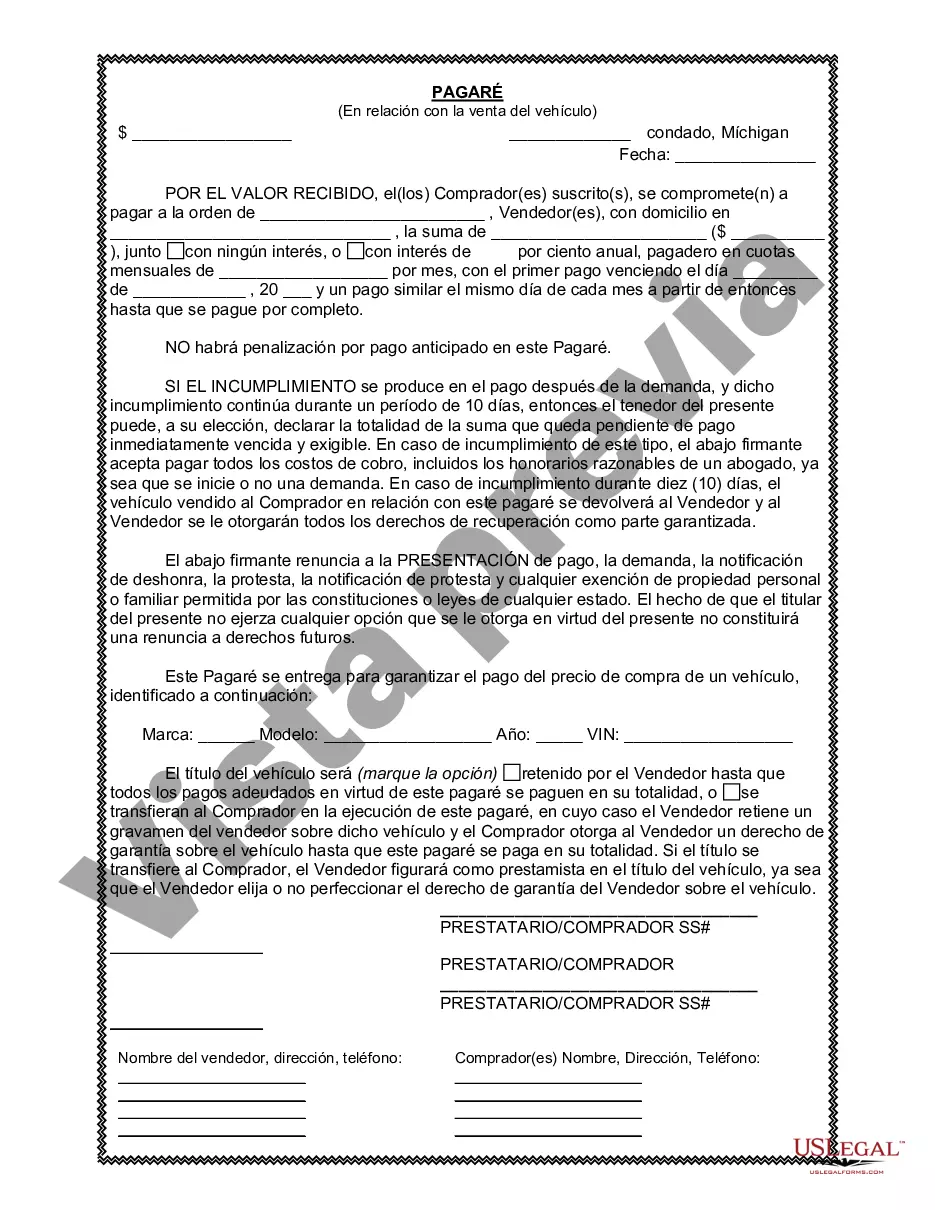

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

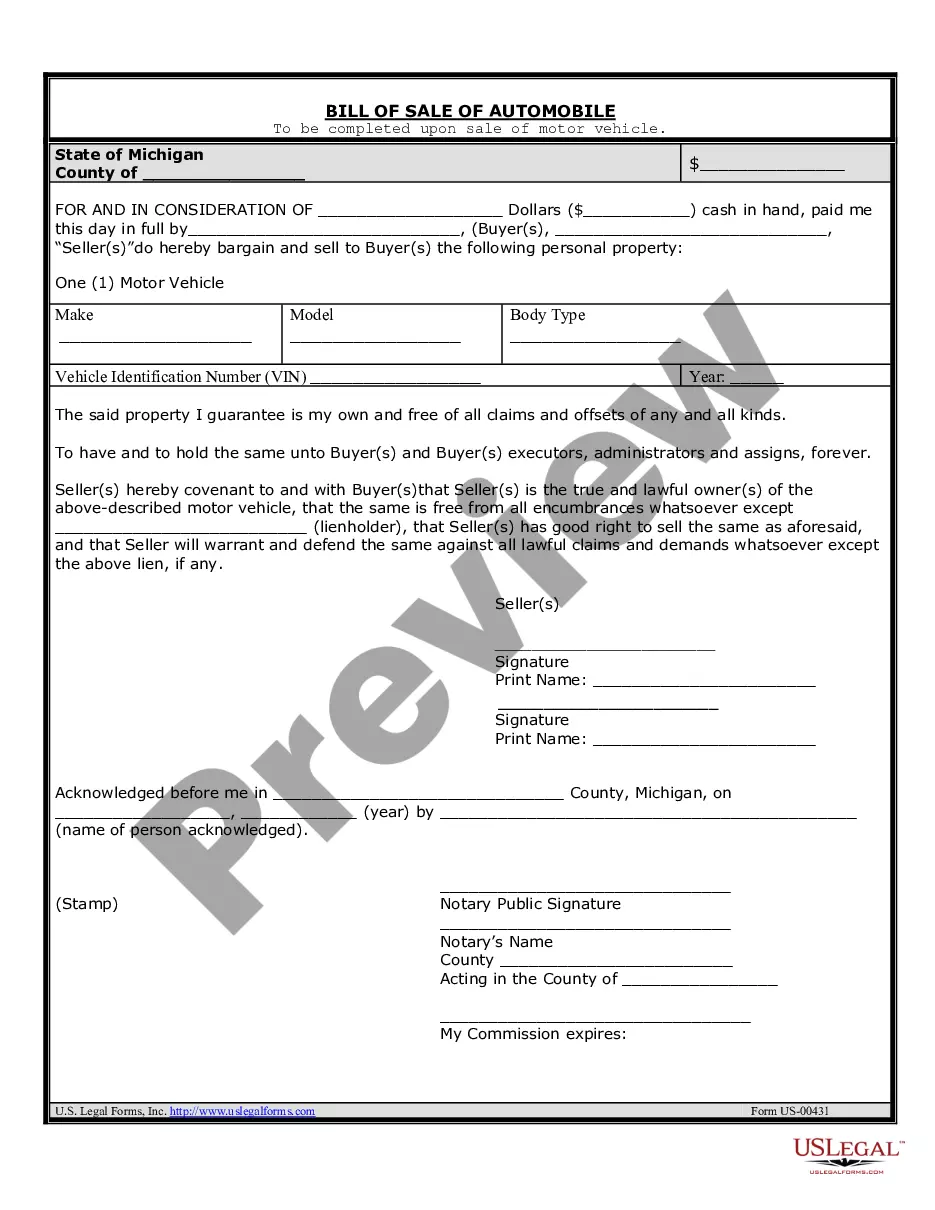

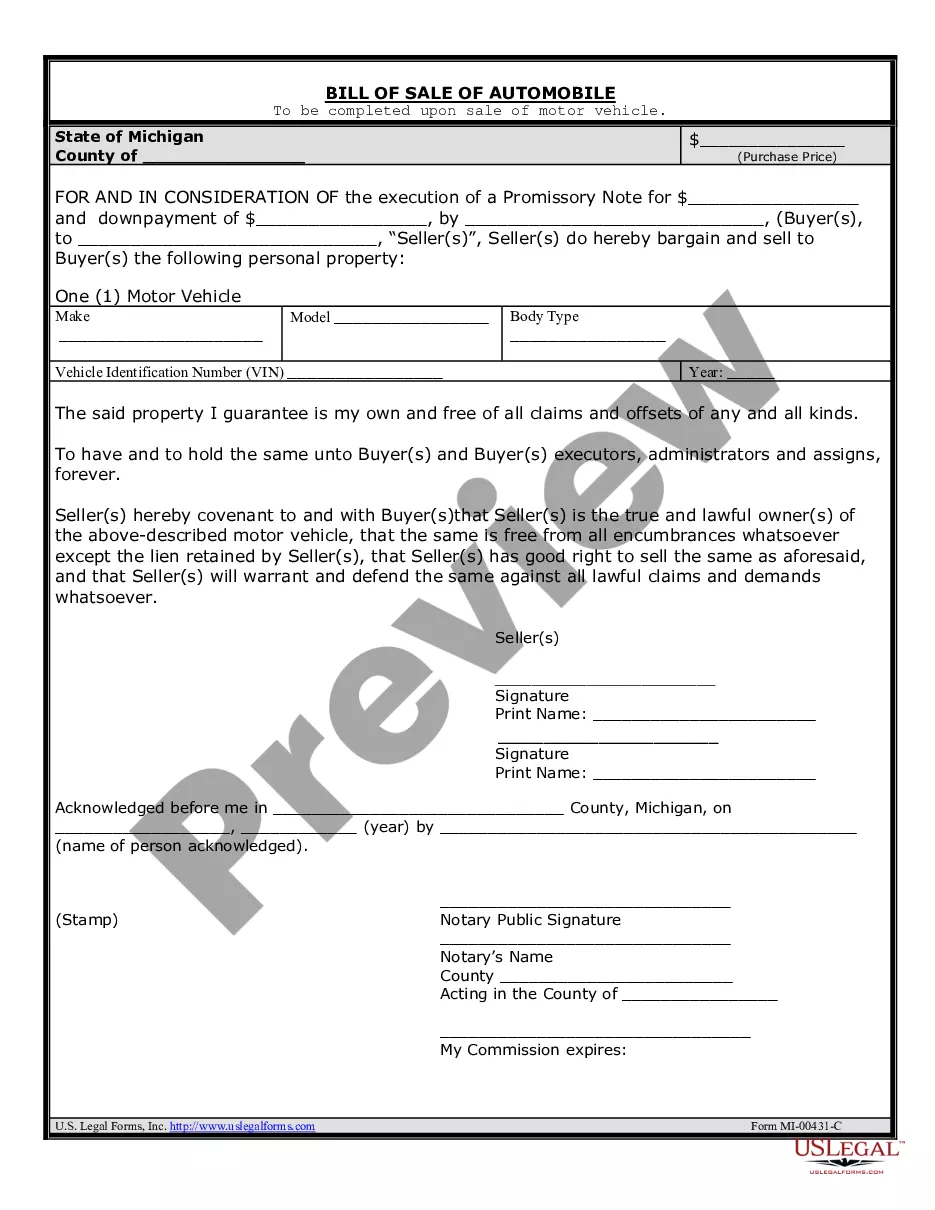

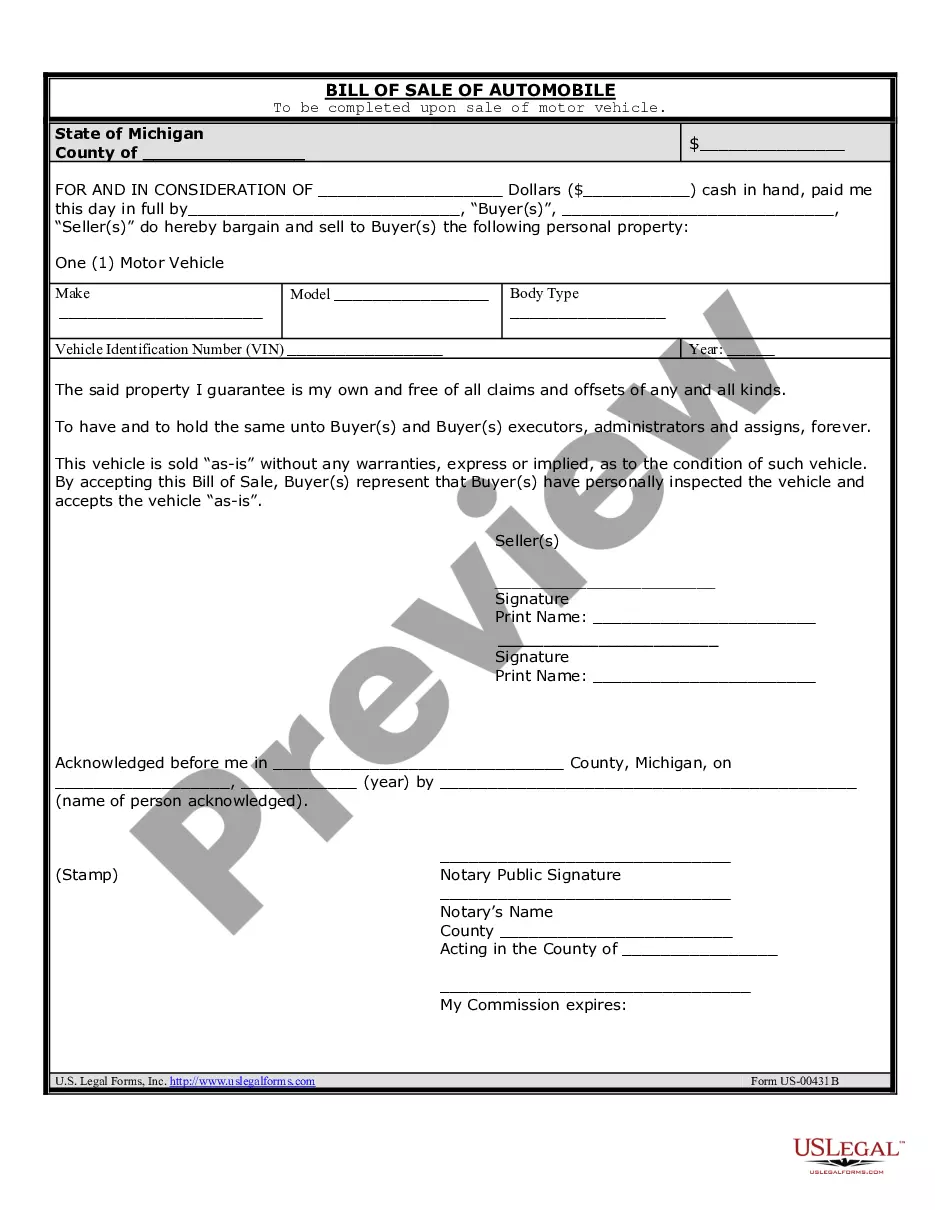

Lansing Michigan Promissory Note in Connection with Sale of Vehicle or Automobile A Lansing Michigan promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a buyer's promise to repay funds borrowed for the purchase of a vehicle. This promissory note serves as a written agreement between the buyer and the seller, ensuring transparency and clarity regarding the loan details. In this context, the Lansing Michigan Promissory Note contains essential information such as: 1. Parties involved: Clearly identifies the buyer and seller, including their legal names, addresses, and contact details. 2. Vehicle description: Provides detailed information about the automobile being sold, including the make, model, year, Vehicle Identification Number (VIN), and any relevant specifications. 3. Purchase price: Specifies the agreed-upon amount for the vehicle. 4. Terms and conditions: Outlines the repayment terms, including the interest rate (if applicable), repayment schedule, and the duration of the loan. 5. Payment method: Indicates how the buyer will make payments, whether through installments, direct deposit, or any other agreed-upon method. 6. Security interest: If applicable, includes information about any down payment, trade-in value, or collateral used to secure the loan. 7. Default and remedies: Clearly states the consequences of defaulting on the loan, such as late fees, repossession rights, or legal action. 8. Assignment and transfer: Specifies whether the promissory note can be assigned or transferred to another party. 9. Governing law: Indicates that the promissory note will be governed by the laws of Lansing, Michigan. It is important to note that there may be different types of promissory notes in connection with the sale of a vehicle or automobile in Lansing, Michigan: 1. Simple promissory note: This type of note outlines the basic terms and conditions of the loan, including the repayment schedule and interest rate (if applicable). 2. Secured promissory note: If the buyer provides collateral, such as another vehicle or a property, this note includes additional provisions regarding the security interest. 3. Installment promissory note: This note divides the loan amount into fixed installments, stating when and how much the buyer needs to pay at regular intervals. 4. Balloon promissory note: In this note, the buyer pays smaller installments over the tenure of the loan and must make a larger final payment, often called a balloon payment, to satisfy the remaining balance. By utilizing a Lansing Michigan Promissory Note in Connection with Sale of Vehicle or Automobile, both the buyer and the seller can have a comprehensive understanding of their rights and responsibilities, providing a secure financial transaction.Lansing Michigan Promissory Note in Connection with Sale of Vehicle or Automobile A Lansing Michigan promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a buyer's promise to repay funds borrowed for the purchase of a vehicle. This promissory note serves as a written agreement between the buyer and the seller, ensuring transparency and clarity regarding the loan details. In this context, the Lansing Michigan Promissory Note contains essential information such as: 1. Parties involved: Clearly identifies the buyer and seller, including their legal names, addresses, and contact details. 2. Vehicle description: Provides detailed information about the automobile being sold, including the make, model, year, Vehicle Identification Number (VIN), and any relevant specifications. 3. Purchase price: Specifies the agreed-upon amount for the vehicle. 4. Terms and conditions: Outlines the repayment terms, including the interest rate (if applicable), repayment schedule, and the duration of the loan. 5. Payment method: Indicates how the buyer will make payments, whether through installments, direct deposit, or any other agreed-upon method. 6. Security interest: If applicable, includes information about any down payment, trade-in value, or collateral used to secure the loan. 7. Default and remedies: Clearly states the consequences of defaulting on the loan, such as late fees, repossession rights, or legal action. 8. Assignment and transfer: Specifies whether the promissory note can be assigned or transferred to another party. 9. Governing law: Indicates that the promissory note will be governed by the laws of Lansing, Michigan. It is important to note that there may be different types of promissory notes in connection with the sale of a vehicle or automobile in Lansing, Michigan: 1. Simple promissory note: This type of note outlines the basic terms and conditions of the loan, including the repayment schedule and interest rate (if applicable). 2. Secured promissory note: If the buyer provides collateral, such as another vehicle or a property, this note includes additional provisions regarding the security interest. 3. Installment promissory note: This note divides the loan amount into fixed installments, stating when and how much the buyer needs to pay at regular intervals. 4. Balloon promissory note: In this note, the buyer pays smaller installments over the tenure of the loan and must make a larger final payment, often called a balloon payment, to satisfy the remaining balance. By utilizing a Lansing Michigan Promissory Note in Connection with Sale of Vehicle or Automobile, both the buyer and the seller can have a comprehensive understanding of their rights and responsibilities, providing a secure financial transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.