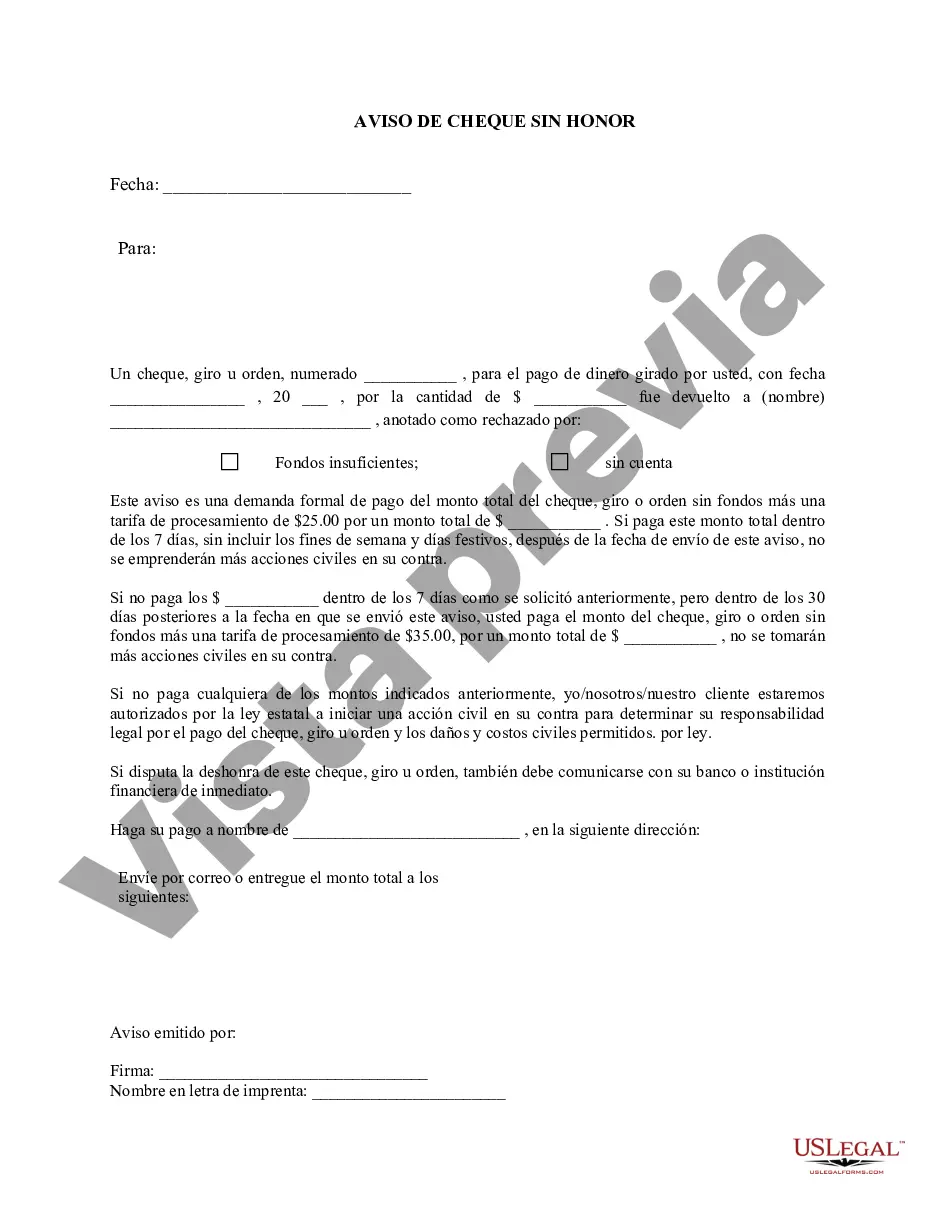

The Grand Rapids Michigan Notice of Dishonored Check — Civil is a legal document issued to individuals or businesses who have received a bad or bounced check in Grand Rapids, Michigan. A bad check refers to a check that is returned by the bank due to insufficient funds, closed accounts, or other reasons that prevent the check from being cashed or honored. In the state of Michigan, a bad check is considered a serious offense and can result in civil penalties. The Notice of Dishonored Check — Civil serves as a formal notification to the check writer that their check has been dishonored by the bank. It informs them of the consequences they may face if they fail to take appropriate actions to resolve the issue. When a person or business receives a bad check, it can cause financial hardships and disruptions in their operations. The Notice of Dishonored Check — Civil is a means to hold the check writer accountable and seek restitution for the damages caused by the bounced check. There are different types of bad checks that may lead to a Notice of Dishonored Check — Civil being issued. These include insufficient funds checks, which occur when the check writer does not have enough money in their account to cover the amount written on the check. Closed account checks are issued when the check writer's account has been closed by the bank. Additionally, post-dated checks, fraudulent checks, and checks with forged signatures or alterations can also result in a Notice of Dishonored Check — Civil. Upon receiving the Notice of Dishonored Check — Civil, the check writer is given a specified period of time to make payment or provide a valid explanation for the issuance of the bad check. If the check writer fails to respond within the given timeframe or neglects their payment obligations, they may be subject to further legal actions, including civil litigation, fines, and potentially criminal charges. It is important for individuals and businesses in Grand Rapids, Michigan to be aware of the consequences associated with issuing bad checks. Promptly addressing any issues related to dishonored checks can help mitigate further legal complications and financial losses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Grand Rapids Michigan Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Grand Rapids Michigan Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

Benefit from the US Legal Forms and obtain instant access to any form sample you require. Our useful platform with a huge number of templates makes it easy to find and obtain virtually any document sample you want. You can export, fill, and sign the Grand Rapids Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in just a couple of minutes instead of surfing the Net for several hours searching for an appropriate template.

Using our library is an excellent way to raise the safety of your document filing. Our professional lawyers on a regular basis review all the documents to make sure that the forms are relevant for a particular region and compliant with new laws and polices.

How can you obtain the Grand Rapids Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the form you require. Make sure that it is the template you were looking for: check its headline and description, and utilize the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading process. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Download the document. Pick the format to obtain the Grand Rapids Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable document libraries on the web. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Grand Rapids Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Feel free to take advantage of our platform and make your document experience as efficient as possible!