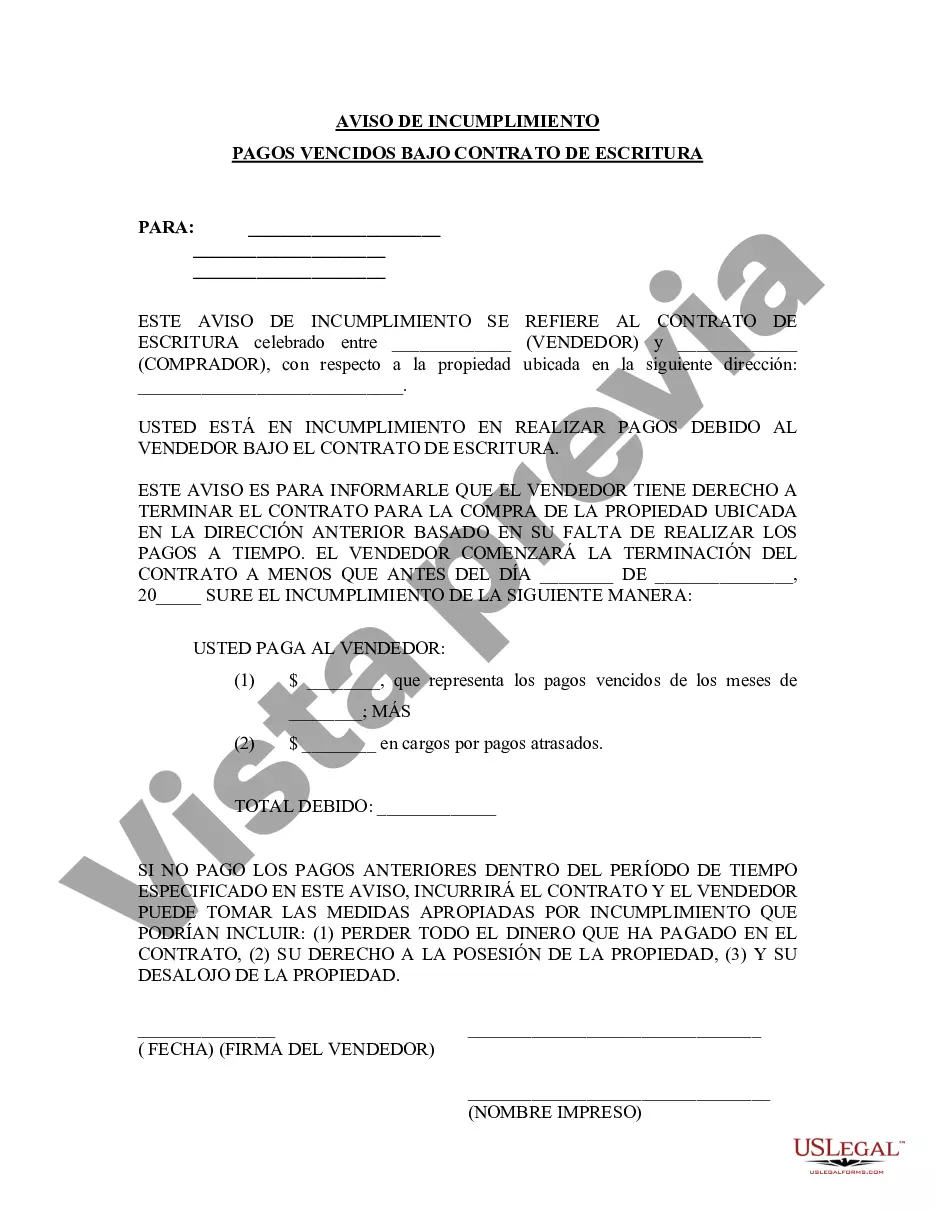

Title: Understanding the Grand Rapids Michigan Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Grand Rapids Michigan, Notice of Default, Past Due Payments, Contract for Deed Introduction: The Notice of Default is a crucial legal document in Grand Rapids, Michigan, that is used to inform parties involved in a Contract for Deed about the past due payments. When a buyer fails to make timely payments towards the agreed-upon installments, the seller or the designated party issues this notice. Understanding the implications of this document is critical for both parties involved. In Grand Rapids, Michigan, there are two main types of Notice of Default for Past Due Payments in connection with Contract for Deed — Statutory Notice of Default and Contractual Notice of Default. 1. Statutory Notice of Default: The Statutory Notice of Default is a standardized document used according to Michigan law to inform the buyer about their current default status. It specifies the amount due, the grace period provided, and the buyer's obligations to rectify the default. This notice is typically issued when a buyer misses consecutive payments or breaches certain contractual obligations, triggering the seller's right to accelerate the debt or initiate foreclosure proceedings. 2. Contractual Notice of Default: The Contractual Notice of Default, as the name suggests, is specific to the terms outlined in the Contract for Deed. Unlike the statutory notice, it is created to address individualized financing arrangements agreed upon between the buyer and seller. The contractual notice usually outlines the agreed-upon recourse options, grace periods, and remedies for default provided by the contract terms. This type of notice is customized to fit the specific provisions within the Contract for Deed. Key Components of the Notice of Default: a. Identification and Contact Information: The notice must clearly identify the parties involved, including names, addresses, and contact details of the buyer and seller or their designated agents or attorneys. b. Description of Default: The notice should state the specific default(s) that the buyer has allegedly committed, such as failure to make payments, breach of other contractual obligations, or violating terms outlined in the Contract for Deed. c. Amount Due: The notice should clearly indicate the total amount currently due on the Contract for Deed, including any late fees, penalties, or other charges incurred as a result of the default. d. Grace Period: The notice should specify the grace period provided, outlining the duration in which the buyer needs to cure the default or respond to the notice to avoid further legal actions. e. Cure Options and Remedies: The document should outline the remedies available to the seller, such as accepting payment to resolve the default, potential acceleration of the debt, initiation of foreclosure proceedings, or any negotiated alternatives agreed upon in the Contract for Deed. Conclusion: Understanding the Grand Rapids Michigan Notice of Default for Past Due Payments in connection with Contract for Deed is essential for both buyers and sellers involved in real estate transactions. Whether it is the standardized Statutory Notice of Default or the customized Contractual Notice of Default, addressing defaults promptly and adhering to the specified guidelines can help mitigate further legal complications. It is advisable for buyers to consult with legal professionals to fully comprehend their rights and responsibilities, while sellers should ensure their notices comply with the relevant legal provisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Grand Rapids Michigan Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Michigan Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Grand Rapids Michigan Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

If you are searching for a valid form, it’s difficult to find a more convenient platform than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can get a large number of document samples for organization and personal purposes by categories and regions, or keywords. With our advanced search option, finding the latest Grand Rapids Michigan Notice of Default for Past Due Payments in connection with Contract for Deed is as elementary as 1-2-3. Additionally, the relevance of each document is confirmed by a team of skilled lawyers that on a regular basis review the templates on our platform and revise them in accordance with the newest state and county demands.

If you already know about our system and have an account, all you should do to receive the Grand Rapids Michigan Notice of Default for Past Due Payments in connection with Contract for Deed is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the sample you require. Check its description and make use of the Preview option to check its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to find the needed record.

- Affirm your decision. Choose the Buy now option. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Indicate the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the received Grand Rapids Michigan Notice of Default for Past Due Payments in connection with Contract for Deed.

Every single template you save in your profile does not have an expiry date and is yours forever. You can easily access them via the My Forms menu, so if you need to have an additional duplicate for enhancing or printing, you can come back and download it once again whenever you want.

Take advantage of the US Legal Forms extensive collection to gain access to the Grand Rapids Michigan Notice of Default for Past Due Payments in connection with Contract for Deed you were seeking and a large number of other professional and state-specific samples on one platform!