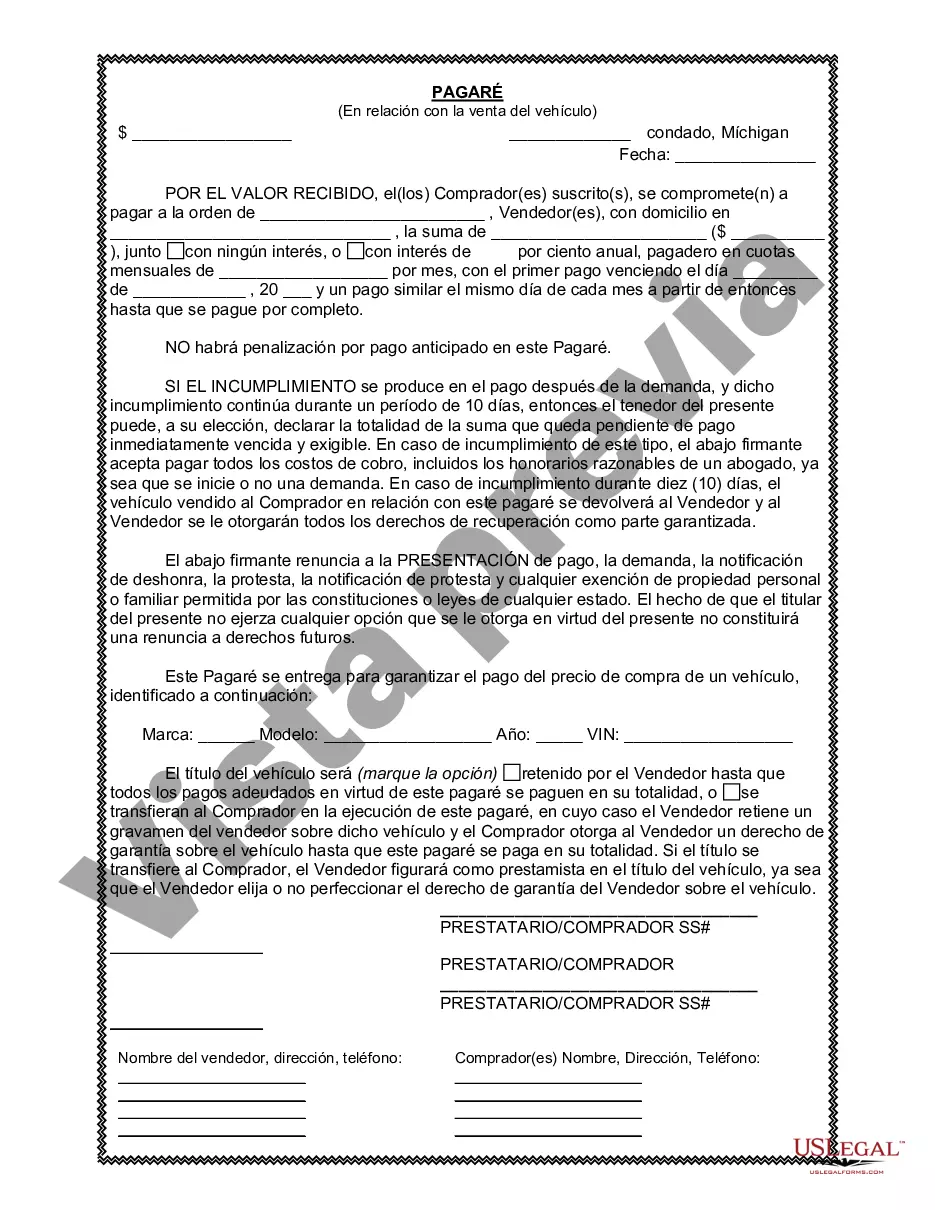

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

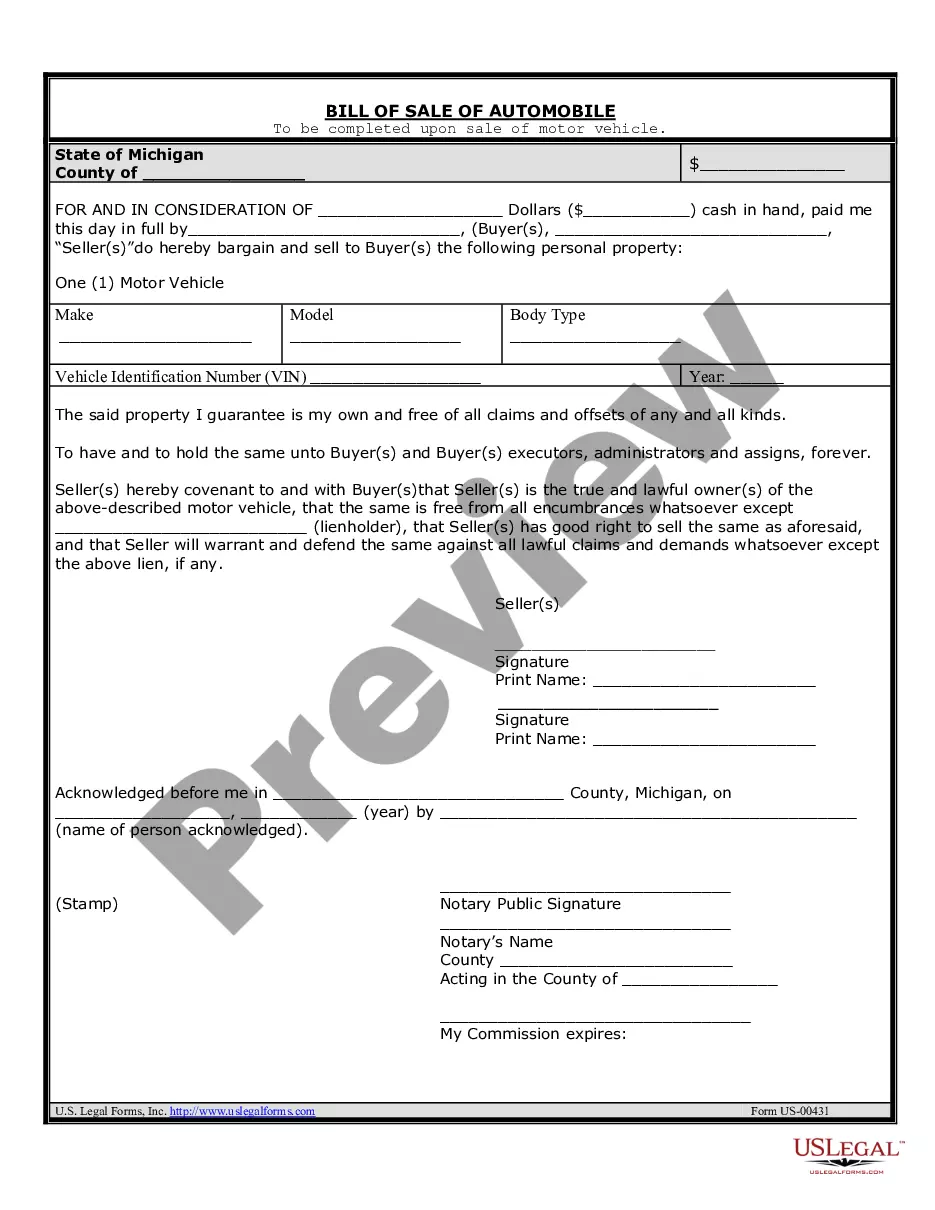

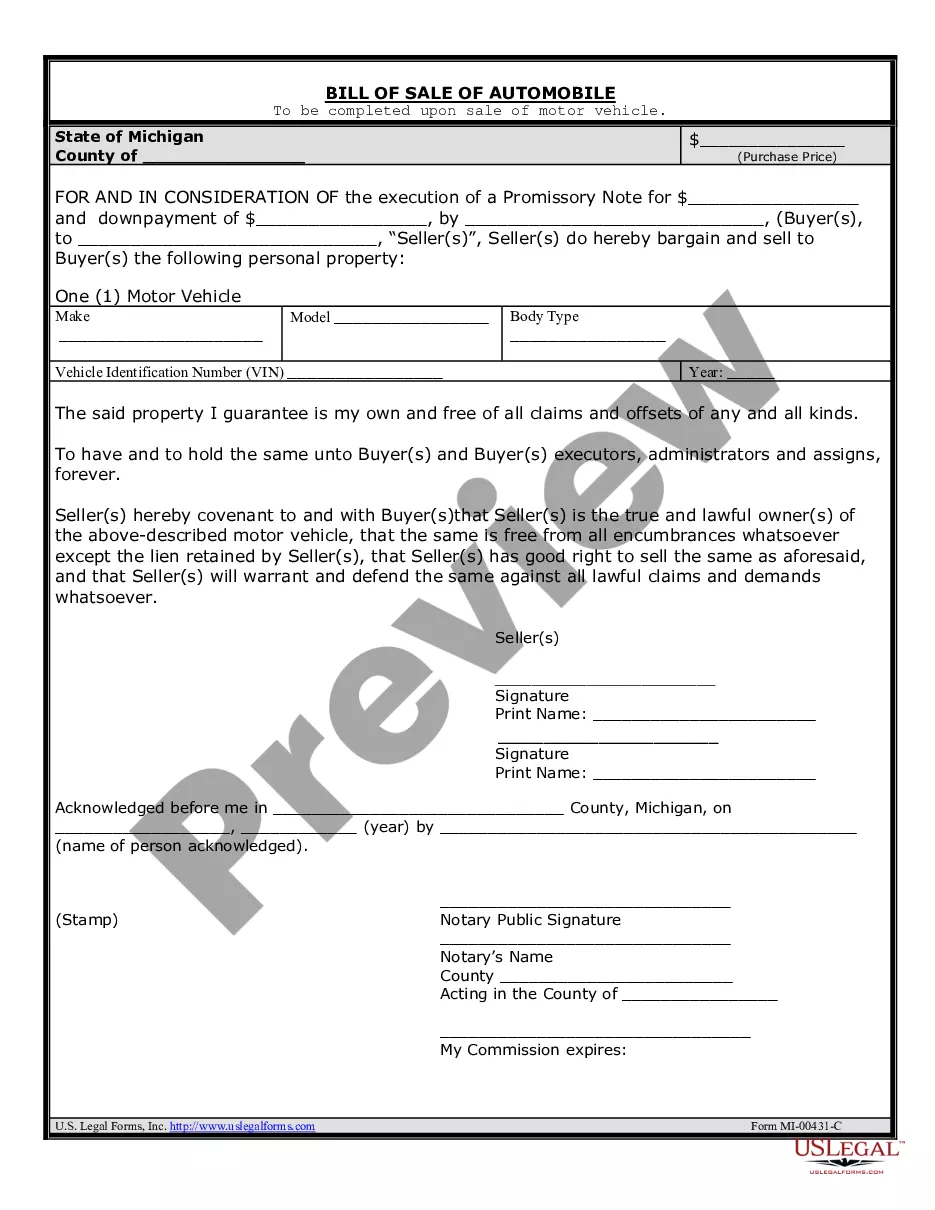

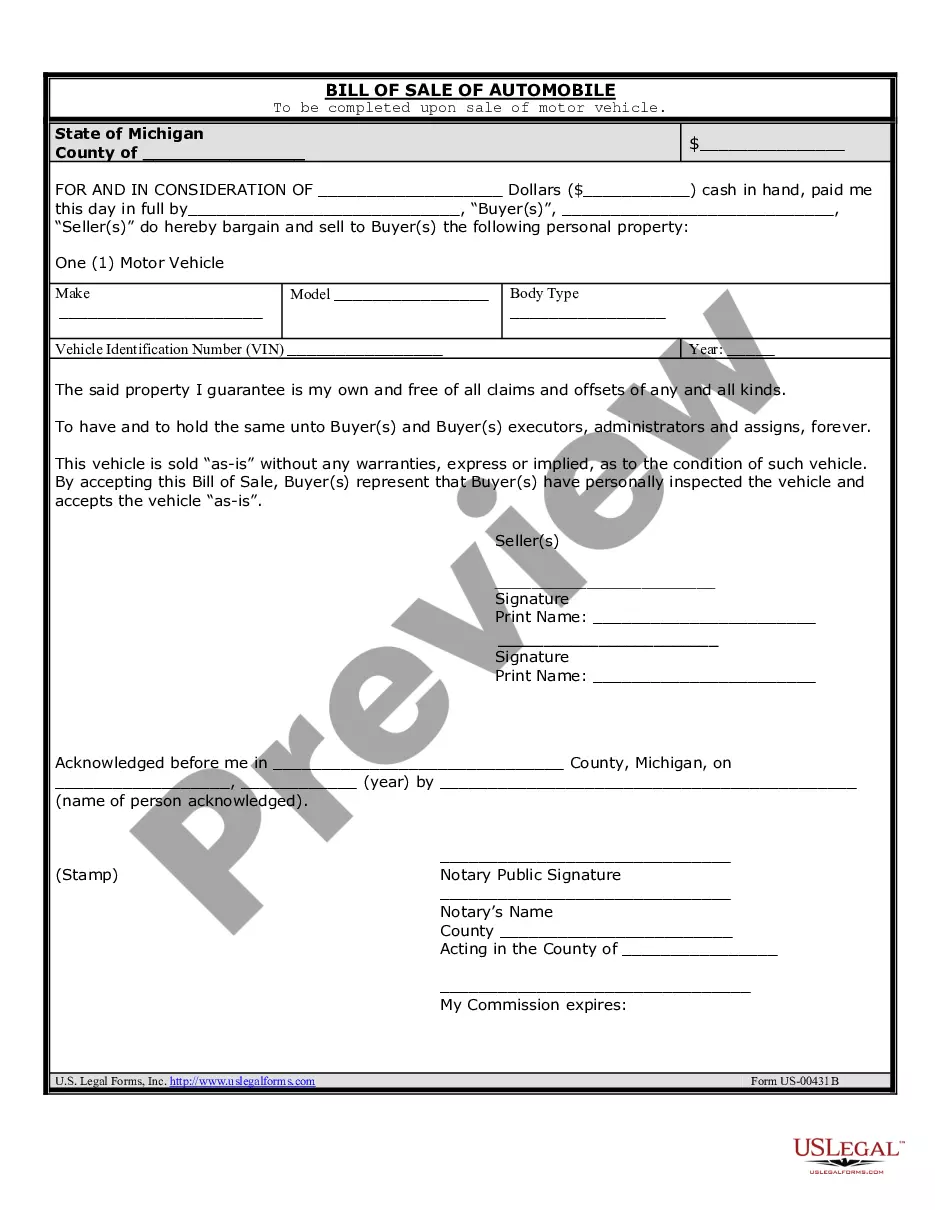

A Wayne Michigan promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This note serves as evidence that the buyer promises to repay the loan amount to the seller within a specified time period, along with any accrued interest. Keywords: Wayne Michigan, promissory note, sale of vehicle, sale of automobile, loan agreement, buyer, seller, terms and conditions, loan amount, specified time period, accrued interest. There are different types of Wayne Michigan Promissory Notes in connection with the sale of a vehicle or automobile, which include: 1. Installment Promissory Note: This type of promissory note allows the buyer to make regular payments towards the loan amount and any interest over a predetermined period. The note outlines the number, frequency, and amount of payments, as well as any late payment penalties. 2. Balloon Promissory Note: A balloon promissory note offers buyers the option to make smaller monthly payments throughout the loan term, with a large "balloon" payment due at the end of the term. This type of note is commonly used when the buyer expects to receive a significant sum of money in the future (e.g., tax refund, bonus) to cover the remaining loan balance. 3. Secured Promissory Note: A secured promissory note includes provisions that allow the seller to obtain a security interest in the vehicle being sold. In case the buyer defaults on the loan, the seller can repossess the vehicle as collateral. This type of note provides added protection for the seller in the event of non-payment. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. It is solely based on the buyer's promise to repay the loan. In situations where the buyer has a good credit history or a strong financial condition, the seller may agree to an unsecured promissory note. 5. Acceleration Clause: An acceleration clause can be included in any of the above types of promissory notes. It grants the seller the right to demand immediate repayment of the entire outstanding loan amount if the buyer breaches any of the terms and conditions specified in the note. It is important for both parties involved in the sale of a vehicle or automobile to carefully review and understand the terms of the promissory note before entering into the agreement. Seeking legal advice or assistance can help ensure that the promissory note accurately reflects the agreed-upon terms and protects the rights and interests of both the buyer and the seller.A Wayne Michigan promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This note serves as evidence that the buyer promises to repay the loan amount to the seller within a specified time period, along with any accrued interest. Keywords: Wayne Michigan, promissory note, sale of vehicle, sale of automobile, loan agreement, buyer, seller, terms and conditions, loan amount, specified time period, accrued interest. There are different types of Wayne Michigan Promissory Notes in connection with the sale of a vehicle or automobile, which include: 1. Installment Promissory Note: This type of promissory note allows the buyer to make regular payments towards the loan amount and any interest over a predetermined period. The note outlines the number, frequency, and amount of payments, as well as any late payment penalties. 2. Balloon Promissory Note: A balloon promissory note offers buyers the option to make smaller monthly payments throughout the loan term, with a large "balloon" payment due at the end of the term. This type of note is commonly used when the buyer expects to receive a significant sum of money in the future (e.g., tax refund, bonus) to cover the remaining loan balance. 3. Secured Promissory Note: A secured promissory note includes provisions that allow the seller to obtain a security interest in the vehicle being sold. In case the buyer defaults on the loan, the seller can repossess the vehicle as collateral. This type of note provides added protection for the seller in the event of non-payment. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. It is solely based on the buyer's promise to repay the loan. In situations where the buyer has a good credit history or a strong financial condition, the seller may agree to an unsecured promissory note. 5. Acceleration Clause: An acceleration clause can be included in any of the above types of promissory notes. It grants the seller the right to demand immediate repayment of the entire outstanding loan amount if the buyer breaches any of the terms and conditions specified in the note. It is important for both parties involved in the sale of a vehicle or automobile to carefully review and understand the terms of the promissory note before entering into the agreement. Seeking legal advice or assistance can help ensure that the promissory note accurately reflects the agreed-upon terms and protects the rights and interests of both the buyer and the seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.