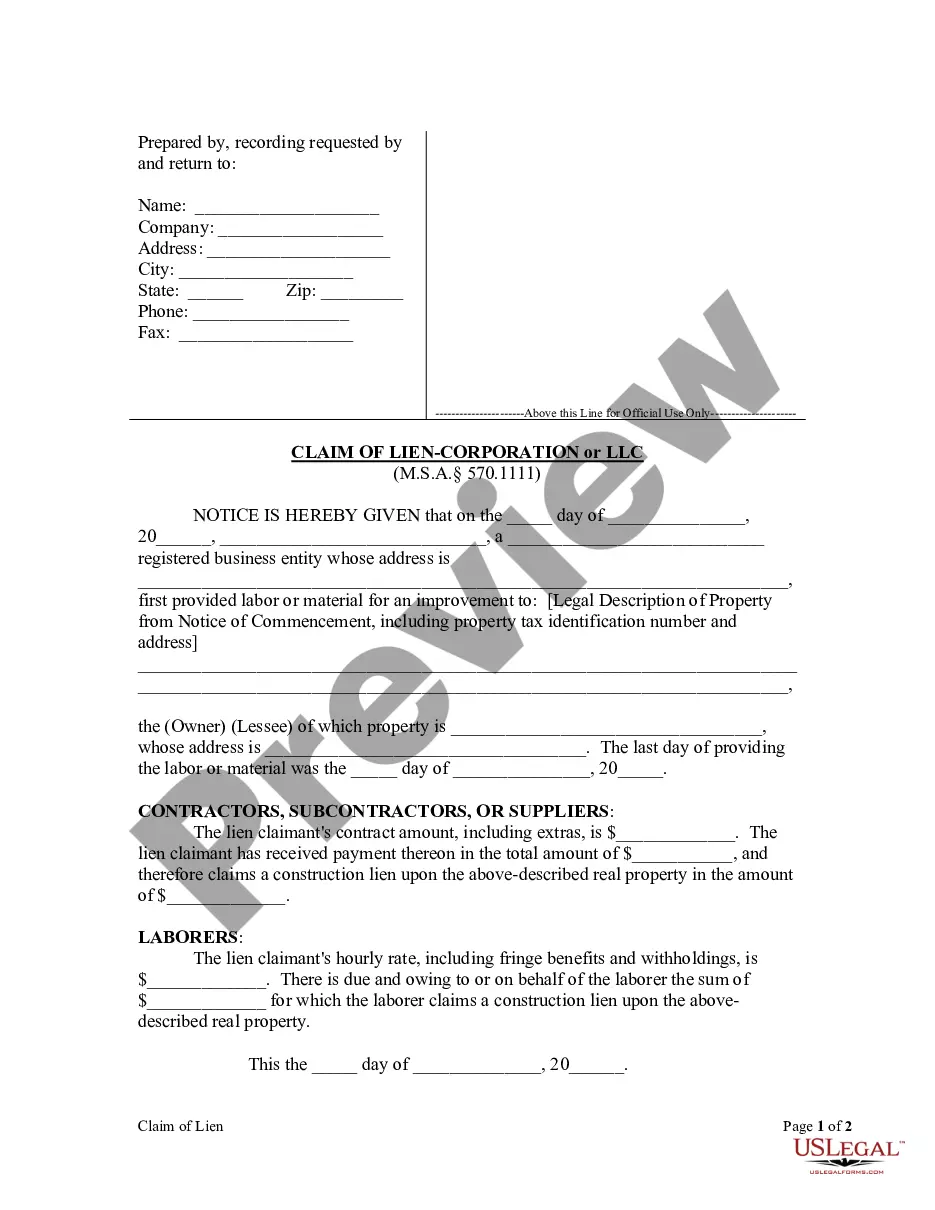

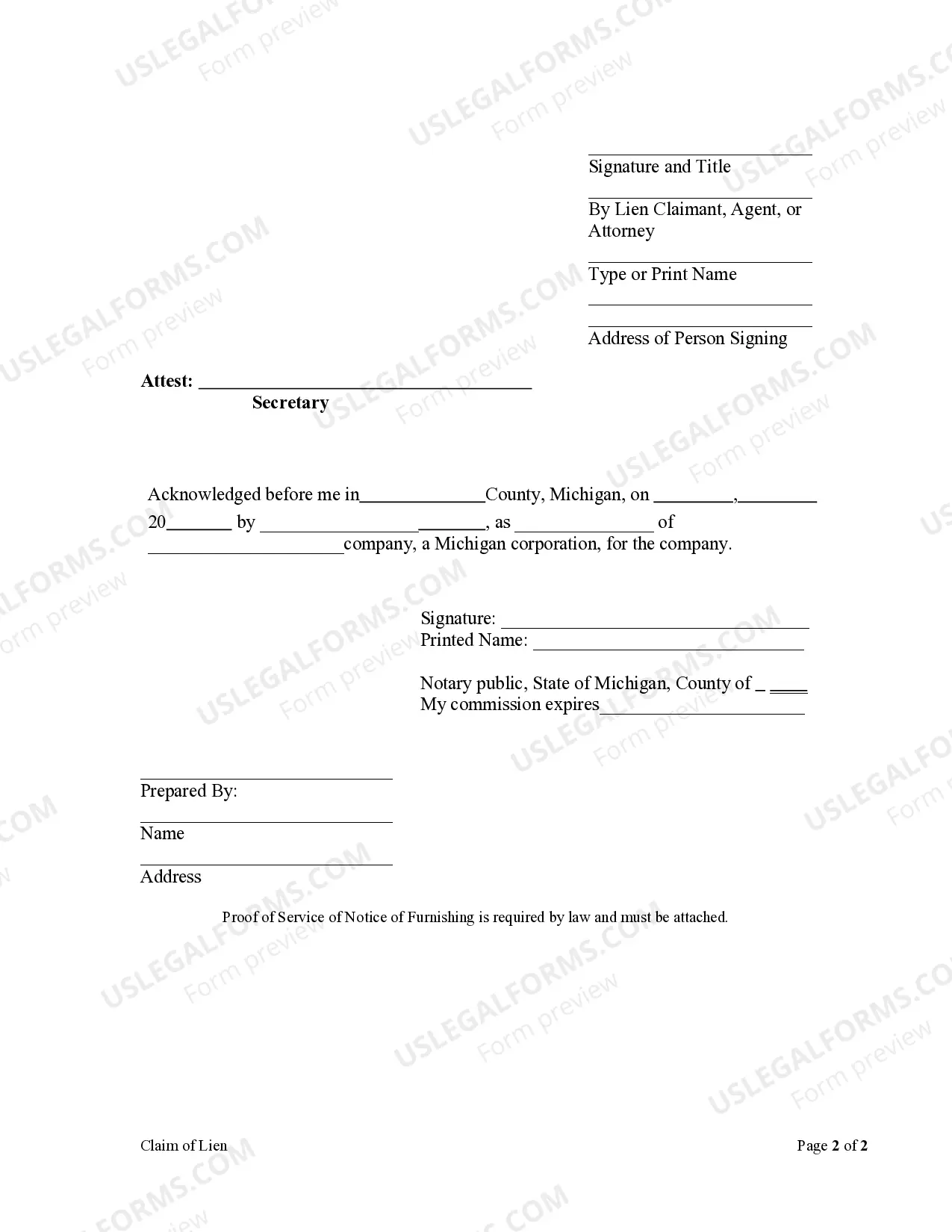

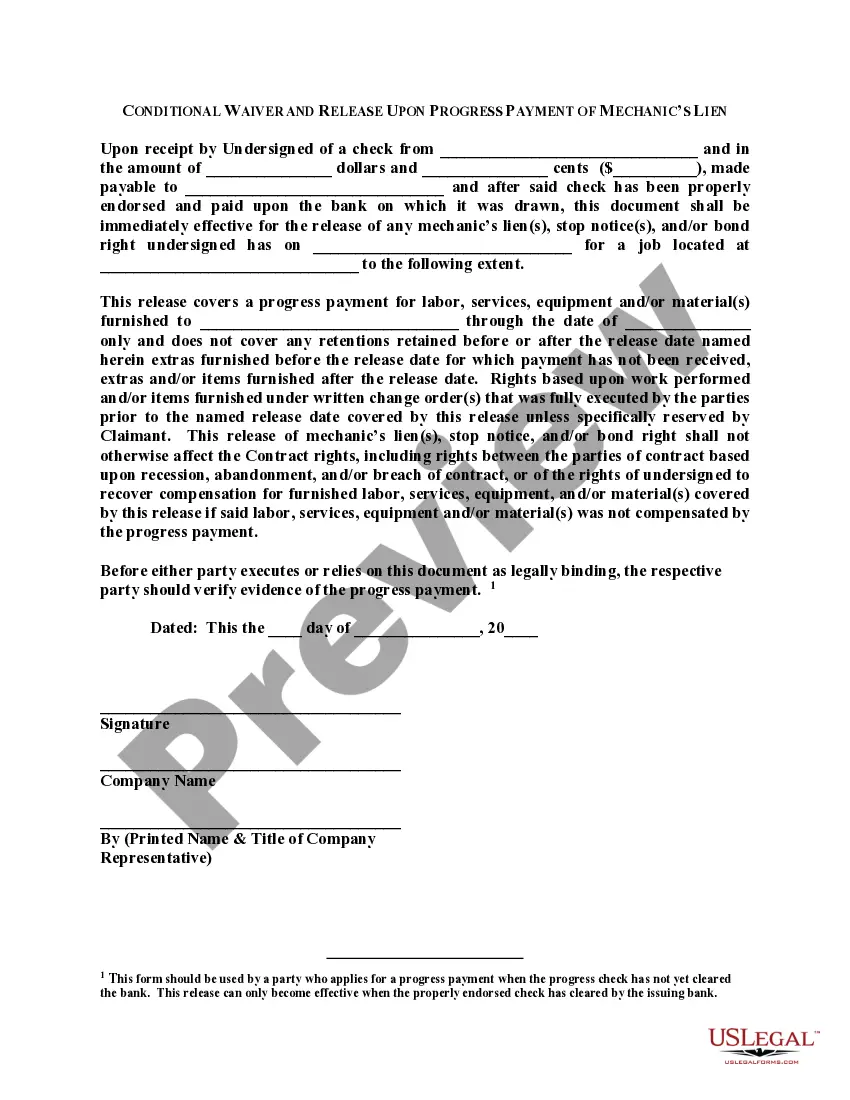

Within ninety (90) days after a corporate or LLC lien claimant's last furnishing of labor or material for the improvement pursuant to the lien claimant's contract, a Claim of Lien must be recorded in the office of the register of deeds for each county where the real property to which the improvement was made is located.

Lansing Michigan Claim of Lien - Corporation or LLC

Description

How to fill out Michigan Claim Of Lien - Corporation Or LLC?

Are you seeking a reliable and budget-friendly legal documents provider to obtain the Lansing Michigan Claim of Lien - Corporation or LLC? US Legal Forms is your preferred choice.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of forms to proceed with your divorce in court, we have what you need. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic but tailored based on the rules of specific states and counties.

To access the document, you must Log In to your account, find the desired form, and click the Download button next to it. Please note that you can download your previously acquired document templates at any time in the My documents section.

Is it your first visit to our platform? No problem. You can create an account with great simplicity, but before doing so, ensure to take the following steps.

Now you can create your account. Then select a subscription plan and proceed to payment. Once the payment is completed, download the Lansing Michigan Claim of Lien - Corporation or LLC in any offered format. You can return to the website whenever you need and re-download the document at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours researching legal documents online permanently.

- Check if the Lansing Michigan Claim of Lien - Corporation or LLC meets the requirements of your state and locality.

- Review the form’s description (if available) to understand who and what the document is meant for.

- Restart the search if the form does not suit your particular needs.

Form popularity

FAQ

To place a lien on someone's property in Michigan, you must first gather all necessary documentation and file a claim with the appropriate county register of deeds. You'll need to ensure your claim meets all legal requirements, including identifying the property and the basis for the lien. If you’re unsure about the process for a Lansing Michigan Claim of Lien - Corporation or LLC, the uslegalforms platform can guide you through the necessary steps. This makes it easier to protect your interests.

Yes, a notice of intent to lien is generally required in Michigan for certain types of liens, especially in construction-related cases. This notice serves to inform the property owner of the claim before filing a formal lien. If you’re dealing with a Lansing Michigan Claim of Lien - Corporation or LLC, understanding this notice is essential for proper legal procedure. Utilizing resources from uslegalforms can help you navigate the requirements effectively.

In Michigan, a lien typically lasts for five years from the date it is recorded. However, it can be renewed for additional periods if necessary. Understanding the duration of a Lansing Michigan Claim of Lien - Corporation or LLC is crucial for both creditors and property owners. This time frame ensures that claimants have adequate time to pursue their rights before the lien becomes void.

To find out who owns an LLC in Michigan, you can search the Michigan Department of Licensing and Regulatory Affairs (LARA) database. This online tool allows you to access information about LLC ownership and status. Knowing the ownership details can be crucial when considering your Lansing Michigan Claim of Lien - Corporation or LLC. For more extensive searches or documentation assistance, US Legal Forms can guide you through the process.

Filing a UCC in Michigan involves completing the necessary forms and submitting them to the Michigan Secretary of State. This can now be done online for added convenience and quicker processing. Properly filing your UCC can protect your interests when dealing with a Lansing Michigan Claim of Lien - Corporation or LLC. US Legal Forms provides resources and templates to help you ensure that your UCC filing is accurate and compliant.

To find out if you have a UCC lien, you can search the Michigan Secretary of State’s database for UCC filings. This resource provides detailed information on any liens against your name or business. Since UCC liens can impact your Lansing Michigan Claim of Lien - Corporation or LLC, it is important to check for any outstanding claims. US Legal Forms can assist you in navigating this search if you need more comprehensive support.

You can indeed complete the entire LLC formation process online in Michigan. This includes preparing, submitting, and managing your documents electronically. By choosing to handle your Lansing Michigan Claim of Lien - Corporation or LLC online, you can take advantage of the efficiency and speed that this method offers. Consider exploring US Legal Forms for helpful resources that simplify this online setup.

Absolutely, you can file a Michigan LLC online through the state’s official portal. This option saves time and allows for direct submission of all necessary forms. When managing your Lansing Michigan Claim of Lien - Corporation or LLC, utilizing online filing ensures that you're compliant and up to date with state requirements. US Legal Forms offers additional guidance and templates to assist you with this online filing.

Yes, you can file an LLC online in Michigan. The state provides a convenient online system for filing the necessary documents to establish your LLC. This process allows you to submit your formation documents quickly, making it easier to manage your Lansing Michigan Claim of Lien - Corporation or LLC. Using platforms like US Legal Forms can streamline this process further, helping you secure your business swiftly.

Filing a lien without a written contract is generally not allowed in Michigan. To successfully file a Lansing Michigan Claim of Lien for a Corporation or LLC, you need to have a formal agreement that outlines the terms of your claim. This document serves as evidence of the debt owed. Utilizing services like USLegalForms can help you navigate the necessary documentation and ensure your lien is valid.