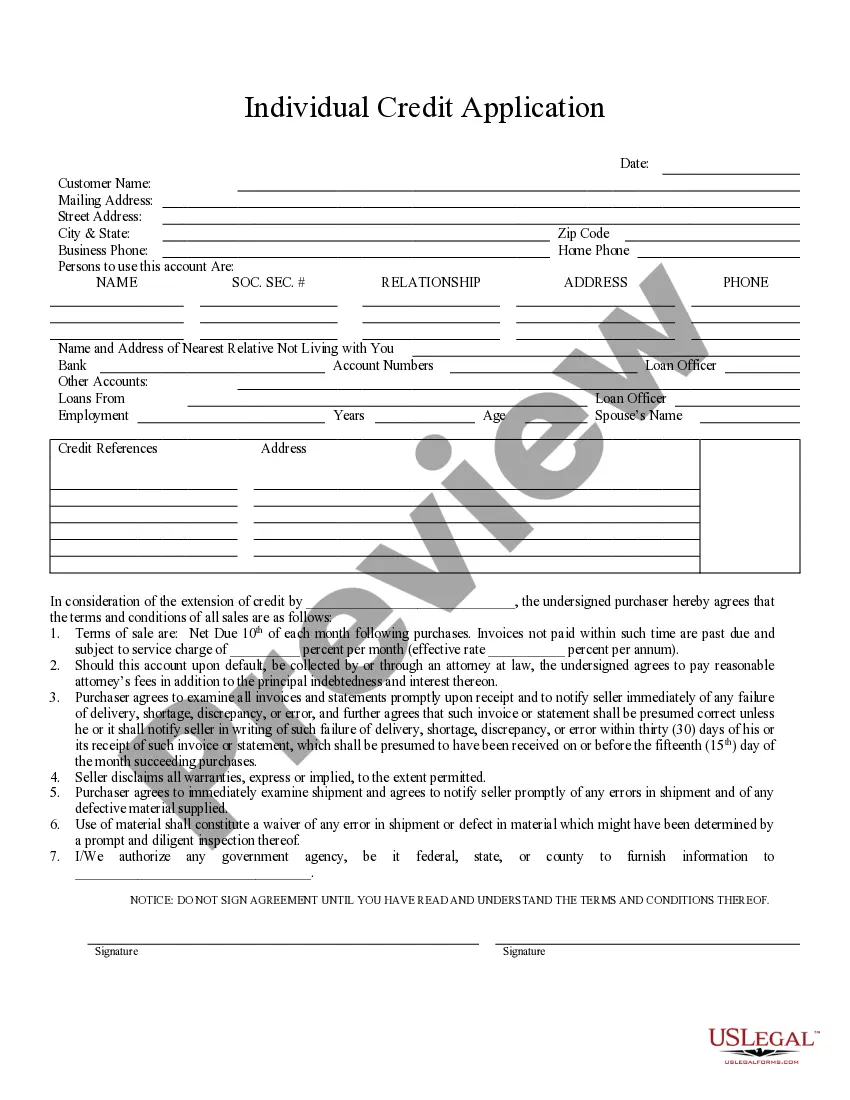

Oakland Michigan Individual Credit Application is a comprehensive and formal document used by individuals in the state of Michigan to apply for credit. This application is designed to gather detailed information about the applicant's personal and financial background to assess creditworthiness. The application considers several key factors such as income, employment history, outstanding debts, credit history, and references to determine the individual's ability to repay any credit extended to them. This application is a crucial step in the credit evaluation process, as it allows financial institutions, credit unions, and lenders to make informed decisions regarding granting credit to individuals residing in Oakland, Michigan. By completing the Oakland Michigan Individual Credit Application accurately and thoroughly, applicants enable lenders to gauge their financial stability and responsibility, which significantly impacts their chances of obtaining credit. While there might not be different types of Oakland Michigan Individual Credit Application per se, variations of credit applications can exist based on the type of credit being applied for. For example, an applicant might fill out a specific credit application for an auto loan, mortgage, personal loan, or credit card. These specific applications often request additional information tailored to the specific credit being sought. In terms of relevant keywords, the following terms can be utilized when describing the Oakland Michigan Individual Credit Application: 1. Credit application: This refers to the general document used to request credit from financial institutions. 2. Creditworthiness: The assessment of an individual's ability to fulfill their financial obligations based on factors such as income, credit history, and employment stability. 3. Financial background: The detailed information about an individual's financial history, including income, assets, and liabilities. 4. Income verification: The process of verifying an applicant's claimed income through pay stubs, tax returns, or bank statements. 5. Employment history: The record of an individual's previous and current employment, including job titles, duration, and income. 6. Outstanding debts: Any existing loans, credit card balances, or other financial obligations that an individual already has. 7. Credit history: A record of an individual's borrowing and repayment activities, including credit score, previous loans, and credit cards. 8. References: Contacts provided by the applicant who can vouch for their character and financial stability. 9. Lenders: Financial institutions, banks, or credit unions that provide credit to qualified individuals. 10. Credit evaluation: The process by which lenders assess an applicant's creditworthiness by analyzing the information provided in the credit application. It is important for individuals in Oakland, Michigan, seeking credit to carefully complete the Oakland Michigan Individual Credit Application, ensuring all requested details are filled out accurately and honestly. Lenders rely on the information provided to make informed decisions on extending credit, interest rates, and loan terms.

Oakland Michigan Individual Credit Application

Description

How to fill out Oakland Michigan Individual Credit Application?

If you are looking for a valid form template, it’s difficult to choose a more convenient service than the US Legal Forms site – one of the most considerable libraries on the internet. With this library, you can find a large number of templates for organization and individual purposes by types and regions, or keywords. With the high-quality search feature, finding the most recent Oakland Michigan Individual Credit Application is as elementary as 1-2-3. Additionally, the relevance of every document is verified by a group of expert attorneys that regularly review the templates on our website and update them based on the latest state and county demands.

If you already know about our system and have an account, all you need to get the Oakland Michigan Individual Credit Application is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the form you want. Look at its description and use the Preview feature (if available) to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the proper document.

- Affirm your choice. Select the Buy now button. Following that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Select the format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the obtained Oakland Michigan Individual Credit Application.

Every template you add to your profile has no expiry date and is yours permanently. It is possible to access them via the My Forms menu, so if you need to receive an additional copy for enhancing or printing, you may come back and save it once again anytime.

Make use of the US Legal Forms professional catalogue to get access to the Oakland Michigan Individual Credit Application you were seeking and a large number of other professional and state-specific samples in a single place!