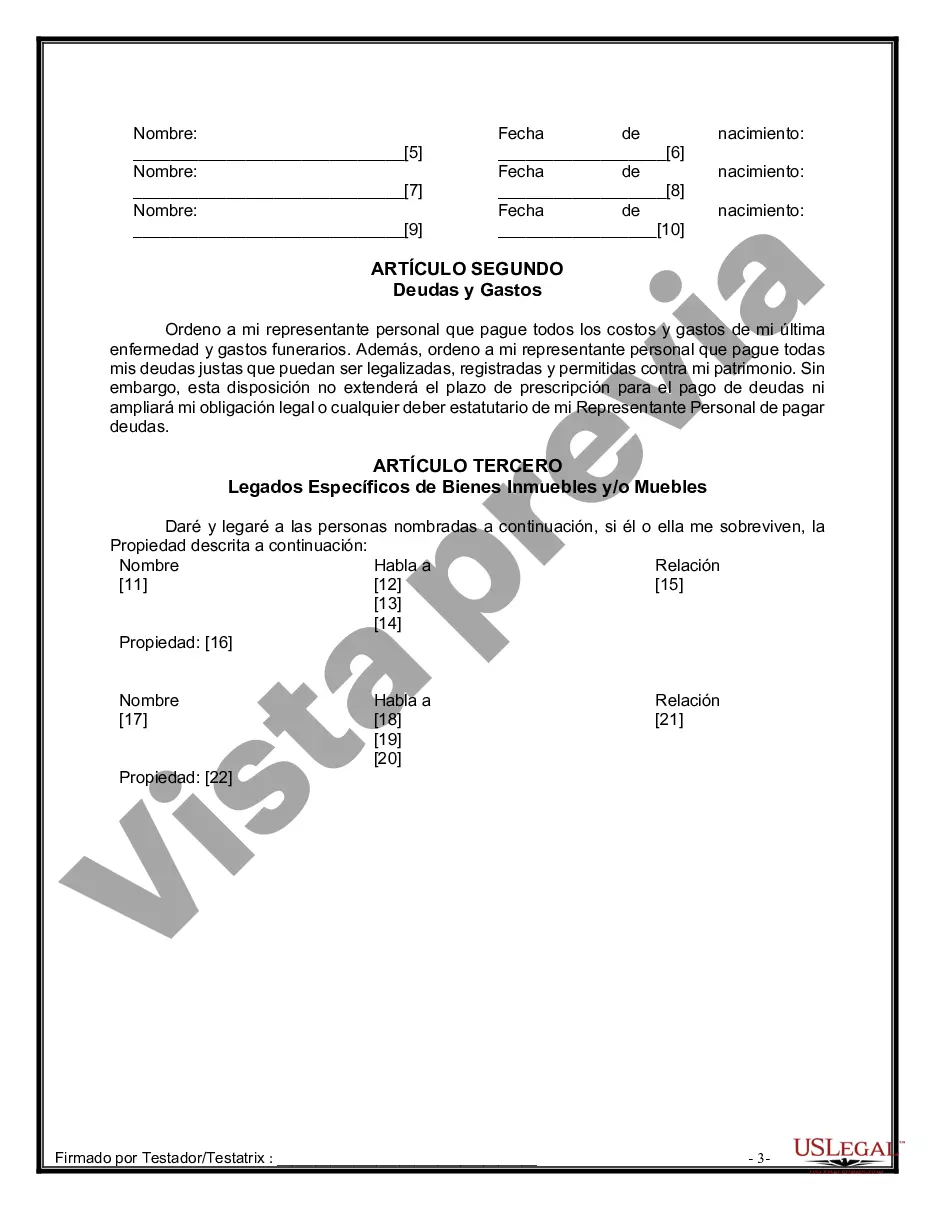

A Montgomery Maryland Legal Last Will and Testament for a Married Person with Minor Children from a Prior Marriage is a legal document that specifies how assets and estate will be distributed after the individual's death. This particular type of will is designed for individuals who are married but have children from a previous relationship. It ensures that the rights and interests of both the spouse and the children are protected. Key elements to include in the will: 1. Guardianship: The will allows the testator (the person creating the will) to nominate a guardian(s) for their minor children in the event of both parents' death. This decision is crucial as it ensures that the children will be cared for by a trusted individual of the testator's choosing. 2. Distribution of Assets: The will outlines how the testator's property, assets, and finances will be distributed among their surviving spouse and minor children. It may specify percentages or specific assets to be allocated to each beneficiary. 3. Trusts for Children: It is common for a Montgomery Maryland Legal Last Will and Testament to establish trusts for minor children. These trusts can ensure that the assets are appropriately managed until the children reach a certain age when they can take full control. 4. Protection of Surviving Spouse: Similar to other wills, this type of legal document ensures that the surviving spouse is adequately provided for. It may grant them a portion of the estate, such as a life estate in the marital home or specific assets, to guarantee their financial security. Different types of Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage: 1. Simple Will: This is a basic will that covers the essential aspects like guardianship and asset distribution. It may not involve complex trusts or provisions. 2. Testamentary Trust Will: This type of will creates a trust upon the testator's death, ensuring that the assets are managed by a designated trustee until the children reach a specified age or milestone. 3. Pour-Over Will: A pour-over will often is used in conjunction with a revocable living trust. It allows any remaining assets outside the trust to be transferred or "poured over" into the trust upon the testator's death. 4. Mutual Will: This will is typically created by married partners to ensure that their assets are distributed according to their joint wishes. It is legally binding and ensures that the surviving spouse receives certain assets, while the children from a previous marriage receive their rightful share. Creating a Montgomery Maryland Legal Last Will and Testament for a Married Person with Minor Children from a Prior Marriage is crucial to protect the interests and financial future of both the surviving spouse and the children. It is advisable to consult with an experienced estate planning attorney to ensure that all legal requirements and personal preferences are appropriately addressed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Última voluntad y testamento legal para persona casada con hijos menores de edad de un matrimonio anterior - Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage

Description

How to fill out Montgomery Maryland Última Voluntad Y Testamento Legal Para Persona Casada Con Hijos Menores De Edad De Un Matrimonio Anterior?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person without any law education to create such papers from scratch, mostly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service provides a massive collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage in minutes using our trusted service. If you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are new to our library, ensure that you follow these steps before obtaining the Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage:

- Ensure the form you have chosen is specific to your area since the rules of one state or area do not work for another state or area.

- Review the form and go through a quick description (if available) of cases the paper can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and look for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Log in to your account credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Montgomery Maryland Legal Last Will and Testament for Married person with Minor Children from Prior Marriage once the payment is through.

You’re good to go! Now you can go ahead and print out the form or fill it out online. Should you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.