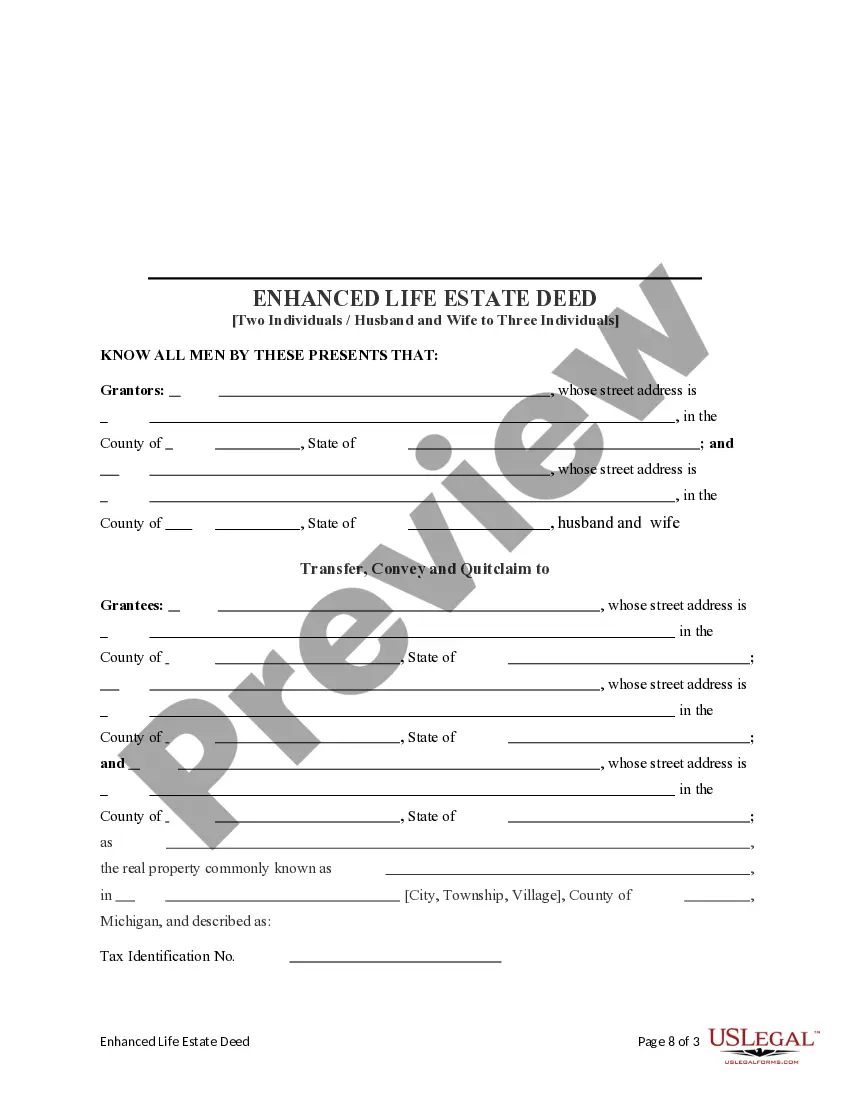

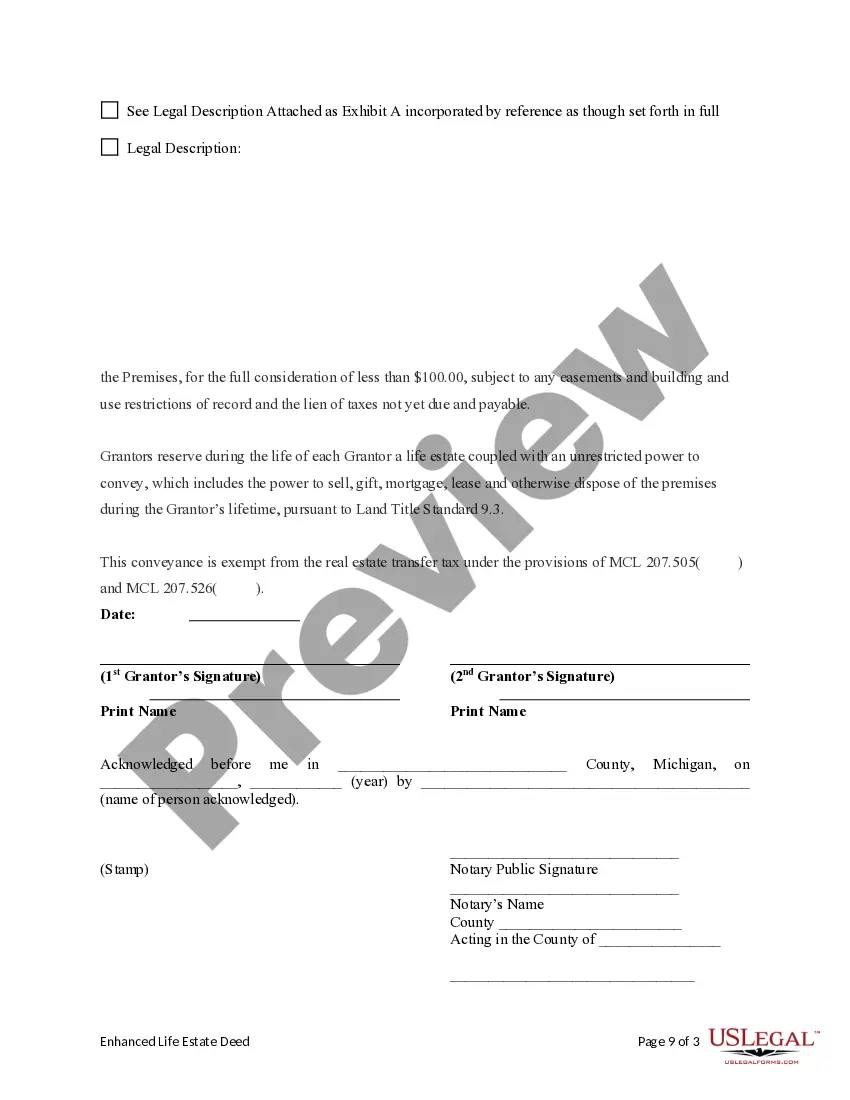

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantees are two individuals or husband and wife. It is also known as a "Lady Bird" Deed. Grantors conveys the property to Grantees subject to a retained enhanced life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

In Lansing, Michigan, an Enhanced Life Estate Deed, commonly known as a Lady Bird Deed, is a legal document that allows two individuals, typically a husband and wife, to transfer their property to three individuals while retaining certain rights and privileges during their lifetime. This type of deed offers several benefits and protections for both parties involved. The Lansing Michigan Enhanced Life Estate Deed or Lady Bird Deed provides the transferring individuals, known as the granters, with the ability to maintain control and use of the property throughout their lifetime. They can retain the right to live on the property, receive any income generated by it, and have the power to sell or mortgage the property without the consent of the recipients, known as the grantees. One type of Lansing Michigan Enhanced Life Estate Deed or Lady Bird Deed is the "Traditional" or "Basic" version, where the granters transfer the property to the grantees, often their children or other family members. This transfer is typically effective immediately but with reserved life estate rights. It ensures that the granters have the right to live in the property, collect income, and maintain control until their death. Another variation is the "Joint with Rights of Survivorship" Lady Bird Deed, where the property is transferred to the grantees as joint tenants with rights of survivorship. This means that if one of the granters passes away, their share automatically transfers to the surviving granter(s) without the need for probate or further legal actions. The "Remainder Beneficiary" Lady Bird Deed is another type available. With this deed, the granters retain the right to sell or mortgage the property during their lifetime, but upon their death, the property automatically transfers to the named remainder beneficiaries. This eliminates the need for probate and ensures a smooth transition of ownership to the intended recipients. Overall, the Lansing Michigan Enhanced Life Estate Deed or Lady Bird Deed provides flexibility, control, and the ability to avoid probate for the granters while ensuring the intended beneficiaries receive the property in a streamlined manner. It is important to consult with a qualified attorney to properly draft and execute this type of deed to ensure compliance with state laws and achieve the desired outcomes.In Lansing, Michigan, an Enhanced Life Estate Deed, commonly known as a Lady Bird Deed, is a legal document that allows two individuals, typically a husband and wife, to transfer their property to three individuals while retaining certain rights and privileges during their lifetime. This type of deed offers several benefits and protections for both parties involved. The Lansing Michigan Enhanced Life Estate Deed or Lady Bird Deed provides the transferring individuals, known as the granters, with the ability to maintain control and use of the property throughout their lifetime. They can retain the right to live on the property, receive any income generated by it, and have the power to sell or mortgage the property without the consent of the recipients, known as the grantees. One type of Lansing Michigan Enhanced Life Estate Deed or Lady Bird Deed is the "Traditional" or "Basic" version, where the granters transfer the property to the grantees, often their children or other family members. This transfer is typically effective immediately but with reserved life estate rights. It ensures that the granters have the right to live in the property, collect income, and maintain control until their death. Another variation is the "Joint with Rights of Survivorship" Lady Bird Deed, where the property is transferred to the grantees as joint tenants with rights of survivorship. This means that if one of the granters passes away, their share automatically transfers to the surviving granter(s) without the need for probate or further legal actions. The "Remainder Beneficiary" Lady Bird Deed is another type available. With this deed, the granters retain the right to sell or mortgage the property during their lifetime, but upon their death, the property automatically transfers to the named remainder beneficiaries. This eliminates the need for probate and ensures a smooth transition of ownership to the intended recipients. Overall, the Lansing Michigan Enhanced Life Estate Deed or Lady Bird Deed provides flexibility, control, and the ability to avoid probate for the granters while ensuring the intended beneficiaries receive the property in a streamlined manner. It is important to consult with a qualified attorney to properly draft and execute this type of deed to ensure compliance with state laws and achieve the desired outcomes.