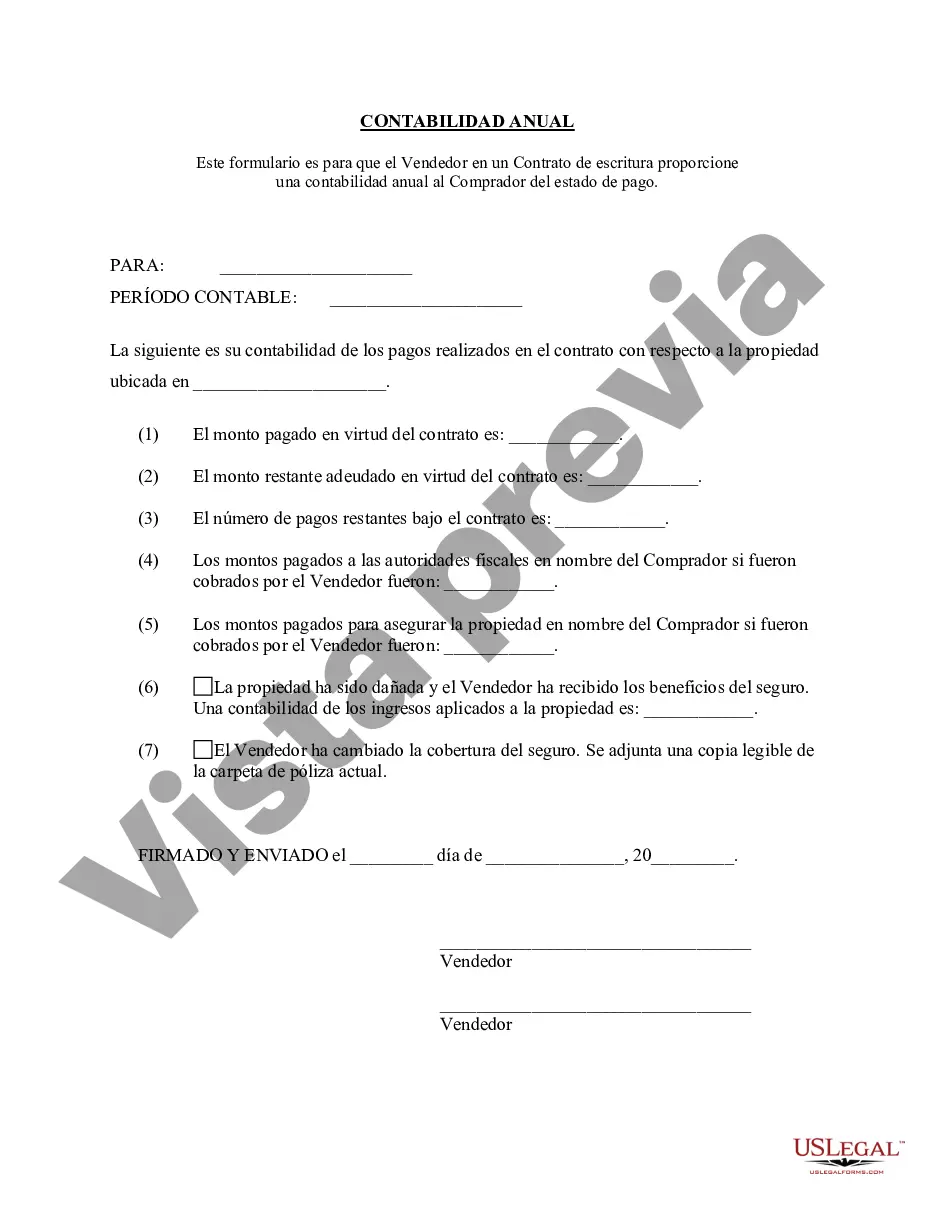

The Detroit Michigan Contract for Deed Seller's Annual Accounting Statement is a legally binding document provided by the seller of real estate through a contract for deed or land contract transaction. It serves as an annual summary report of the financial transactions and obligations pertaining to the contract for deed agreement. This accounting statement outlines the financial activities related to the contract for deed during a specific reporting period, which is usually a year. It provides detailed information regarding the payments received from the buyer, expenses incurred by the seller, and any outstanding balances or obligations. The statement typically includes the following relevant keywords: 1. Payments Received: This section outlines the total amount of money received from the buyer during the reporting period, disaggregated by principal payments, interest payments, and any additional charges or fees. 2. Expenses Incurred: This section details any expenses incurred by the seller in relation to the property covered under the contract for deed. Examples of such expenses may include property taxes, insurance premiums, maintenance costs, or repairs. 3. Outstanding Balances: This section presents the outstanding balance of the contract for deed, including the remaining principal balance, accrued interest, and any other charges or fees that may be due from the buyer. 4. Escrow Account: If an escrow account was established as part of the contract for deed agreement, this section provides information about the current balance in the account and any relevant transactions during the reporting period. 5. Insurance and Taxes: If the seller is responsible for ensuring property insurance or paying property taxes on behalf of the buyer, this section will include relevant information about the coverage, premiums paid, and any adjustments made during the reporting period. 6. Additional Obligations: This section lists any other obligations or terms specified in the contract for deed agreement, such as buyer's responsibilities for repairs, improvements, or property-related expenses. Different types of Detroit Michigan Contract for Deed Seller's Annual Accounting Statements may exist, depending on the specific requirements or variations in contractual agreements. However, the above-mentioned keywords generally apply to all types, emphasizing the need for comprehensive financial disclosure regarding the contract for deed transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Detroit Michigan Contrato de Escrituración Estado Contable Anual del Vendedor - Michigan Contract for Deed Seller's Annual Accounting Statement

State:

Michigan

City:

Detroit

Control #:

MI-00470-4

Format:

Word

Instant download

Description

Declaración por escrito notificando al Comprador el número y monto de los pagos realizados hacia el contrato por el capital e intereses de la escritura.

How to fill out Michigan Contrato De Escrituración Estado Contable Anual Del Vendedor?

In case you are seeking a legitimate form template, it’s unattainable to find a more user-friendly platform than the US Legal Forms site – one of the largest online libraries.

Through this library, you can access countless form examples for organizational and personal use categorized by categories and states, or key terms.

With our premium search functionality, locating the latest Detroit Michigan Contract for Deed Seller's Annual Accounting Statement is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the form. Choose the format and download it to your device.

- Furthermore, the accuracy of each document is confirmed by a group of skilled attorneys who routinely examine the templates on our site and refresh them in accordance with the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Detroit Michigan Contract for Deed Seller's Annual Accounting Statement is to Log In to your user profile and click the Download button.

- If you utilize US Legal Forms for the first time, simply adhere to the guidelines below.

- Ensure you have located the form you require. Review its description and use the Preview feature (if available) to inspect its content. If it isn’t adequate for your needs, utilize the Search field at the top of the page to find the necessary document.

- Confirm your selection. Click the Buy now button. Subsequently, select the desired subscription plan and provide details to create an account.

Form popularity

More info

In a traditional land contract, the seller keeps the legal title to the property until the land contract is fully paid off. Land contracts usually involve private sellers, not a bank or other financial institution.Thank you for taking the time to read the Region V 2020 HUD Annual Report. Annual Report on Form 10-K for the fiscal year ended December 31, 2020. Michigan. Forms for the state of Michigan. Account Title Amount. Exhibitors may wire transfer payment to: JP Morgan Chase Bank, NA, 10 S. 011401533 Tax Id. Single Report . , Chicago, IL 60603 USA. If you have a PayPal account, you may make your payment with that account.