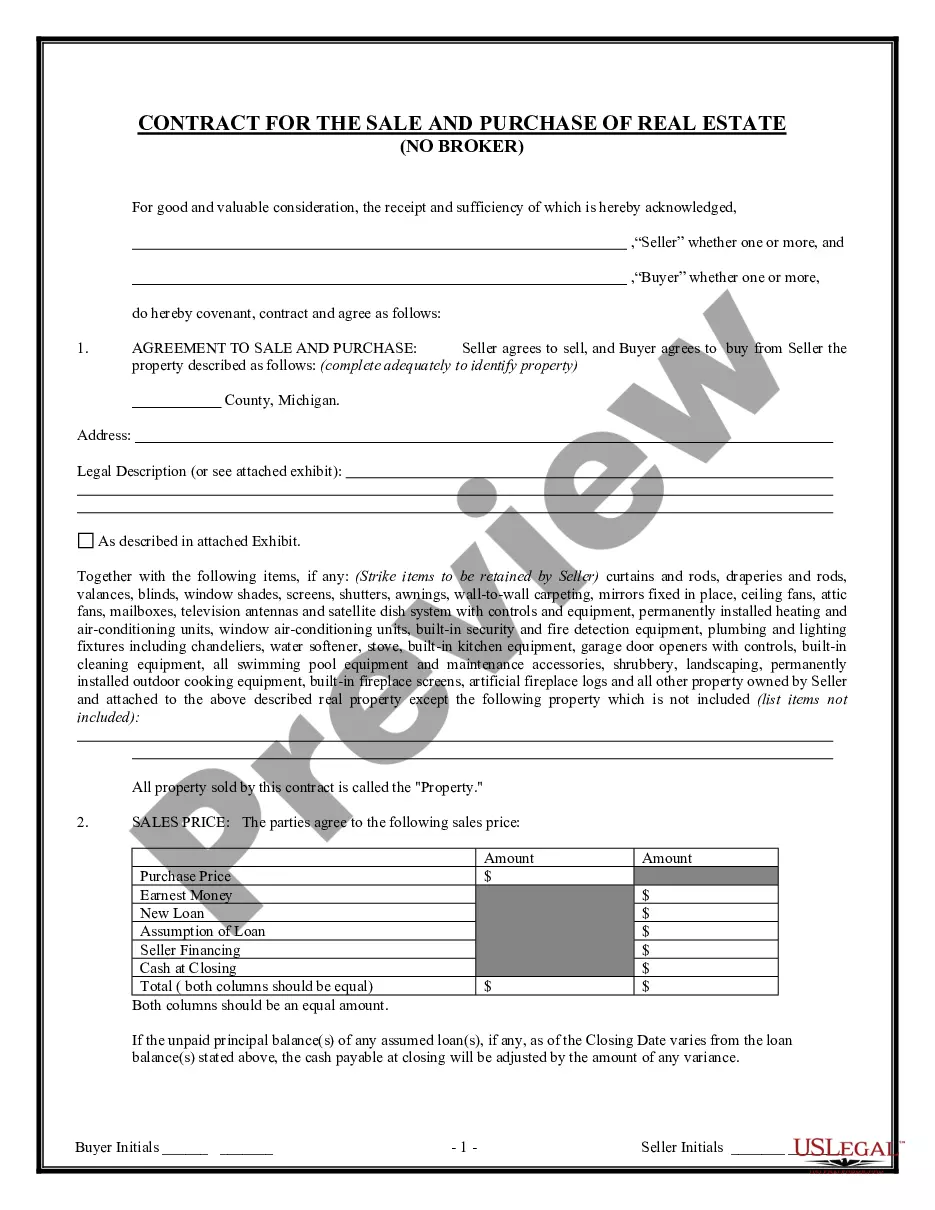

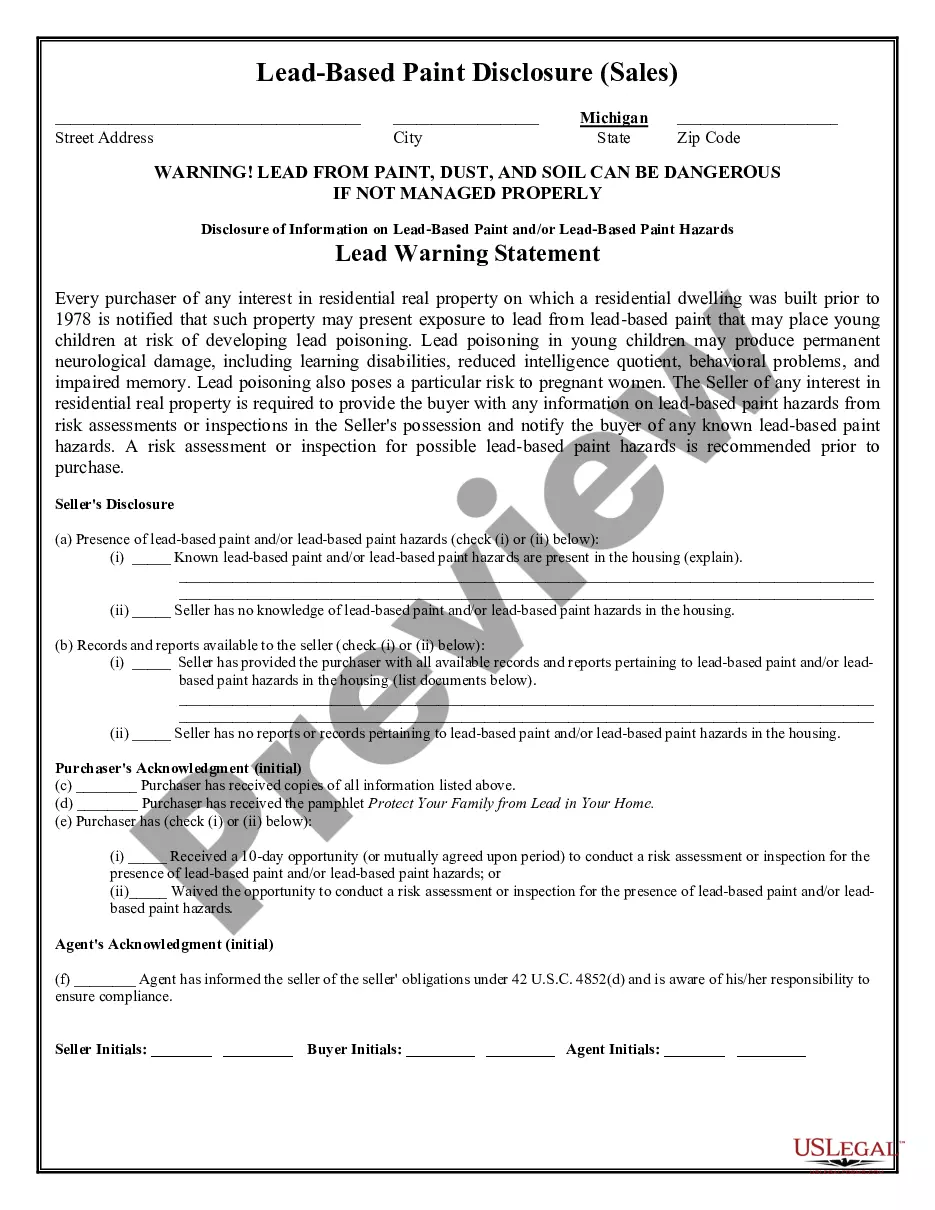

The Wayne Michigan Residential Real Estate Sales Disclosure Statement serves as a crucial document in any real estate transaction within Wayne, Michigan. It provides potential buyers with important information regarding the property they are interested in purchasing. By offering full disclosure, this document ensures transparency and protects both sellers and buyers from any legal complications that may arise in the future. Keywords: Wayne, Michigan, residential real estate, sales disclosure statement, property, buyers, sellers, disclosure, transparency, legal complications. Different types of Wayne Michigan Residential Real Estate Sales Disclosure Statement: 1. Standard Residential Real Estate Sales Disclosure Statement: This is the most common type of disclosure statement used in Wayne, Michigan. It covers general aspects of the property, such as its condition, previous renovations or repairs, and any known issues that could potentially affect the buyer's decision. 2. Environmental Disclosure Statement: This specific disclosure statement focuses on factors related to the environment surrounding the property. It may include information about potential hazards, presence of contaminants, or the proximity to environmentally sensitive areas. This document is essential for ensuring buyers have a full understanding of the property's environmental impact. 3. Condominium Disclosure Statement: This type of disclosure statement is specific to condominiums or shared housing complexes in Wayne, Michigan. It provides information about the homeowner association (HOA) fees, rules, and regulations that buyers need to adhere to when living in the property. It also highlights any pending litigation or disputes involving the HOA. 4. Lead-Based Paint Disclosure Statement: If the residential property was built before 1978, federal law requires sellers to provide buyers with a Lead-Based Paint Disclosure Statement. This document discloses the presence of lead-based paint or any known lead hazards in the property and provides buyers with information about potential health risks associated with lead exposure. 5. Seller's Property Disclosure Statement: This disclosure statement is completed by the seller and contains detailed information about the condition of the property, known defects, repairs or renovations, and any other relevant information a buyer should be aware of before making a purchase. It offers a comprehensive understanding of the property's history and current state, allowing buyers to make informed decisions. In conclusion, the Wayne Michigan Residential Real Estate Sales Disclosure Statement is a crucial document that ensures transparency during property transactions. It covers various types, including the standard disclosure statement, environmental disclosure statement, condominium disclosure statement, lead-based paint disclosure statement, and seller's property disclosure statement. These documents protect both buyers and sellers from potential legal complications and provide comprehensive information about the property being sold.

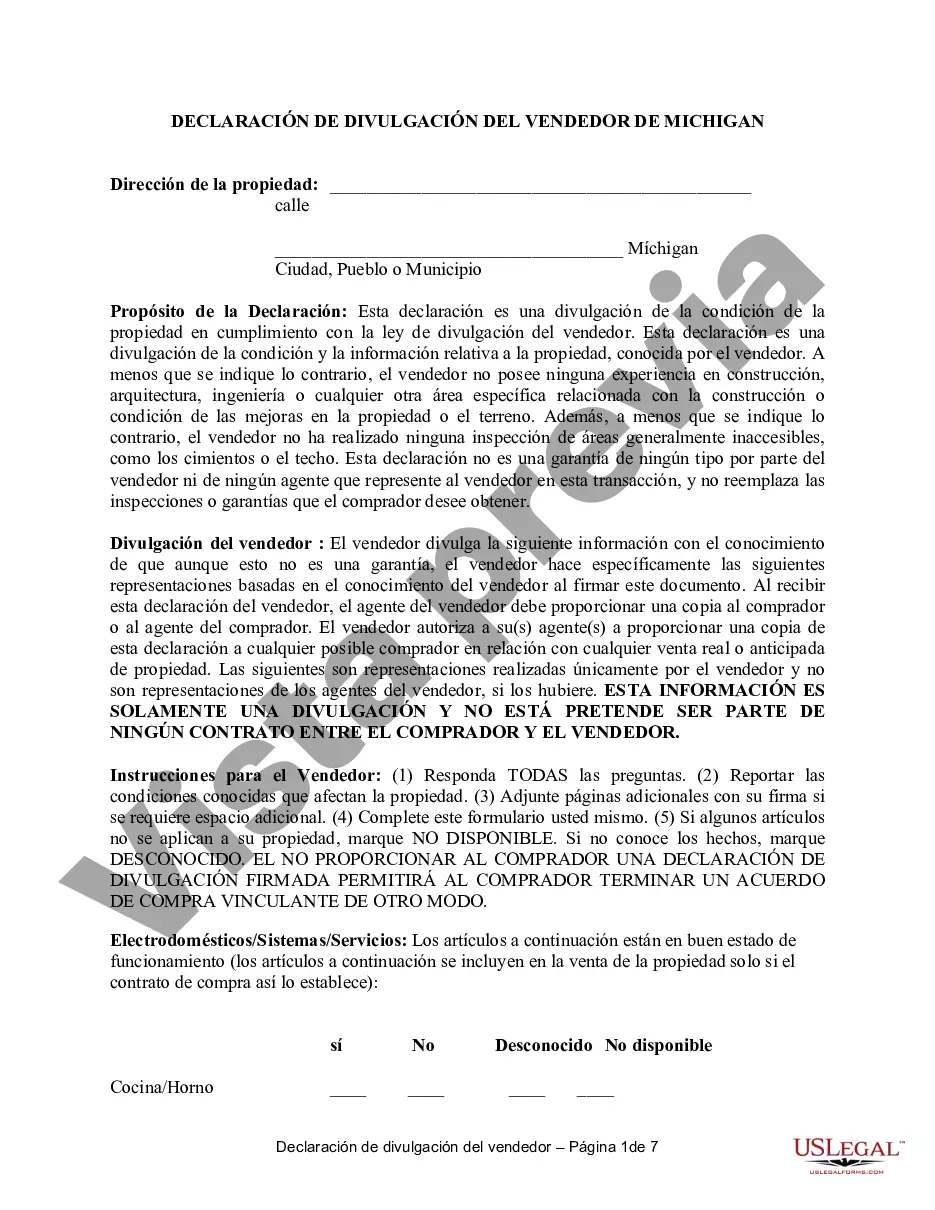

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Declaración de Divulgación de Ventas de Bienes Raíces Residenciales - Michigan Residential Real Estate Sales Disclosure Statement

State:

Michigan

County:

Wayne

Control #:

MI-37014

Format:

Word

Instant download

Public form

Description

Divulgación de Bienes Raíces para Terminación en una transacción de venta de casa.

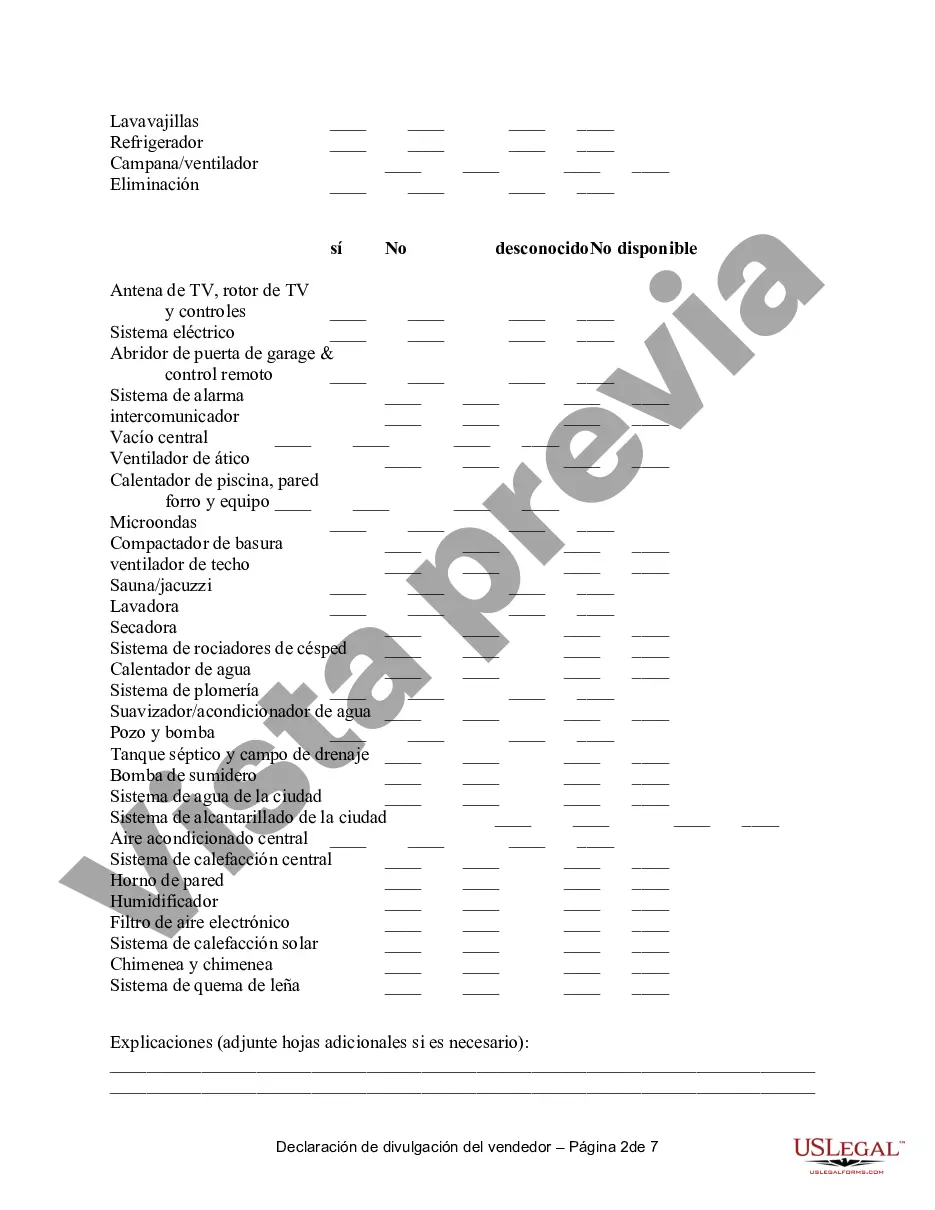

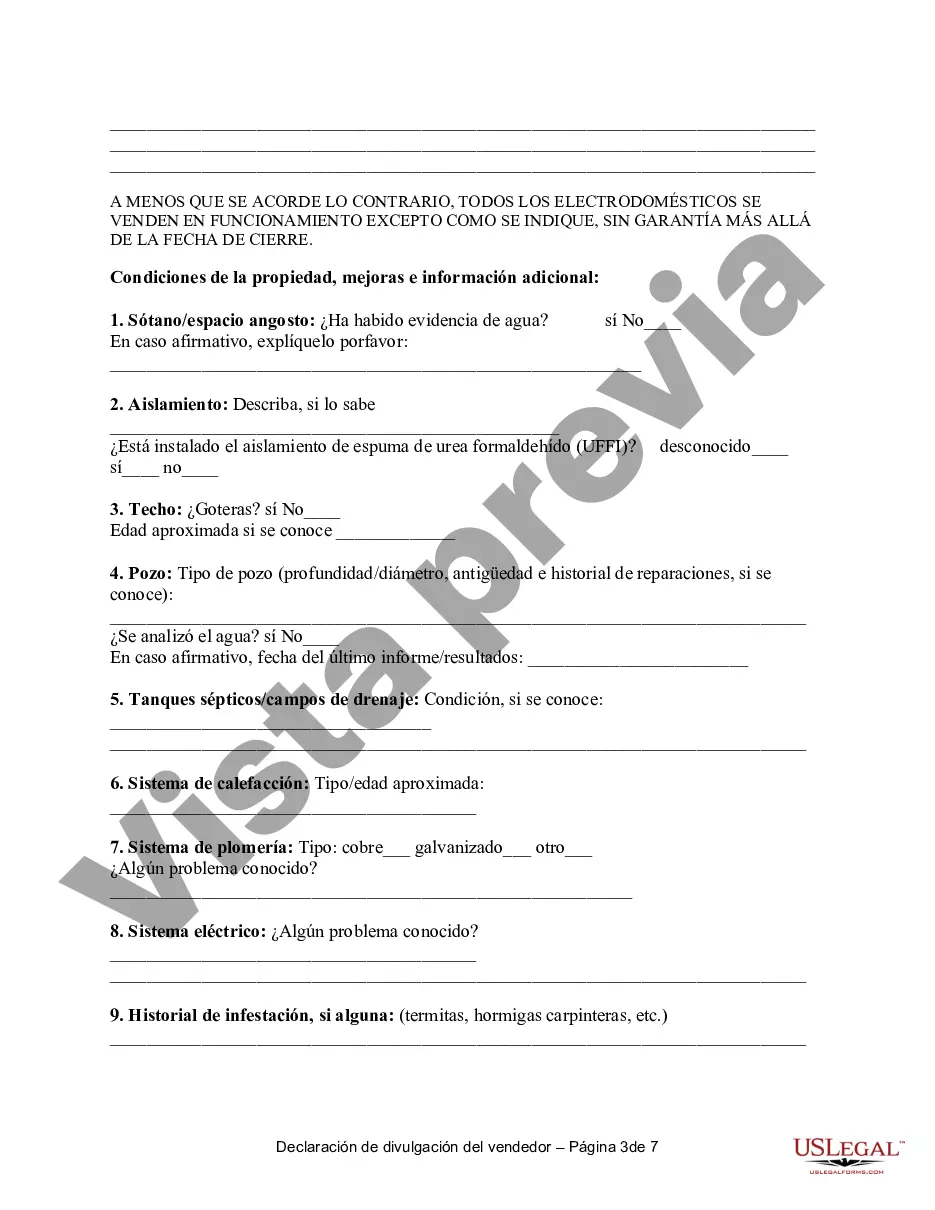

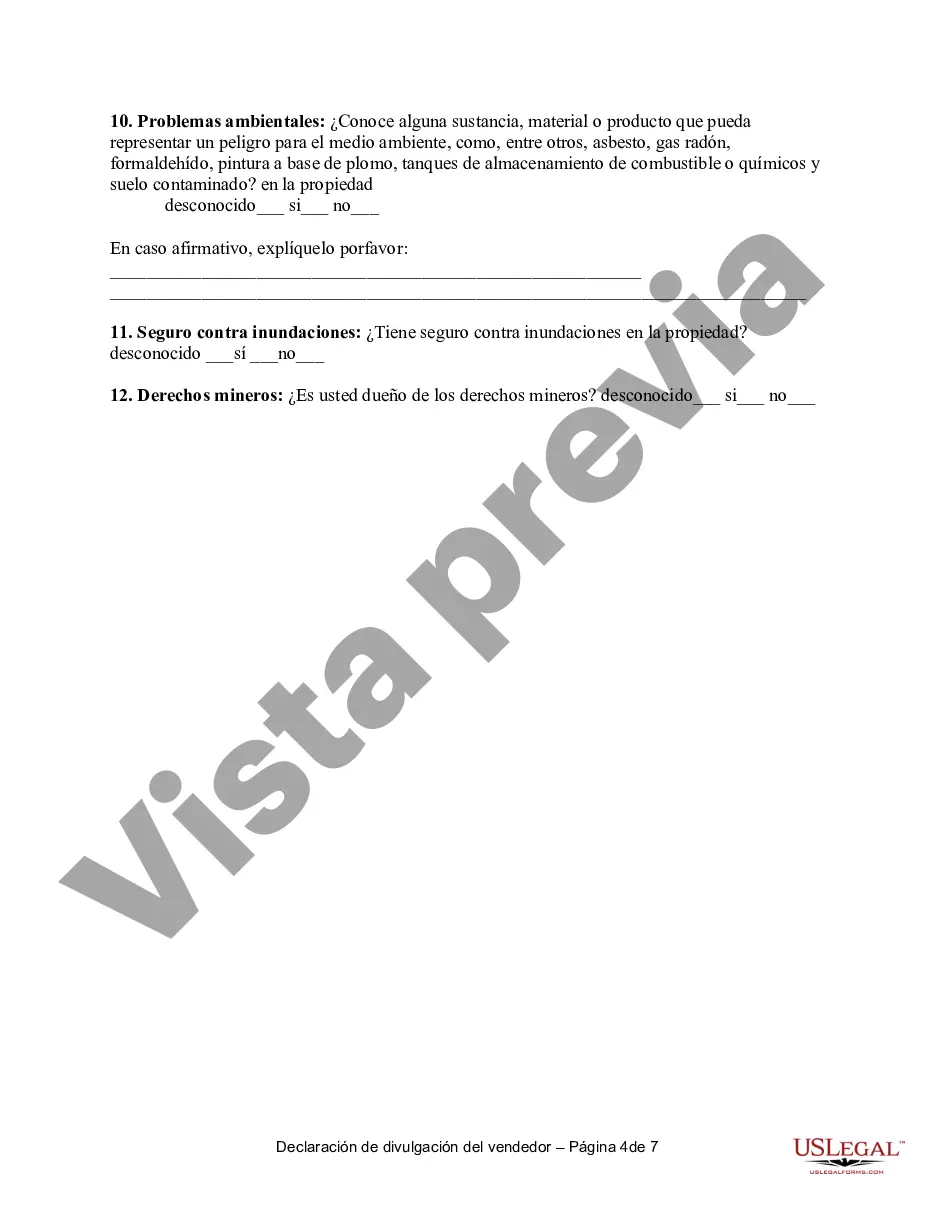

The Wayne Michigan Residential Real Estate Sales Disclosure Statement serves as a crucial document in any real estate transaction within Wayne, Michigan. It provides potential buyers with important information regarding the property they are interested in purchasing. By offering full disclosure, this document ensures transparency and protects both sellers and buyers from any legal complications that may arise in the future. Keywords: Wayne, Michigan, residential real estate, sales disclosure statement, property, buyers, sellers, disclosure, transparency, legal complications. Different types of Wayne Michigan Residential Real Estate Sales Disclosure Statement: 1. Standard Residential Real Estate Sales Disclosure Statement: This is the most common type of disclosure statement used in Wayne, Michigan. It covers general aspects of the property, such as its condition, previous renovations or repairs, and any known issues that could potentially affect the buyer's decision. 2. Environmental Disclosure Statement: This specific disclosure statement focuses on factors related to the environment surrounding the property. It may include information about potential hazards, presence of contaminants, or the proximity to environmentally sensitive areas. This document is essential for ensuring buyers have a full understanding of the property's environmental impact. 3. Condominium Disclosure Statement: This type of disclosure statement is specific to condominiums or shared housing complexes in Wayne, Michigan. It provides information about the homeowner association (HOA) fees, rules, and regulations that buyers need to adhere to when living in the property. It also highlights any pending litigation or disputes involving the HOA. 4. Lead-Based Paint Disclosure Statement: If the residential property was built before 1978, federal law requires sellers to provide buyers with a Lead-Based Paint Disclosure Statement. This document discloses the presence of lead-based paint or any known lead hazards in the property and provides buyers with information about potential health risks associated with lead exposure. 5. Seller's Property Disclosure Statement: This disclosure statement is completed by the seller and contains detailed information about the condition of the property, known defects, repairs or renovations, and any other relevant information a buyer should be aware of before making a purchase. It offers a comprehensive understanding of the property's history and current state, allowing buyers to make informed decisions. In conclusion, the Wayne Michigan Residential Real Estate Sales Disclosure Statement is a crucial document that ensures transparency during property transactions. It covers various types, including the standard disclosure statement, environmental disclosure statement, condominium disclosure statement, lead-based paint disclosure statement, and seller's property disclosure statement. These documents protect both buyers and sellers from potential legal complications and provide comprehensive information about the property being sold.

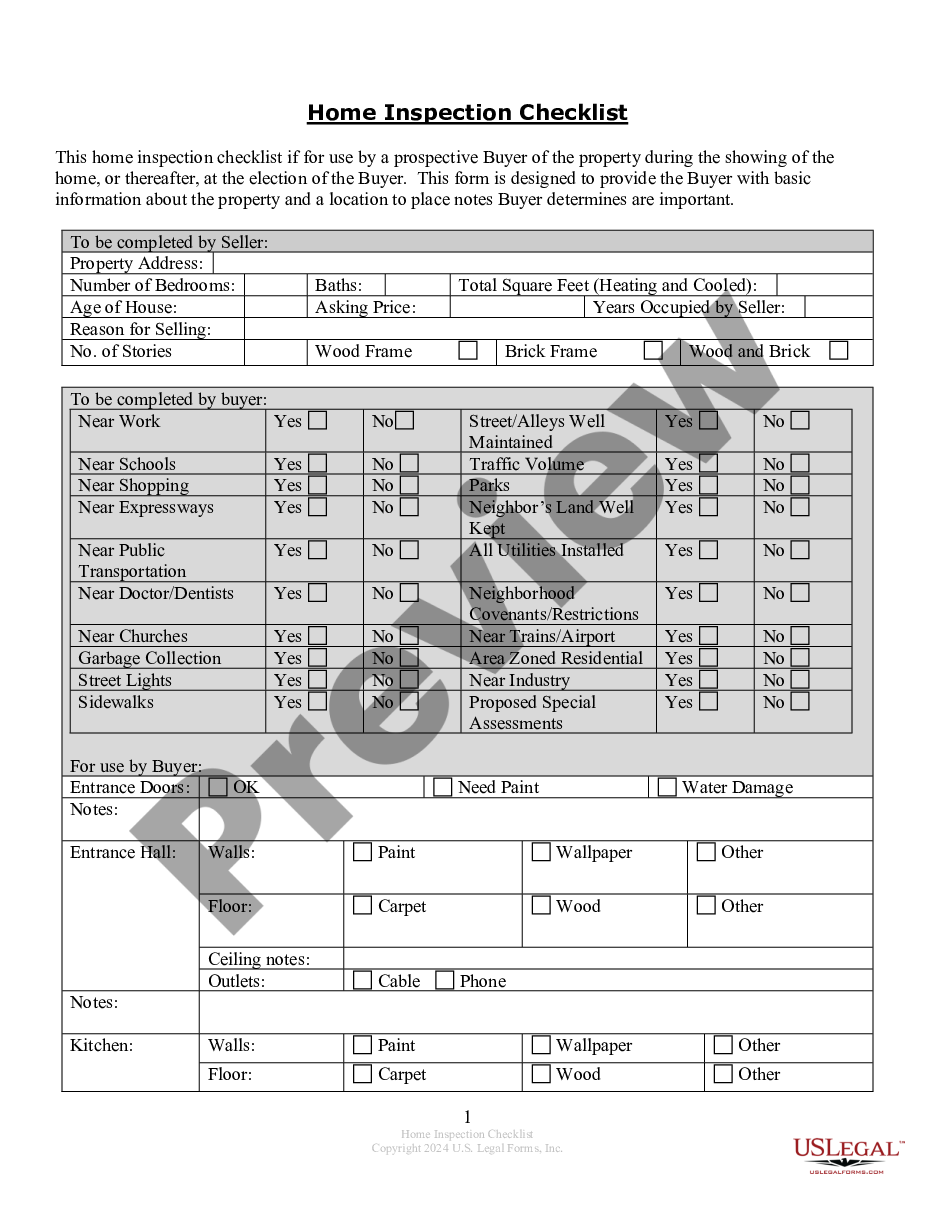

Free preview

How to fill out Wayne Michigan Declaración De Divulgación De Ventas De Bienes Raíces Residenciales?

If you’ve already used our service before, log in to your account and download the Wayne Michigan Residential Real Estate Sales Disclosure Statement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Wayne Michigan Residential Real Estate Sales Disclosure Statement. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!