Lansing Michigan Bill of Sale without Warranty by Corporate Seller: A Comprehensive Overview In Lansing, Michigan, the Bill of Sale without Warranty by Corporate Seller holds great significance when it comes to the transfer of ownership of various assets from a corporation to another party. This legal document serves as concrete evidence of the transaction and protects the interest of both the seller and the buyer. It is essential to understand the key elements of this bill to ensure a smooth and lawful transfer. Key details to include in a Lansing Michigan Bill of Sale without Warranty by Corporate Seller: 1. Parties Involved: Clearly mention the names, addresses, and contact information of both the corporate seller and the buyer. Additionally, state the complete legal name of the corporation along with its registration details. 2. Asset Description: Provide a precise and comprehensive description of the asset being sold. This may include vehicles, machinery, real estate, equipment, stocks, or any other tangible and intangible property. 3. Purchase Price: Clearly state the agreed-upon purchase price for the asset being sold. It is vital to write this amount in both textual and numerical formats to avoid any ambiguity. 4. Payment Terms: If the purchase price is to be paid in installments or using any specific payment method, spell out the terms and conditions in this section. Specify the due dates, interest rates (if applicable), and payment mode (cash, check, bank transfer, etc.). 5. Seller's Warranty Disclaimer: Emphasize that the corporate seller is releasing the asset without any form of warranty. This means that the seller is not responsible for any defects, damages, or liabilities related to the asset after the sale. 6. Indemnification and Hold Harmless Clause: This clause protects the buyer and holds the seller harmless against any claims, losses, or liabilities arising from the asset post-purchase. It ensures that the buyer accepts the asset's condition and assumes all risks associated with it. 7. Governing Law: Specify that the bill of sale will be governed by the laws of the state of Michigan and that any legal disputes will be resolved in the courts of Lansing, Michigan. Types of Lansing Michigan Bill of Sale without Warranty by Corporate Seller: While the basic structure of a Lansing Michigan Bill of Sale without Warranty by Corporate Seller remains the same, variations can occur based on the nature of the asset being transferred. Here are some common types: 1. Vehicle Bill of Sale without Warranty by Corporate Seller: Used for the transfer of motor vehicles such as cars, motorcycles, trucks, and trailers. 2. Real Estate Bill of Sale without Warranty by Corporate Seller: Specifically designed for the transfer of real estate properties like land, houses, commercial buildings, or condominiums. 3. Equipment Bill of Sale without Warranty by Corporate Seller: Pertains to the sale of various types of machinery, tools, appliances, or technological equipment. 4. Stock Bill of Sale without Warranty by Corporate Seller: Applied when stocks or shares of a corporation are being transferred to another party as part of a sale or investment transaction. In conclusion, the Lansing Michigan Bill of Sale without Warranty by Corporate Seller is crucial in legally documenting the transfer of assets between a corporation and another party. By streamlining the transaction process and establishing clear ownership rights, this document protects both the seller and the buyer. It is essential to carefully draft and execute a comprehensive bill of sale to ensure a fair and transparent transaction.

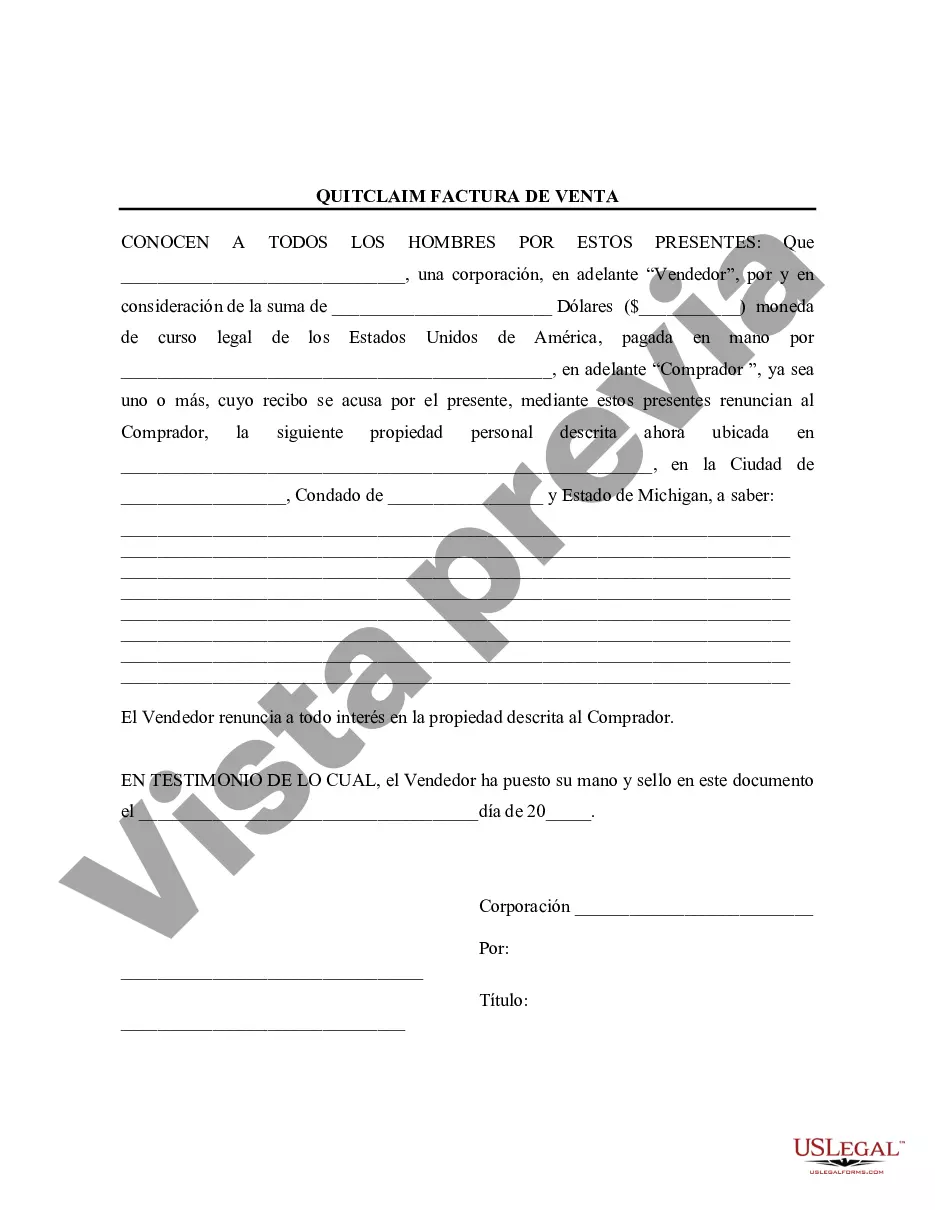

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Lansing Michigan Factura de venta sin garantía por parte del vendedor corporativo - Michigan Bill of Sale without Warranty by Corporate Seller

Description

How to fill out Lansing Michigan Factura De Venta Sin Garantía Por Parte Del Vendedor Corporativo?

Do you need a reliable and inexpensive legal forms provider to get the Lansing Michigan Bill of Sale without Warranty by Corporate Seller? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of particular state and area.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Lansing Michigan Bill of Sale without Warranty by Corporate Seller conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Start the search over if the form isn’t suitable for your specific scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Lansing Michigan Bill of Sale without Warranty by Corporate Seller in any available file format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal paperwork online for good.