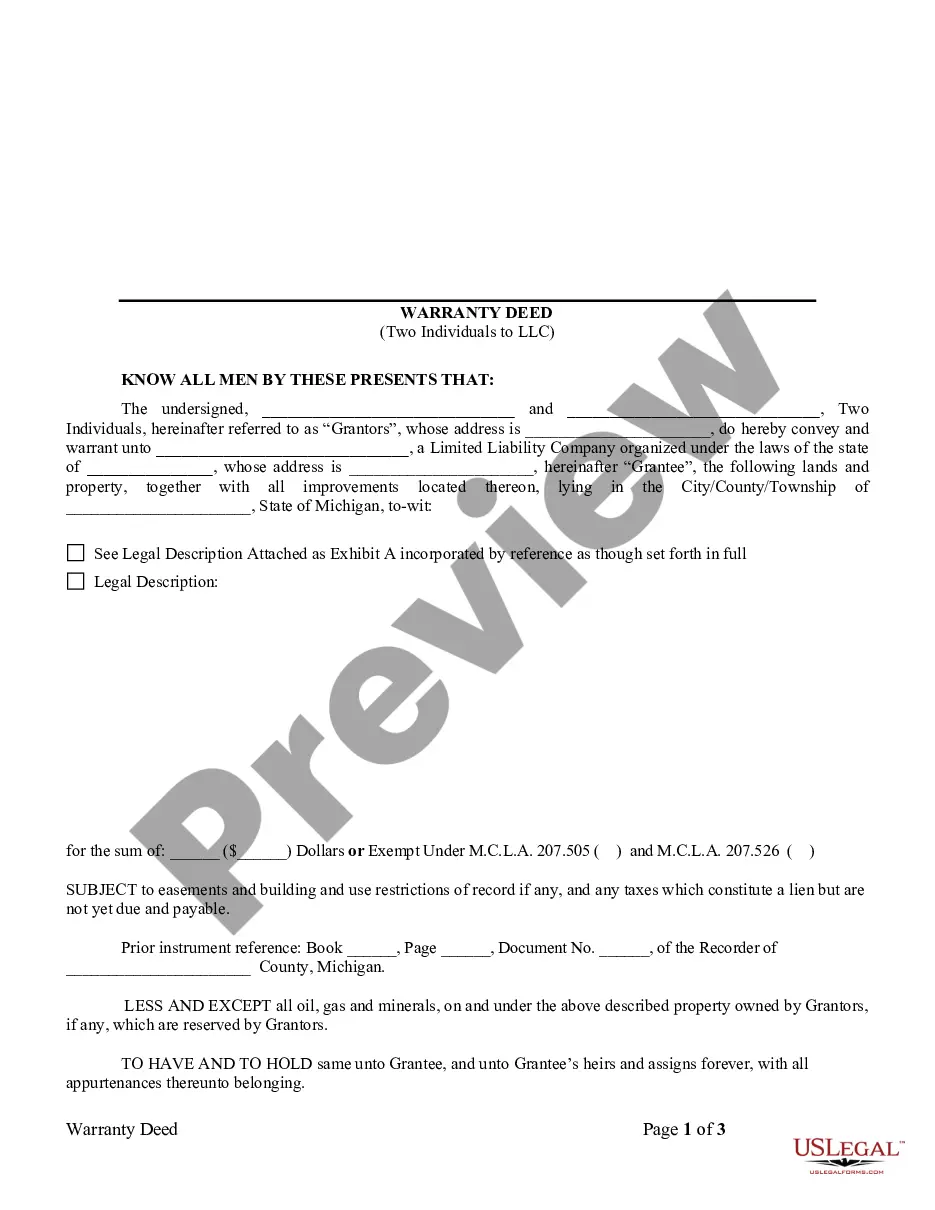

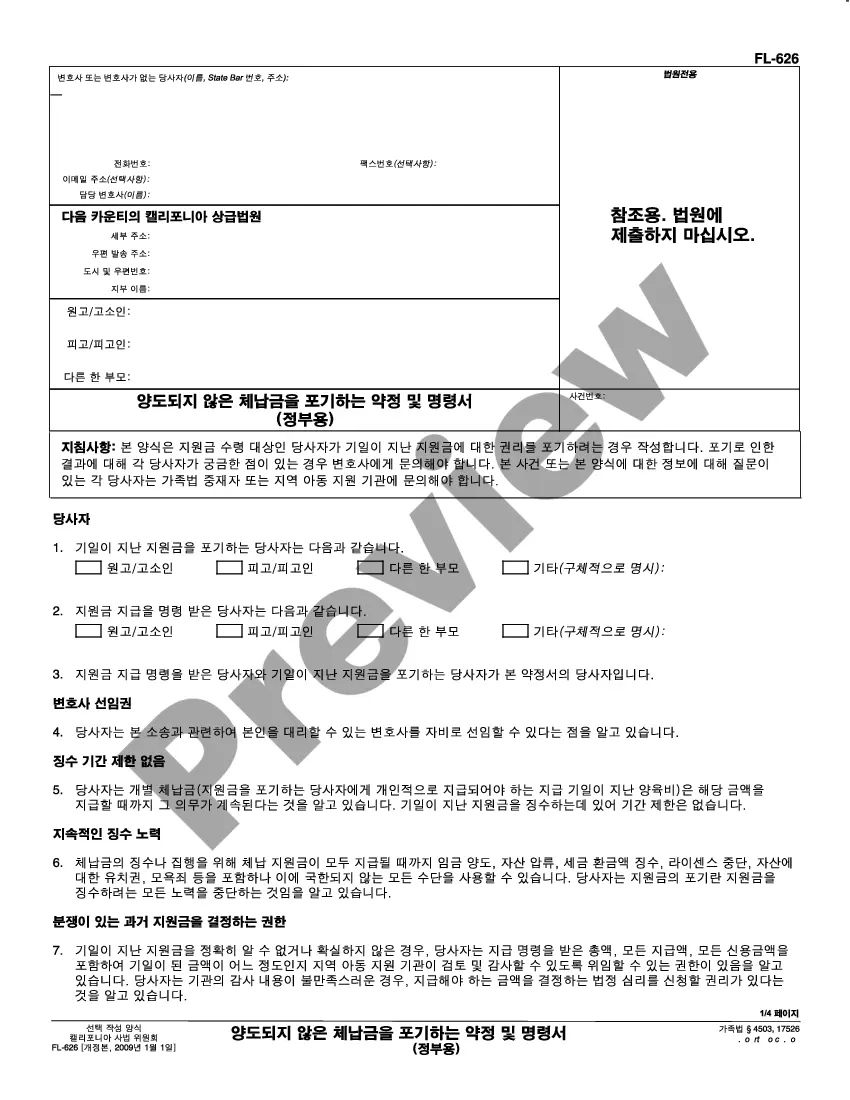

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Detroit Michigan Warranty Deed from two Individuals to LLC

Description

How to fill out Michigan Warranty Deed From Two Individuals To LLC?

If you are in pursuit of a pertinent document, it’s unattainable to select a more suitable service than the US Legal Forms site – one of the most extensive repositories online.

Here, you can locate a plethora of form templates for business and personal purposes organized by categories and regions, or specific keywords.

With our sophisticated search feature, obtaining the most recent Detroit Michigan Warranty Deed from two Individuals to LLC is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to conclude the registration process.

Obtain the document. Choose the file format and store it on your device. Edit the document. Fill out, modify, print, and sign the acquired Detroit Michigan Warranty Deed from two Individuals to LLC.

- Furthermore, the accuracy of each record is authenticated by a team of qualified lawyers who routinely evaluate the templates on our platform and update them according to the most current state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to acquire the Detroit Michigan Warranty Deed from two Individuals to LLC is to Log In to your profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure you have accessed the document you desire. Review its description and utilize the Preview option to inspect its content. If it doesn’t satisfy your requirements, employ the Search field at the top of the screen to locate the necessary document.

- Validate your choice. Click the Buy now button. Subsequently, select your preferred subscription plan and enter your details to create an account.

Form popularity

FAQ

To transfer a joint ownership property to sole ownership, it is essential for all parties to sign the transfer deed and register it with the Land Registry. People who are interested in becoming the sole owner of the property can buy out the share of their ex-spouse or siblings, or reach a different type of agreement.

Steps to Create a Michigan Rental Property LLC Name Your Michigan LLC. Appoint a Registered Agent. File Michigan Articles of Organization. Create an Operating Agreement. Apply for an Employment Identification Number (EIN) Transfer Title of the Property to LLC. Talk to Lenders and Tenants.

A general warranty deed is used to transfer real property from one person to another. This type of deed offers the greatest protection for the buyer and has specific requirements for what must be included in the document.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law.

12. Who benefits the most from recording a warranty deed? D. Explanation: The grantee is the one who has acquired an interest in the land, and she is the one who benefits the most from recording the deed to provide constructive (legal) notice of that interest.

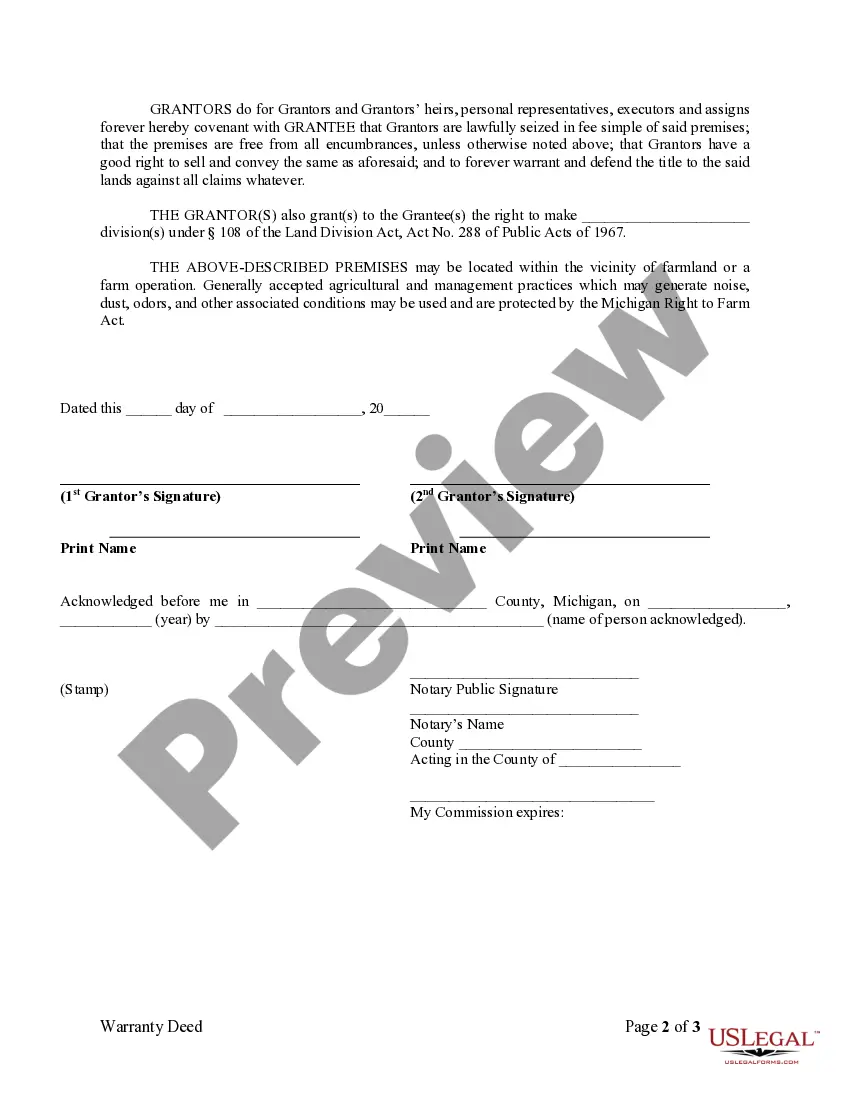

MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.