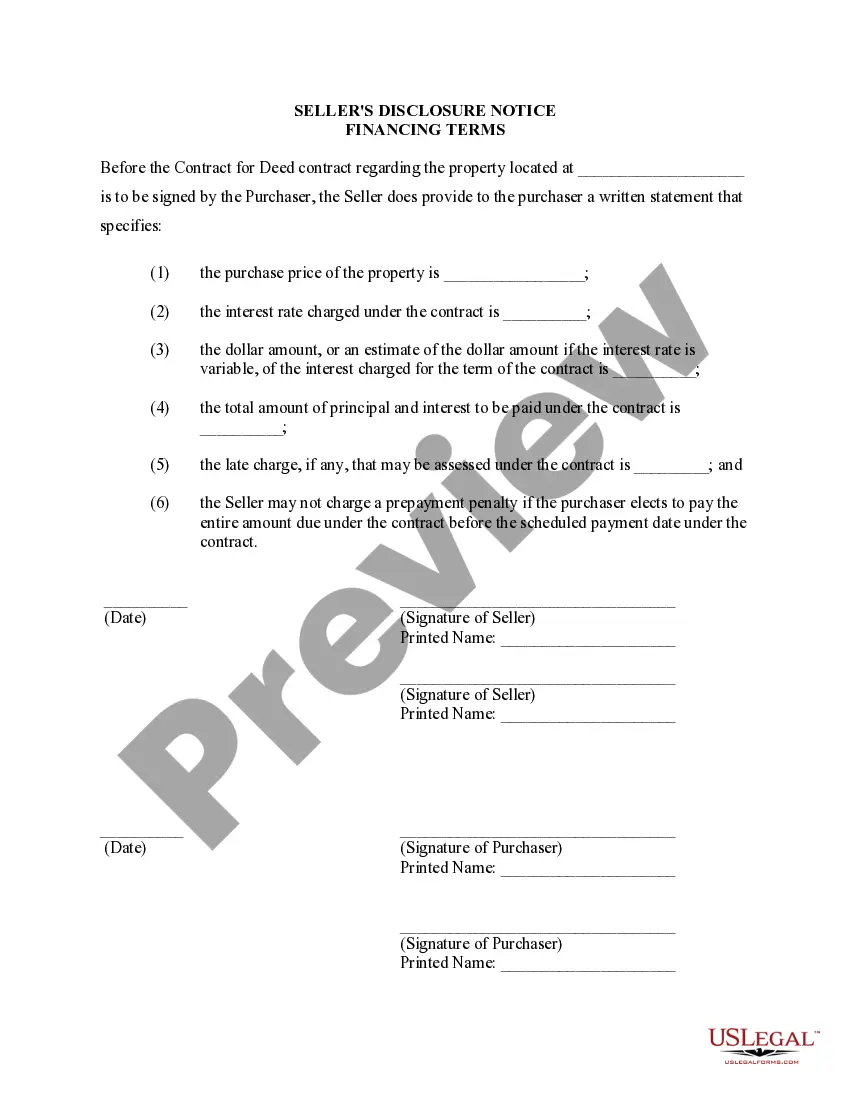

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Detroit Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as Land Contract, is a legal document that outlines the financing terms and conditions for the sale of a residential property in Detroit, Michigan. This disclosure is typically provided by the seller to the buyer prior to entering into a contract or agreement for deed. The purpose of this disclosure is to inform the buyer about the financing arrangement and any terms or conditions associated with the land contract. It is designed to ensure transparency and ensure that the buyer has a clear understanding of the financial obligations and rights involved in the transaction. The Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may vary depending on the specific terms negotiated between the buyer and seller. Therefore, there may not be different types of disclosures, but rather, variations based on individual agreements. However, some key elements commonly found in the disclosure may include: 1. Purchase price: The disclosure will specify the agreed-upon purchase price for the property. 2. Down payment: It will outline the amount of the down payment required by the buyer and any payment schedule associated with it. 3. Payment terms: This section will detail the installment payments or interest payments required by the buyer, along with the frequency and duration of these payments. 4. Interest rate: The disclosure will specify the interest rate charged on the outstanding balance, if applicable. 5. Balloon payment: If there is a balloon payment, which is a lump sum payment due at the end of the contract, this will be clearly outlined in the disclosure. 6. Escrow and taxes: The document may include information regarding the escrow account, if any, established for the payment of property taxes and insurance. 7. Condition of the property: While not directly related to the financing terms, the disclosure may also include information about the condition of the property, any known defects, or other material issues that the buyer should be aware of. It is important for both the buyer and seller to carefully review and understand the Seller's Disclosure of Financing Terms for Residential Property before signing the contract or agreement for deed. Additionally, seeking legal advice or consulting with a real estate professional is recommended to ensure full comprehension and protection of the rights and obligations as stipulated in the financing terms.The Detroit Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as Land Contract, is a legal document that outlines the financing terms and conditions for the sale of a residential property in Detroit, Michigan. This disclosure is typically provided by the seller to the buyer prior to entering into a contract or agreement for deed. The purpose of this disclosure is to inform the buyer about the financing arrangement and any terms or conditions associated with the land contract. It is designed to ensure transparency and ensure that the buyer has a clear understanding of the financial obligations and rights involved in the transaction. The Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may vary depending on the specific terms negotiated between the buyer and seller. Therefore, there may not be different types of disclosures, but rather, variations based on individual agreements. However, some key elements commonly found in the disclosure may include: 1. Purchase price: The disclosure will specify the agreed-upon purchase price for the property. 2. Down payment: It will outline the amount of the down payment required by the buyer and any payment schedule associated with it. 3. Payment terms: This section will detail the installment payments or interest payments required by the buyer, along with the frequency and duration of these payments. 4. Interest rate: The disclosure will specify the interest rate charged on the outstanding balance, if applicable. 5. Balloon payment: If there is a balloon payment, which is a lump sum payment due at the end of the contract, this will be clearly outlined in the disclosure. 6. Escrow and taxes: The document may include information regarding the escrow account, if any, established for the payment of property taxes and insurance. 7. Condition of the property: While not directly related to the financing terms, the disclosure may also include information about the condition of the property, any known defects, or other material issues that the buyer should be aware of. It is important for both the buyer and seller to carefully review and understand the Seller's Disclosure of Financing Terms for Residential Property before signing the contract or agreement for deed. Additionally, seeking legal advice or consulting with a real estate professional is recommended to ensure full comprehension and protection of the rights and obligations as stipulated in the financing terms.