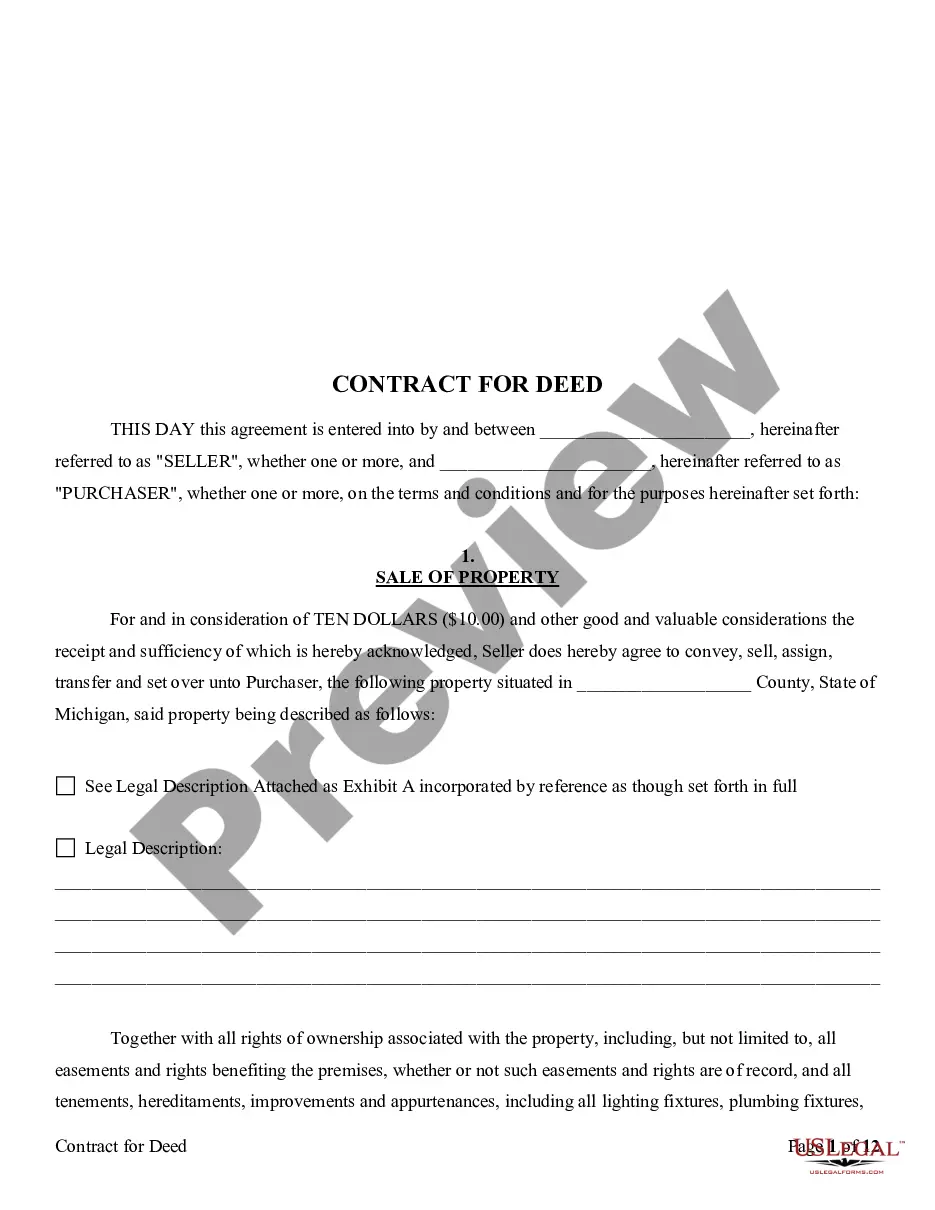

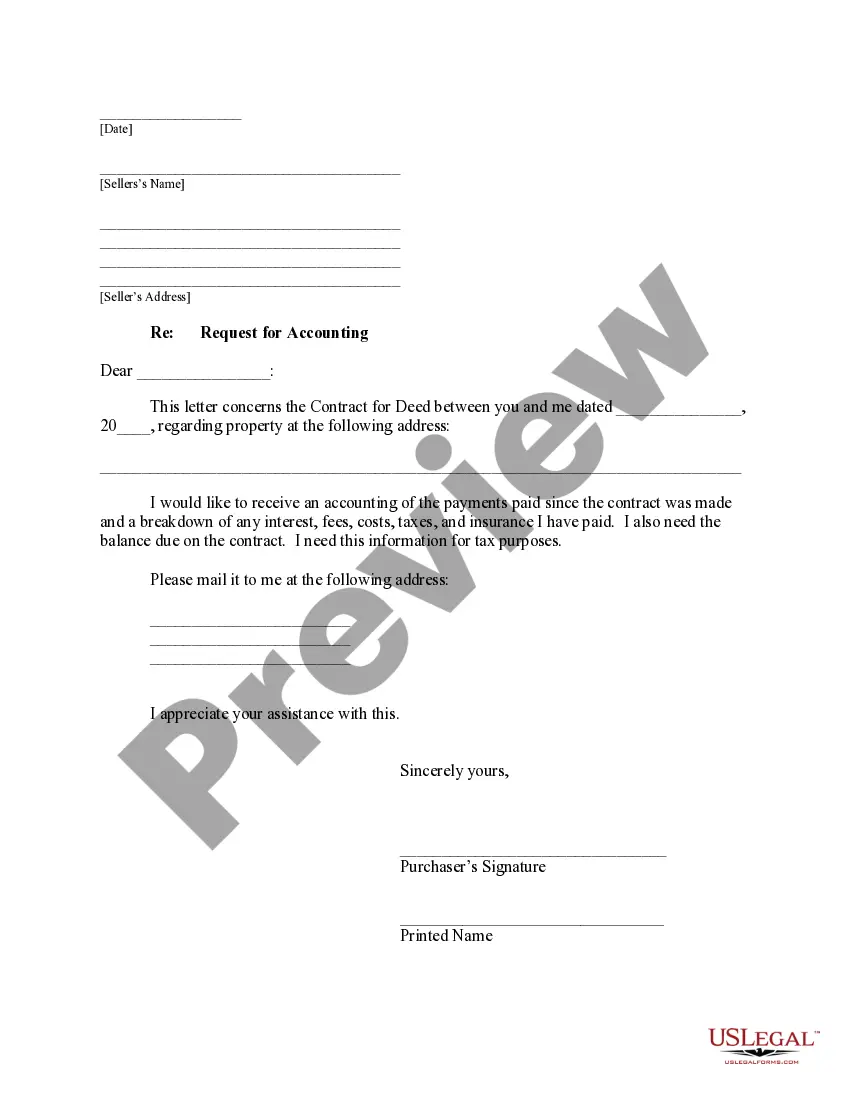

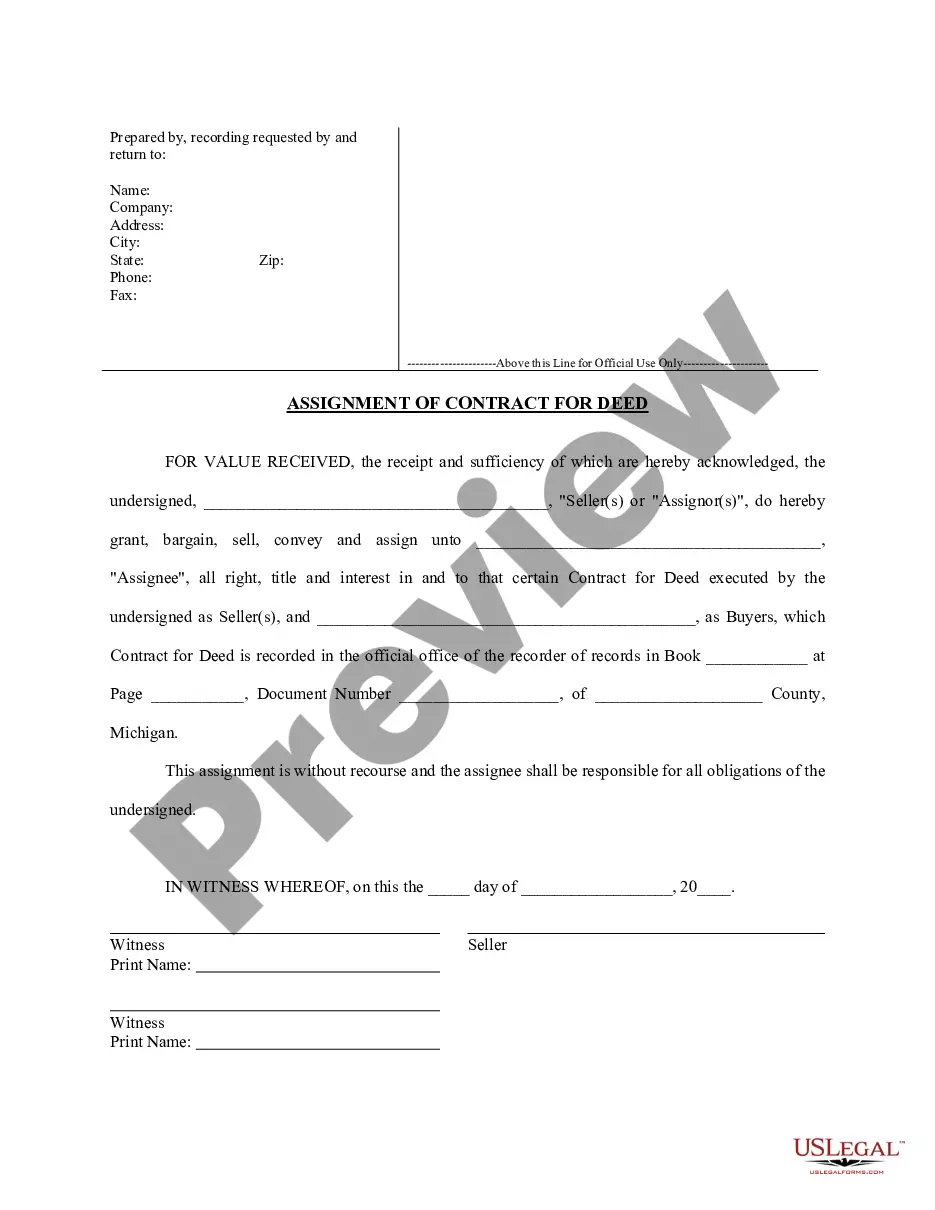

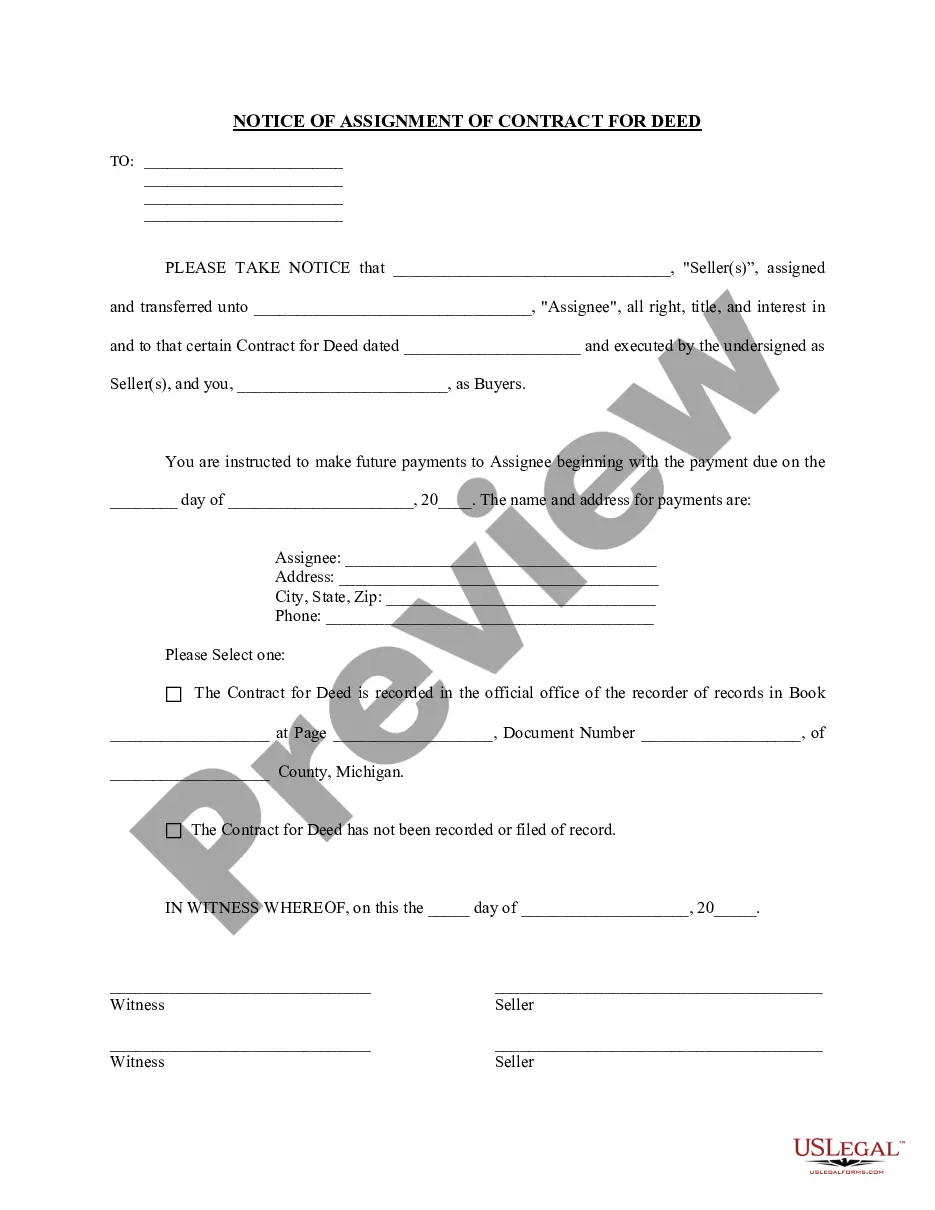

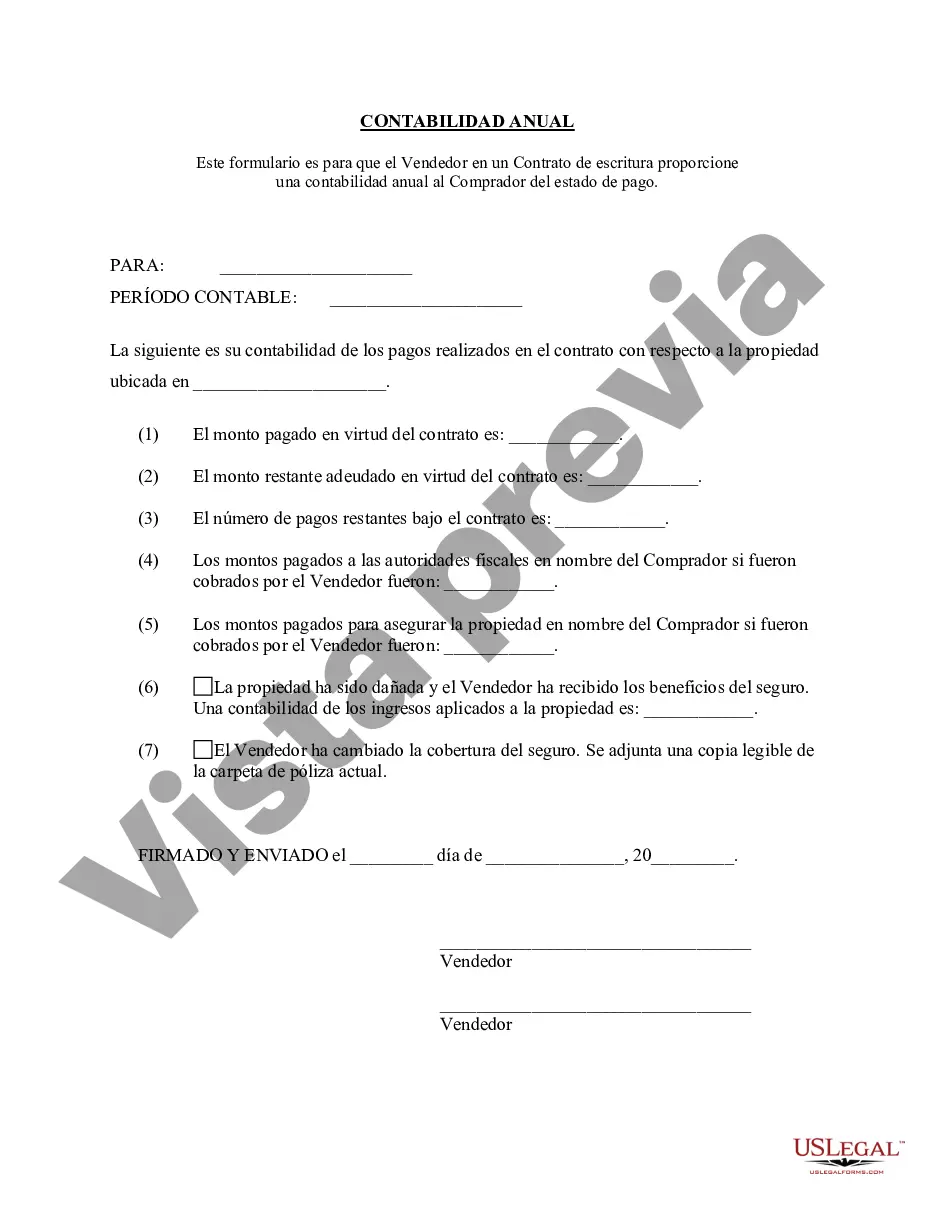

The Grand Rapids Michigan Contracts for Deed Seller's Annual Accounting Statement is a vital document in the real estate industry that provides a comprehensive financial overview of the contract for deed transaction for sellers in Grand Rapids, Michigan. This statement outlines the financial transactions and obligations between the seller and the buyer for the specified year, ensuring transparency and accountability for both parties involved. Keywords: Grand Rapids, Michigan, Contract for Deed, Seller's Annual Accounting Statement, real estate, financial overview, transactions, obligations, transparency, accountability Types of Grand Rapids Michigan Contracts for Deed Seller's Annual Accounting Statement: 1. Traditional Contract for Deed Seller's Annual Accounting Statement: This type of statement is used in standard contract for deed transactions in Grand Rapids, Michigan, where the seller retains legal ownership of the property until the buyer completes the agreed-upon payments. The annual accounting statement for this type of contract highlights the payment history, interest calculations, principal reductions, fees, and any other significant financial aspects of the transaction. 2. Amortized Contract for Deed Seller's Annual Accounting Statement: In an amortized contract for deed, the seller receives regular payments from the buyer, consisting of both principal and interest. The annual accounting statement for this type of contract includes detailed breakdowns of the amortization schedule, interest payments, principal reductions, and the remaining balance. 3. Balloon Contract for Deed Seller's Annual Accounting Statement: In a balloon contract for deed, the buyer makes regular payments for an agreed-upon period, with a large "balloon" payment due at the end. The annual accounting statement for this type of contract outlines the payment history, interest calculations, principal reductions, and provides a clear overview of the remaining balance and the upcoming balloon payment. 4. Prepaid Interest Contract for Deed Seller's Annual Accounting Statement: In some contract for deed agreements, the buyer may choose to prepay interest to reduce the overall interest amount over the course of the contract. The annual accounting statement for this type of contract includes details of the prepayment, along with regular payment breakdowns, principal reductions, and any additional financial obligations. It is important for sellers and buyers in Grand Rapids, Michigan to refer to the specific type of contract for deed when preparing or referencing an annual accounting statement. This ensures that the statement accurately reflects the financial aspects and obligations unique to their contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Grand Rapids Michigan Contrato de Escrituración Estado Contable Anual del Vendedor - Michigan Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Grand Rapids Michigan Contrato De Escrituración Estado Contable Anual Del Vendedor?

Take advantage of the US Legal Forms and have immediate access to any form template you want. Our useful platform with a large number of documents makes it simple to find and get almost any document sample you require. It is possible to save, complete, and certify the Grand Rapids Michigan Contract for Deed Seller's Annual Accounting Statement in just a couple of minutes instead of surfing the Net for several hours attempting to find the right template.

Using our library is a superb strategy to raise the safety of your form submissions. Our experienced legal professionals regularly review all the documents to make certain that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the Grand Rapids Michigan Contract for Deed Seller's Annual Accounting Statement? If you already have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Furthermore, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Open the page with the form you need. Make certain that it is the form you were seeking: check its headline and description, and use the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Export the document. Select the format to obtain the Grand Rapids Michigan Contract for Deed Seller's Annual Accounting Statement and change and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and trustworthy template libraries on the internet. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Grand Rapids Michigan Contract for Deed Seller's Annual Accounting Statement.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!