Title: Understanding the Wayne Michigan Notice of Dishonored Check — Civil Introduction: In Wayne, Michigan, individuals and businesses are protected against the consequences of receiving bad checks through the legal process outlined in the Notice of Dishonored Check — Civil. This legal document serves as a notice to the check issuer, informing them of the consequences of issuing a bad or bounced check. In this article, we will delve into the details of this notice, explaining its purpose, legal implications, and the different types of bad checks it covers. 1. What is a Bad Check? A bad check refers to a financial instrument, usually a personal or business check, that is returned unpaid due to insufficient funds or a closed account. It is an illegal and fraudulent act as it deceives the recipient into believing that the check has value. A bad check can cause financial hardships for the recipient, leading to potential legal action. 2. Understanding the Wayne Michigan Notice of Dishonored Check — Civil: The Wayne Michigan Notice of Dishonored Check — Civil is a legal document used by individuals or businesses who have received a bad check in Wayne County. This notice serves as an official and documented warning to the check issuer, informing them of the dishonored check and the potential legal consequences they may face. 3. Legal Implications: When a person or business receives a bad check, they have the right to seek legal recourse to recover the owed funds. The Wayne Michigan Notice of Dishonored Check — Civil serves as a precursor to taking legal action, allowing the check issuer a final opportunity to rectify the situation and avoid further legal consequences. 4. Types of Bad Checks: i. Insufficient Funds Checks: This category refers to checks that bounce due to a lack of sufficient funds in the account mentioned. It can occur unintentionally, usually due to oversight, or intentionally as an act of fraud. ii. Account Closed Checks: When a checking account has been closed before the check is cleared, it results in a bounced or dishonored check. This usually happens when the account holder closes the account without resolving their pending transactions. iii. Post-Dated Checks: Post-dated checks are those that bear a future date beyond the date of issuance. If the check is presented for payment before the specified future date, it will be considered a bad check, leading to a dishonored notice. 5. Potential Consequences for the Check Issuer: Upon receiving the Wayne Michigan Notice of Dishonored Check — Civil, the check issuer has a specific period, as mentioned in the notice, to rectify the situation by paying the amount owed or arranging an alternative solution with the recipient. Failure to do so can lead to legal action such as fines, civil penalties, and potential misdemeanor charges. Conclusion: Understanding the Wayne Michigan Notice of Dishonored Check — Civil is crucial for both individuals and businesses. It highlights the legal implications of issuing bad checks and the potential consequences one may face if the dishonored check remains unresolved. By familiarizing themselves with this notice, recipients can take appropriate action to recover the owed funds and protect themselves from financial losses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

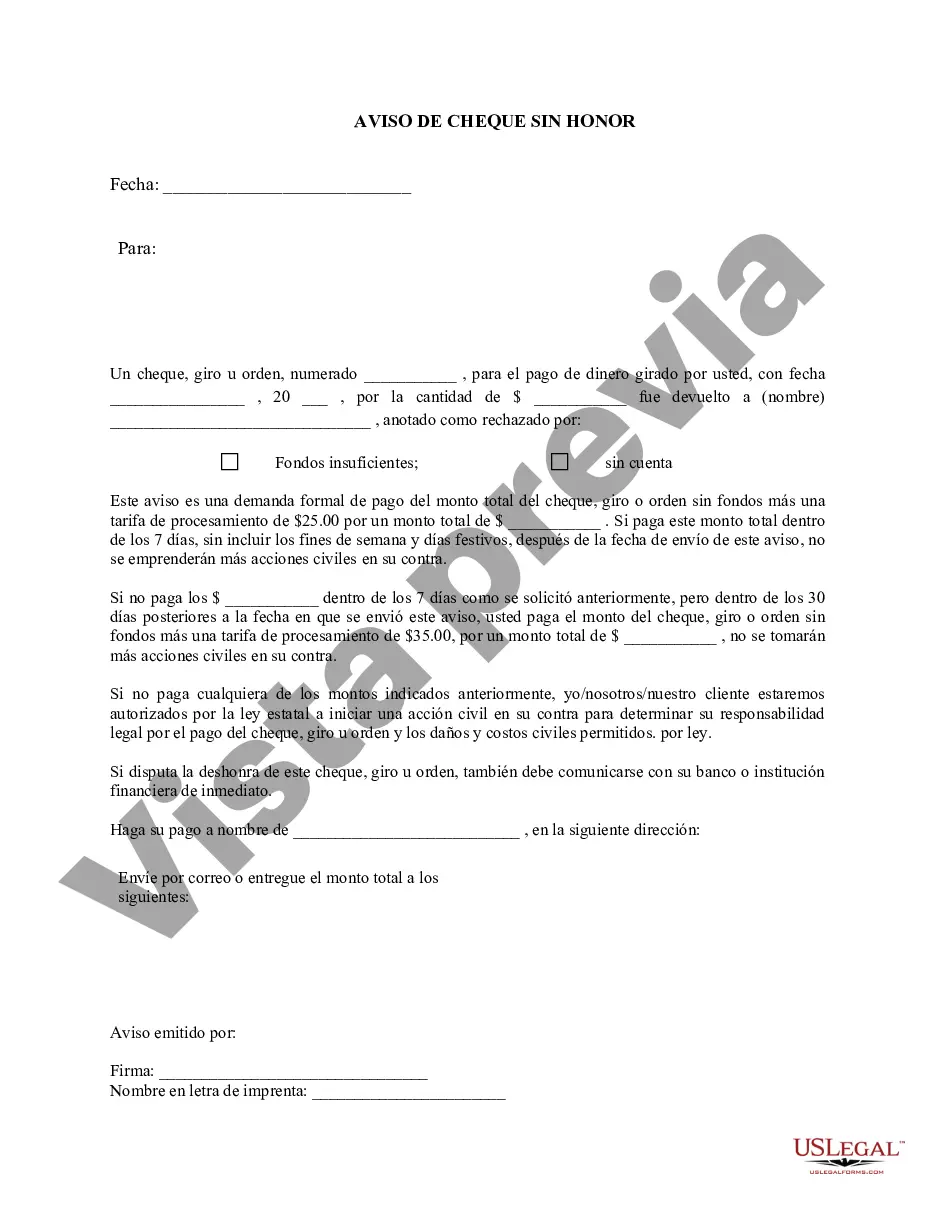

Description

How to fill out Wayne Michigan Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no legal education to create such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform offers a huge collection with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Wayne Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Wayne Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check quickly employing our trustworthy platform. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are unfamiliar with our platform, ensure that you follow these steps prior to downloading the Wayne Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check:

- Be sure the template you have found is good for your area because the regulations of one state or area do not work for another state or area.

- Preview the form and read a quick description (if provided) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start again and look for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Choose the payment method and proceed to download the Wayne Michigan Notice of Dishonored Check - Civil - Keywords: bad check, bounced check as soon as the payment is completed.

You’re all set! Now you can go on and print the form or fill it out online. Should you have any problems locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.