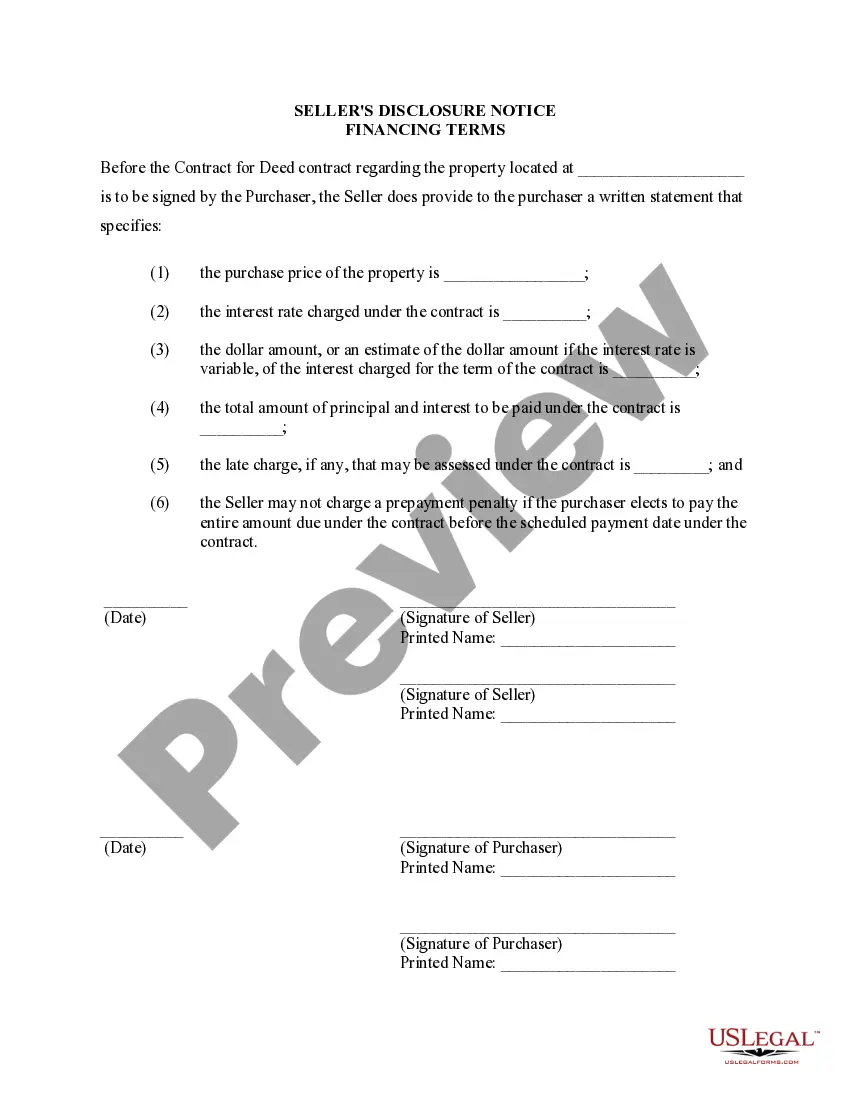

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Title: Understanding Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed (Land Contract) Description: Are you planning to sell or purchase a residential property in Sterling Heights, Michigan, through a land contract or agreement for deed? It's crucial to understand the Seller's Disclosure of Financing Terms to ensure a smooth transaction. This detailed description provides insights into the various types and essential aspects of the Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, commonly known as a Land Contract. 1. Sterling Heights Michigan Seller's Disclosure of Financing Terms: The Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property outlines the seller's obligations and the purchaser's rights regarding the property's financing arrangement. It serves as a legally binding document that provides transparency and clarity to both parties involved in the transaction. 2. Types of Sterling Heights Michigan Seller's Disclosure of Financing Terms: a. Full Disclosure: This type of disclosure provides a comprehensive overview of all financial terms involved in the land contract, including the interest rate, payment schedule, duration, penalties, and any potential adjustments. b. Partial Disclosure: This variant provides a limited overview of the financing terms, usually focusing on critical aspects like interest rates, payment schedule, and default provisions. However, it may exclude detailed information such as penalties or adjustments. 3. Essential Elements of the Seller's Disclosure of Financing Terms: a. Interest Rate: The disclosure should clearly state the initial interest rate applicable to the land contract. Additionally, it should specify whether the rate is fixed or adjustable and any conditions governing potential rate adjustments. b. Payment Schedule: The disclosure should outline the agreed-upon payment frequency (monthly, quarterly, etc.) and specify the due dates for each installment. It should also mention the consequences of late or missed payments. c. Loan Duration: Sellers must disclose the agreed-upon term length for the land contract, i.e., the duration within which the purchaser should complete the payments. d. Default Provisions: This section outlines the consequences and penalties in case of a default by the purchaser, such as late payment fees, interest rate increase, or possible legal actions. e. Disclosure of Rights and Responsibilities: The document should detail the rights and responsibilities of both parties, including the obligations for property maintenance, insurance, taxes, and potential restrictions, if any. f. Prepayment Clause: If applicable, the disclosure should specify whether prepayment of the land contract is allowed and whether any penalties or fees are associated with it. Remember, these are general guidelines for the Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. It's always recommended consulting with a qualified real estate attorney or professional for accurate and specific advice regarding your individual situation. By understanding and adhering to the Sterling Heights Michigan Seller's Disclosure of Financing Terms, both sellers and purchasers can ensure a transparent and successful land contract transaction.Title: Understanding Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed (Land Contract) Description: Are you planning to sell or purchase a residential property in Sterling Heights, Michigan, through a land contract or agreement for deed? It's crucial to understand the Seller's Disclosure of Financing Terms to ensure a smooth transaction. This detailed description provides insights into the various types and essential aspects of the Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, commonly known as a Land Contract. 1. Sterling Heights Michigan Seller's Disclosure of Financing Terms: The Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property outlines the seller's obligations and the purchaser's rights regarding the property's financing arrangement. It serves as a legally binding document that provides transparency and clarity to both parties involved in the transaction. 2. Types of Sterling Heights Michigan Seller's Disclosure of Financing Terms: a. Full Disclosure: This type of disclosure provides a comprehensive overview of all financial terms involved in the land contract, including the interest rate, payment schedule, duration, penalties, and any potential adjustments. b. Partial Disclosure: This variant provides a limited overview of the financing terms, usually focusing on critical aspects like interest rates, payment schedule, and default provisions. However, it may exclude detailed information such as penalties or adjustments. 3. Essential Elements of the Seller's Disclosure of Financing Terms: a. Interest Rate: The disclosure should clearly state the initial interest rate applicable to the land contract. Additionally, it should specify whether the rate is fixed or adjustable and any conditions governing potential rate adjustments. b. Payment Schedule: The disclosure should outline the agreed-upon payment frequency (monthly, quarterly, etc.) and specify the due dates for each installment. It should also mention the consequences of late or missed payments. c. Loan Duration: Sellers must disclose the agreed-upon term length for the land contract, i.e., the duration within which the purchaser should complete the payments. d. Default Provisions: This section outlines the consequences and penalties in case of a default by the purchaser, such as late payment fees, interest rate increase, or possible legal actions. e. Disclosure of Rights and Responsibilities: The document should detail the rights and responsibilities of both parties, including the obligations for property maintenance, insurance, taxes, and potential restrictions, if any. f. Prepayment Clause: If applicable, the disclosure should specify whether prepayment of the land contract is allowed and whether any penalties or fees are associated with it. Remember, these are general guidelines for the Sterling Heights Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. It's always recommended consulting with a qualified real estate attorney or professional for accurate and specific advice regarding your individual situation. By understanding and adhering to the Sterling Heights Michigan Seller's Disclosure of Financing Terms, both sellers and purchasers can ensure a transparent and successful land contract transaction.