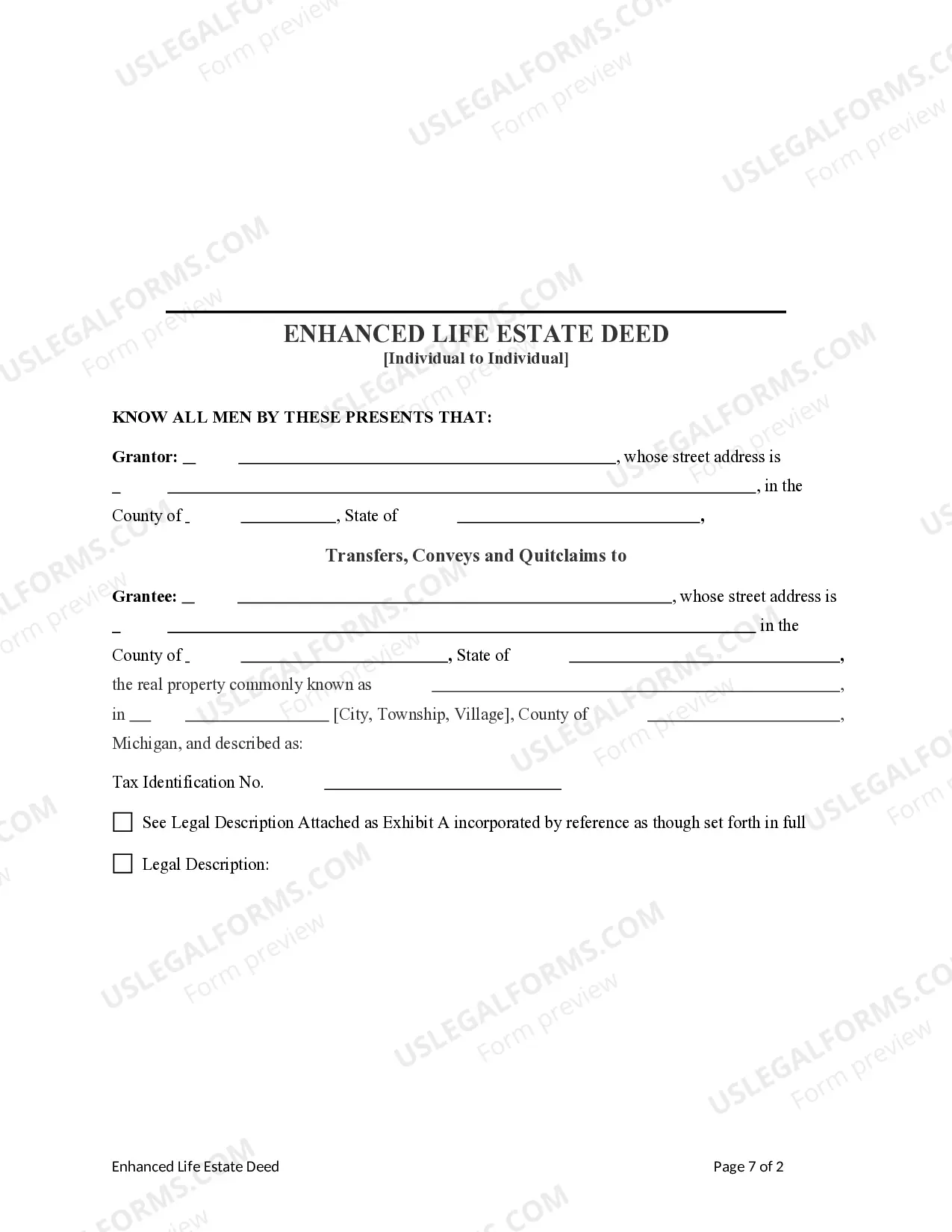

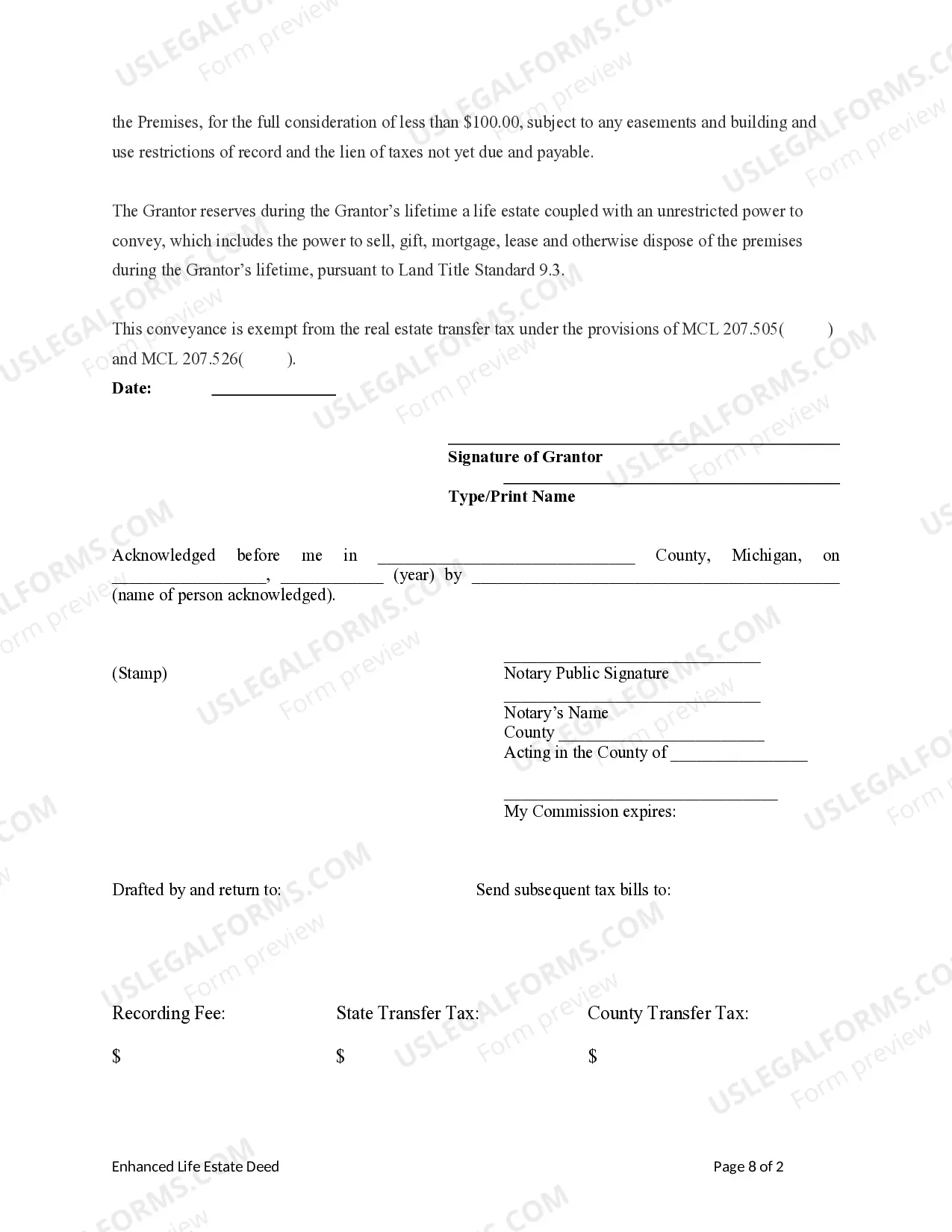

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

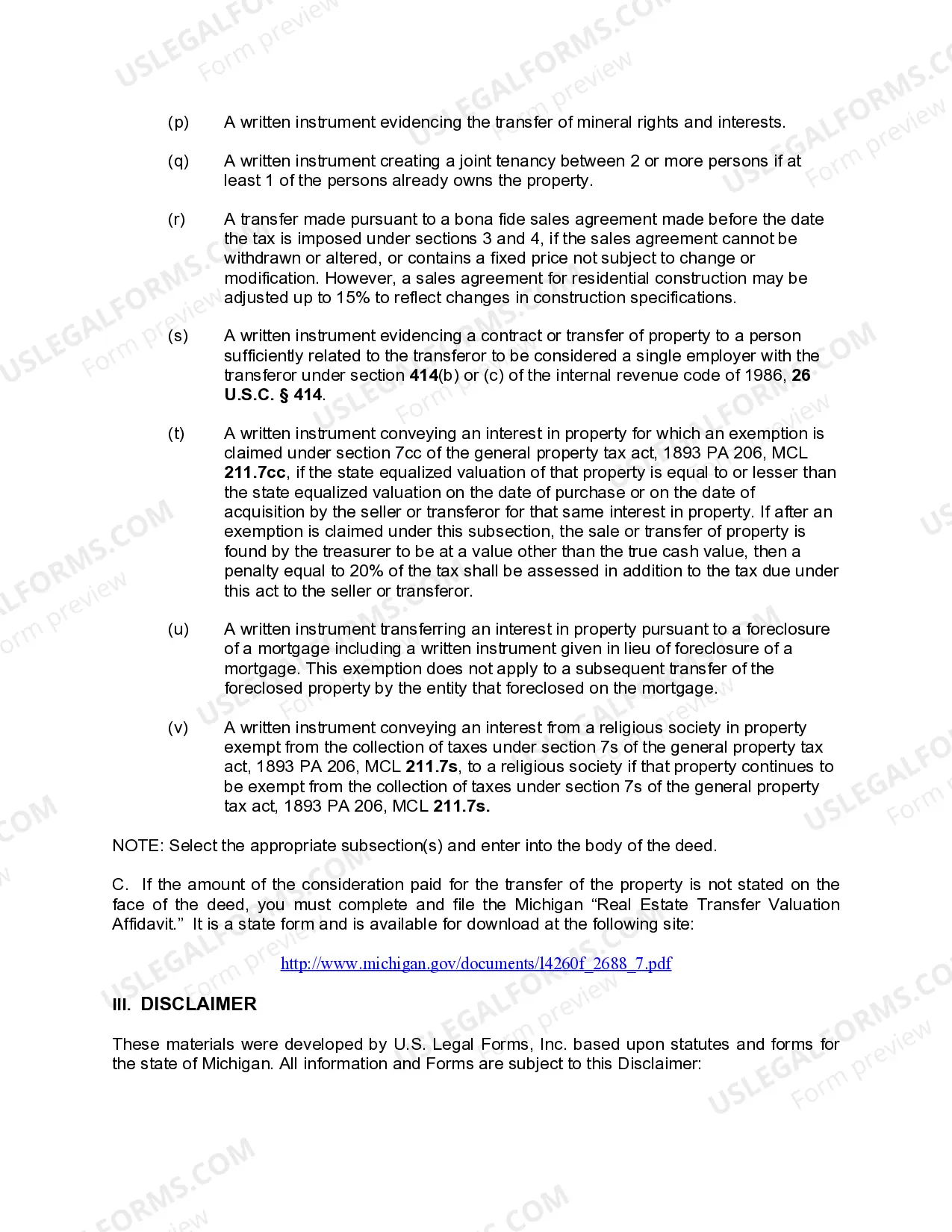

Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual is a legal document often utilized in estate planning to transfer property rights while retaining certain benefits. This type of deed allows property owners to retain control and possession of their property during their lifetime and, upon their death, automatically transfer ownership to a designated beneficiary or beneficiaries, without the need for probate. The Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed provides several key advantages for individuals wishing to create a seamless transfer of property. It allows the property owner, known as the Granter, to maintain complete control over the property, including the ability to sell, mortgage, or even revoke the deed if desired. This autonomy is a valuable feature, granting the granter the flexibility to make decisions regarding the property without involving the beneficiaries. Furthermore, the Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed protects the property from potentially being subject to Medicaid Estate Recovery. Under Medicaid rules, a person's property can be subject to recovery after their passing to repay any medical expenses covered by Medicaid during their lifetime. However, by utilizing this type of deed, the property is excluded from such recovery, ensuring that it can pass directly to the designated beneficiaries, preserving the property for future generations. There are two main types of Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed: 1. Enhanced Life Estate Deed: This type of deed grants the granter the ability to retain control and possession of the property during their lifetime while transferring the property to the beneficiary upon the granter's death. The beneficiary receives full ownership of the property upon the granter's passing without the need for probate, allowing for a smooth and efficient transfer of property rights. 2. Lady Bird Deed: The Lady Bird Deed is a specific type of Enhanced Life Estate Deed, named after Lady Bird Johnson, the former First Lady of the United States. This deed adds an extra layer of protection by allowing the granter to retain various rights, such as the ability to sell, mortgage, or even revoke the deed during their lifetime. This flexibility sets it apart from traditional life estate deeds, providing an increased level of control for the granter. Overall, the Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual offers individuals a comprehensive estate planning tool to transfer property while maintaining control, protecting it from Medicaid Estate Recovery, and avoiding the complexities of probate. Consultation with an experienced legal professional is recommended to ensure that all legal requirements and considerations are met when drafting and executing this type of deed.Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual is a legal document often utilized in estate planning to transfer property rights while retaining certain benefits. This type of deed allows property owners to retain control and possession of their property during their lifetime and, upon their death, automatically transfer ownership to a designated beneficiary or beneficiaries, without the need for probate. The Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed provides several key advantages for individuals wishing to create a seamless transfer of property. It allows the property owner, known as the Granter, to maintain complete control over the property, including the ability to sell, mortgage, or even revoke the deed if desired. This autonomy is a valuable feature, granting the granter the flexibility to make decisions regarding the property without involving the beneficiaries. Furthermore, the Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed protects the property from potentially being subject to Medicaid Estate Recovery. Under Medicaid rules, a person's property can be subject to recovery after their passing to repay any medical expenses covered by Medicaid during their lifetime. However, by utilizing this type of deed, the property is excluded from such recovery, ensuring that it can pass directly to the designated beneficiaries, preserving the property for future generations. There are two main types of Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed: 1. Enhanced Life Estate Deed: This type of deed grants the granter the ability to retain control and possession of the property during their lifetime while transferring the property to the beneficiary upon the granter's death. The beneficiary receives full ownership of the property upon the granter's passing without the need for probate, allowing for a smooth and efficient transfer of property rights. 2. Lady Bird Deed: The Lady Bird Deed is a specific type of Enhanced Life Estate Deed, named after Lady Bird Johnson, the former First Lady of the United States. This deed adds an extra layer of protection by allowing the granter to retain various rights, such as the ability to sell, mortgage, or even revoke the deed during their lifetime. This flexibility sets it apart from traditional life estate deeds, providing an increased level of control for the granter. Overall, the Sterling Heights Michigan Enhanced Life Estate or Lady Bird Deed — Individual to Individual offers individuals a comprehensive estate planning tool to transfer property while maintaining control, protecting it from Medicaid Estate Recovery, and avoiding the complexities of probate. Consultation with an experienced legal professional is recommended to ensure that all legal requirements and considerations are met when drafting and executing this type of deed.